Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Human Analysis is so 1980's

Marcus Padley | Marcus Today

I’m a bit old school – I used to work in institutional broking from 1982 to 1998 – the research process in those days was for a company to produce a results announcement (with a fraction of the data provided today) and over the next 24 hours some Excel-rated analyst would cogitate knowingly on the announcement and write a bit of ‘research’ which would, if the analyst was super efficient, make it onto the institutional sales desk the next morning for verbal dissemination to the biggest institutional clients.

Over a period of days, the institutional fund manager’s own analysts would absorb the research opinions from the top 10 stockbroker analysts and report their own analysis of the analysis to the lead fund managers at their institution. That feedback might inspire a decision to buy or sell the stock and the execution of that decision would be executed in the market over the next few days or weeks.

More often than not, all this research inspired nothing, no changes, no movement, as was the habit of large slow slow-moving fund managers in the 1980s, whose idea of technology was to work out on a calculator plugged into the wall, how big the company was and on the back of that, how many shares they should hold.

"We'll get our analysis to you before anyone else. That'll be on Wednesday"

Of course, these days, things have changed. That cogitation process has seemingly been condensed from days and weeks, into milliseconds, causing the share price of Meta to drop 14.5% within minutes of its last set of results, whilst the share price of Amazon jumped 12.6%, also in 'but a moment'.

So who is doing the research? How could the share prices of Meta or Amazon possibly, accurately, adjust in minutes, when the analysis of the results has to be done by an analyst, the analyst has to communicate the conclusions to the sales desk, the sales desk has to pass the research on to the fund manager’s analysts, the fund manager's analysts have to absorb ten opinions from the top 10 brokers, analyse the analysis, pass their conclusion on to the fund managers, and those fund managers have to decide to buy or sell, calculate the size of the orders to be done, pass the orders to the trader, who pass the orders on to the broking house, and the broking house has to use its skills to execute the orders in the market without market impact.

Don’t tell me the analysis is being done by a computer algorithm, or, God forbid, AI.

But how else does the share price move that much in such a short period of time?

Well, let’s ask AI shall we? Here is the answer.

The Market Doesn’t Wait for Human Brains

Sleeping at night and working from home - Human analysts are sooo 1980's

Sleeping at night and working from home - Human analysts are sooo 1980's

When quarterly results hit, especially unexpected ones, markets react in milliseconds. It’s not analysts sitting down with spreadsheets and coffee. It’s pre-programmed systems and high-frequency traders that act instantly. That’s how modern markets work now, not sitting rooms full of brokers deliberating.

Algorithmic & High-Frequency Trading Drives Immediate Moves

- Around earnings, trading volume and volatility spike because algorithms trigger trades on news keywords, EPS beats/misses, guidance changes, and other metrics.

- High-frequency traders (HFT) and automated trading systems scan news feeds the moment numbers are released. They don’t “analyse” in a human sense. They respond based on predefined rules and risk parameters at lightning speed.

Are Brokers Using AI to Analyse Earnings in Seconds?

Yes, but not in the Hollywood “AI sitting down and writing a report instantly” sense.

- Firms deploy natural-language processing (NLP) and machine learning to scan earnings releases, sentiment from transcripts, guidance statements, and price reaction patterns.

- This data feeds algorithms designed to trade immediately on certain outcomes: unexpected misses, weak guidance, margin contraction, etc.

So the initial rise or fall isn’t based on long-form reports. There isn’t time for human cogitation. It’s a combination of:

- Preconfigured trading triggers in algorithmic systems (e.g., if EPS < expected, overweight sell signals are fired instantly).

- HFT and algo cascades that amplify moves — once a price starts dropping, more algos detect downside momentum and pile in. This can exaggerate the move in moments.

- Sentiment signals and natural-language scanning that flag “bad beats” within milliseconds of release, sending initial trades.

So why the 14.5% drop immediately? Or the 12.6% rise.

Because:

- Unexpected results or guidance are published – NLP reads the documents, the algorithms (designed by the broker or fund manager – it’s not just generic AI – it's proprietary AI) compare the results (on many levels) to the market’s pre-baked expectation, assess how and where the actual release deviated, and recalculates company forecasts and valuations – almost immediately.

- Then the attached algorithmic trading software triggers buy and sell orders in fractions of a second, ratcheting the price up or down before most humans even see the release.

AI is involved, but not in a ChatGPT "available to all" way. It is customised AI - trained to do what the broker/trader/fund managers train it to do, in seconds instead of days. Same process. Different method.

Bottom line, the instant price movements aren’t from brokers reading reports. It’s from algorithms acting on data triggers extracted from the analysis of the published announcements by NLP, all in the blink of an eye.

There is no Excel-rated analyst cogitating on the profundity of the results announcement.

Real life, strategic analysis happens later, but the initial move? That’s algorithmic.

Sidenote – Natural Language Processing

NLP - Doing the same things as humans, without the wait and without mistakes

- Reads text instantly — earnings releases, RNS statements, press announcements.

- Extracts key numbers — revenue, EPS, margins, guidance.

- Detects sentiment — words like “challenging”, “slower”, “ahead of expectations”, etc.

- Flags surprises — e.g. if EPS is below consensus, the system recognises it in milliseconds.

- Feeds signals to algorithms — which then buy or sell automatically.

Before computers learned to read text, markets could only react when a human read the numbers. Now:

- Machines read faster than any human ever could.

- Trading models can act immediately on the meaning of the text.

- Price moves happen before most investors even open the announcement.

Back to Me

This 'new' research process is in its infancy. It is more prolific in the large US investment banks than anywhere else in the world, and they are only just beginning to perfect the system. In Australia, and other less developed countries, there are still humans cogitating profoundly. Most smaller Australian brokers simply don’t have the resources or know-how (yet) to do the same thing.

The process is flawed. Algorithms are learning by mistakes and by definition, in this development stage, are making mistakes. They are picking up on adjectives and keywords like ”downgrade” or “weak”, for instance, which, until they are perfected over time, could easily be misinterpreted by the algorithms or manipulated by the announcement writers.

Years ago, the CEO of a listed Australian company told me that (well before AI) that the bulk of ASX-listed companies were missing an opportunity to pump their share prices by not using adjectives in the first line of announcements. Most company secretaries (hardly marketing people) send announcements to the ASX with sterile titles like “XYZ Final Results to End June”. And the ASX take that line as the company's ASX announcement heading and which is then published on news services – clipped straight from the document heading. Instead, the opportunity is to publish headings like “Record Full year results to Year End June – Guidance upgraded”.

In the same way, once companies start to realise how algorithms are reading announcements, they will start to manipulate them for the share price’s benefit.

It's all a game which is still in development stage. But the bottom line is that the analysis is still being done, and probably even better, without humans involved.

Humans Are a Joke

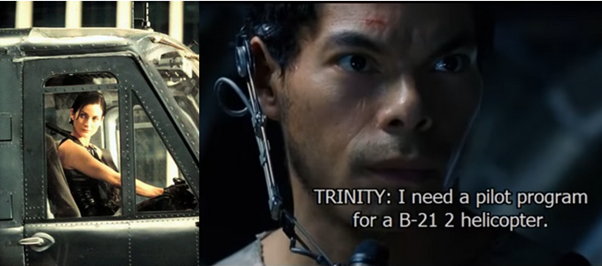

In the film The Matrix – at one point, Trinity, being pursued by Agent Smith, emerges at the top of a building, and there is a helicopter. Neo asks, "Can you fly that thing?" She replies, "Not yet". One phone call, and in the time between making the call to the operator and the time it takes for her to run to the helicopter, he downloads to her virtual brain an expert pilot program for a B-21 2, and off she flies.

Neo - "Can you fly that thing". Trinity - "Not yet".

This scene brought home to me how terribly slow human input devices are in the computer world. Eyes and ears just can't compete with a USB port.

One thumb drive can now hold more pages than a human could ever read in its lifetime – there is more information available to us on one thumb drive than we have the time to absorb. So we must be very careful choosing what we allow to absorb our input time (yet we choose TikTok).

The processing power of a human depends on organic eyes, ears and a brain that is emotional. In a modern world, it is a joke. We are a joke. Humans are too slow.

And the idea, if you think about it, that a company is going to bother to hold an earnings conference call, or an AGM, or company meeting, with humans involved, asking questions in turn, taking over an hour, in a process limited by time, polluted by self promotion, that acts as marketing for the contrived credibility of the CEO and the company, interrupted by self promoting journalists and analysts trying to build profile, is simply soooo inefficient, perverted by non-empirical irrelevancies.

So all this is going to change. Is changing.

Humans are the weakest link, and they are already being replaced.

And, given the right inputs, the algorithms are already doing a better job.

So, the next time Meta drops 14.5% on results, or Amazon rises 12.6%, in a blink, don’t be surprised. The analysis has been done, and the outcome has more integrity than the organically processed conclusions of any number-one-rated Excel analyst.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 9 December 2025. This document was originally published in Livewire Markets on 9 December 2025. This information has been prepared by by Marcus Today Pty Limited. Marcus Today Pty Ltd ABN 57 110 971 689 is a Corporate Authorised Representative (no. 310093) of AdviceNet Pty Ltd ABN 35 122 720 512 (AFSL 308200). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.