Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Five thematic ETFs to consider as inflation and interest rates rise

My local Vietnamese bakery increased the price of a Banh Mi roll from $9.50 to $10.50 on the weekend – its second price increase this year. My favourite Banh Mi roll is now 17% dearer than at the start of 2022 (and still as delicious).

Presumably, the bakery lifted prices because its costs rose. Or perhaps because it can: a long line of customers at lunchtime gives the bakery significant pricing power. Either way, the bakery has lifted prices 17% when annual inflation is up 5.1%.

My Banh Mi anecdote is no surprise. From talk of a $7 coffee to the $5 lettuce (that politicians discussed) to media reports of a single mushroom that cost $3.50… stories abound of people paying higher prices for everyday items.

The real story is not just rising prices. Inflation (and interest rates) are now front-page news. Inflation shocks occur when inflation expectations take off. Wage pressures grow. Companies pass on faster price increases. Some firms price gouge. Inflation begets inflation.

Earlier this year, inflation doves argued a big difference this time (compared to the 1970s inflation shock) was expectations. Consumers didn’t expect a large, sustained inflation breakout. Also, a big part of higher prices was COVID-19-related and transitory.

Readers will recall I had a different view. For over a year, I’ve argued that higher inflation was coming. The biggest investment risk this decade would be loss of purchasing power as rising inflation ate into real returns on assets.

I’ve also argued that the best way to play rising inflation is by investing in hard and soft commodity producers – and banks.

On asset allocation, I suggested investors should hold more equities and cash in their portfolio (and avoid fixed-rate bonds). Well-chosen equities can maintain the real return as inflation rises. And more cash in the portfolio (even though it has a negative real return) provides optionality to buy equities during market corrections.

That view remains. I see local and global inflation heading higher from here, despite talk that inflation pressures will soon abate. Central banks have been too slow to tame inflation. The Reserve Bank of Australia was so far “behind the curve” on rate rises that its credibility was in question (before this week’s interest rate rise).

None of the main forces driving higher prices will abate anytime soon. Wage pressures will intensify as workers see prices jumping (witness some sectors pushing for a 25% increase). Energy costs will remain elevated as the Russia/Ukraine conflict sadly turns into a long, drawn-out conflict. COVID-19 in China is another wild card.

This thinking informs my view on the five Exchange Traded Funds (ETFs) outlined below.

Contrarians might use thematic ETFs to pounce on oversold sectors. Global biotech and Chinese tech are two candidates. Both have high risk (particularly China).

I prefer to use thematic ETFs to position portfolios for an extended period of higher inflation and slowing global economic growth. I still don’t believe “stagflation” (low growth, high inflation) will occur. But the odds are shortening by the day.

1. Food producers

Historically, soft commodities outperform when inflation rises. Also, Russia’s terrible war on Ukraine continues to affect the supply of wheat and other key grains.

Longer term, I like the thematic of a rising global population and more people joining the middle class (and upgrading their diet). At the same time, the supply of arable land is shrinking. Higher agricultural productivity is needed to feed more people.

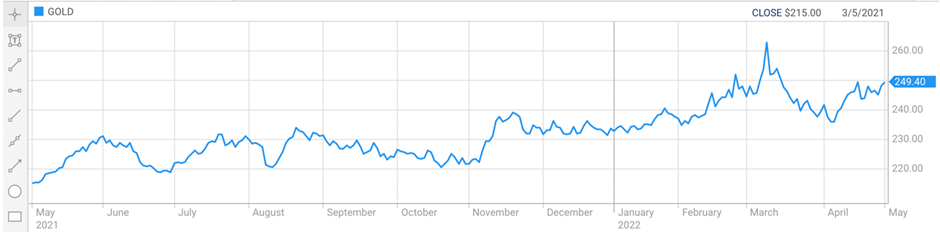

The BetaShares Global Agriculture Companies ETF Hedged (FOOD) fund has attracted interest this year. The ETF tracks an index of 56 of the world’s largest agriculture and farming-related companies. A third of the ETF is invested in fertiliser companies.

FOOD returned 24% over one year to end-March 2022. It’s done well since the March 2020 market low. The annualised five-year return is 11.2%. As inflation rises, global agriculture should outperform.

Chart 1: BetaShares Global Agriculture ETF Hedged (FOOD)

Source: ASX

2. Banks

Banks remain among the best ways to play rising inflation/interest rates. An expanding Net Interest Margin (NIM) as rates rise boosts bank earnings and dividend capacity. Of course, the NIM is only part of the story. A slowing global economy risks a spike in bad and doubtful debts, which is bad for banks.

For the past 12 months, I’ve preferred global banks, believing US and European banks are better priced than their Australian peers. The BetaShares Global Banks ETF – Currency Hedged – is a simple, cost-effective tool for global bank exposure.

Lately, my focus has swung more towards Australian banks. I’m concerned that the Russia-Ukraine war could be a headwind for Europe’s economy for longer than expected. Soaring US inflation (I don’t believe US inflation has peaked) and aggressive rate hikes by the US Fed are another concern.

Australia’s economy looks better placed than most. We won’t escape the growth/inflation problems overseas, but a sharp increase in bad debts here looks less likely. There is too much at stake in Australian housing for policymakers to stomach a wave of defaults by allowing rates to rise too far.

For Australian banks, the VanEck Australian Banks ETF appeals.

Chart 2: VanEck Australian Banks ETF (MVB)

Source: ASX

3. Resource producers

Australia’s big miners (notably BHP Group) look interesting after price falls in April. Energy, too, appeals for long-term investors.

A deterioration in the global economy might weaken short-term expectations that the next commodities supercycle is starting. Longer term, hard commodities have good prospects due to underinvestment in new mines – and the supply lag that will create.

Unrelenting focus on Environment, Social and Governance (ESG) investing has made it harder for some miners to invest in new projects. Oil projects are an example as investors, governments and other stakeholders pressure energy supermajors to focus more on renewables and less on new fossil-fuel projects. The difference between investment in this commodities cycle to the previous cycle is stark.

The SPDR S&P/ASX 200 Resources Fund (OZR) offers exposure to this market’s largest resource stocks through an ETF. Prospective investors should note that the ETF is highly concentrated in BHP Group (42% of the fund). Rio Tinto, Woodside Petroleum and Fortescue Metals Group constitute another 20% of the fund by company weighting.

Investors who like BHP Group’s outlook (and view it as the best local way to play the commodities cycle) could use the ETF. But concentration risk is a consideration for those seeking more diversified exposure to Australian resource stocks.

Chart 3: SPDR S&P/ASX 200 Resources Fund

Source: ASX

4. Precious metals

Investors typically favour gold ETFs during heightened market volatility. The precious metal’s “safe-haven” qualities are well known. The ETF Securities Physical Gold ETF (GOLD) is among this market’s largest ETFs (by assets) and popular with those seeking gold exposure.

The ETFS Physical Precious Metal Basket (ETPMPM) index is another option. This ETF provides exposure to gold, silver, platinum and palladium. Just under half of the ETF is invested in gold. A basket approach to precious-metals investing provides better diversification. But silver (18% of the fund) is affected by slowing global growth as that metal is used in industrial applications.

As stagflation risks increase, ensuring portfolios have sufficient gold exposure (as a defensive play) is important. Even though gold provides no income, most investors should have a small portfolio allocation (around 5%) to gold for diversification.

Chart 4: The ETF Securities Physical Gold ETF (GOLD)

Source: ASX

5. Cash

I’ve been criticised for including cash in lists on ETF ideas. So, here goes again: higher exposure to cash is warranted as inflation rises and market volatility increases.

Yes, cash pays an almost zero net return and even less after inflation. It’s been the worst asset to hold with term deposits paying barely anything. But cash is most valuable when nobody has it – and provides critical optionality to buy equities during corrections.

A near-zero return on cash might look awful on paper. That is until global equities fall 15-20% in a year and the relative return on cash feels like winning the lotto.

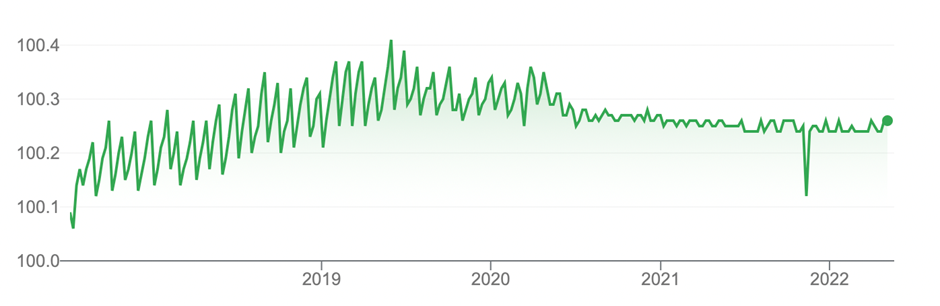

The iShares Core Cash ETF (BILL) or BetaShares High Interest Cash ETF pay a bit less than term deposits. But unlike term deposits, which lock money away for years, cash ETFs can be sold quickly. That’s a valuable trait given the prospect of heightened market volatility this year.

Chart 5: iShares Core Cash ETF

Source: ASX

All prices and analysis at 4 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531). This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.