Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Morningstar: 5-star moat stocks for the medium term

The equity analysts at Morningstar use two main ways to determine the merit of investing in a company’s shares.

First is the star rating.

The highest level is 5-stars, where a stock is undervalued and trading at an attractive discount to the analyst’s estimate of fair value.

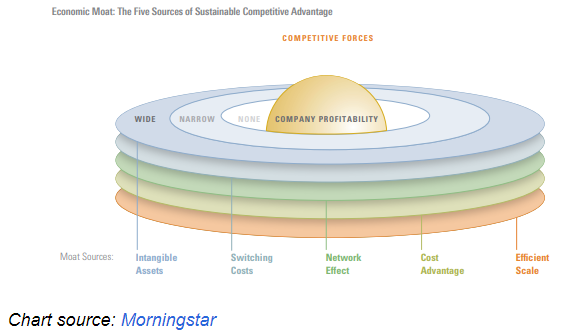

Second is the economic moat.

Companies with strong moats are judged to hold a competitive edge, giving better pricing power, or the ability to raise prices without losing customers.

Morningstar has identified five sources of economic moat:

- Switching costs are obstacles that keep customers from changing from one product to another.

- Network effects occur when the value of a good or service increases for both new and existing users as more people use that good or service.

- Intangible assets such as patents, government licenses, and brand identity that keep competitors at bay.

- Cost advantages allow a company to produce goods or services at a lower cost.

- Efficient scale benefits companies operating in a market that only supports one or a few competitors, limiting rivalry.

A company whose competitive advantages are expected to last more than 20 years has a wide moat, while one that can fend off its rivals for 10 years has a narrow moat. A company with either no advantage or one that may dissipate quickly has no moat.

It is rare that a company has a 5-star rating and a wide moat, because the market usually recognises the quality of a strong competitive advantage from a moat, and does not allow the share price to go to a large discount to its estimated value.

There are (at the time of writing, 4 October 2022) five companies listed on the ASX which have a Morningstar 5-star rating on price and qualify for a moat, either wide or narrow.

While the current investment environment is difficult, with rising interest rates and inflation and a threat of impending recession, these companies have strong medium- to long-term potential for patient investors.

The companies with 5-star rating and strong moats

Please note that ratings and prices change regularly and for more details including target prices and updates, see details on Morningstar at the end of the article.

AGL Energy (ASX:AGL) – Narrow moat

AGL Energy is one of Australia's largest integrated energy companies. We believe it has a narrow economic moat, underpinned by its low-cost generation fleet, concentrated markets, and cost-advantages from vertical integration. Earnings are dominated by energy generation (wholesale markets), with energy retailing about half the size. Strategy is heavily influenced by government energy policy, such as the renewable energy target.

We continue to believe the stock is heavily undervalued, trading on a fiscal 2024 P/E ratio of 7. Management provided fiscal 2023 net profit after tax guidance of AUD 200 million to AUD 320 million. We leave our forecast of AUD 263 million unchanged. We knew 2023 would be another poor year and are far more interested in the 2024 earnings recovery, but management remained tight-lipped, merely saying that the firm is well positioned to benefit from high electricity prices as unfavourable hedges roll off. We upgrade our medium-term NPAT forecasts by 15% on average, factoring in continuing strength in electricity futures prices.

Fineos Corporation (ASX:FCL) – Wide moat

Fineos is a core software vendor to the global life, accident, and health, or LA&H, insurance industry. Customers are primarily large multinationals and midmarket insurers. The firm generates revenue mainly from subscriptions and product implementation services. About 80% of revenue is generated from the U.S., the rest from Asia Pacific and Europe.

Wide-moat Fineos had a mixed fiscal 2022. Positively, total revenue growth of 18% from fiscal 2021 was strong. The proportion of sticky, subscription revenue also pleasingly grew to 42% of revenue from 37% in fiscal 2021. Both align with our forecasts, suggesting Fineos is cross-selling and up-selling to customers, a sign of improving switching costs. But we were let down by slower-than-expected margin growth, which we think is important to improve investor sentiment. Cost of sales and operating expenses as a proportion of revenue were slightly higher than last year. Crucially, Fineos is a long-term growth story. Pricing power and margins are likely to improve if switching costs keep strengthening.

Invocare (ASX:IVC) – Wide moat

We expect InvoCare to continue to dominate the Australian death care industry. We estimate InvoCare already enjoys a revenue share of over a third in Australia as the largest provider of funeral, cemetery, and crematorium services. The company boasts well-known, highly respected brands and cost advantages over the long tail of smaller players in the highly fragmented death care industry, underpinning our wide economic moat rating.

With COVID-19 restrictions largely absent during the latest reporting period, average case pricing has recovered, and mortality rates are returning to long-term trends, both now above pre-pandemic levels. The firm declared an interim fully franked final dividend of AUD 13.5 cents, representing a payout ratio of about 70% of underlying earnings. We expect InvoCare to continue paying fully franked dividends toward the top end of its target payout ratio range of 60% to 80% of underlying earnings.

Perpetual (ASX:PPT) – Narrow moat

Perpetual has three business offerings: as an asset manager, a private wealth advisor, and a corporate trust service provider. Acquisitions form part of the group’s strategy to build scale and expand its products and services.

Narrow-moat Perpetual ended fiscal 2022 with underlying net profit after tax, or UNPAT, of AUD 148 million, up by 21% from fiscal 2021. UNPAT beat our forecasts by 5%, mainly due to higher fee margins in asset management, which made up close to 50% of group profit before tax. High fee margins are unmaintainable, and we expect them to compress with time.

Crucially, funds under management, or FUM, was 10% below our forecast, while the medium-term cost outlook was higher than expected. The former reduces the compounding of FUM and revenue, and the latter (mainly wages) doesn’t directly grow revenue and would constrain margins. But we still expect profit growth from higher revenue over time—its funds are seeing flow improvements, private wealth had its ninth straight year of net inflows, and corporate trust is extracting a greater share of wallet from its customers. The proposed acquisition of Pendal is Perpetual’s latest attempt to boost growth. We’re not confident the synergies will outweigh the costs, which include the AUD 150 million of transaction costs.

TPG Telecom (ASX:TPG) – Narrow moat

TPG Telecom is grappling with structural changes in the Australian telecom industry. Rollout of the national broadband network, or NBN, and take-up of high-traffic products such as internet protocol television and video streaming, will increase the demand for broadband and backhaul capacity. However, the NBN will also force TPG Telecom to become a reseller, impacting its consumer broadband margins.

TPG Telecom's price-leader strategy still sees the company delivering solid subscriber and market share performance. Product bundling has also become a key segment in the market, with all players using broadband as a lead-in product and cross-selling voice, mobile, pay-TV, and digital streaming services.

We have assigned a narrow economic moat rating to TPG Telecom. The key source for the moat is cost advantage, stemming from the company's infrastructure and network ownership. This cost advantage is augmented by characteristics of efficient scale in the Australian telecommunications industry, aided by TPG's extensive infrastructure assets. Full ownership and operating control over these "hard-to-replicate" assets allow high margins and returns to TPG, compared with competitors who must pay to access these networks.

Source of research

It is worth noting that the Morningstar’s research and ratings you access through nabtrade may differ from the above analysis. Morningstar’s quantitative research determines a fair value based on algorithms run from select data points and can be found through nabtrade.

The research mentioned in this article is conducted by Morningstar’s equity analysts and is found through Morningstar Investor.

Source: Morningstar

Morningstar’s Global Best Ideas list are hand-picked opportunities from Morningstar’s global team of analysts. The list is updated each month and contains equities that the team considers as quality companies that are undervalued, or strong growth opportunities that are trading at an attractive discount.’ For the full list of stocks, sign up for a free, four week trial of Morningstar Investor here, and find it under the ‘Discover Investments’ tab.

Analysis as at 4 October 2022. This information has been provided by Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.