Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Volatility with a silver lining: Small caps are back in focus

James Nguyen | Tyndall AM

FY25 reporting season: A rally defined by volatility

As another reporting period concludes, with 260 companies in the ASX 300 having reported, the FY25 results season has proven a challenging one to interpret. Despite modest earnings growth and relatively subdued earnings beats, the broader ASX 300 index breached the 9,000 mark and reached new all-time highs.

This disconnect between market performance and earnings fundamentals is underscored by valuation metrics. The ASX300 currently trades at 19.9-times forward earnings — two standard deviations above its long-term average — even as consensus earnings growth continues to be revised downward.

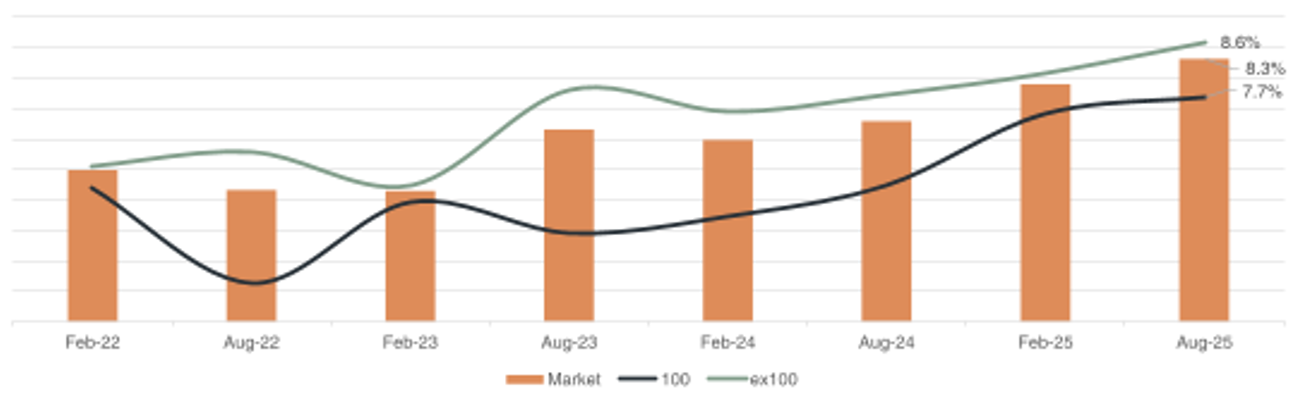

Beneath the surface, the defining feature of this rally appears to be volatility. This reporting season has been the most volatile on record, with the standard deviation of company returns on reporting day reaching an unprecedented 8.3%. This surpasses the previous high of 8.0% set during February 2025 and is well above the long-term average of 6.9%.

Importantly, this surge in volatility was observed across both large-cap and small-cap stocks (refer Chart 1).

Chart 1: The Standard Deviation of Relative Returns on Company Result Day (ASX 300/ASX 100/ASX ex-100)

Source: Barrenjoey Research, Bloomberg, Visible Alpha

Source: Barrenjoey Research, Bloomberg, Visible Alpha

Volatility as Opportunity: Active Positioning in FY25

While heightened volatility can be unsettling, we view it as a stock picker’s ally — a dynamic environment that enables us to acquire quality businesses at attractive valuations and exit positions where we believe market exuberance appears unjustified.

During this reporting period, portfolio turnover increased as we actively responded to market dislocations. We trimmed outperformers including Zip Financial (ASX: ZIP), Codan (ASX: CDA), and Generation Development Group (ASX: GDG), while selectively adding to underperformers including AUB Group (ASX: AUB) and SciDev (ASX: SDV). This tactical rebalancing, driven by company-specific news flow, contributed to a strong performance for the Tyndall Australian Small Companies Fund, which returned ~15% in August(1), outperforming its benchmark by over 600 basis points.

Despite headline valuations suggesting a full market, pockets of relative value remain. One standout sector this season was Consumer Discretionary, delivering robust earnings beats and notable share price appreciation. Companies such as Baby Bunting (ASX: BBN), AP Eagers (ASX: APE), Harvey Norman (ASX: HVN), Super Retail Group (ASX: SUL), and portfolio holdings Nick Scali (ASX: NCK), ARB Corporation (ASX: ARB), and Jumbo Interactive (ASX: JIN) all performed strongly.

With the prospect of further interest rate cuts in Australia and resilient labour market conditions, the macroeconomic backdrop continues to support discretionary spending. Reflecting this view, we initiated a new position in auto dealer Peter Warren Automotive (ASX: PWR) and increased our exposure to consumer-facing oOh!media (ASX: OML).

Small Caps: Poised for Continued Outperformance

While the small cap index delivered an impressive 8.4% return in August, we believe this catch-up to large caps remains at an early stage. After three years of relative underperformance, the small cap benchmark now trades at a 15% discount to its large cap counterpart — a notable divergence from its historical 10% premium.

This valuation gap, combined with superior earnings growth, a more attractive starting point, and a supportive macroeconomic environment — including the potential for easing monetary policy — positions small caps for continued strong performance.

In an environment where heightened share price volatility has become the norm, we believe the conditions for active management to add value have rarely been more compelling.

(1) Performance quoted is before fees, is preliminary and subject to change.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 3 September 2025. This document was originally published in Livewire Markets on 3 September 2025. This information has been prepared Tyndall Asset Management is an investment team within the Yarra Capital Management Group. Yarra Capital Management Limited (ABN 99 003 376 252, AFSL 237563). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.