Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Much ado about everything

Schroders Australia

There seems little doubt that the nominee for the Federal Reserve chair, Kevin Warsh, will do his master’s bidding. The POTUS will get his wish; the Fed will lower rates. In itself, this is unlikely to have large market consequences. Other policies outlined by Warsh, however, could have massive market consequences, which will exaggerate the direction and magnitude of market moves we have seen on the ASX200 through recent months, and again in January.

In an op-ed in the WSJ, ”The Federal Reserve’s Broken Leadership”, Warsh nominated four factors that the Fed needs to change. Indeed, if this was a successful public pitch for the job, Warsh presumably will get to work and put them all in effect.

Warsh believes the great US asset is a culture of reward for enterprise, and resulting commercial ingenuity; AI, as the latest manifestation of this, will be a powerful deflationary force not yet incorporated into Fed growth and inflation models. Hence, US short rates will see more downwards pressure under a Warsh regime than may have been the case hitherto. Secondly, inflation is not caused when economic growth and wages are growing too strongly; it is caused when government “… spends too much and prints too much. Money on Wall Street is too easy and credit on Main Street is too tight. The Fed’s bloated balance sheet can be reduced significantly …”. This monetarist approach is a critical point which, if effected, may materially depress asset prices; and is especially pertinent for sectoral performance in an ASX200 context, as we detail below. Thirdly, Warsh maintains bank regulation has been undue, especially on smaller banks. And finally, Warsh believes that “the Basel endgame isn’t America’s endgame”, and suggests the US should detach from Basel regulatory and supervisory standards. It is difficult to see the Australian market following suit and this is unlikely to have local consequences, at least in the near term.

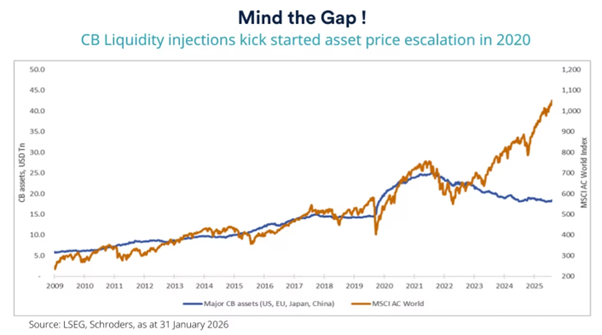

In seeking to reduce liquidity, Warsh may in turn compress the multiples paid for assets and especially equities, which have grown aggressively with the Fed balance sheet since the GFC, as highlighted in the chart below.

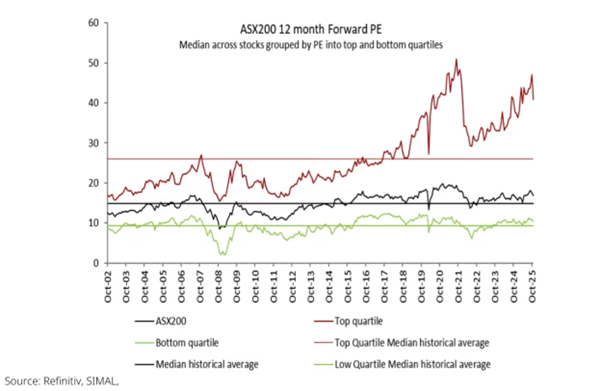

The benefit of this escalation in multiples hasn’t been democratic. Reflecting the global experience, higher multiples stocks on the ASX200 have fared best. As can be seen in the chart below the bifurcation has been extreme, and the retracement of recent months still quite modest relative to almost any previous period. If Warsh makes good on his threat to reduce the size of the Fed balance sheet, and in turn equity market multiples are pressured, it can be seen that in an Australian context higher multiple stocks are where all of this pressure will vest. And the magnitude of the correction could be greater than what has been seen in recent months, which is simply unwinding the rerating which has occurred since the Fed and other central banks started aggressively increasing the size of their balance sheets in 2020:

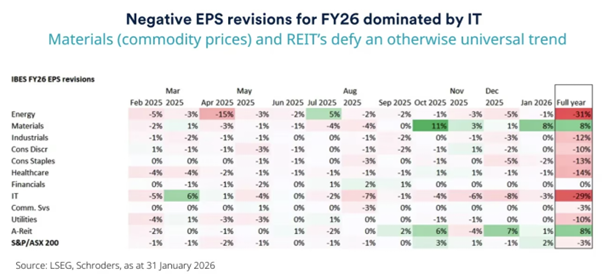

The obvious retort to any suggestion of a convergence in multiples between sectors, towards a level more consistent with what has been observable for much of recent decades, is to point to the difference in earnings growth expectations. Alas, as is often the way, price is what you pay and value is what you get. It is one thing to expect magnificent earnings growth; it is yet another to have it delivered. In the US, IT stocks have largely delivered on earnings growth expectations. That has not been the case in Australia, and the shortfall against expectations has been as large as Ben Duckett’s during the recent Ashes tour. As a case in point; IT on the ASX200 has seen a 29% reduction in F26 eps estimates through the past year, with only Energy (-31%) faring worse. In contrast, REITs and Materials (8%) have seen F26 earnings revised up through the past year, and in the case of Materials this is purely due to commodity price increases driving revenues (as costs have continued to rise faster than initial expectations).

When starting from elevated multiples, with earnings growth falling far short of lofty expectations, one doesn’t need a commercially existential threat such as the emergence of commercial applications of AI, let alone the wilful misallocation of capital such as Xero’s acquisition of Melio, to crystallise the potential for derating. We would like to own many of the companies which have been derated in recent months at fair prices given a proportionate balancing of the prospective opportunities and risks they face; and yet it can be seen from the foregoing that our best assessment is that in many cases we are still a material way from that point, especially should Fed Chair Warsh make good on his banner policy of withdrawing liquidity.

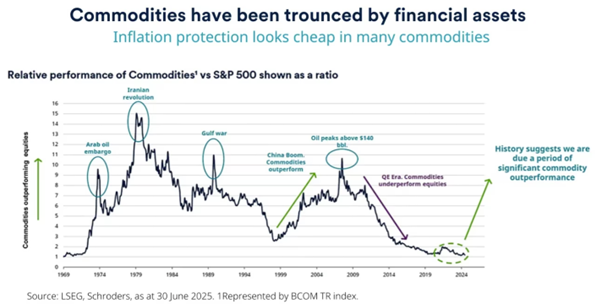

Just as stark as the weakness in the growth sectors on the ASX during the past several months has been the strength in commodity linked sectors and stocks. This has been driven by commodity prices, which have seen rolling manias – gold, and more recently other precious metals, whilst lithium has been strong for much of the past several months as well. There is little doubt that government policy has excited the market in many of these cases, whether it be because of thematics including monetary debasement (gold and precious metals); decarbonisation (copper); and defence policy and onshoring (broad metals suite). Warsh’s concept of reversing a strong momentum of recent years, and rebalancing away from Wall Street to Main Street, together with fiscal policy directed towards a restoration of domestic industrial capacity in developed markets, could well see a reversion in the relative prices of commodities and financial assets to a far greater extent than has been observable just in recent months.

Notwithstanding the above and lower starting multiples and stronger earnings growth, even within the commodities related stocks on the ASX, absolute value hasn’t been easy to find in an almost 5% government bond world, if one requires an additional equity risk premium, and accepts that real earnings growth will continue to be harder to find than forecasts may suggest. This is compounded by an ongoing temptation to misallocate large amounts of capital; suffice to say, we believe that RIO (ASX: RIO) dodged a bullet in walking away from its proposed bid for Glencore. As the saying goes, if you can’t see the patsy at the card table; it’s you. Glencore could see their patsy, whilst RIO was initially blinded by love. Equally, we could see little value in BHP’s (ASX: BHP) proposed acquisition of Anglo American, mostly because our long run copper price remains below market, not because of any scepticism on demand on our part but simply reflecting future cost curves.

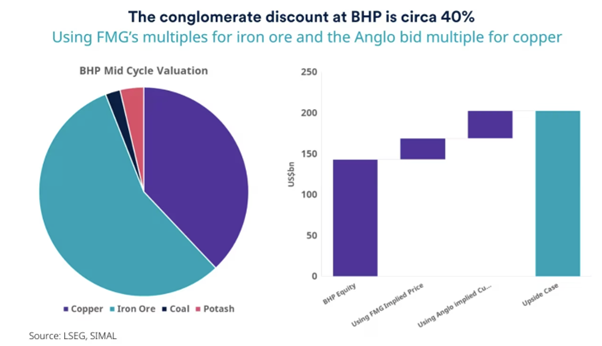

The bigger opportunity for the major miners, in our opinion, in pursuing an M&A agenda driven by the creation of value, is to break themselves up. As our learned colleague Mr Halliwell has highlighted, taking Fortescue’s multiple for iron ore and the multiple used for the Anglo bid and applying them to the relevant segments within BHP were they to be listed as pure play commodity entities, would see 40% upside for BHP, which is an enormous value driver for what during January became the biggest stock listed on the ASX. A similar break up value exercise, with also material upside, can also be undertaken for RIO. The prospect of either pursuing a transaction of this type is remote, but it should be the counter factual that is measured against before either executes on their seemingly primeval urge to undertake any further large-scale acquisitions at high multiples of book value.

Finally, the bid for Bluescope (ASX: BSL) during the month crystallised some value in a position which we have held for some years. Whilst volumes are relatively stable, and spreads are cyclical, Bluescope still has many of the attributes we covet in a business; an asset base which is difficult to replicate and instate in an age of increasing cross border tariffs, manufacturing differentiated product which garners a price premium in the case of Colorbond, and earnings which whilst depressed at current spreads have the potential to lift materially. With negligible debt, the business also trades at low multiples, which for businesses with long duration are difficult qualities to find.

Market Outlook

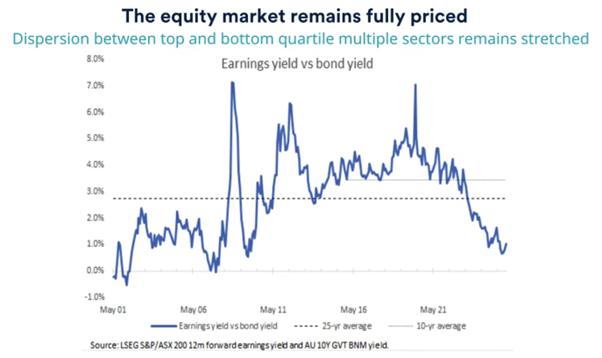

As we have detailed, we continue to believe assets are broadly fully priced, and those with the most optimistic growth forecasts on the ASX continue to be the most fully priced, even after the rotation from growth to value stocks observed in recent months. As global inflationary pressures continue to mount, and incoming Fed chair promises to consign the six or more years of excess liquidity to history, we are starting to see a rotation into those stocks offering more certain, nearer term cashflows. Whilst on the one hand this should not be surprising given this has been the long run historical pattern when asset prices falter, recent years had started to temper that belief as “buy the dip” was the prevailing and rewarded wisdom at a market and stock level. The forces of change are upon us; we suspect the last few months are better seen as the beginning of a restoration of more traditional policy and market settings, than they are seen as a blip. If so, much of what has been seen in terms of sectoral and stock rotation through recent months on the ASX, is still nascent as a trend, and investors best position accordingly.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 16 February 2026. This document was originally published in Livewire Markets on 16 February 2026. This information has been prepared by Schroder Investment Management Australia Limited (ABN 22 000 443 274, AFSL 226473) (Schroders). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.