Key points

- In a unanimous decision, the RBA Monetary Policy Board increased the cash rate to 3.85%.

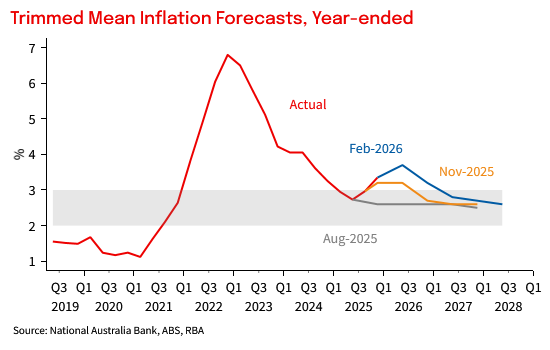

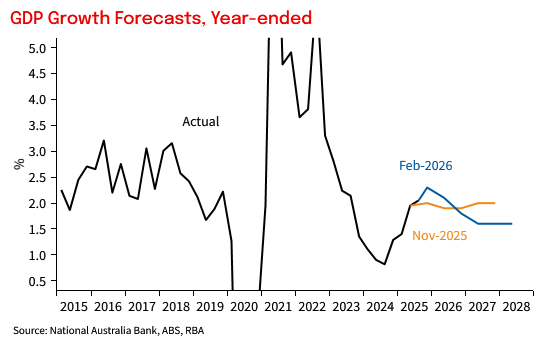

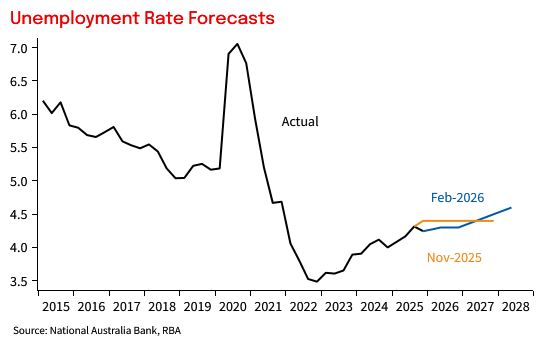

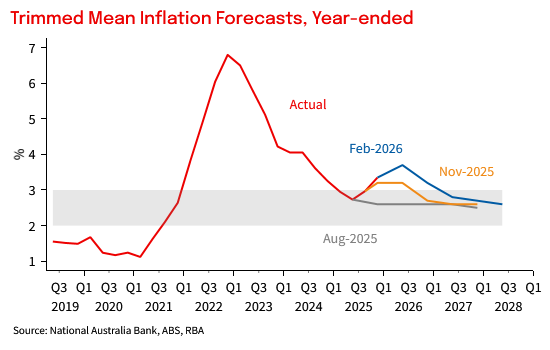

- For the second consecutive quarter, there were meaningful upward revisions to the RBA’s trimmed mean forecasts in the quarterly SoMP; longer-term GDP forecasts were revised down and there is now a gentle upward drift in the unemployment rate forecasts.

- The RBA sees the labour market as a “little tight” and that capacity constraints are binding more than previously expected.

- NAB expects the RBA to deliver another 25bp increase in the cash rate in May; risks are biased towards more than 50bps of hikes. The RBA could also remain on hold at 4.1% longer than we currently expect.

Outcome and Assessment

The RBA increased the cash rate by 25bp to 3.85%, with the Statement noting that “…inflation is likely to remain above target for some time.” The SoMP provides a little more colour to this assessment, observing “…Strong inflation outturns in the second half of 2025 indicate that there is greater breadth and strength to current inflationary pressures than previously assessed.”

However, there are other dynamics at work too – private demand growth has been stronger than expected, the unemployment rate has been a little lower than expected and there are greater capacity pressures in the economy. Financial conditions were assessed as easing over 2025 and housing activity and prices continue to pick up.

The Statement notes that the RBA is willing to attribute some of the pick-up in inflation to temporary factors, reflecting “…sector-specific demand and price pressures that are expected to wane over the coming year…” But with the RBA’s core inflation forecast for June 2026 having increased by 110bps in the space of six months, little comfort should be taken from this assessment.

A narrative which reflects an economy where “…private demand is growing more quickly than expected, capacity pressures are greater than previously assessed and labour market conditions are a little tight” means that this is unlikely to be a “one and done” scenario for the RBA. We continue to forecast a follow-up 25bp hike in May, although risks are biased to an earlier hike and the possibility of more than just a modest 50bp recalibration. Indeed, the Statement refers only to upside risks for the domestic economy, and global uncertainty is viewed as significant but of little consequence for the Australian economy. Should inflationary pressures prove more persistent and / or domestic economic activity surprise on the stronger side of expectations, the RBA may be forced to consider the need for a larger policy adjustment in 2026.

RBA SoMP Forecasts

There were some significant changes to the RBA’s forecasts in the updated Statement on Monetary Policy (see charts below):

- On inflation, near-term forecasts were upgraded significantly, and the return into the target band pushed out from December 26 to June 27. A stronger profile for market services inflation is a significant driver of this forecast change. Longer-term, core inflation does not get back to the near the mid-point (2.6%) until June 28. In August, the forecasts envisaged core inflation of 2.6% by December 2025.

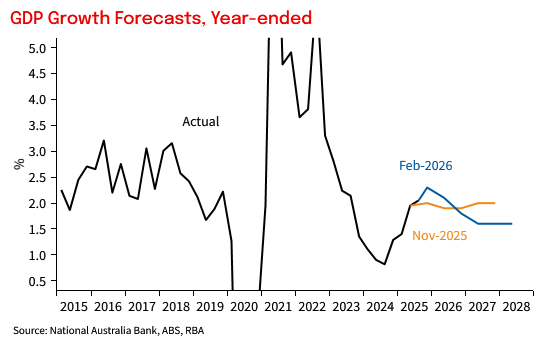

- On GDP growth, the longer run forecast has been downgraded by 40bp to 1.6% yoy by June 2027. A downward revision to the household consumption trajectory appears to be the main driver of this forecast change. Near-term, the forecasts have been revised up, consistent with evidence of stronger outcomes in private final demand.

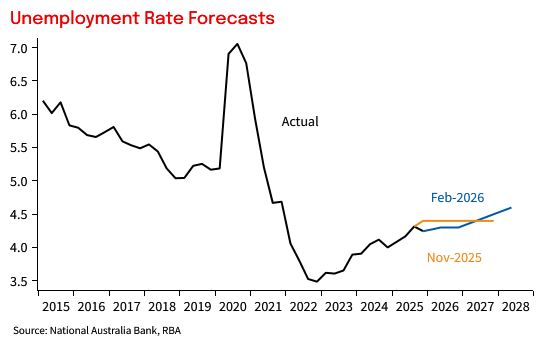

- The unemployment rate forecast now sees a gradual drift higher in the trajectory, with the unemployment rate reaching 4.6% by June 28. Near-term forecasts have been revised down a touch, reflecting better than expected outcomes of late.

On net, the forecasts now envisage sub-trend growth in 2026/27 and 2027/28, a necessary outcome to get inflation back towards the mid-point of the RBA’s target band by mid-2028. Importantly, risks to the forecasts set in the SoMP appear to be reasonably symmetric, which is a good starting point.

It is also important to remember that these forecasts are conditioned on a cash rate path which anticipates a policy rate of ~4.20% by June 28; the SoMP notes that “…The path for monetary policy assumed in the forecasts – with cash rate rises this year – is expected to restore balance between aggregate demand and potential supply.”

Chart 1: Trimmed Mean Inflation forecasts

Chart 2: GDP forecasts

Chart 3: Unemployment forecasts

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 3 February 2026. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

|