Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Beyond the Magnificent 7: Why investors are flocking to Asia’s tech sector

Tamara Haban-Beer Stats | BlackRock

As US equities face challenges this year on the back of trade policy uncertainty, Asian markets including China and South Korea have boomed, fuelled by advances in AI technology and supportive domestic economic policies.

In 2025 to date, the FTSE China 50 Index has returned almost 20%, far head of its annual average of 7% since inception. The S&P Asia 50 Index, comprised of the 50 largest companies in Asia ex-Japan, has returned 17% year to date, compared to 8% annually since inception.[2]

Investors have taken notice, with the iShares FTSE China 50 ETF (IZZ) taking in more than AU$80 million from Australian investors in 2025 to date, versus AU$29 million of outflows last year.[3]

Other iShares funds focused on Asian stocks are seeing similar trends. The iShares Asia 50 ETF (IAA) has seen AU$60 million in flows so far this year, versus AU$42 million outflows in 2024, while the iShares MSCI Emerging Markets ex China ETF (EMXC) - offering significant weightings to Taiwan and South Korea - has attracted more than AU$255 million since its inception in June 2024.[4]

Globally, we’ve also seen ETF investors embrace China in particular as a complementary exposure to US tech. Globally, China tech ETFs have gathered almost US$22 billion so far this year, outstripping US tech ETFs with around US$18 billion of flows.[5]

This is perhaps no surprise as US equities now represent as much as 70% of global equity market indices, and tech and communications make up 35% - a threshold last crossed just prior to the dot-com bubble of the early 2000s.[6]

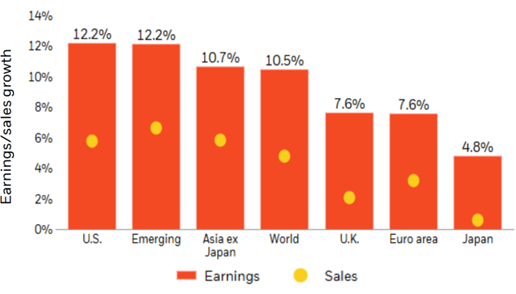

Asia sales/earnings growth estimates are above many developed markets[7]

Source: LSEG Datastream/MSCI, as of 14 July 2025

Why some of Asia’s key markets are thriving

Chinese stocks have surged this year as investors bet on a domestic economic recovery and get excited about the country's latest advances in AI, particularly after DeepSeek released its new model in early 2025.

Since the announcement of a comprehensive stimulus package in late 2024, China’s government has stepped up efforts to pull the economy out of deflation and address oversupply in key sectors that has seen growth falter. A recent focus has been on reducing excessive competition between businesses that has led to falling prices and slowed growth.

Similarly to the US, China’s equity market is also skewed towards tech, which has helped it benefit from the AI boom. The biggest companies in the FTSE China 50 are leading the way in adopting AI, with social media giant Tencent – the largest weighting in the index - having recently launched its DeepSeek rival AI model that can personalise content recommendations and moderate content on its WeChat platform.

South Korea’s stock market has performed strongly in 2025, helped by local economic support and AI growth. Reforms enacted by new president Lee Jae Myung aim to make the domestic equity market more shareholder friendly and reduce the control of South Korea’s chaebols, or family-controlled conglomerates.

Semiconductors are South Korea’s top export and, similar to export ‘front-loading’ effects seen in China, have been growing at a rapid rate as importers seek to circumvent US tariffs[8] – though South Korea was recently granted a 15% tariff rate rather than the initial 25% proposed by the US administration.

Taiwan is another key market of focus for investors interested in the AI buildout. TSMC – the world’s largest chipmaker and Taiwan’s biggest company by market cap[9] – has seen soaring demand for its chips, which are exempt from US tariffs on semiconductor imports, thanks to a deal to expand its factories in the US.[10]

In July 2025, Taiwan broke its record for annual trade surplus with the US just seven months into the year[11], illustrating the strength of demand for advanced chips as megacap tech companies continue to step up spending.

Ways to trade the AI mega force in Asia

ETFs offering exposure across Asia and emerging markets allow investors to dynamically slice their allocations depending on their market views. For those wishing to tap into potential further recovery in China, IZZ offers access to the 50 largest offshore Chinese stocks, with significant weightings to sectors like consumer discretionary and financials that could benefit from economic expansion.

For broader Asia market exposure with a technology tilt, investors could consider IAA. Currently the lowest cost Asian equities ETF on the ASX[12], IAA offers a 44% weighting to technology and 17% to communication, with TSMC, Tencent and Alibaba among its top holdings.[13]

Investors interested in broader exposure to emerging markets that could benefit from mega forces outside AI may wish to implement their views using EMXC. With a 30% weighting to technology through key holdings such as TSMC and Samsung,[14] the fund also offers access to other emerging markets like India and Brazil, that are set to benefit from longer-term trends such as reshoring and demographic change.

By making use of one or multiple exposures, investors can tap into the positive fundamentals, supportive domestic tailwinds and tech-driven momentum of some of Asia’s leading economies.

Product Details

iShares China Large-Cap ETF (IZZ)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

iShares China Large-Cap ETF | IZZ | -

iShares Asia 50 ETF (IAA)

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

iShares Asia 50 ETF | IAA | -

iShares MSCI Emerging Markets ex China ETF

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares MSCI Emerging Markets ex China ETF | EMXC | -

Sources:

- Source: BlackRock data as of 31 August 2025

- Source: BlackRock data as of 22 August 2025

- Source: BlackRock data as of 22 August 2025

- Source: BlackRock/Markit data as of 31 July 2025. China tech includes both offshore and onshore exposures

- Source: BlackRock/MSCI data as of 25 August 2025, refers to make-up of the MSCI World Index

- Forecasts may not come to pass

- Source: Bloomberg as at 20 August 2025

- Source: US National Association of Manufacturers, 4 March 2025

- Source: TSMC, 17 July 2025

- Source: Bloomberg as at 8 August 2025

- Source: ASX data as of 31 August 2025

- Source: BlackRock data as of 27 August 2025. Note the 3 securities mentioned are the top holdings of IZZ as of 27 August 2025

- Source: BlackRock data as of 27 August 2025. Note the 2 securities mentioned are the top holdings of IAA as of 27 August 2025

Disclaimer:

Opinions are subject to change, and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation. Diversification and asset allocation may not fully protect you from market risk.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 28 July 2025. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) at blackrock.com/au to see if the products referenced are appropriate for you. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide at blackrock.com/au for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. MKTGH0825A/S-4706059.