Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Does It End with a Whimper, not a Bang?

Henry Jennings | Marcus Today

Someone once said that predictions are hard, especially about the future! Niels Bohr.

Many people have asked whether the bubble will burst? Or more precisely when the bubble will burst? We’ve seen the hyperscalers reveal the profits that they’re raking in from the AI boom; alongside the massive investments they’re making in new chips. I watched Jensen Huang deliver his keynote speech at the GTC conference — really interesting — and I’d urge everyone to have a listen, especially to the first ten minutes. I must admit, most of what followed was a little lost on me as it got quite technical, but it certainly painted a fascinating, if daunting, picture of the future we’re heading into.

For investors, the questions remain. Given the massive concentration we’ve seen in the US market and the heady heights it has reached, it would be nice at this stage of the bull market to see some diversification — other stocks starting to perform. But so far, it’s been confined to the major tech names. A crowded trade. Everyone’s nervous. Yet hedging is still relatively cheap witness the VIX. Will it last? Will the bubble burst? Will the hyperscalers fail to get the returns they desire on their massive investments? Or are interconnected deals with any mention of AI enough to keep the saucepan boiling. We have seen good results from the tech sector, but the market is starting to get less enthusiastic about the huge spends required to stay ahead in the AI race. Meta fell hard on its plans.

Then there’s the Federal Reserve, which cut rates by 25 basis points at its last meeting — as expected — but with two dissenters. One, Stephen Miran, wanted a 50-point cut; the other, the Kansas City president, wanted to hold steady. The problem for Jerome Powell is that he’s flying blind while the US government remains shut down. Not something we hear much about, but it’s still there, making his job harder. Flying the US economy blindfolded is hardly conducive to good policy, especially with the “critic-in-chief” waiting on the sidelines, eager to berate him for not cutting fast enough. Powell also finishes his term in May, just to complicate matters further. Who takes over? You can bet they will want lower rates!

Rate cuts and tech results are the driving force of the US market as we head into the all-important Christmas run-up. Thanksgiving and the season to spend are upon us, but the strain is showing. Lower-paid workers are feeling the squeeze, consumer confidence at a six-month low, and the shutdown is hurting others. Maybe this year’s “season to be jolly” won’t be so jolly after all.

The bulls, of course, will point to the recent US–China ‘trade’ deal. On the face of it, it’s not a huge breakthrough — Trump cut China’s tariffs to 47% from 57%, hardly the stuff of dreams. Even the rare earth export bans have merely been delayed by a year. Still, Trump plans to visit China next April, and everyone’s playing nice. So, are all the planks of the bull run still in place? Tech strength, Fed rate cuts, a China deal, an accommodative Trump administration cutting red tape, pumping money into the economy — it’s a heady mix. One that could unravel quickly, given the trading velocity these days. Are we in one of those Wile E. Coyote moments — running off the cliff but not realising it yet?

Or is this truly a new paradigm — the AI revolution driving profits and productivity through automation and job cuts? Greater efficiency, but fewer workers. It’s a dynamic central banks won’t ignore.

It seems the biggest threat to this bubble isn’t macro or political — at least not yet — but valuations and concentration. Sky-high tech multiples are driving the US market higher. As we near the end of tech reporting season, the story — and the bubble — remain intact. Perhaps it will end not with a bang, but with a whimper. NVIDIA’s mid-November results will be the next key test, but so far, the hurdles to continued gains have been cleared. The market still wants to push higher into Christmas.

Meanwhile, in Australia, disappointment followed a hotter-than-expected CPI, taking rate cuts off the table for Melbourne Cup Day. Given Michelle Bullock’s earlier reluctance to cut, we look set for a period of stagnant rates. That’s not necessarily bad — property prices continue to rise, helped by seasonality. While lower mortgage rates would please borrowers, cuts hurt savers — many of them older Australians who rely on interest income.

Younger Australians, of course, have all but given up on home ownership, with Sydney’s median house price at $1.75m — extraordinary and out of reach for many. Out of reach for me!

As I’ve said before and will say again: you buy America for tech, and Australia for resources. We seem to rotate through mini-bull markets in different commodities. Copper remains the bright light, though pure copper exposure on the ASX is hard to find. BHP and Rio remain the heavyweights, and a meaningful China deal could push iron ore — and those stocks — higher. Brokers are also lifting lithium price forecasts, fuelling a short squeeze in local producers. Add the recent US–Cameco nuclear agreement, and uranium stocks are back in favour. The rare earths frenzy was short and sharp, but not without substance — China has shown it’s willing to wield that weapon. At least now, the West has time to respond and reduce its dependence. The clock is ticking.

Gold, meanwhile, is up 50% this year, and while miners have been stellar performers, a correction was inevitable. Those queues outside ABC Bullion in Sydney will haunt a few punters. But uncertainty remains — geopolitics, tariffs, US debt, and a Federal Reserve under Trumpian pressure to cut again. Add central bank buying and the ongoing government shutdown, and a golden Christmas is still possible.

All up, the risks of a bubble bursting are real — but so too are the chances of a market melt-up. Between a pro-business US administration, trade optimism, and tech exuberance, the rally still has fuel. US Corporates appear to be in great shape. Bears will point to the valuations and the PE of the US market being above the long-term averages.

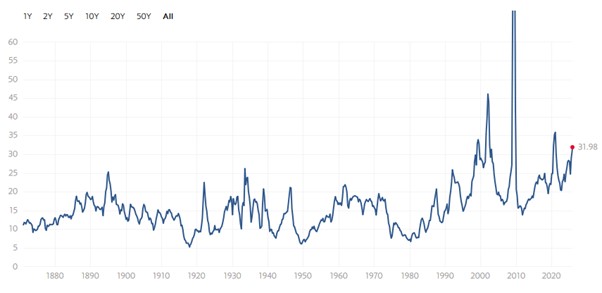

This is the Shiller PE Ratio

Source: Marcus Today

Anytime it has risen above 40 has spelled trouble.

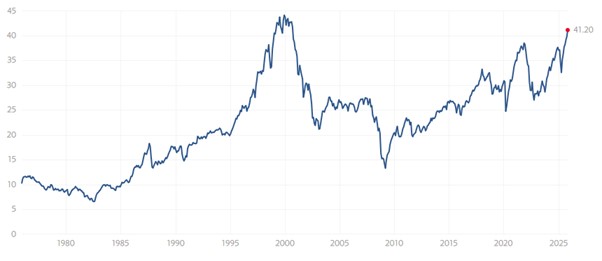

Yet here is the S&P500 PE Ratio

Source: Marcus Today

Not that elevated in comparison. Still expensive, but maybe that is justified. Maybe this is the new normal. Just because the Shiller PE Ratio is at the highest level since the Dot-Com bubble does that mean it will burst? The Dot-Com boom was based on nefarious measurements (clicks and eyeballs), more hope than substance, weak new companies trying to bluff their way through the tectonic change. This time it is not the weak players, but the strong, the survivors. Huge balance sheets and pricing power. Microsoft rammed through price changes to Office 365 and basically said this is the price you will pay (ACCC has had something to say about this). Done. That is not something that was conceivable in 2000.

During all this noise and uncertainty, at Marcus Today we have substantially reduced our exposure with our Strategy Portfolio now 100% in cash. We have achieved our 20% target in just 8 months, and we are looking for the next move. We are keen to see a trend and a theme emerge again. For now, the jury is out. Have we sold too early, or read the tea leaves correctly?

Bull or bear? Or on the sidelines? A bang or a whimper? Plenty of views. Who will be right?

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

All prices and analysis at 31 October 2025. This information has been prepared by Marcus Today Pty Limited. Marcus Today Pty Ltd ABN 57 110 971 689 is a Corporate Authorised Representative (no. 310093) of AdviceNet Pty Ltd ABN 35 122 720 512 (AFSL 308200). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.