Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

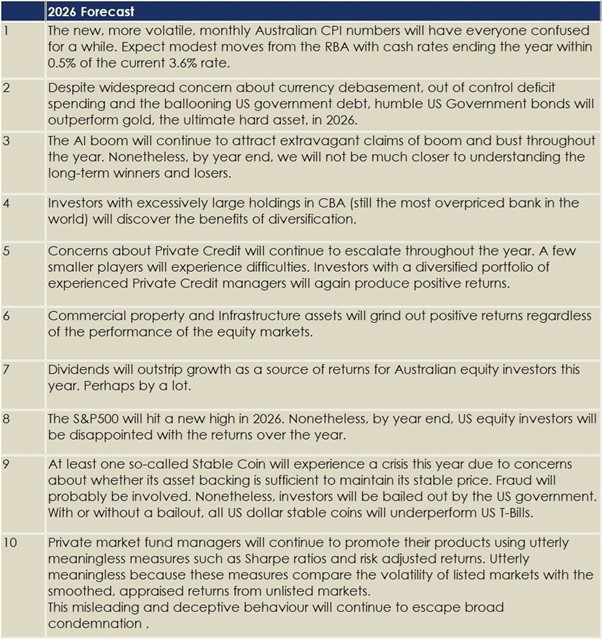

10 fearless forecasts for 2026

Tim Farrelly | Delta Portfolios

As is our custom at this time of the year, we provide 10 fearless forecasts for the year ahead.

The track record of these forecasts is pretty good as you’ll see later.

Off to the races? Unfortunately, no. These forecasts are quite different from most that you read at this time of the year. Firstly, they are quite accurate. Secondly, there are not a lot of money-making opportunities in there. Thirdly, while there are not a lot of money-making ideas, there are some ideas that may help avoid some disasters.

Reading between the lines, at the heart of the forecasts, are really just some pretty commonsense ideas.

- Stay diversified.

- Be careful about assets that have run hard in recent years

- Don’t chase past returns.

- Be sceptical when reading fund manager marketing materials – particularly those promoting past returns and using dubious risk metrics.

The idea that is categorically NOT in our list of forecasts is the one that we normally see at this time of the year which is that the author has some special insights into the year ahead and will enable the positioning of the portfolio to take advantage of that.

And, we reproduce our forecasts and the outcomes of those forecasts. This is the other thing that is different about these forecasts: we hold ourselves to account.

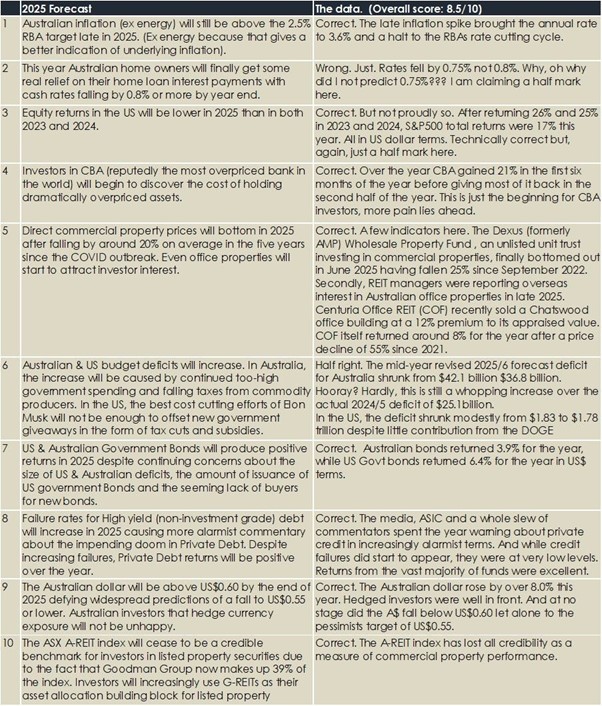

2025 forecasts in review: 8.5 out of 10

The 2025 results were healthy with three half marks reducing the score from a perfect 10 down to 8.5. Nothing wildly wrong but not quite spot on either.

While the 2025 forecasts may not have helped readers make money, we believe that they did contain quite a lot of commonsense.

Firstly, try to ignore forecasts or recommendations that are not backed by sound data.

For example, the idea that government deficits will produce high inflation and interest rates is often spruiked around. Last year we correctly forecasted that deficits will remain high but that cash rates will fall and bonds will produce reasonable returns. In fact, the data shows that there is a very weak linkage between deficits and interest rates over meaningful timeframes.

Another widely held idea is that a struggling Australian economy may cause a major fall in the Australian dollar. Again, the data simply does not support this idea. Hopefully, readers of our forecast will have resisted the urge to lift any currency hedging they may have had in place, saving money if not actually making it.

Also in that category was the suggestion that High Yield Debt will continue to produce strong returns despite all the alarmist commentary. Another example of money saved for those who continued to hold positions in High Yield Debt of various stripes despite all the chatter.

Secondly, unremarkably, we continue to be fans of diversification whether it is to rebalance wildly overpriced and over-represented assets (eg. CBA) or to add to assets that may have been through a tough time (commercial property).

Related to our strong support of diversification was our encouragement to drop A-REITs as a benchmark for commercial property and real assets. With around 40% exposure to Goodman Group, the ASX A-REIT Index is wildly undiversified and could, if followed closely, lead to some pretty bizarre behaviour. (Like the A-REIT manager who boasted in 2024 that they beat the index by being over-weight GMG! Good stock picking but terrible risk management. If GMG had gone south, it would have be terrible on both counts.)

Hopefully, nothing in the forecasts would have encouraged any reader to make any big macro bets which, in Delta’s view, more often than not, end in tears.

Finally, if while reading any of the multitude of 2026 outlook papers you do find yourself tempted to take some action, we suggest you first check out what the data says.

How have the pundits’ forecasts worked out in the past? (And not just a sampling but all of their forecasts and for every year.) Is there any data-based evidence to suggest a real connection between what is being claimed and the suggested drivers?

If you don’t have the resources to do this work yourself, dial a friend. We will be anxiously awaiting your call!

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 7 January 2026. This document was originally published on firstlinks.com.au on 7 January 2026 and has been prepared by prepared by Delta Portfolios Pty Ltd ABN 60 688 845 150 is a Corporate Authorised Representative of Delta Research & Advisory Pty Ltd ABN 43 155 969 163 AFSL 420093. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.