Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

From DeepSeek to Liberation Day: Why investors stuck closer to home in 2025

Tamara Haban-Beer Stats | BlackRock

This year has been a rollercoaster ride for markets, from the launch of DeepSeek’s AI model in January, to April’s Liberation Day tariff announcements, to conflicts between Iran and Israel and the US government shutdown.

At the same time, markets are being transformed by the AI buildout, leading some to speculate that the tech sector is entering bubble territory as it grows to a larger concentration within global share indexes.

Coming off two strong years in US equities, investors were more wary around placing their eggs in one basket in 2025 and while the US remained popular, we observed more interest in areas like domestic equities, currency hedged exposures and Asian equity markets.

Here are some of the key themes we saw Australian investors jump into in the volatile market conditions of 2025.

Theme 1: Home bias rears its head once more

Australians have typically under-allocated to global shares versus domestic1. While we saw this trend reverse in 2024 as the US market outperformed, with the total amount of Australian assets invested in the US growing by almost 30%, it looks as if local investors have swung back towards their home market this year.

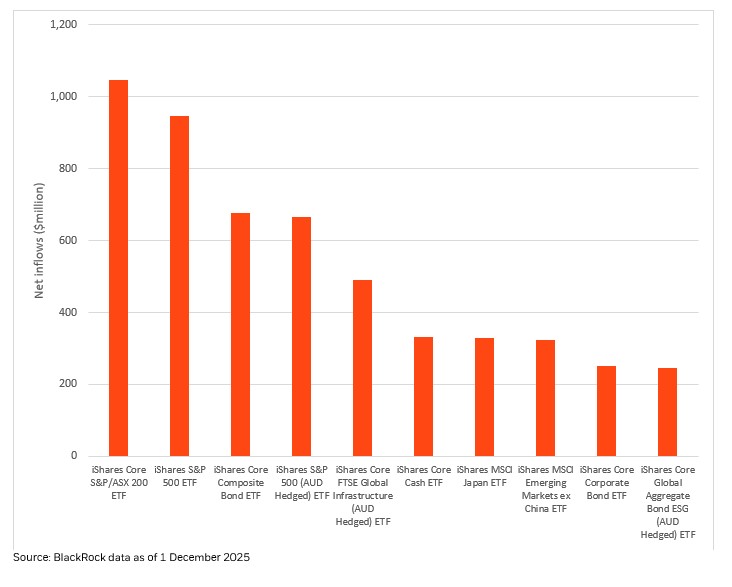

The iShares Core S&P/ASX 200 ETF (IOZ) was our most popular product on an inflow basis in 2025, gathering more than $1 billion from investors – compared to the iShares S&P 500 ETF (IVV) in second place with around $945 million of inflows, roughly half the amount the fund gathered last year.2

Despite the Australian share market seeing only moderate performance this year, with around an 8.5% return in the year to October 20253, it seems Australians prefer the comfort of their own household names when equity markets turn volatile.

Theme 2: Investors bet on US dollar declines

As policy uncertainty has played out in the US this year on a number of fronts, we’ve seen investors look to take advantage of any declines in the US dollar by choosing currency hedged ETFs. The iShares S&P 500 (AUD Hedged) ETF (IHVV) saw around $665 million in flows this year – around triple last year’s flows and placing the fund in our top 5 exposures on an inflow basis.4

More broadly, three of this year’s top 10 funds were currency hedged – IVV, the iShares Core FTSE Global Infrastructure (AUD Hedged) ETF (GLIN) and the iShares Core Global Aggregate Bond ESG (AUD Hedged) ETF (AESG) – and their combined inflows were around $1.4 billion.5

In the latter part of this year in particular we’ve seen investors rewarded for choosing hedged exposures – over the six months to October 2025, IHVV outperformed IVV by around 2%, while the iShares Global 100 (AUD Hedged) ETF (IHOO) outperformed its unhedged counterpart, the iShares Global 100 ETF (IOO) by around 3%.6

Top 10 iShares ETFs by inflows, 2025 (year to date)

Theme 3: Growing interest in Asia

As US equity valuations rose, particularly across the ‘Magnificent 7’ tech stocks, investors looked to new markets for growth exposure in 2025.

The iShares MSCI Japan ETF (IJP) took in around $328 million from investors this year, around triple its 2024 flow numbers, as Japanese equities outperformed off the back of corporate reforms and the surprise election of fiscally expansionary prime minister Sanae Takaichi.7

Similarly, the iShares MSCI Emerging Markets ex China ETF (EMXC) saw around $324 million of flows in 2025, as investors sought to tap into economies such as Taiwan and South Korea who are central to the AI buildout8. With around 40% of respondents to a recent BlackRock APAC client survey saying they planned to increase allocations to emerging markets in the next three months, we expect this trend to continue into next year.9

Theme 4: De-risking through fixed income

Following an extended equity market rally in 2023 and 2024, it’s fair to say many local investors shifted back to a more balanced stance on risk assets heading into 2025. In the year to October 2025, fixed income ETFs were one of the fastest growing product categories on the ASX, with assets under management swelling by just under 40%.10

Four of the top 10 iShares products on an inflow basis in 2025 – iShares Global Aggregate Bond ESG (AUD Hedged) ETF (AESG), the iShares Core Composite Bond ETF (IAF), the iShares Core Cash ETF (BILL) and the iShares Core Corporate Bond ETF (ICOR) were fixed income ETFs, compared to just two fixed income ETFs in the top 10 in 202411. Cash in particular saw huge growth from investors this year, with BILL seeing around $331 million of inflows in 2025 compared to $19 million of outflows in 2024.12

With three out of four of these ETFs focusing on Australian fixed income, investors also stuck close to home when it came to their bond allocations. Australian yields remained attractive this year, helping to keep returns stable and provide some insulation to portfolios when markets turned volatile, while the RBA cash rate is expected to remain on hold for an extended period following recent hot inflation data.

Overall, 2025 was a year of mixed fortunes, with global equity markets generating strong returns despite many ups and downs along the way. Off the back of this, we see investors becoming more selective and careful, with an understanding that they may need to pivot as market conditions evolve.

- Source: 2023 ASX Investor Study (note: study is conducted every 3 years)

- Source: BlackRock data as of 1 December 2025

- Source: BlackRock data as of 31 October 2025. Based on S&P/ASX 200 returns

- Source: BlackRock data as of 1 December 2025

- Source: BlackRock data as of 1 December 2025

- Source: BlackRock data as of 31 October 2025

- Source: BlackRock data as of 1 December 2025

- Source: BlackRock data as of 1 December 2025

- Source: BlackRock data as of 24 November 2025, based on a post-event survey of 244 BlackRock APAC clients

- Source: ASX data as of 31 October 2025

- Source: BlackRock data as of 1 December 2025

- Source: BlackRock data as of 19 December 2025

Product list

iShares Core S&P/ASX 200 ETF (IOZ)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years

• with a medium to high risk/return profile

iShares Core S&P/ASX 200 ETF | IOZ

iShares S&P 500 ETF (IVV)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares S&P 500 (AUD Hedged) ETF (IHVV)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

iShares S&P 500 (AUD Hedged) ETF | IHVV

iShares Core FTSE Global Infrastructure (AUD Hedged) ETF (GLIN)

This product is likely to be appropriate for a consumer:

- who is seeking capital growth and/or income distribution

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

iShares Core FTSE Global Infrastructure (AUD Hedged) ETF | GLIN

iShares Core Global Aggregate Bond ESG (AUD Hedged) ETF (AESG)

This product is likely to be appropriate for a consumer:

• who is seeking capital preservation and/or income distribution

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years, and,

• with a medium risk/return profile

iShares Global Aggregate Bond ESG (AUD Hedged) ETF | AESG

iShares Global 100 (AUD Hedged) ETF (IHOO)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

iShares Global 100 (AUD Hedged) ETF | IHOO

iShares Global 100 ETF (IOO)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares Global 100 ETF | IOO | -

iShares MSCI Japan ETF (IJP)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares MSCI Japan ETF | IJP | -

iShares MSCI Emerging Markets ex China ETF (EMXC)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares MSCI Emerging Markets ex China ETF | EMXC | -

iShares Core Composite Bond ETF (IAF)

This product is likely to be appropriate for a consumer:

• who is seeking capital preservation and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 3 years, and

• with a medium risk/return profile

iShares Core Composite Bond ETF | IAF

iShares Core Cash ETF (BILL)

This product is likely to be appropriate for a consumer:

• who is seeking capital preservation and/or income distribution

• using the product for a whole portfolio solution or less

• with no minimum investment timeframe, and

• with a very low risk/return profile

iShares Core Corporate Bond ETF (ICOR)

This product is likely to be appropriate for a consumer:

• who is seeking capital preservation and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 3 years, and

• with a medium risk/return profile

iShares Core Corporate Bond ETF | ICOR

Disclaimer

Opinions are subject to change, and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation. Diversification and asset allocation may not fully protect you from market risk.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 28 July 2025. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) at blackrock.com/au to see if the products referenced are appropriate for you. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide at blackrock.com/au for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. MKTGH0825A/S-4706059.