Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

On track for a Feb RBA rate hike and a likely follow-up in May

Kieran Davies | Coolabah Capital

The RBA looks on track to raise rates by 25bp in February and likely follow up with another hike in May.

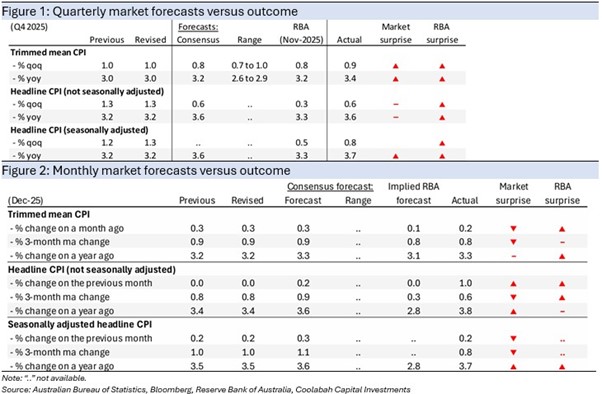

As foreshadowed by the monthly CPI, the RBA’s preferred measure of underlying prices – the trimmed mean CPI – rose by 0.9% in Q4 after a 1.0% increase in Q3. The strong increase plus some small revisions to history saw annual inflation round up to 3.4% in Q4.

Although not as disastrous a result as the Q3 outcome, the quarterly increase was above the RBA staff’s quarterly forecast of 0.8%, with annual inflation of 3.4% materially higher than the RBA estimate of 3.2%.

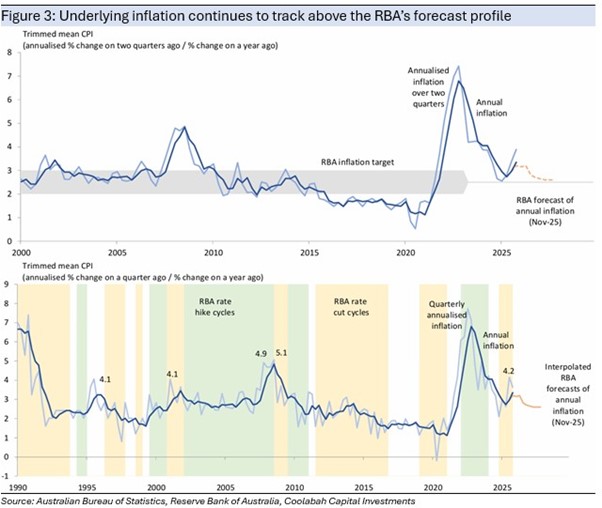

The RBA sometimes calculates the trend in inflation as the annualised inflation rate over two quarters, with this measure picking up from 3.4% in Q3 to 3.9% in Q4. Excluding the pandemic and its aftermath, this is the highest annualised rate over two quarters since the global financial crisis.

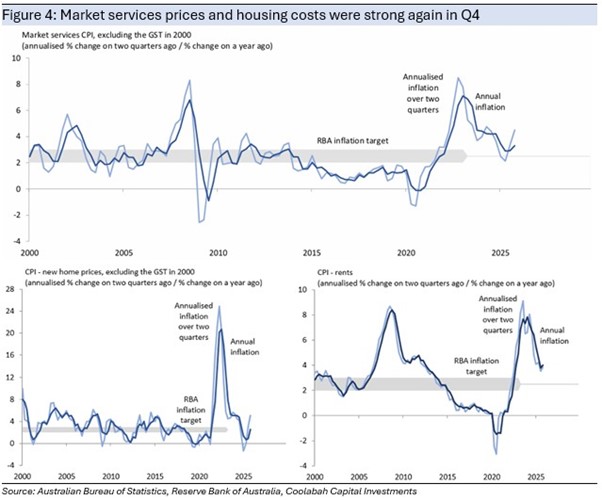

The detail of the CPI was also unwelcome news for the RBA, with housing costs and market services prices both rising strongly in Q4.

Housing costs are important because they have the largest weight in the basket of goods and services that make up the CPI.

The price of a new home, excluding land – which is the largest single component of the CPI –has recovered strongly from some small falls around the start of last year, rising more quickly in Q4, up 1.4% in the quarter to be 2.5% higher than a year ago.

Rents, which are the second-largest component of the CP, posted another strong rise, increasing by 1% in the quarter to be up 4% over the past year (note that rents were distorted in earlier quarters by government subsidies).

Market services are services for which pricing tends to be market-based, with prices generally driven by domestic factors, especially labour costs.

Consistent with the strength in trimmed mean inflation, market services prices rose by an estimated 1.1% in Q4 to be 3.3% higher than a year ago.

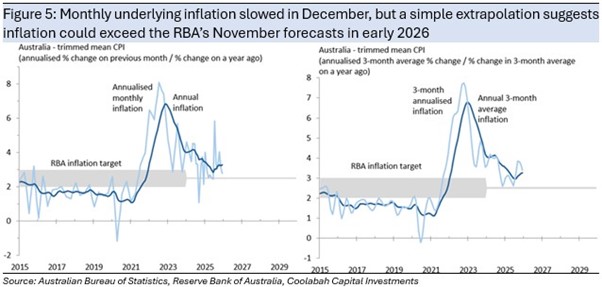

The only moderately good news for the RBA was that the monthly trimmed mean CPI rose more slowly in December, up 0.2% after increasing by 0.3% for four months in a row.

However, a simple extrapolation of this smaller monthly increase would still see annual inflation track above the RBA’s forecast profile in the first half of this year, running closer to 3½% than the RBA estimate of 3.2%.

The RBA staff will finalise their forecasts this week for the RBA board to consider at their policy meeting next week.

Given the persistence in inflation and a better labour market than the RBA had anticipated, we still think that the RBA will hike rates by 25bp, lifting the cash rate from 3.6% to 3.85%.

The RBA rarely hikes rates once and a message of fine-tuning with only one rate rise would risk undermining the impact of tighter policy, such that a follow-up hike in May seems likely, where the Q1 CPI is due in late April.

The obvious risk to this view is that enough board members vote in favour of waiting for more information, particularly when the government will likely pressure the RBA not to hike.

Importantly, the persistence in inflation also suggests that the RBA needs to reconsider whether it has been wrong to overwrite staff estimates with lower judgement-based assumptions for the NAIRU and neutral policy rate.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 29 January 2026. This document was originally published in Livewire Markets on 29 January 2026. This information has been prepared by Coolabah Capital Ltd ACN 153 555 867 Australian Financial Services Licence No. 482238. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.