Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The major forces set to have outsized impacts on markets this year

Justin Tyler | Daintree Capital

Delayed tariff drag, fragile resilience

As 2026 begins, global markets are sending a deceptively calm signal. Tariffs remain a dominant geopolitical and economic theme, yet risk assets have shown a remarkable ability to absorb the noise. Equity markets have avoided a decisive drawdown, credit spreads remain contained, and volatility has struggled to stay elevated.

This resilience is not accidental, nor does it imply tariffs are irrelevant. Instead, it reflects a belief that the economic effects are delayed rather than avoided, and that monetary policy still retains the capacity to respond if growth weakens. The challenge for 2026 is that this belief system is vulnerable to disruption — not necessarily from tariffs themselves, but from exogenous drivers (for example geopolitics) as well as second-order effects in labour markets, interest rates, and regional divergences.

Why tariff risk looks manageable — for now

The muted market response to tariffs can be traced to three overlapping dynamics.

First, timing effects are masking the drag. When tariffs are announced or escalated, firms tend to front-run the shock. Inventories are rebuilt, shipments are accelerated, and demand is pulled forward. That behaviour temporarily supports activity and trade volumes, even as it sets up a weaker phase later when inventories normalise and demand softens. Recent deterioration in exports growth to the United States suggests this adjustment is beginning, but the broader macro data has yet to fully reflect it.

Second, inflation has remained contained. Despite higher tariff barriers, inflation has not re-accelerated in a way that forces central banks to tighten policy. A key reason is that many firms have absorbed tariff costs through margins rather than passing them fully through to consumers. That has preserved confidence that central banks — particularly the Federal Reserve — can ease policy if growth disappoints.

Third, perceived tail risks have been steadily repriced lower. The most severe policy outcomes implied by rhetoric have often failed to materialise, and retaliation has been more limited than initially feared. Over time, investors have learned to discount the most extreme scenarios, reducing the premium paid for protection and allowing risk assets to remain supported.

Together, these forces explain why markets enter 2026 without obvious signs of stress. But they also leave markets exposed if the next shock arrives from an unexpected direction.

A key risk: US labour-market tipping point

In the United States, the most important macro variable for 2026 is not tariffs, but the labour market. Growth has become increasingly narrow (supported primarily by health care and social assistance), unemployment measures have drifted higher, and layoffs have picked up.

The danger lies in the nonlinear nature of labour markets. Employment can absorb gradual deterioration for an extended period — until a threshold is crossed. Once firms shift from freezing hiring to actively reducing headcount, the impact on consumption, confidence, and credit conditions can be rapid. This tipping-point risk is difficult to price because it often becomes visible only after it has begun.

Monetary policy remains the key counterweight. As long as inflation stays contained, the Federal Reserve retains scope to ease toward a more neutral stance if labour weakness intensifies. This expectation underpins much of the market’s current resilience.

However, 2026 also carries a less intuitive risk: tighter financial conditions without a recession. If early-year weakness proves modest and growth momentum improves later in the year, markets may conclude that fewer rate cuts are required. That may push yields higher, tighten financial conditions, and pressure valuations — even as economic data improves.

Regional divergences sharpen in 2026

Europe enters 2026 with a potential upside catalyst concentrated in Germany. Defence and infrastructure spending, if implemented on schedule, could shift the region’s growth mix toward domestic demand in the second half of the year. That would partially offset external headwinds from weaker trade and geopolitical uncertainty. Execution risk remains the key caveat: delays or dilution would significantly reduce the impact.

China’s outlook is one of stabilisation rather than acceleration. Policy support is likely, but oriented toward sustaining production and exports rather than delivering a decisive consumption-led rebound. A persistently undervalued currency supports competitiveness but limits upside for domestic demand growth. This mix implies steady industrial activity without a material re-rating of global growth expectations.

Australia faces a different set of challenges. Capacity utilisation remains elevated, inflation surprises have complicated the policy outlook, and expectations for further easing have faded. Market pricing has increasingly shifted toward the possibility of rate hikes later in 2026.

Four macro regimes to watch in 2026

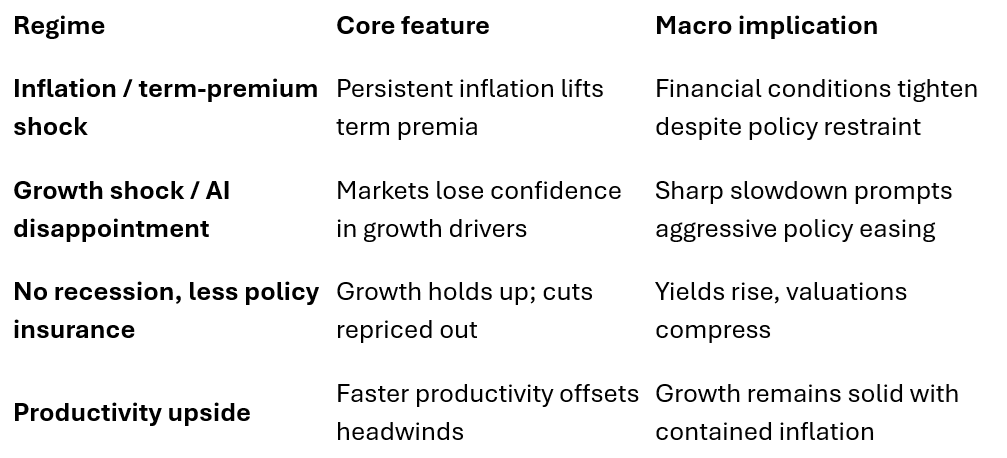

The year ahead can be framed around four plausible macro regimes, each with distinct market implications:

A critical point is that these regimes are mutually exclusive in their drivers, but not in their probability. 2026 may involve transitions between them.

What makes 2026 different

Unlike earlier phases of the cycle, 2026 may feature a changed global monetary policy backdrop, and as such the price action in Australian rates may be a precursor for price action in other markets. Downside risks are no longer concentrated in one obvious shock, and economies may need to withstand tighter financial conditions as monetary stimulus expectations are reduced.

Markets have been calm because the tariff shock has been delayed and inflation has behaved. The risk for 2026 is that this calm becomes fragile — not because tariffs suddenly intensify, but because labour markets tip, or rates reprice, or regional divergences widen, or policy credibility in the US specifically is questioned. Indeed, we believe all these uncertainties may shape markets in some way over the coming year.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 13 January 2026. This document was originally published in Livewire Markets on 13 January 2026. This information has been prepared by Daintree Capital Management Pty Ltd, ABN 45 610 989 912, AFSL: 487489. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.