Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is there opportunity in the software shakeout?

Andrew Mitchell | Ophir Asset Management

The global IT sector, and software businesses in particular, have been caught in a full-blown bloodbath that began in the back end of 2025 and has only gathered momentum this year.

Domestically in Australia, the IT sector was down -9.4% in January, while it fell a much more modest -1.7% in the U.S. This understates the carnage in the U.S., though, where the S&P 500 Software Index was down -13.1% on the month, nearly twice the fall of the next worst industry group.

What caused it? Well, it’s a murderer’s row of suspects, including:

- Claude’s new AI release

- ChatGPT

- Agentic coding

- Fear of what’s to come from Elon Musk’s ‘Macrohard’ – which started as a joke on Microsoft’s name.

But broadly, investors have become petrified at how easy it might be for AI to replicate and improve on traditional software businesses, particularly those operating what was previously thought of as stable Software-as-a-Service models (delivering applications on the internet usually via subscriptions).

The victim list so far is a roll call of some of Australia’s best-known tech names, like Xero, TechnologyOne, WiseTech, Catapult Sports, Pro Medicus and Life360.

In the U.S., it includes names like Atlassian, Docusign, ServiceNow, Salesforce, Palantir and Adobe – all those names are down -20% or more so far this year, at time of writing.

The sell-off has been indiscriminate, with high-quality stocks tossed out with the low quality, and those with likely big moats against AI disruption getting carted with the rest.

It’s interesting, because if history tells us anything with the internet, it’s that the software application layer of the internet made all the money – think Google, Meta, Amazon, WhatsApp, etc.

But with AI, there are essentially five layers:

- Energy needs: Including companies like Constellation Energy that power data centres.

- Chips needs: NVIDIA is the clear standout here in the semiconductor design and manufacturing space.

- Memory/storage needs: Mostly in the cloud, in data centres with winners like Microsoft Azure, Amazon Web Services, Coreweave and NextDC.

- Large Language Models: Like Claude, ChatGPT, Gemini and Grok, which are the most visible winners so far.

- Application software layer: This is also where some hardware like robotics sits as investors debate what form factor the software will be delivered in – e.g. desktop/mobile/glasses/robot, etc.

There will no doubt be new AI-enabled application software companies that we don’t know yet, or haven’t been established, that will likely be big winners and household names in 5-10 years.

But to assume all of today’s traditional software companies are going to be losers and not be able to successfully integrate and leverage AI seems very shortsighted.

It really is an environment of ‘shoot first, ask questions later’ at the moment.

SaaSpocalypse Now?

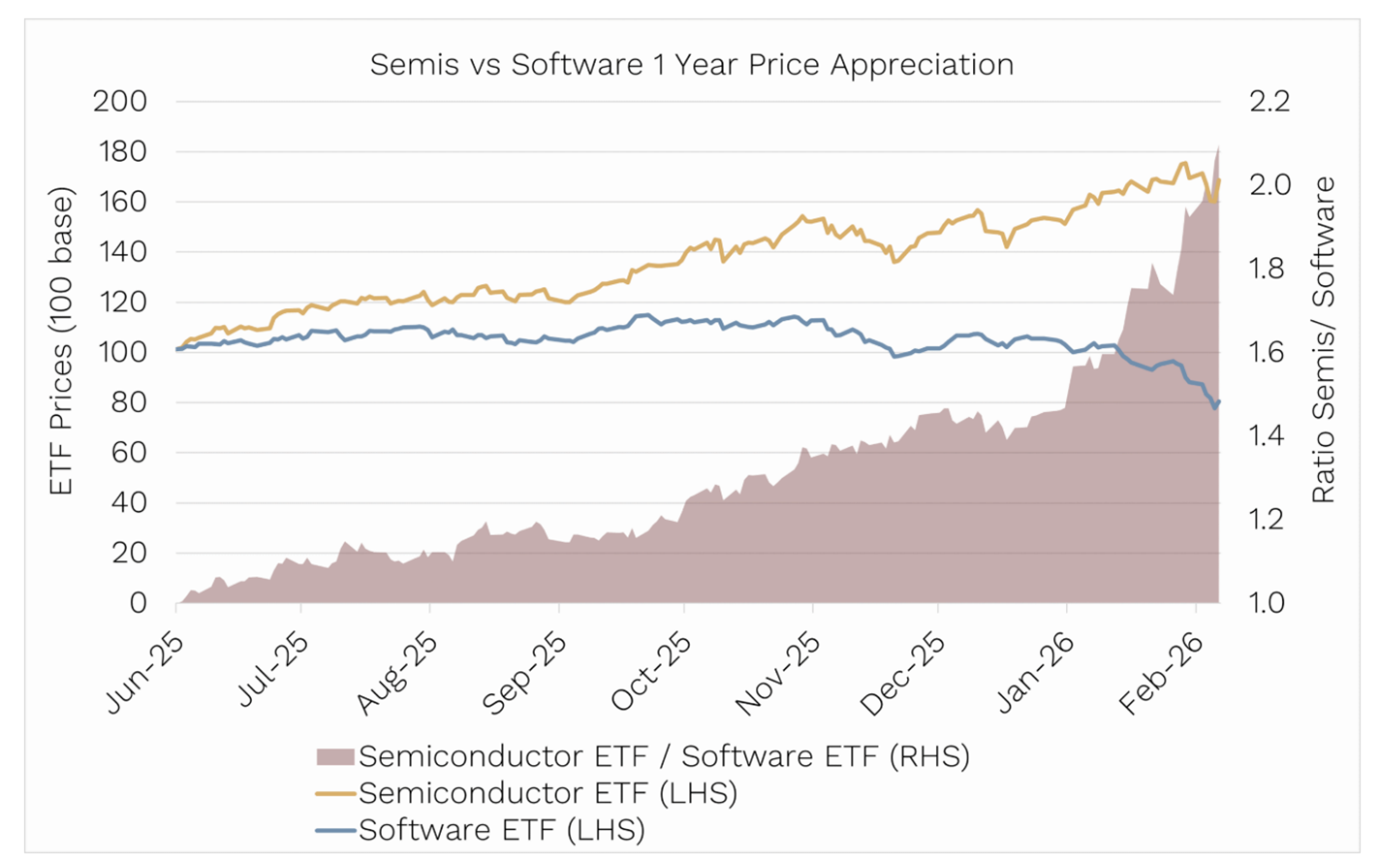

Within the broader AI thematic there has been a growing dispersion between software and semiconductors. This began in mid-2025, but has accelerated in 2026.

Both groups sit under the ‘tech’ umbrella, but their near-term investor narratives couldn’t be more different.

Put simply:

- The application layer (SaaS) is being severely punished for uncertainty around the durability of its business models in an AI world.

- The picks and shovels (semis, AI Infrastructure) are being rewarded for their growth potential and the earnings certainty that AI investment is creating for them.

This dispersion is throwing up big opportunities for Ophir in both application companies and semis, but we are mindful of managing downside risks as debates about the impact of AI continue to play out.

Source: Ophir. Bloomberg.

The software shakeout: zero-seat threat

The woes of the software sector started as a slow bleed in the second half of 2025 when it became clear AI investment would skew heavily toward infrastructure, rather than application-layer enhancements. Investors began recalibrating growth expectations for software businesses.

But then the software sector was rocked on January 12 when Anthropic released its Claude Cowork preview. It showcased autonomous agents that could perform complex workflows with minimal human input.

This wasn’t just another chatbot. It highlighted that entire seat-based workflows (licensing models based on the number of users) could be replaced.

For the past decade, enterprise SaaS companies have grown alongside corporate headcount. Products were priced ‘per seat’, and forward multiples assumed that more humans meant more licences.

But if AI agents can perform a week’s worth of work in a day, the unit of value in software – the human seat – comes under serious structural pressure.

This is the Zero-Seat Threat.

While big-cap incumbents like Salesforce (CRM) and Adobe (ADBE) have launched AI initiatives (Agentforce, Firefly) to defend their moats, these have yet to translate into a tangible revenue uplift, and investors fear that incumbents are simply running to stand still.

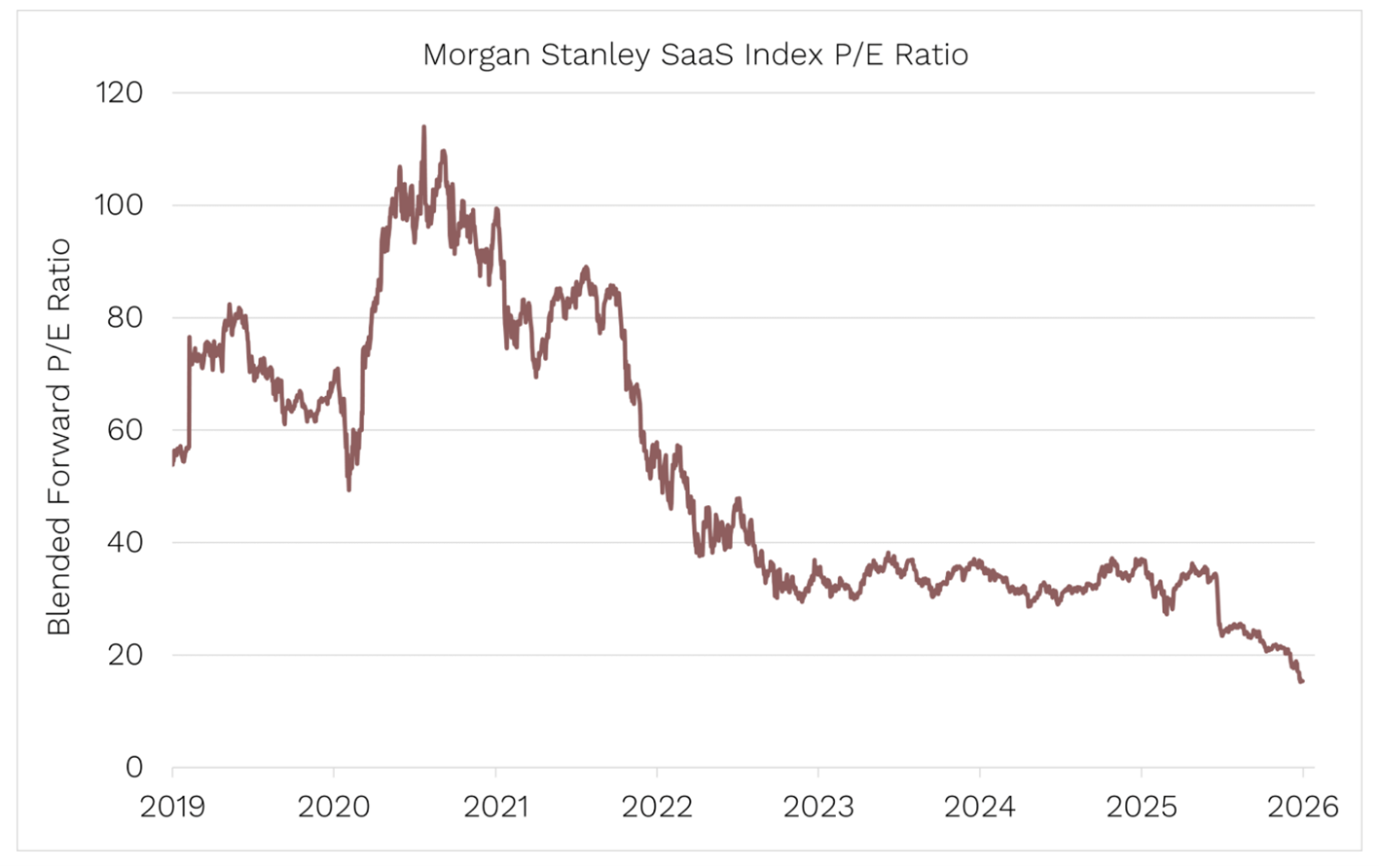

When long-duration stocks lose revenue predictability, multiples compress quickly. Morgan Stanley’s SaaS index forward earnings expectations are now trading on ~15x, compared to a 30-40x range since mid-2022.

Source: Ophir. Bloomberg.

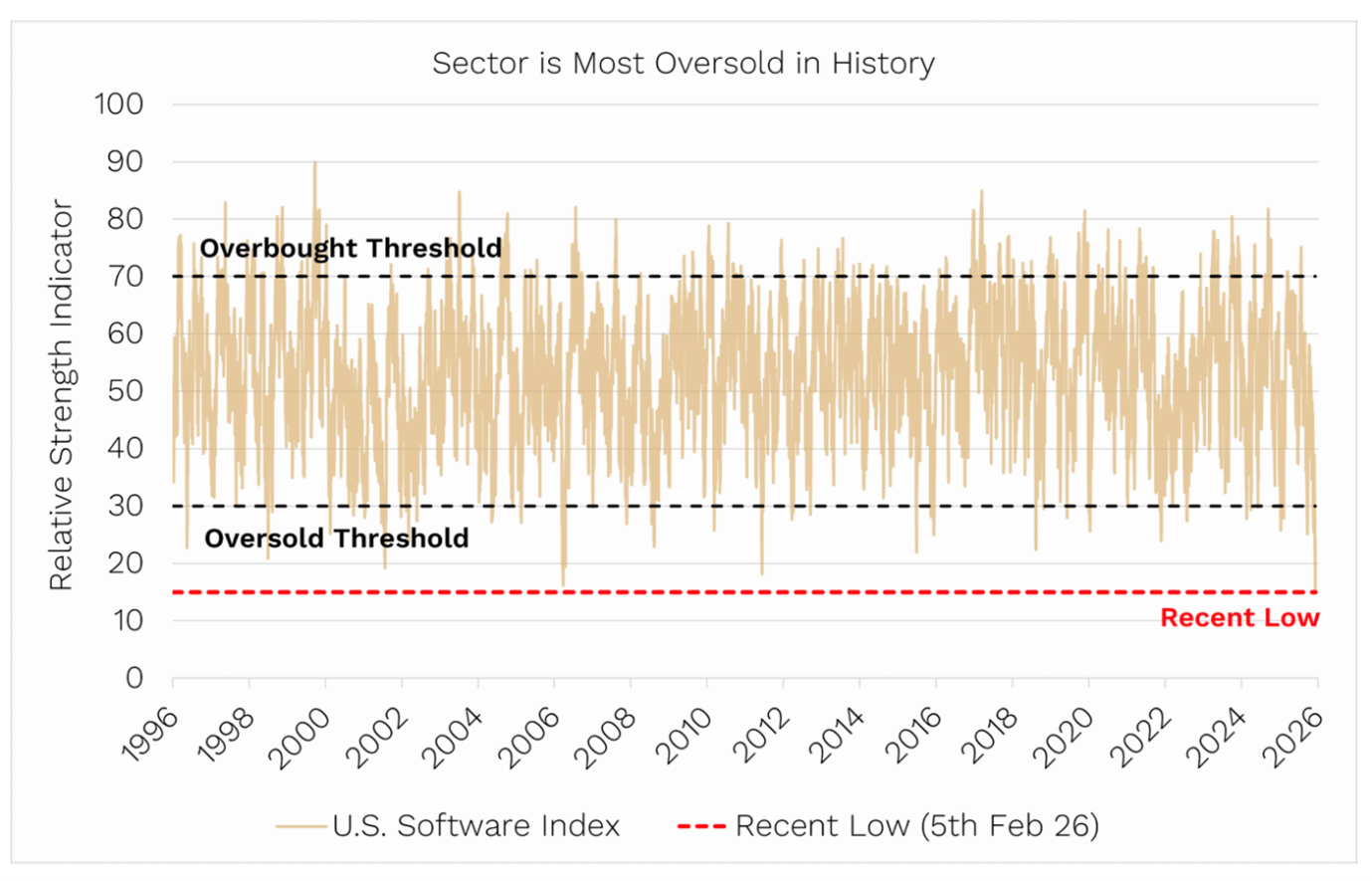

The software sector is now showing its weakest technical breadth since 2018. The S&P North American Software Index recently hit it’s most oversold level ever based on its 14-day RSI (relative strength index) – even more than in the tech wreck of 2001!

Source: Ophir. Bloomberg.

U.S. Software Index refers to S&P North American Technology Software Index (SPGSTISO).

Given the quantum and indiscriminate nature of the price moves in the sector, we expect there to be opportunities to invest in companies that have been oversold.

However, we are mindful that as uncertainty persists and the debate around future earnings continues, it will be difficult for many software names to see their multiples re-rate.

Meanwhile in semis: earnings visibility is the new growth

While software stumbles, semiconductors are going from strength to strength.

Semis are benefiting from both a cyclical rebound and structural AI demand.

It began, of course, with Nvidia, the poster child of the AI build-out, but it’s now expanded into the broader infrastructure stack.

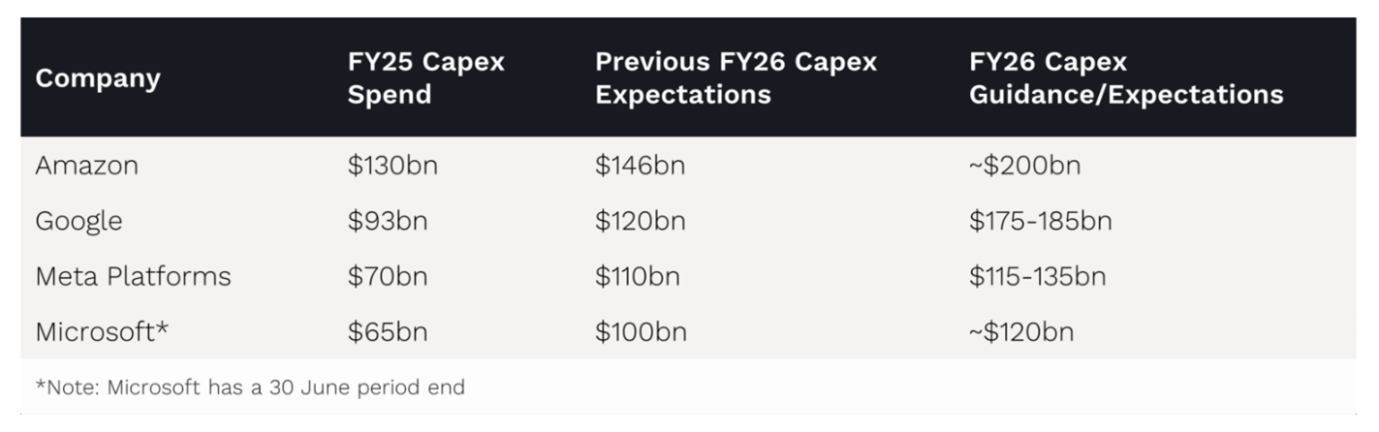

The major driver is huge AI capex.

Microsoft, Amazon, Alphabet, and Meta have all locked into multi-year AI capex plans, committing hundreds of billions each toward training clusters (specialised supercomputers to build large language models) and inference capacity (infrastructure to run AI for users).

In their recent results, all of these companies provided capex guidance for 2026 that was well above market expectations.

This obviously creates surging demand for chips and chip-making infrastructure.

Source: Ophir & Company Reports. Figures in $USD.

Semis have typically been more cyclical, but massive AI capex has given them what investors love – earnings visibility.

With AI being funded in real time, order books are now full, supply is constrained, and lead times are stretched.

This has shifted the entire sector’s narrative from ‘cyclical’ to ‘critical infrastructure’.

At the same time, semis are benefiting from a broader macro recovery in PCs and smartphones.

And in January there were several key events that added more fuel to the fire:

- At CES (Consumer Electronics Show), Nvidia CEO Jensen Huang called out memory and storage as the next AI frontier.

- Samsung and Micron said the price of memory was increasing 40-50%.

- TSMC came out with really strong capex guidance of ~US$52-56 billion, which was well above market expectations.

As a result, memory and storage names have continued to surge, including (approximate 1-year returns) SanDisk (+1,230%), Seagate (+315%) and Western Digital (+415%).

Managing exposure across the stack

So how is Ophir playing this dynamic?

From our seat, this isn’t just about picking winners amidst an ever-shifting debate and material share price movements.

It’s about managing risk and not doubling down when stocks could de-rate further.

We believe in application-layer AI, but the market will take time to separate the winners and the survivors from the losers and the disrupted.

And while we remain exposed to some AI infra winners, we’re conscious that ‘earnings certainty’ trades rarely last forever as the market eventually overcapitalises future earnings and pays too high of a multiple.

While we will selectively invest in SaaS names that have cash flow support and have catalysts to reduce uncertainty, we won’t be relying on a recovery in software or a continuation of semi strength to drive future performance.

Importantly, though, it’s clear some of these traditional software businesses today that are able to harness the benefits of AI to increase their moats, along, of course, with new AI-related start-ups, will be some of the best performing in the years ahead, and they remain firmly in our investment ‘hitting zone’, which keeps us incredibly excited.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 17 February 2026. This document was originally published in Livewire Markets on 17 February 2026. This information has been prepared by Ophir Asset Management Pty Ltd ABN 88 156 146 717. AFSL 420082. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.