Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The shift toward scarcity: a playbook for a new era of investing

Chad Padowitz | Talaria Capital

In 1964, John DeLorean jump-started the era of the American muscle car when he fitted out a Pontiac LeMans with a V8 engine and called it the GTO. Until then, powerful engines were reserved for expensive luxury cruisers far beyond the reach of most Americans. The GTO changed all that: it had a 325-horsepower V8, hood scoops, dual exhaust, and blistering straight-line acceleration, all for about $3,000 USD, putting real performance within reach of ordinary drivers and helping spark a nationwide obsession with speed.

The success of the GTO kicked off an arms race among carmakers, each turning out cheap cars with massive engines for the everyman, made possible by cheap fuel, mass production, and minimal regulation. But when the oil shocks of the 1970s hit, the age of horsepower met the reality of scarcity. Efficiency replaced extravagance, restraint replaced indulgence, and what had once been thrilling began to look reckless. That is because values tend to shift when constraints appear.

Running on empty

For more than 30 years, investors have benefitted from an era of globalisation that delivered falling production costs, rising profit margins, and abundant capital. Asset prices rose as goods, labour, and money flowed freely across borders. This era is coming to an end. The world is shifting away from global integration toward a great separation, a period where nations compete to retain their savings and fund their own priorities.

This fight for capital is rewriting the rules of global trade and finance as supply chains shorten, defence spending rises, and governments encourage domestic investment. The abundant liquidity that once underpinned markets is being replaced by a sense of scarcity. As with the end of the muscle car era, the shift now facing investors demands a return to efficiency, discipline, and value over speed and spectacle.

The cost of debt

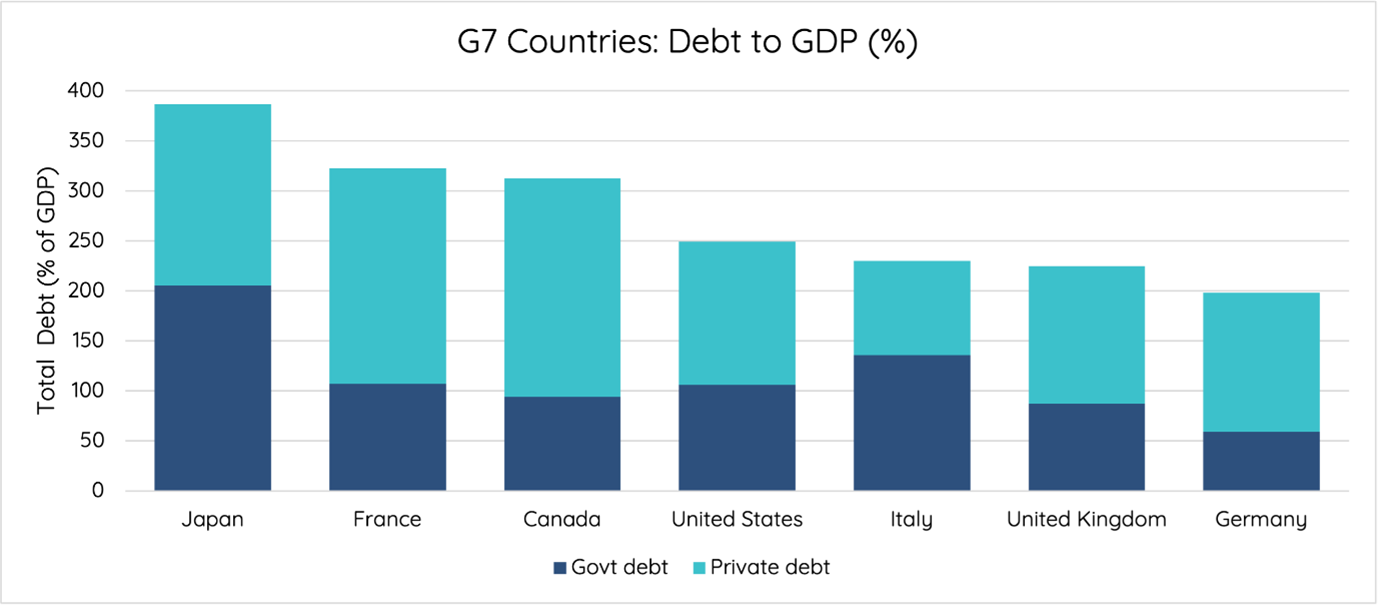

Decades of cheap money have left the global economy with an unprecedented debt burden. Some major economies, including Japan, France, and Canada, now carry debt exceeding three times their annual output. That’s far more than Greece in 2010 when it was forced to request a bailout from the EU and IMF. US debt is 2.5 times its annual output and servicing that debt has become increasingly costly as interest rates remain elevated.

Source: Talaria, Bank for International Settlements Data Portal

Source: Talaria, Bank for International Settlements Data Portal

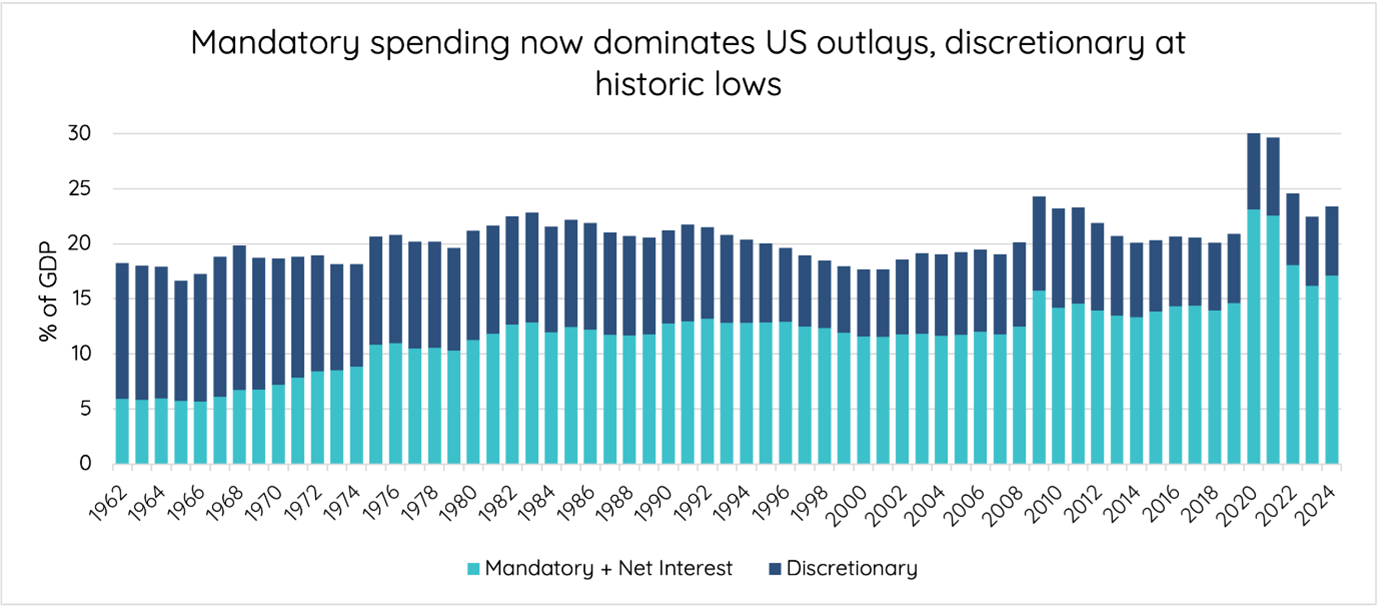

The US government’s discretionary spending (spending that policymakers have on wants rather than needs) is now less than a third of total government expenditure. Plus, with fiscal deficits still widening, the scope for stimulus is narrowing. Across much of the developed world, the same pattern applies: more debt, higher servicing costs, and less flexibility.

Source: Congressional Budget Office, Office of Management and Budget, Talaria

Source: Congressional Budget Office, Office of Management and Budget, Talaria

Playbook for a new era

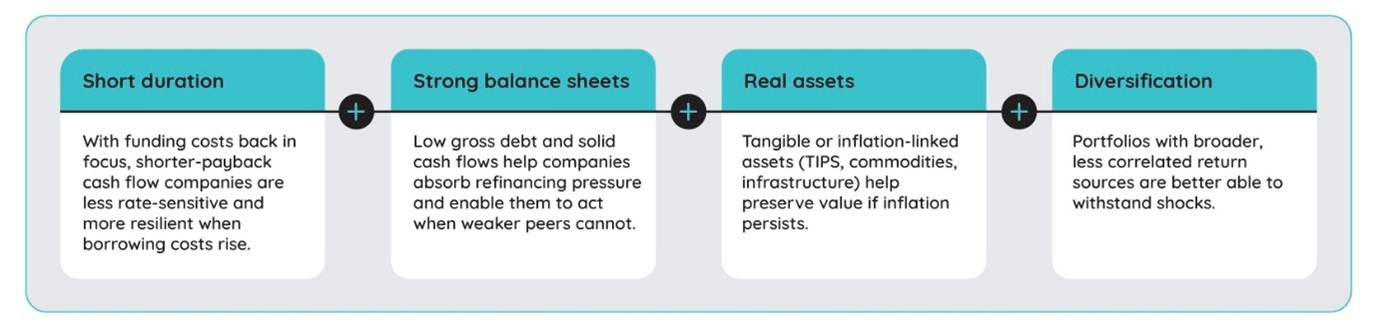

Periods of transition are rarely smooth, but they can reveal opportunities for those who adapt faster. In a world moving from capital abundance to scarcity, four principles really matter:

- Shorter duration. Investments that return capital sooner provide greater certainty in an environment of higher inflation and interest-rate volatility.

- Stronger balance sheets. Companies that can fund themselves rather than rely on external credit are likely to prove more resilient.

- Real assets. Businesses and assets backed by tangible cash flows (resources, infrastructure, and high-quality equities) offer protection against the erosion of purchasing power.

- Diversification of return sources. Income streams that are not dependent on market direction, such as the volatility-risk premium embedded in Talaria’s approach, can add stability when traditional assets are more correlated.

Valuation and opportunity

Capital once again comes at a cost. That makes discipline, selectivity, and liquidity far more valuable. Equity markets, particularly in the United States, remain near the highest valuations in history. Historically, starting from such levels has led to subdued long-term returns. Yet within the market, opportunity persists.

Companies with steady earnings and strong balance sheets are trading at their largest discount to the broader market in over fifteen years. Prudence, in other words, isn’t in fashion. For long-term investors however, that is where the best opportunities lie.

Just as the muscle-car era gave way to vehicles built for practicality, investors are rediscovering that performance can depend on durable and disciplined fundamentals, a natural shift in values as new constraints shape the road ahead.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 17 November 2025. This document was originally published in Livewire Markets on 17 November 2025. This information has been prepared by Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Talaria Global Equity Fund Complex ETF (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This report has been prepared by Talaria Asset Management (Talaria) to provide you with general information only. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.