Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

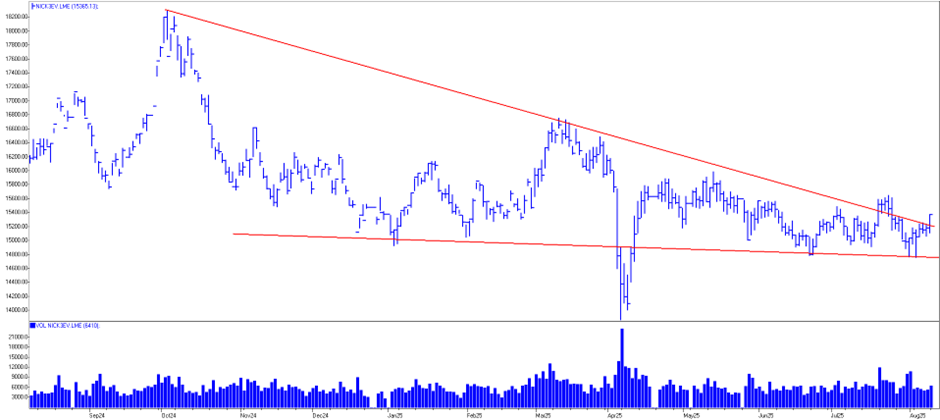

Nickel – ‘As a contrarian investor, there's nothing I love as much as hate' - Rick Rule

Nicholas Boyd-Mathews | Eden Asset Management

Indonesia dominates the global nickel market, producing around 65% of world production last year. Government policy to restrict the export of laterite ore has seen massive Chinese investment into domestic smelting and processing. Indonesian production has grown from 600Kt in 2020 to 2.2Mt in 2024. This has pushed the nickel market into oversupply, with prices falling to current lows of ~US$15,000/t. Sentiment at this year’s Indonesian Critical Metals Conference in June 2025 was downbeat, with even the Head of Sales at Tsingshan (the world largest producer) declaring “no one is making money at these prices”.

It is well documented that this Chinese-led growth has come at great environmental and social cost to Indonesia. By its nature, shallow laterite mining evolves widespread clearing of huge areas of rainforest, and the processing of laterite ore is itself highly carbon intensive. The Indonesian Government is beginning to clean up the industry and back in June cancelled four mining permits near Raja Ampat after local outcry to protect the UNESCO-designated Global Geopark, known for its marine biodiversity.

Meanwhile, demand for nickel remains robust, with stainless steel demand (its primary use at ~66%) continuing to grow at 6-10% pa over the last few years. Further growth in nickel demand is also coming from high quality EV batteries, particularly those in the US and Europe, where nickel’s contribution to EV battery chemistry leads to higher performance and longer range. In Eden’s view, nickel is likely to be a major long-term beneficiary of global growth and the transition to a low-carbon economy. From the current trough in nickel prices, we can see clear upside in the medium term 3-5 year view the fund takes, as ongoing demand growth works its way through the near-term oversupply.

Nickel:London Metal Exchange

Graph source: WMG

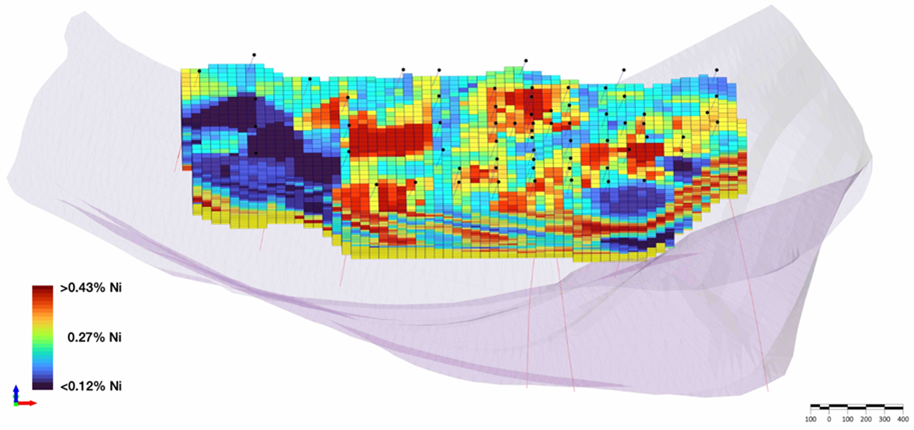

Graph source: WMG

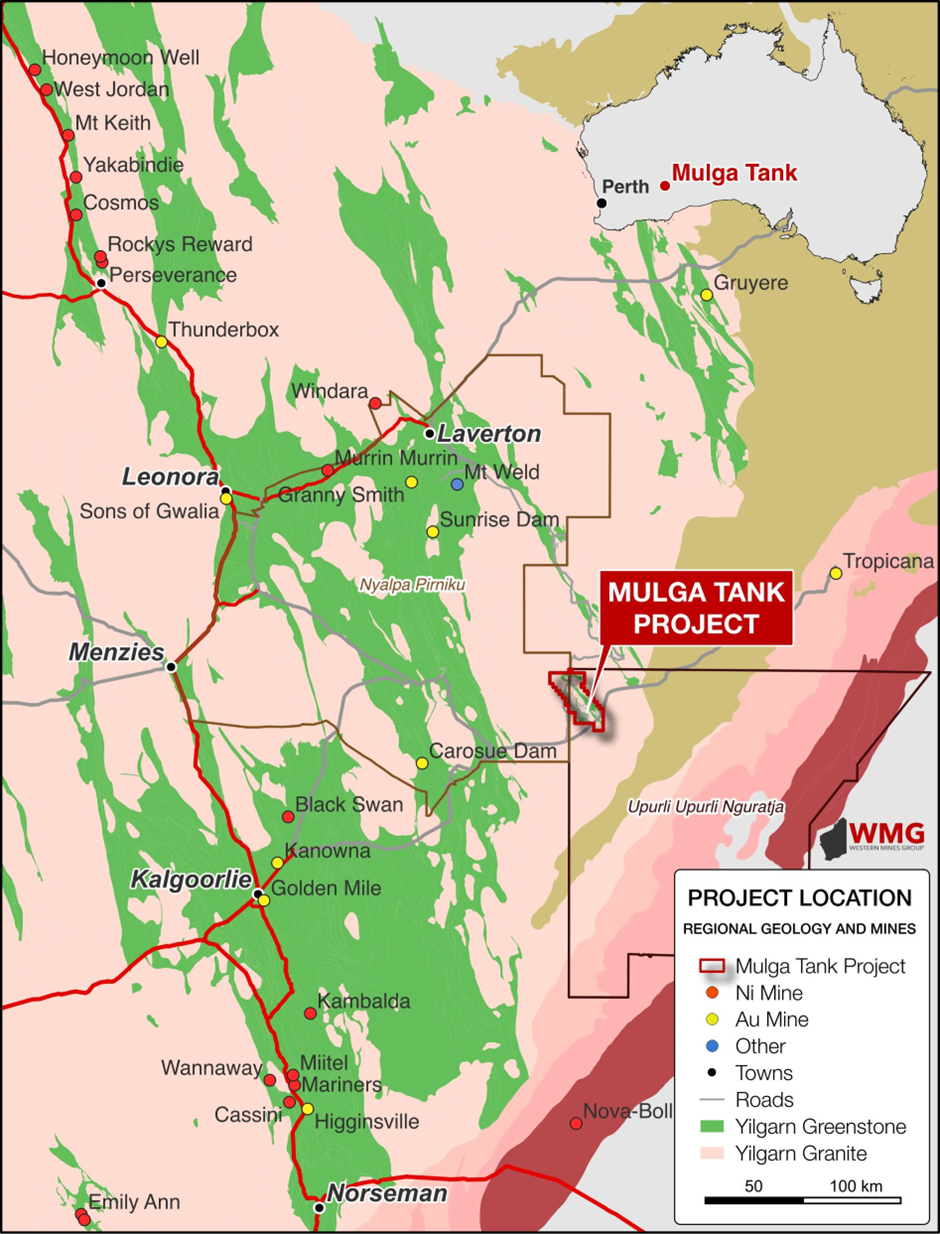

But given the Chinese dominance of the Indonesian nickel industry, where will the western world source it’s future nickel demand? And given the questionable ESG credentials of the Indonesian industry, where can Eden gain exposure to this commodity? We have screened a number of western nickel sulphide projects and one that stands out is Western Mines Group (ASX:WMG) and their recent Mulga Tank nickel sulphide discovery. Unheard of a couple of years ago, this has emerged as the largest nickel sulphide deposit in Australia following their initial resource announcement in April this year.

I caught up with Dr. Caedmon Marriott, Managing Director of WMG, earlier this week, who noted that "Its been a tough 12 months in the nickel market, but prices seem to have stabilised around this US$15,000/t level and we see upside from here. We’ve stuck to our exploration work during this trough and in April revealed what a world class nickel sulphide discovery Mulga Tank is – comfortably the largest nickel sulphide deposit in Australia and top 10 in the world. There’s light at the end of the tunnel and we’re starting to see interest from a number of smarter resource investment funds such as Eden. We’re currently back in the field drilling our Phase 4 program and expect to reveal further exciting results over the next 6 months.” and I am also looking forward to a site visit next week

WMG’s Mulga Tank Project is located ~200km east of Kalgoorlie in Western Australia’s Eastern Goldfields. The company has consolidated the entire Minigwal Greenstone Belt that it believes is highly prospective for nickel, as well as gold, and even Cu-Pb-Zn VMS.

Since the company’s IPO in July 2021, WMG has been focused on the nickel sulphide potential of the Mulga Tank Ultramafic Complex. Whereas many other ASX nickel explorers have fallen by the wayside, WMG has persisted, and their exploration results are beginning to unlock a globally significant nickel sulphide mineral system.

The Mulga Tank Ultramafic Complex was first discovered by BHP in 1983 but remained largely overlooked for the next 20-30 years. This large dunite intrusion lies beneath sand cover, with only 12 drill holes penetrating the intrusion prior to WMG acquiring the project. Over the last three years they have drilled a further 19 diamond holes and 67 RC holes totalling over 35,000m. This led to the unveiling of an initial mineral resource in April totalling 1,968Mt at 0.27% Ni with over 5.3Mt of contained nickel.

Mulga Tank Project Location in Western Australia

The company is conducting further infill and extension drilling and beginning to move into economic scoping studies. They see a clear pathway to catching up with the likes Canada Nickel (TSXV:CNC) and their Crawford Project, currently trading at 9x WMG’s market cap.

But Mulga Tank isn’t just a large, low-grade “Mt Keith-style” deposit. The real value in the project is the belt or camp scale potential of the project. WMG believes the main intrusion is more akin to a Perseverance-style hybrid system with great potential to find deeper higher grade basal massive sulphide accumulations. The company has begun to step out along the belt testing a komatiite channel system. First drilling results appear very positive demonstrating well mineralised channel flows, whilst multiple look-a-like targets, extending up the belt, are currently completely untested.

WMG’s Muga Tank Resource Block Model

The company offers a unique combination of clear value generation as the project moves through scoping and feasibility studies on the current resource, whilst also offering exciting exploration potential.

Investment Highlights

- High-impact exploration targeting gold (Au) and Ni-Co-Cu-PGE opportunities

- Discovery of Australia’s largest nickel sulphide deposit

- Portfolio of six projects across Tier-1 WA mineral belts, each with “company-making” potential

- Proven and experienced board and management with a track record of discovery and value creation

- Tight capital structure, providing maximum leverage to exploration success

- Attractive valuation, offering significant upside potential

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 11 September 2025. This document was originally published in Livewire Markets on 11 September 2025. This information has been prepared Eden Asset Management Pty Ltd (ABN 53 115 111 058) (AFSL 296 466). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.