Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

CBA or global banks?

Daniel Pennell | Plato Global Shares Income Fund

Earlier this year, as CBA’s market cap soared to nose-bleed heights, I wrote about a new wave of dividend darlings (global banks) emerging as CBA alternatives.

The key message was that despite CBA historically being a great investment for yield and returns, stretched valuations were flashing a signal for investors to reduce single stock risk and diversify into global banks.

CBA delivered a total return of +67.7% in the period through 2023 and 2024.

This was a comparable return to an investment in the MSCI World Banks Index (+68.5% in AUD). But just holding CBA came with obvious single-stock risk – risk that has now materialised.

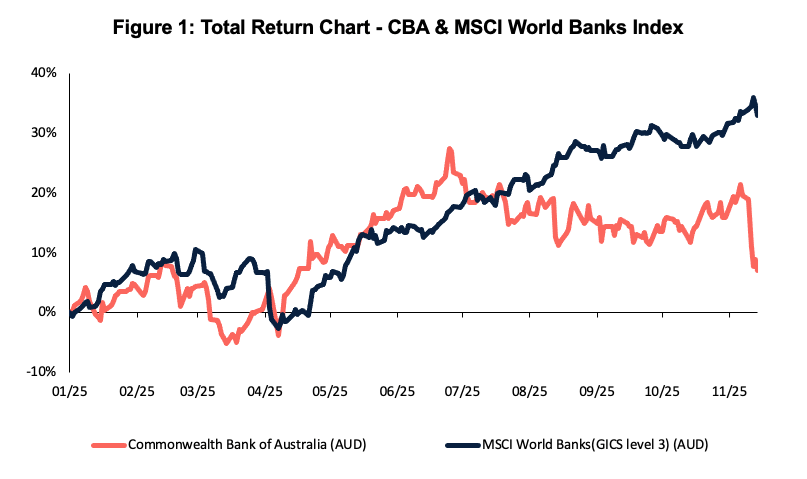

Year-to-date (to Nov 17, 2025) CBA has returned +5.9%, including the recent draw down.

On the other hand, a domestic investor in the broad MSCI World Banks Index would have been up +32.3% (in AUD terms). In USD terms the index is up +39.2%.

Source: Bloomberg, YTD (17/11/2025)

Does the case for global banks still stack up?

As you can see in Figure 1, global banks have rallied hard as CBA’s share price has come under pressure.

But valuations still provide a compelling argument for going global in 2026.

Despite CBA’s pullback, it continues to trade at a P/E ratio of 25.7x, maintaining a significant premium over other major Australian banks (NAB 18.8x, Westpac 19.3x, ANZ 18.3x).

And in comparison, the MSCI World Banks Index is trading at 12.7x (and for this price you still get exposure to CBA thrown in, sitting at 3.4% of the World Bank Index at the end of October 2025).

A lower PE for the broad index indicates potential future upside, driven by major constituents of the index trading at around half CBAs valuation.

In the US, profitable well-run banks, including JPMorgan Chase & Co (14.9x), Wells Fargo (13.7x) and Bank of America (14.0x), trade at much lower levels. Even deeper discounts are on offer across the ocean on European exchanges. For example, Nordea Bank (10.6x) and BNP Paribas (7.2x).

As ASX bank reporting season drew to a close, my colleague Peter Gardner released a note on the Australian bank’s dividend outlook. Peter observed that top-line numbers didn’t thrill, with ANZ’s headline earnings down -14% (cash earnings broadly flat after adjustments) and both Westpac and NAB’s earnings experiencing little to no growth.

In contrast, several major U.S. banks have kicked off their third-quarter reporting season with a strong start.

JPMorgan posted a 16% rise in earnings, while Bank of America reported an 11% increase in revenue to more than US$28 billion.

Collectively, the six largest U.S. banks generated around US$142 billion in profits over the last calendar year – up roughly 20% from the previous year.

For investors, global banks present an appealing proposition: they trade on lower valuations that are underpinned by more diversified earnings streams across segments such as wealth management, trading, and investment banking.

But doesn’t CBA provide high income in volatile times?

Many clients I speak to rightly note that global yields have historically trailed those in Australia, anchored by the MSCI World Index’s modest 1.3% yield.

Yet, as with any market, pockets of opportunity remain for those who know where to look. The key question is how to access them.

I’m reminded of a client who once said, half-jokingly, that investing internationally felt like “travelling for yield” – you have to leave home to find it, but the trip can be worth it.

That observation rings true today. Global banking names are increasingly providing the kind of income and growth investors search for.

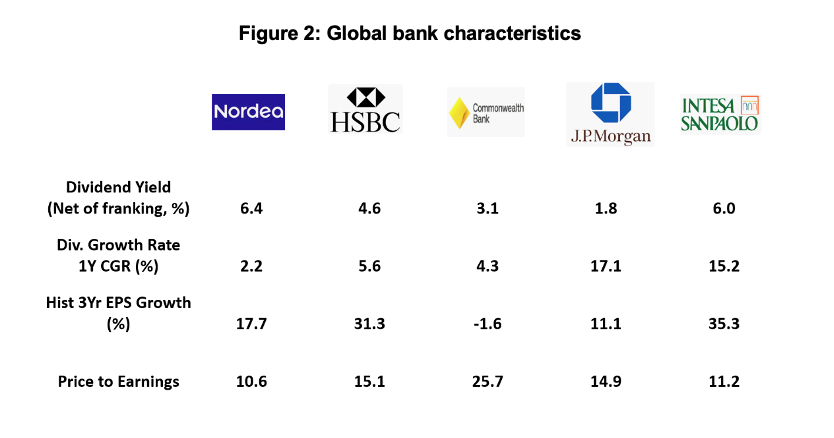

Source: FactSet, Plato Investment Management, 17/11/25

Source: FactSet, Plato Investment Management, 17/11/25

Figure 2 highlights several key metrics from a selection of global banks, revealing some noteworthy insights.

It is immediately apparent that certain global banks offer higher income levels (sufficient to meet a retiree’s income needs), whilst also delivering positive dividend growth.

In contrast to CBA’s earnings per share (EPS) growth, which has moderated slightly over the last 3 years, investors can still access banks with stronger earnings momentum at more attractive valuations. This is reflected in their lower price-to-earnings (P/E) ratios.

As Buffett famously noted, “Price is what you pay; value is what you get”. A reminder that disciplined investors can often find greater long-term value in quality companies trading at a discount.

What does this mean for yield-hungry Aussie investors?

The big banks, and Australian equities in general, remain an outstanding asset class for income-seeking investors. The mix of dividends and franking credits has a track record of generating materially higher yield than the so-called safe assets such as cash, term-deposits, and bonds.

However, diversification in income-portfolios, particularly for Australian retirees, is critical for both enhancing yield and mitigating risk.

Simply surviving on dividends from a small number of stocks in a concentrated local market puts retirees at higher risk of running down their savings too soon when sector or country-specific issues cause drawdowns and threaten income.

CBA is a case in point – despite solid fundamentals, the recent pullback was driven by the market view that CBA is priced for perfection and too expensive for the level of future growth, net interest margin compression, and cautious guidance provided.

Global markets provide access to dividend-paying equities in growth industries that are underrepresented on the ASX, such as technology and global consumer brands while introducing geographic and sector diversification.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 26 November 2025. This document was originally published on firstlinks.com.au on 26 November 2025 and has been prepared by Plato Investment Management Limited ABN 77 120 730 136 (‘Plato’) AFSL 504616. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.