Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Japan in 2026: Is the Takaichi trade the new Trump trade?

Tamara Haban-Beer Stats | BlackRock

Amid worrying headlines around tariff uncertainty and the tech sector approaching bubble territory, we saw investors cool on US equities last year and reignite their interest in Asia.

Japan stood out as a particularly positive investment story, as the surprise election of Sanae Takaichi as prime minister ushered in a new era of fiscal support and Japan’s phased shareholder reforms continued to take shape.

These trends fuelled Japanese equities to record highs last year, with the Topix 100 Index breaching 3000 points and the Nikkei 225 rising above 50,000 late in 2025.1

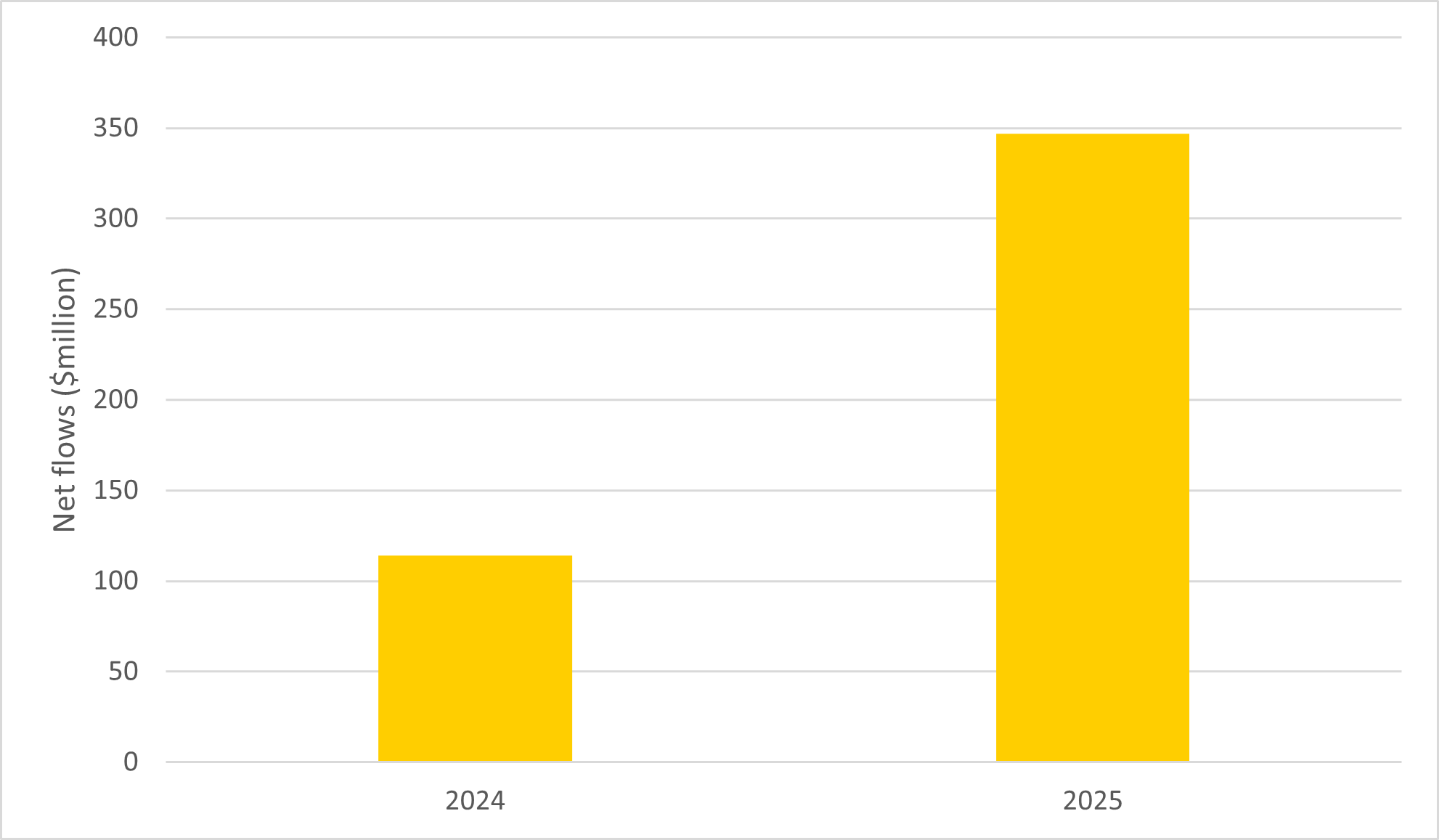

They also drove buoyant inflows to Japanese equities among Australian investors, with the iShares MSCI Japan ETF (IJP) gathering over $360 million in net flows last year – more than triple the fund’s 2024 flow numbers.2

Inflows to the MSCI Japan ETF (IJP), 2024 vs 2025

Source: BlackRock data as of 15 December 2025. Note 2025 figures are from 1 January – 15 December 2025

Source: BlackRock data as of 15 December 2025. Note 2025 figures are from 1 January – 15 December 2025

Looking ahead in 2026, we expect continuing investor interest in Japan and other Asian equity markets. A recent BlackRock client survey indicated just under 50% of respondents intended to increase their exposure to share markets in the Asia Pacific region in the next three months.3

So as investors search for new growth opportunities beyond the US, do the fundamentals in Japan stack up for another strong year of returns?

Can the Takaichi trade last?

Much like the so-called ‘Trump trade’ of late 2024, the ‘Takaichi trade’ fuelled investor optimism on Japan last year due to the incoming prime minister’s dovish monetary policy leanings and ambitions to support economic growth through a program of tax cuts and subsidies.

While Takaichi has so far had to negotiate through a coalition with the Japan Innovation Party and other independents, the prime minister is expected to call a snap election in February to take advantage of her strong approval rate and increase her party’s majority.

This would give the prime minister more room to push ahead with her growth-oriented agenda, supporting domestically-oriented Japanese equities and aligning with BlackRock’s general overweight view on Japan this year.

One of the main risks around Takaichi’s policy stance that has concerned markets is the impact on inflation, with November 2025 figures indicating a 3% increase in consumer prices, ahead of the Bank of Japan’s 2% target rate.4

Although CPI has moderated from close to 4% earlier in 2025, the Bank of Japan has now resumed hiking interest rates, which it largely held off doing in 2025 as uncertainties around global trade played out.

Looking ahead, we anticipate the central bank will proceed cautiously and rely on data, with one more rate increase expected in Q3. BoJ Governor Ueda has stated inflation must be sustained by domestic wage growth to justify further hikes.5

Although rising goods prices have hurt real wages, Japanese unions plan to push for significant pay raises this year, with negotiation outcomes typically announced in March.6

The Tokyo Stock Exchange reforms that have driven increased investor interest in Japan over the last few years are also set to move into a new phase in 2026, with companies being delisted that have not made sufficient improvements to earnings growth and capital efficiency.

The Japanese Financial Services Agency will also revise its corporate governance code this year, with a focus on effective capital allocation and better use of cash for investment.

Modernisation has driven significant reform to Japan’s equity market in recent years, with shareholder distributions more than tripling over the past decade.7

While Japanese share valuations are currently at the higher end compared to history, the reforms may ultimately see the local equity market – which has been chronically undervalued compared to developed market peers – re-rated higher on a long-term basis.

Accessing growth in Japan

As well as offering a compelling tactical investment case in 2026, Japanese equities can also provide useful long-term diversification opportunities for Australian portfolios.

For those holding broad global equities exposure through an index such as MSCI World, Japanese equities are under-represented, making up less than 6% of the index weighting.

As such, investors may wish to use a single-country ETF like IJP to dial up their exposure to Japanese shares if valuations are looking appealing.

The MSCI Japan Index tracked by IJP also provides access to sectors that may be under-represented in local investor portfolios.

With a 25% weighting to industrials and 17% weighting to consumer discretionary, the index may offer complementary exposure to the Australian share market which is dominated by financials and materials, as well as tech-heavy US equities.8

As an unhedged exposure, returns in IJP can fluctuate with movements in the Japanese yen. As the Bank of Japan potentially resumes its rate hike path in 2026, this may work to investors’ benefit versus currency hedged ETFs, as we may see the yen appreciate when interest rates rise.

Overall, with a strong program of fiscal support providing tailwinds to the domestic economy, and reforms having an ongoing positive impact on the equity market, we see Japan continuing to attract interest as investors search for new growth opportunities in Asia.

- Source: Invesco, 2 December 2025

- Source: BlackRock data as of 31 December 2025, based on 2025 vs 2024 calendar year net flows

- Source: BlackRock data as of 13 January 2026, based on a post-event survey of 526 BlackRock APAC clients

- Source: BlackRock data, as of 19 December 2025

- Source: Reuters, 1 December 2025

- Source: Reuters, 25 November 2025

- Source: Bloomberg/S&P data, as of 31 July 2025

- Source: Bloomberg/S&P data, as of 31 July 2025

DISCLAIMER

Opinions are subject to change, and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation. Diversification and asset allocation may not fully protect you from market risk.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 14 January 2026. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Where BIMAL funds are referenced - Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) at blackrock.com/au to see if the products referenced are appropriate for you. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide at blackrock.com/au for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. All currency in AUD unless otherwise stated.

Product list

iShares MSCI Japan ETF (IJP)

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

iShares MSCI Japan ETF | IJP | -