Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

From Sydney to Silicon Valley: Unlocking Global Growth with ETFs

Tamara Stats | BlackRock Australasia

Australians are known for their love of globetrotting and being adventurous travellers – but the same can't always be said when it comes to our investing behaviour.

Historically, Australian investors have had a strong preference to invest in Australian-listed securities because the ASX tends to be dominated by dividend-paying companies, that provide investors with a source of regular income thanks to our dividend imputation credit system.

Additionally, the familiarity of home-grown companies and brands, combined with uncertainty around currency exposure also play a role in the hesitation to invest beyond our own backyard. According to the most recent ASX Investor Study, just 16% of Australian investors owned international shares, compared to 58% who owned domestic shares.1

In 2024, as the US share market saw outsized returns, this trend appeared to be reversing, with the total amount of Australian assets invested in the US increasing by almost 30% to more than $1.5 trillion.2 Across BlackRock’s Australian-listed ETF range, the iShares S&P 500 ETF (IVV) was our most popular product in 2024 by a huge margin, gathering more than $2 billion from investors.

However, as US trade policy uncertainty has hit headlines this year, Australians have retreated back to domestic companies, with the iShares S&P/ASX 200 ETF (IOZ) gathering the most inflows across our local ETF range this year so far3.

Regardless of day-to-day market noise, however, we believe it is worth looking at global exposures to realise diversification benefits.4 According to S&P Dow Jones Indices, the Australian market only represents around 2% of the global equity market5. With that context, the Australian portion of the global public market is a relatively small pond to be fishing in when it comes to return opportunities and has sector concentrations towards banking and materials.

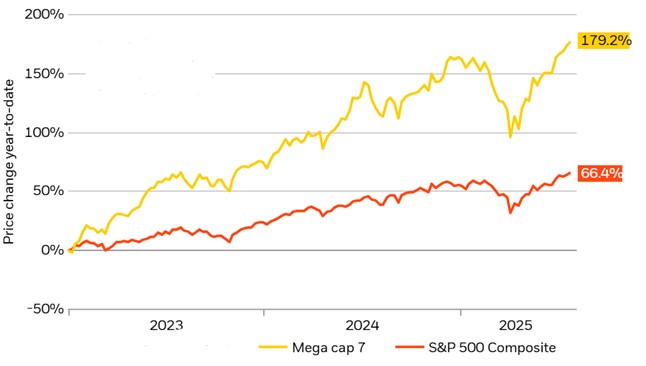

As a result, Australian portfolios are likely missing out on exposure to sectors such as technology, where the US-listed ‘MegaCap 7’ stocks - Nvidia, Amazon, Microsoft, Apple, Alphabet, Meta and Tesla – have been generating outsized growth in recent years (see chart below). Similarly, following the release of DeepSeek’s new AI model earlier in 2025, large-cap tech stocks have helped the FTSE China 50 Index to a substantial 41% return for the year to June 2025.6 Investors can access these stocks by investing in iShares Global 100 (IOO) and iShares China Large-Cap ETF (IZZ).7

And over in Europe, large-scale fiscal spending by the EU and German governments has driven the best first quarter result for the European equity market – which investors can access through the iShares Europe ETF (IEU) - versus the US in three decades.8 These are just a few examples of the long-term earnings growth Australian investors may potentially be missing out on by choosing to invest in purely home-grown names.

Figure 1: ‘Megacap 7' vs S&P 500 returns, 2023-2025

Note Megacap 7 includes Nvidia, Amazon, Apple, Alphabet, Meta and Tesla. For illustrative purposes only, this is not a recommendation to invest in any particular financial product or security

Global investing made easy

Global equity ETFs represent a simple, efficient way for investors to gain access to growth opportunities in overseas markets, as well as reducing concentration risk with broader exposure to assets across sectors and regions. This is increasingly being noted by investors - according to Investment Trends data, new ETF Australian investor numbers grew by 11% between 2023 and 2024, with diversification cited as the key reason an investor would use ETFs.9

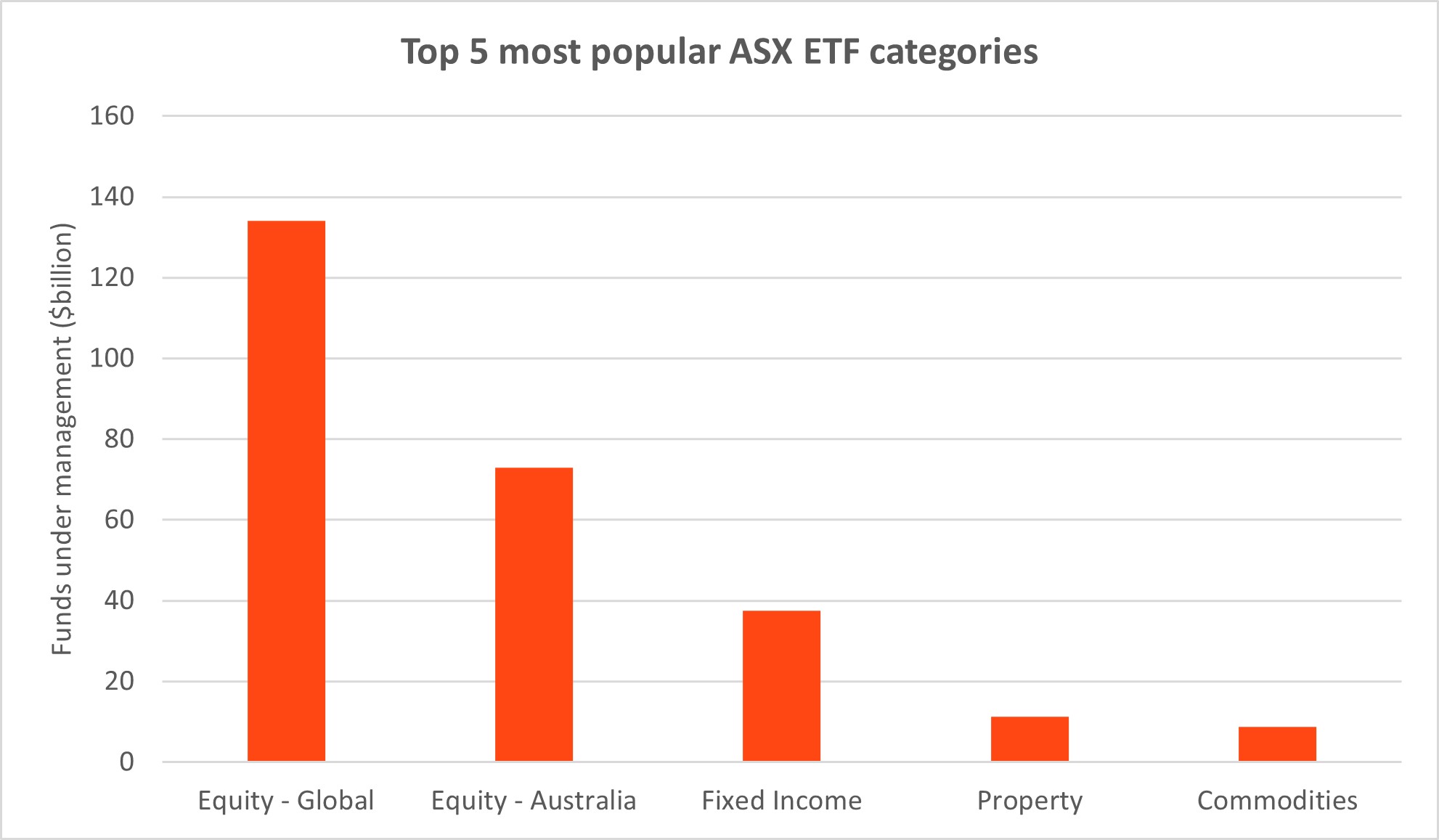

Global equity exchange traded products also remain the largest product category on the ASX, with $134.1 billion in assets under management – almost double the size of the Australian equity ETP category.10 Additionally, international equities remain the most popular ETF category among Australian financial advisers, with 36% of their new client ETF investments in 2024 going to this category.11

It’s clear that investors are increasingly realising the benefits that ETFs provide when it comes to accessing global markets. ETFs can play an important role in broadening out the choice available to investors, by enabling easy access to potentially hundreds of international stocks through a single trade on the local exchange.

In some cases, global exposures also have a currency hedged version, providing Australian investors with a valuable tool for their global investing journey – one that may come in handy, given current speculation around the direction of the US dollar amid trade policy volatility and rising US government debt.

Figure 2: Global exposures are a popular choice with Aussie ETF investors

Source: ASX data as at 30 June 2025

Source: ASX data as at 30 June 2025

When we reflect on the growth of markets over the years including increasingly higher ETF adoption rates, the cost-efficiency of ETFs as an investment vehicle has also played a role in their fast adoption. With over 380 exchange traded products now available on the ASX12, increasing competition means Australians have been able to access these global exposures at a fraction of the cost of yesteryears.

The future of the ETF market

While there is a lot to celebrate in terms of the exponential growth we’ve seen in the Australian ETF market, we believe there is more room to grow to close the gap to other developed markets. In June 2025, Australia crossed $270 billion in ETF AUM, but this still represents just a fraction of the more than US$13 trillion invested in ETFs globally13.

As the first ETF provider to offer global equity ETFs on the ASX, BlackRock’s iShares product suite includes over 20 global exposures spanning developed markets, emerging markets, sectors such as real estate, tech, healthcare, as well as factor ETFs such as quality, value and momentum. The range also includes seven currency hedged global equities exposures.

We believe that this accessible, transparent and comprehensive range of ETFs is a compelling proposition for Australian investors who wish to broaden their sights and diversify14 and indeed complement their Australian investment portfolio.

To find out more about iShares’ ETF range, log into your nabtrade account or visit blackrock.com.au/ishares.

Product details

iShares Core S&P/ASX 200 ETF (IOZ)

https://www.blackrock.com/au/products/251852/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years

• with a medium to high risk/return profile

iShares S&P 500 ETF (IVV)

https://www.blackrock.com/au/products/275304/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares Global 100 ETF (IOO)

https://www.blackrock.com/au/products/273428/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares China Large-Cap ETF (IZZ)

https://www.blackrock.com/au/products/273424/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

iShares Europe ETF (IEU)

https://www.blackrock.com/au/products/273427/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

•using the product for a core component of their portfolio or less

•with a minimum investment timeframe of 5 years, and

•with a medium to high risk/return profile

Opinions are subject to change and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 28 July 2025. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) at blackrock.com/au to see if the products referenced are appropriate for you. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide at blackrock.com/au for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. MKTGH0825A/S-4706059