Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

‘May You Live in Interesting Times’

Henry Jennings | Marcus Today

One of the great things about precious metals — and gold in particular — is the almost mythical presence it holds in financial markets. Spend an hour on YouTube searching for gold and conspiracy theories, and you’ll emerge with a head full of paranoia and plotlines lifted straight from a Hollywood script.

Gold has held a mysterious allure for humanity since the dawn of time. It’s been a store of value, a cause of conflict, and the ultimate symbol of greed. The Midas touch. Goldfinger. Fort Knox. Robberies. Daring heists. You don’t get that with iron ore.

It’s probably the most emotional asset on a fund manager’s shopping list, and that emotion fuels narratives soaked in fear and greed. Wander down the online rabbit hole, and you’ll find theories about manipulation, secret vaults, shadowy central bank deals and global plots involving precious metals. Whether you believe any of it or not, it shows how emotionally charged gold is.

There really is no other commodity like it. Nobody ever made a movie called Copperfinger. There’s no Fort Knox for nickel. No underground vault dramas for aluminium.

In today’s fast-paced financial world, markets overshoot — violently — both up and down. Maybe that’s options positioning and leverage at work. Maybe it’s ETFs amplifying flows. Or maybe, if you’re deep enough on YouTube, it really is a global conspiracy and Chinese speculators are plotting to overthrow Western capitalism via bullion prices.

More likely, it’s the big themes: investors and institutions diversifying away from fiat currencies, worries about debt-laden governments, and the search for something that can’t be printed with a keystroke.

Gold sits right at the intersection of money, fear, history and human psychology.

Which is exactly why it never trades quietly.

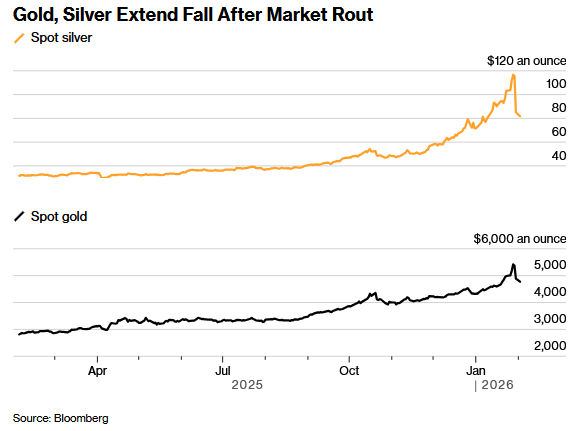

It’s only early February, and we’ve already seen extraordinary moves in commodities — especially gold and silver. Silver was nudging US$120 an ounce and is now around US$76. Gold, in Aussie dollar terms, ran to nearly A$7,900 and is now closer to A$6,700. These are wild swings. Plenty of investors — and more than a few retail punters — will have been toasted on the blow-off top and the trapdoor that followed.

Maybe they’re not precious metals anymore. Maybe they’re ‘precarious’ metals.

The pullback was blamed on Friday’s announcement of the next Federal Reserve chair, Kevin Warsh. But let’s be honest — this sell-off was loaded, cocked, and just waiting for someone to pull the trigger. What it really exposed was the immense leverage in the system, the tidal wave of money chasing the same trades, and ETFs’ special talent for turning market moves into market events.

We saw the same thing in 2025 when passive flows into the ASX 200 and ETFs pushed Commonwealth Bank to $192 on a P/E approaching 29 — richer, at times, than US tech growth darlings. For a bank! That lends money. A building society, really! Crazy times.

The same mechanics drove precious metals. As retail money piled into silver and gold ETFs, liquidity looked deep — until it wasn’t. On the Friday of the silver smash, turnover in one major US silver ETF reportedly hit US$40bn. A normal day? About US$2bn. That’s not orderly trading. That’s everyone trying to leave through the same revolving door.

Now we wait to see whether Kevin Warsh is as hawkish as his historical comments suggest. In the past, he’s liked higher US rates, but he’s also keen on reshaping how the Fed operates. He’s said to be close to Treasury thinking, which matters when the US has US$38 trillion of debt and roughly a quarter needs refinancing this year. You don’t need to be a political scientist to see why President Trump might prefer lower rates. Is Warsh the man to deliver? Time will tell — Senate approval, Powell’s future role, and all the usual Washington theatre still sit in the wings.

There’s no doubt that gold and silver had become silly. But bulls will argue nothing fundamental has changed: central bank buying, retail flows, US dollar debasement fears, geopolitical risk, and a perceived decline in US dominance have all supported gold. Silver, as usual, hitched a turbocharger to gold’s engine. The gold–silver ratio reached extremes not seen in decades — rarely a sign of calm, rational markets.

Chinese speculators piled in too, and the enormous leverage used to buy these metals is now being unwound. Not gently. More like being dropped down a lift shaft.

So, the real question: end of the commodities bull market, or just a violent, necessary correction?

For gold producers fresh from the quarterly reporting season, bullion prices remain extraordinary. With all-in sustaining costs around A$2,600–2,700, margins are still enormous even after the pullback. These businesses remain cash-generating machines. Notably, when gold and silver went parabolic, the miners didn’t follow to the same degree — a quiet hint that equity investors already suspected bullion had temporarily left reality behind.

Inevitably, bargain hunters will reappear. We’ve seen this movie before. In October, gold peaked around US$3,500, corrected sharply, the bears declared victory — and months later the bulls were back in charge. That’s commodities: cyclical, emotional, and never boring.

The difference now? Algos, leverage, trading bots, hedge funds and retail platforms have strapped rockets to the cycles.

Value will return to gold miners. Central banks aren’t done buying. The drift away from US-dollar assets continues. And it feels unlikely Trump would appoint a Fed chair unwilling to cut rates. His Powell experience didn’t end in red roses for him on Valentine’s Day. Perhaps Warsh said exactly what needed to be said in the interview. Who hasn’t? We all do it to get the job. Remember, Warsh was passed over for Powell in the November 2017, in the Trump 1.0 interview round.

If US rates really do head towards 3.1% this year, a weaker dollar could easily reignite the commodities rally.

Interesting times, indeed. Just maybe keep your seatbelt fastened. And avoid leverage. That is the real killer in any market. And did I mention reporting season is coming? More volatility on the way. The Killing Season beckons!

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

All prices and analysis at 3 February 2026. This information has been prepared by Marcus Today Pty Limited. Marcus Today Pty Ltd ABN 57 110 971 689 is a Corporate Authorised Representative (no. 310093) of AdviceNet Pty Ltd ABN 35 122 720 512 (AFSL 308200). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.