Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The year AI comes of age

Denny Fish | Janus Henderson

For much of the past three years, AI has been the story in global equity markets. Far more than just capturing headlines, AI-related stocks – especially the megacap hyperscalers – have been responsible for a large portion of aggregate market returns over this period.

Despite this remarkable run – and as evidenced by a brief early 2025 dip – many investors a trying to decipher something of paradox within the AI story: How can it be a long-duration theme playing out over a multi-decade horizon, while also advancing at such a rapid pace that the goal posts seemingly move every few months?

In this instance, both statements are true. It will take years for the AI theme to unfold, but the rapid adoption of this revolutionary technology has surprised even some of AI’s biggest cheerleaders.

“If you build it…”

Reconciling this secular vision and real-time deployment comes to a head in the historic amount of capital expenditure (CapEx) allocated to bring an AI future to bear. The capital investment debate was also behind the early 2025 volatility as the market questioned the scale of the investment, especially in the wake of China’s DeepSeek purportedly achieving impressive results on the cheap.

While the DeepSeek episode ultimately proved to be a head fake – the Chinese model relied heavily upon Western platforms – it came at a time when some in the investment community were expecting incremental CapEx to diminish as AI moved from the training phase to the inference, or reasoning, phase. That has emphatically turned out not to be the case.

One of the revelations of 2025 has been a resetting of expectations for the computing power required for AI reasoning.

Behind this recalibrated outlook was test-time inference. Rather than AI’s operational phase riding on the coattails of the computation-heavy training stage, increasingly complex models now exhibit the ability to think through problems, with each iteration producing data that can be referenced for future uses. This process will require a massive amount of additional CapEx.

In 2024, 100,000 graphic processing units (GPUs) would have been considered a large data cluster for AI compute. That number is now a million GPUs, with some estimates calling for double that amount in the near future. Such a concentration of computing power requires a commensurate amount of energy. The electricity generation required to support AI clusters will be measured not in megawatts but gigawatts. The current mismatch between existing power supply and skyrocketing demand has led to an arms race among tech hyperscalers seeking to secure sufficient generation capacity.

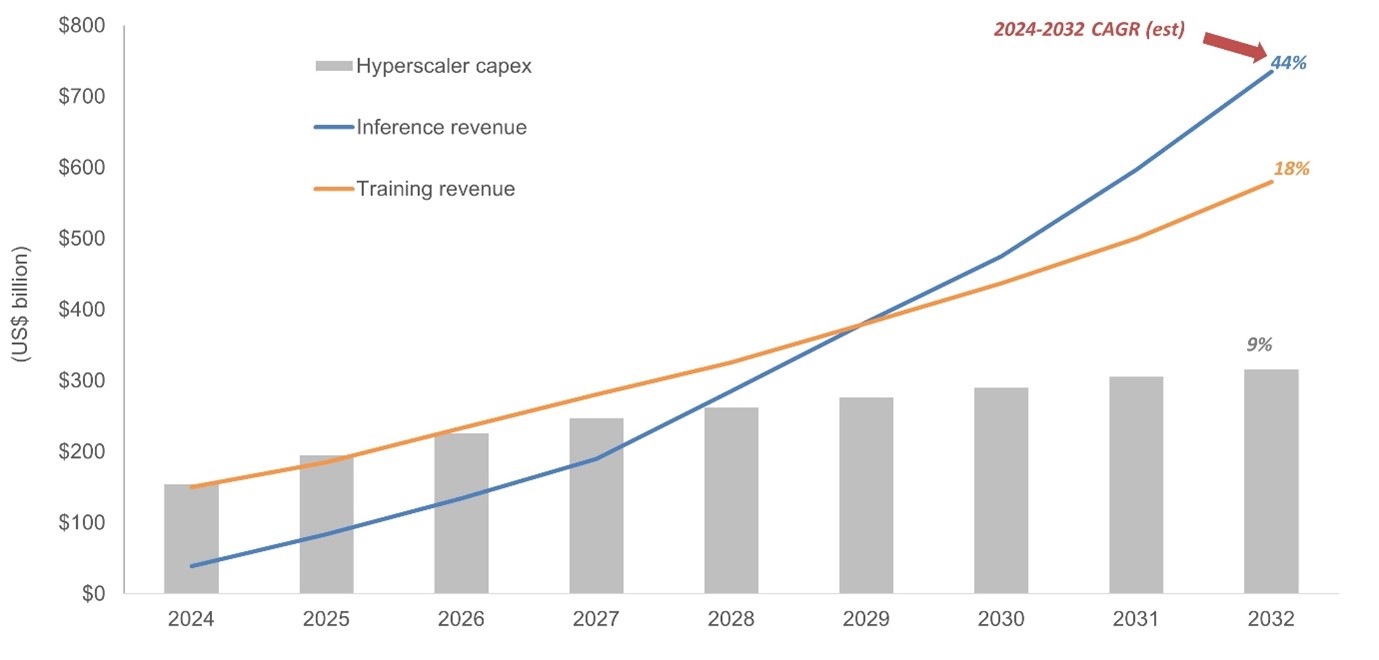

AI-related revenues and CapEx forecasts (2024-2032)

The expectation that the CapEx required to sustain AI models would level off once the training phase matured has been upgraded as it’s now apparent that inference would require massive investment. Conservative estimates call for roughly $2.5 trillion over the next eight years, with more bullish forecasts calling for three times that amount.

Source: Bloomberg Intelligence, McKinsey, Janus Henderson Investors; as of 31 July 2025. Note: 2025-2032 projections for price levels and growth rates are estimates.

From this perspective, the level of investment slated by the AI heavyweights, in our view, is the downpayment required to reap the economic returns expected from an AI-enabled future. As evidenced by some innovative approaches taken by DeepSeek, efficiencies will no doubt be uncovered. But rather than experience sticker shock at some of the dollar amounts allocated to AI capex, investors should recognize there are two sides to the equation: investment and return. As with any secular theme – especially one so potentially transformative – returns will be measured over a decade-plus horizon. And there is a realistic possibility that many valuation models underestimate the durability of AI’s economic benefits over this horizon.

Enablers – and early adopters

Another reason behind the market’s early 2025 consternation surrounding AI CapEx was the question of when returns on this investment would begin to materialize. The answer came with the most recent wave of tech-sector earnings reports. Companies like Microsoft revealed that not only are AI investments leading to monetization, but deployed capacity has been met with robust demand, and managers expect this to continue for the foreseeable future.

In this respect, the tech sector has assumed the dual role of AI enabler – for the broader economy – and early beneficiary within its own operations. While CEOs across sectors have prioritized developing an AI strategy, tech companies have a head start due to their greater familiarity with these novel platforms.

Many tech players are already seeing AI-related productivity gains flow through to margins.

In fact, we believe that the market still underappreciates the degree to which the operating leverage inherent in AI will be accretive to margins. Couple that with the ability of front-office AI capabilities to grow revenues, and we see a scenario where long-term aggregate earnings growth resets to a materially higher level. These financial benefits are unfolding today within the tech sector but will invariably spread to other industries as corporate managers solidify their AI strategies.

For a select subset of tech hyperscalers, another prize will be achieving artificial general intelligence (AGI). While this breakthrough won’t be a winner-take-all scenario, it will put those that can deliver AGI to the market in a commanding position. Meanwhile, most AI platforms are concurrently developing their own niches, meaning each is likely to develop a stable customer base that aligns with their particular model’s capabilities.

Beyond the boardroom

This past year has proven that developing an AI strategy is not just a corporate priority. Sovereign AI has become a strategic imperative as countries recognize the significant benefits and manifold risks presented by the advent of this technology. Governments rightly believe that AI will impact their countries’ economic, social, and security interests.

Many countries will want to achieve AI autonomy, while others will seek ways to form partnerships to ensure access to the technology and fortify national initiatives. For example, after initially seeking to block access to the most advanced chips, the U.S. now appears to champion a strategy of getting other countries to utilize its AI infrastructure to cement is leading position.

Schumpeter’s maxim for the twenty-first century

Investors may cheer at AI’s potential to improve global economic growth. But as has been the case with other stages of the ongoing digital revolution, some companies, through thoughtful strategy, will find themselves on the winning side of AI, while others will fail to grasp the magnitude of this sea change and find their business models vulnerable. This bifurcation is playing out today within the tech sector as hyperscalers compete for the most potent models. Over the next several years it will spread to all corners of the global economy and broader society.

The widely anticipated productivity gains are likely to represent a net positive for the economy. But there will be a cost in the form of the “creative destruction” that Joseph Schumpeter foresaw nearly a century ago. Given the breadth of change afoot – and the scale of the economic stakes – investors should be both excited about AI’s promise and clear-eyed about its ability to upend myriad business models, industries, and economic paradigms.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 26 August 2025. This document was originally published in Livewire Markets on 26 August 2025. This information has been prepared by Janus Henderson Investors (Australia) Limited ABN 47 124 279 518 and its related bodies corporate including Janus Henderson Investors (Australia) Institutional Funds Management Limited ABN 16 165 119 531, AFSL 444266 and Janus Henderson Investors (Australia) Funds Management Limited ABN 43 164 177 244 AFSL 444268. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.