The investment topics on everybody's radar

We're marking our 10 year anniversary by giving you more of what makes nabtrade one of the most trusted trading platforms in the country. With our exclusive wrap on trends, tips and tactics from the best investing minds, it's the knowledge you need to navigate the volatile markets ahead. With sharp and sometimes surprising insights, you won't want to miss what they have to say.

Volatility is an opportunity

nabtrade was born in a post financial-crisis climate in 2012 when investors were eager to benefit from a world recovering from the ‘Great Recession’. It was a time of opportunity, and not dissimilar to where we find ourselves now, as steep slides in share indices were counter-balanced by equally aggressive increases.

Today, we once again find ourselves in a period of volatility as the world grapples with the prospect of a global recession. While a plunging share market can test your resolve, it is also a window of opportunity where investors can build positions in companies they believe will perform strongly as economic growth recovers, and provide the dividends they require to meet investment income expectations.

As nabtrade celebrates 10 years of service, our commitment remains the same – to always be there to enable you to invest with confidence, providing the platform, insights and tips from experts you need to execute your strategies. We also have an ongoing pledge to continuously optimise our trading platform, and the observation and analytical tools we provide to make trading easy, even at a sophisticated level.

Investing in you with $9.95 trades

For trades up to $1,000.

David Koch: "What I've learned in 10 years"

One of Australia's most respected financial voices shares what he's learned about market behaviour over the past 10 years and how he keeps his cool when the 'doomsayers' have the floor.

David Koch is co-host of Channel 7's Sunrise and chair and co-founder of markets channel ausbiz.

WealthHub Securities Limited ABN 83 089 718 249 AFSL 230704 (WealthHub Securities) is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in this communication is general advice only and has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any general advice or information in this communication, we recommend that you consider whether it is appropriate for your circumstances.

WealthHub Securities recommends that you obtain and consider the relevant Product Disclosure Statement, Terms and Conditions, Financial Services Guide or other disclosure documents available at nabtrade.com.au before making any decision about a product including whether to acquire or to continue to hold it.

Visit nabtrade.com.au for the terms of use about the nabtrade service (nabtrade) provided by WealthHub Securities. nabtrade is the information, trading and settlement service provided by WealthHub Securities.

Sally Auld's guide to rising rates

Watch JBWere's Sally Auld unpack one of the key questions on everyone's lips - how to navigate the markets in a rising interest rate environment. She shares her expert outlook on what will perform and what obstacles to look out for in the medium to long term.

Sally Auld is the Chief Investment Officer at JBWere and leads the Investment Strategy Group.

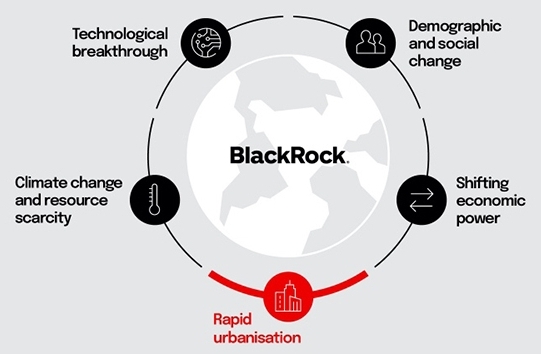

BlackRock's Top 5 Megatrends

Identifying the potential for structural change and investing in expected transformations early is key to postioning portfolios for long-term growth opportunities. We see five megatrends shaping our future - shifting the way we live and work.

- Technological breakthrough

- Demographic and social change

- Shifting economic power

- Rapid urbanisation

- Climate change and resource scarcity

BlackRock is a leading global investment manager with a range of investment solutions, including iShares Exchange Traded Funds.

Bloomberg Intelligence: high interest rate opportunities not to miss

Interest rates are rising around the world, but it's not all doom and gloom if you know where to look. Hear what Bloomberg Intelligence believes will perform in the current conditions.

Bloomberg Intelligence is part of Bloomberg L.P, a global leader in business and financial data, news and insight, linking the world’s decision makers to accurate information on the financial markets.

WealthHub Securities Limited ABN 83 089 718 249 AFSL 230704 (WealthHub Securities) is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in this communication is general advice only and has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any general advice or information in this communication, we recommend that you consider whether it is appropriate for your circumstances.

WealthHub Securities recommends that you obtain and consider the relevant Product Disclosure Statement, Terms and Conditions, Financial Services Guide or other disclosure documents available at nabtrade.com.au before making any decision about a product including whether to acquire or to continue to hold it.

Visit nabtrade.com.au for the terms of use about the nabtrade service (nabtrade) provided by WealthHub Securities. nabtrade is the information, trading and settlement service provided by WealthHub Securities.

Important information

The nabtrade service is the information, trading and settlement service provided by WealthHub Securities Limited ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities). WealthHub Securities is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL No. 230686 (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. WealthHub Securities is not an authorised deposit-taking institution, and its obligations do not represent deposits or liabilities of NAB and you are subject to investment risk, including loss of principal invested.

Click here for the terms of use about the nabtrade service provided by WealthHub Securities.

© National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.