Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Unemployment remains at a low 4.1% in January

Taylor Nugent & Michael Hayes | Markets Research

Key points

- Unemployment remained at 4.1% (NAB and consensus 4.2%)

- Employment was broadly in line with expectations at +18k, moderating after a strong December print (NAB and consensus +20k)

- Underemployment rose 0.2ppts to 5.9%, partially retracing tightening in December

- Today’s print suggests the labour market remains tight

- NAB continues to expect the RBA to hike policy in May

Summary Table

Bottom line

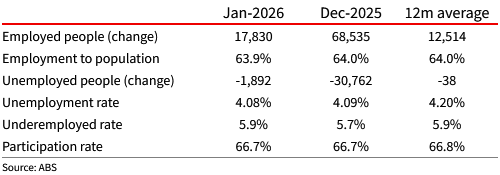

Employment growth of 18k was near our, and consensus expectations for +20k but the unemployment rate was steady at 4.1%, (4.08% unrounded) against expectations of a small increase following the 2-tenth decline in December. Until mid-to-late 2025, the labour market had shown some easing relative to 2024, but the past couple of months of data, which show a trend decline in the unemployment rate, bring it more into line with other indicators that show some ongoing capacity pressures.

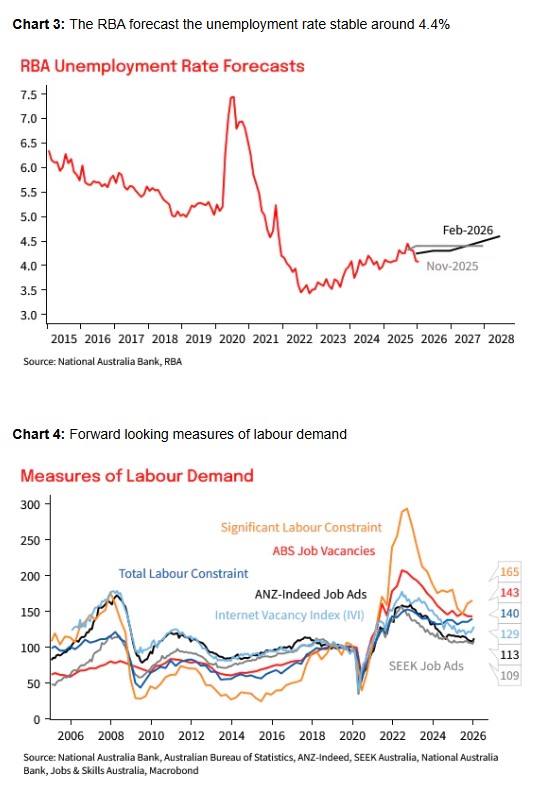

The RBA forecast the unemployment rate averaging 4¼% over the first half of 2026. Today’s outcome won’t be a material surprise to that forecast but will reinforce that some further tightening in policy will be required. NAB continues to expect the RBA will hike rates in May, noting that the risk skews to an additional hike or a longer period of rates on hold relative to our baseline forecast.

Detail

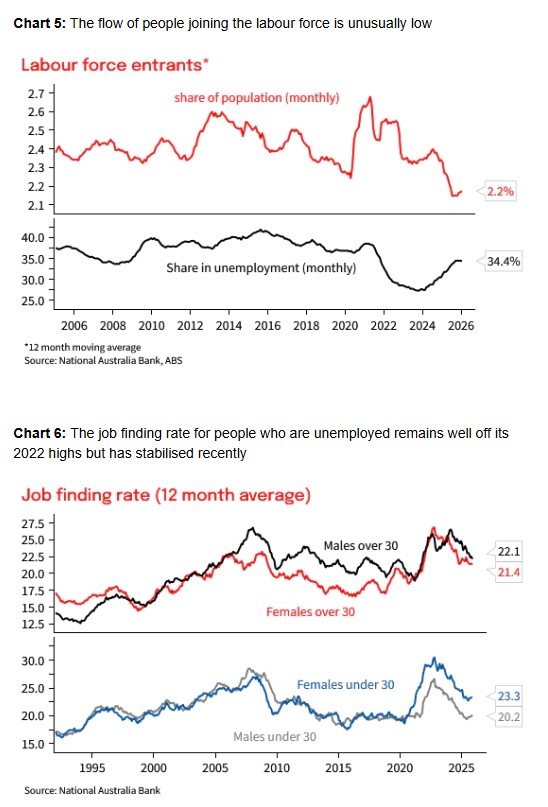

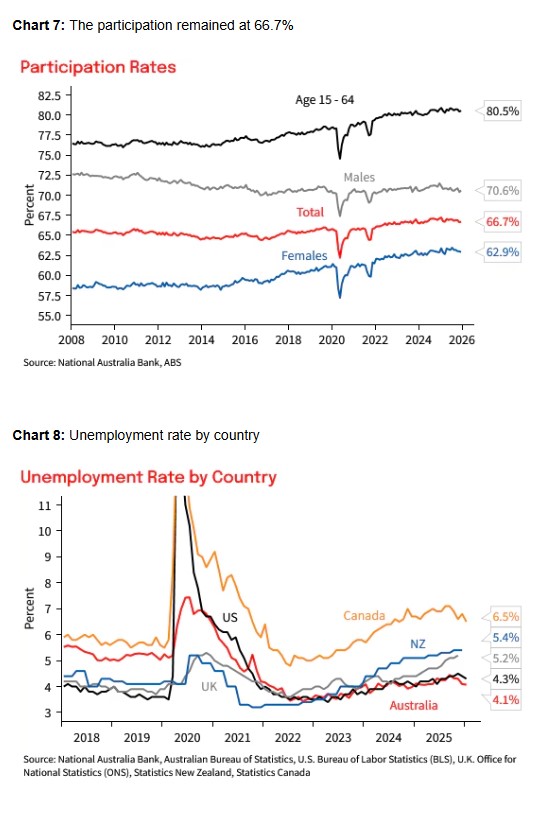

Employment growth has average just 12.5k over the past 12 months, about half of what is required to keep pace with population growth, but it has not translated into an increase in the unemployment rate because the participation rate has fallen. It is now down 0.6ppt from its record high 12 months ago. Gross flows data shows that is the result of much fewer than usual people joining the labour market. As a result, labour supply growth has been much more constrained than population growth alone suggests, reflected in elevated capacity constraints and continued difficulty finding suitable labour which in the NAB Business Survey remains around a level last seen prior to the GFC where the labour market had been tight for an extended period and wage growth very strong.

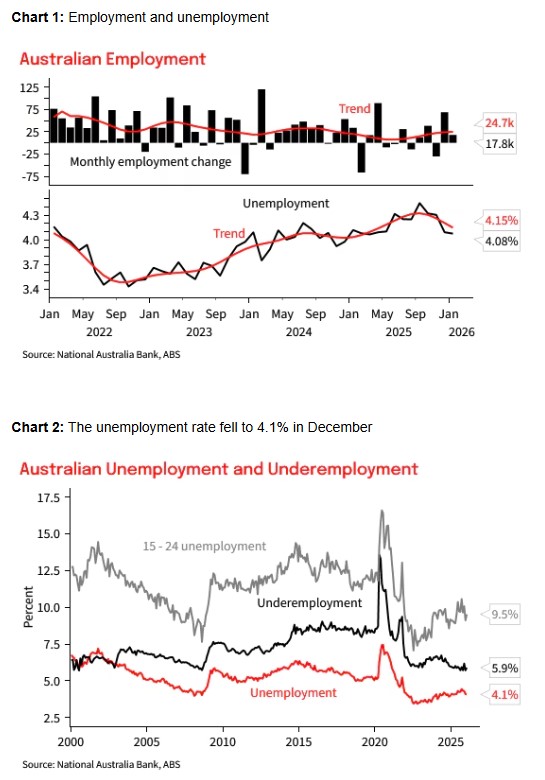

While the unemployment rate was steady at 4.1% in January, some other indicators of underutilisation did at least partially retrace their December fall. Underemployment rose 0.2ppts to 5.9% partially retracing the fall from December to be in line with the 12-month average. Youth underemployment rose 1.0ppt almost fully retracing the fall from December. Even so, both remain well below pre-pandemic levels,

The participation rate declined less than 0.1ppts and remained at 66.7 fall which helped the unemployment rate remain at 4.1%. The employment to population rate fell by 0.1ppt to 63.9%.

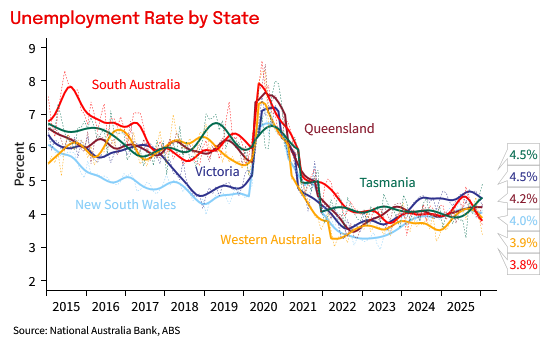

By state, the unemployment rate is at or below 4% in SA, WA and NSW. Labour markets in QLD, WA and SA remain substantially tighter than they were pre-pandemic.

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 19 February 2026. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.