Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Rising interest rates and the impact on banks

The Reserve Bank of Australia's (RBA) surprise decision to lift rates by 0.50% at their June meeting confirms the central bank's determination to attack inflation. While there has been some angst in the financial press about rising interest rates, this is a sensible move to stop the economy from overheating and to tackle inflation. With the unemployment rate at 3.9%, the lowest since 1974, average Australian house prices up 30% since January 2020 and inflation at 5%, it is hard to make the case that the RBA needs to keep rates at ultra-low crisis levels.

Since the RBA decision, the major banks' share prices have fallen on average by -12% based on fears around higher bad debts as well general market malaise based on rising inflation in the US. However, a rising interest rate environment has historically been beneficial for bank profits, and loan losses in 2023 are likely to be significantly less than in the early 1990s or 2008-10.

Rising interest rates and expanding profit margins

Rising interest rates have historically expanded bank profit margins as rates charged on loans increase immediately while rates paid on cash accounts and term deposits rise slowly or not at all. Indeed, all the major banks increased variable mortgages by 0.5% within hours of the RBA decision, moving their standard variable rates to around 5.3%, with only minor increases in rates paid on a limited range of term deposits.

Rising interest rates increase the benefits banks get from the billions of dollars held in zero or near-zero interest transaction accounts that can be lent out profitably. In May 2022, Westpac revealed $601 billion in customer deposits (earning between 0% and 0.5%), enough to fund 83% of the bank's net loan book, which means that the bank doesn't have to go to the now more expensive wholesale money markets to fund their lending book.

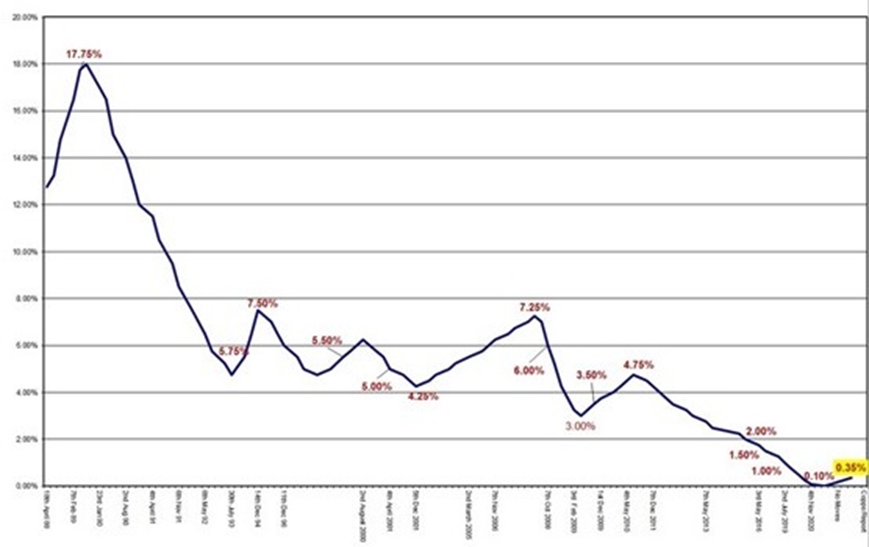

RBA rate moves since 1988 – the last 34 years

Source: Coppo Report

The market is ignoring the impact on bank earnings of the rise in interest rates. Every 0.25% increase in the cash rate expands bank net interest margins by around 0.02%. While this sounds like a small increase, based on a combined loan book of $3 trillion, this is significant. A movement in the cash rate from 0.35% to 1% will see an additional $5 billion of revenue flow to the Big 4 Australian banks.

Bad debts will rise, but that is not bad

Rising interest rates will see declining discretionary retail spending as a higher proportion of income is directed towards servicing interest costs. While bad debts will increase, this should be expected. In May 2022, the major banks reported bad debt expenses between 0% and 0.2%, the lowest in history and clearly unsustainable. Excluding the property crash of 1991, bad debt charges through the cycle have averaged 0.3% of gross bank loans for the major banks, with NAB and ANZ reporting higher bad debts than Westpac and CBA due to their greater exposure to corporate lending.

The 1989-93 spike in bad debts should be excluded, as here, bank bad debts jumped due to a combination of poor lending practices to 1980s entrepreneurs such as Bond and Skase et al., as well as interest rates approaching 20%.

In 2022 the composition of Australian bank loan books is considerably different to the early 1990s or even 2007, with fewer corporate loans and a greater focus on mortgage lending, secured against assets with historically low loan losses. In any case, bank loans will be priced assuming higher bad debts. In May, NAB noted that their average customer has approximately two years of loan payments in their offset accounts.

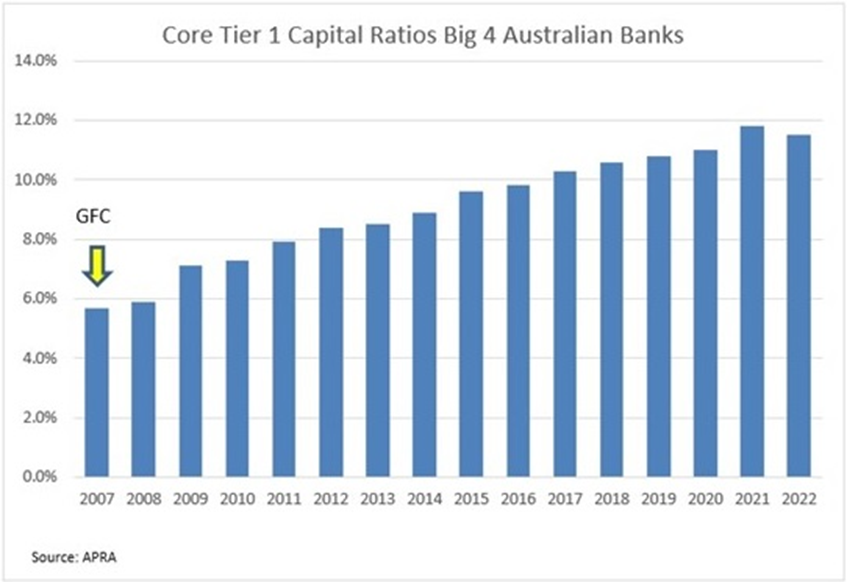

Well capitalised

All banks have a core Tier 1 capital ratio above the Australian Prudential Regulation Authority (APRA) 'unquestionably strong' benchmark of 10.5%. This allowed Australia's banks to enter the 2022/23 rising rate cycle with a greater ability to withstand an external shock than was present in 2006 going into the GFC.

The table below shows that the banks have been building capital, particularly since 2015, when APRA required that the banks have "unquestionably strong and have capital ratios in the top quartile of internationally active banks". Furthermore, in the aftermath of the Financial Services Royal Commission, the banks divested their wealth management and insurance businesses to varying degrees. This resulted in the banking sector remaining well capitalised to withstand increases in bad debts, though capital has dipped in 2022 due to share buy-backs conducted by all major banks.

Currently, in aggregate, the four major banks retain $15 billion in collective provisions against unknown doubtful debts. This equates to around 0.53% of gross loans, significantly above expected rises in bad debts. This provisioning level should comfort shareholders that the banks are well capitalised, and dividends will be maintained in the medium term.

Our take

The May 2022 reporting season showed that Australia's banks are in good shape and face a better outlook than many sectors of the Australian market. One of the major questions confronting institutional and retail investors alike is the portfolio weighting towards Australian banks in an environment of rising rates.

After the shock of rate rises has been digested, we expect the banks to outperform in the near future, enjoying a tailwind of a rising interest rate environment and high employment levels, which will see customers make the new higher loan repayments.

Additionally, the large domestic banks have much simpler operations in 2022, than the sprawling empires of the early 1990s and 2006, as well as minimal exposure to events in Europe and economic issues in the USA. With an average grossed-up yield of 8% and rising earnings, bank shareholders should be rewarded for their patience and for ignoring the current market noise.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. Analysis as at 22 June 2022. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.