Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

AU CPI Indicator surprises sharply higher

Taylor Nugent | Markets Research

Key points:

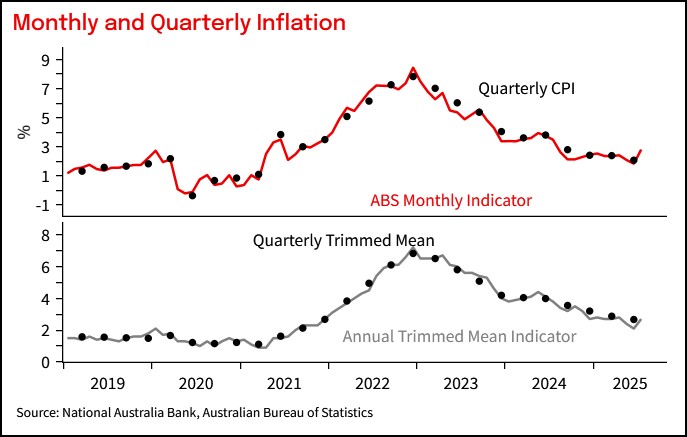

- Monthly CPI indicator jumped to 2.8% from 1.9% (NAB and consensus 2.3%)

- The annual trimmed mean also jumped to 2.7% from 2.1%.

- The surprise was strength in travel and timing of electricity subsidy payments and so is not as material as it looks at face value

- Even so, the RBA Q3 forecast was ~0.64% qoq for trimmed mean, a 0.7% is now more likely, but a lot of data to come

Bottom line

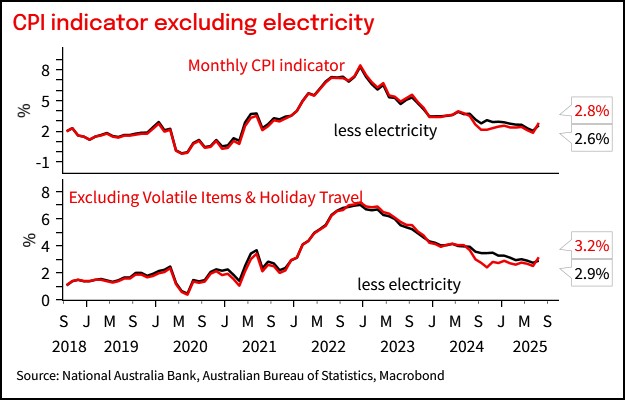

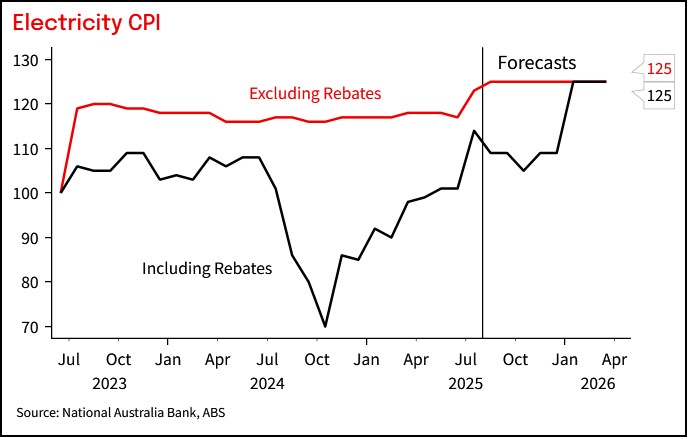

The outcome of the July indicator was always going to come down to measurement of electricity subsidies and travel prices. Those components drove the surprise.

- Electricity prices rose 13% mom. Underlying prices rose around 5% as expected, but our forecast missed that Q3 payments for NSW and ACT were delayed until August. Measured electricity prices will fall back once those subsidy payments are made even as underlying prices may see a small further increase.

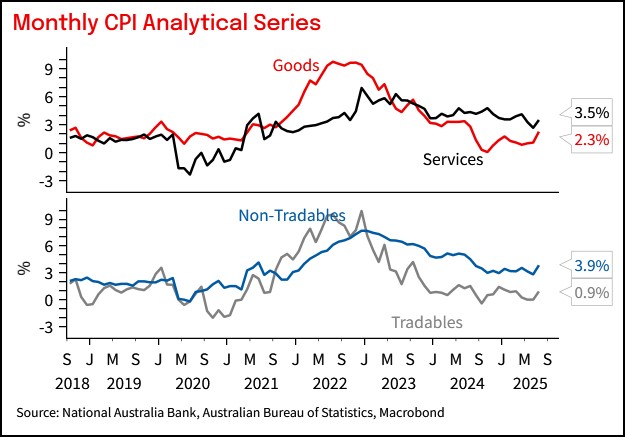

- Travel prices were much stronger than expected, up 4.7% mom and 5% yoy. Travel prices are volatile but had tended to fall in July the past couple of years even as domestic travel prices are supported alongside school holidays. We had anticipated some additional strength after a surprisingly soft June outturn and strength in demand alongside major events in July, but evidently not enough.

The key point is that the surprise, while large, was driven by the timing of subsidy payments and the volatile travel component. It will tell the RBA little about the underlying pulse of inflation and comes after a period where the Monthly CPI Indicator had been understating the strength of inflation on both the trimmed mean and headline measures. That said, as it stands a 0.7% qoq looks more likely than a 0.6% for the RBA’s preferred quarterly trimmed mean forecast for Q3. (The RBA’s August SoMP forecast was for 2.5% yoy, equivalent to 0.64%).

The annual trimmed mean measure also jumped more than expected from 2.1% to 2.7%. The annual trimmed mean reflects the same surprise as the headline, rather than an indication of breadth. That is because annual growth in electricity, domestic travel, and international travel were on the low side of the trim in June, but were in or on the high side in July. To see that, an alternate underlying measure, which excludes fruit & veg, fuel, travel and electricity, rose only around 15bp to 2.9% yoy in the month. The annual trimmed mean is a different, less informative, concept than the quarterly trimmed mean.

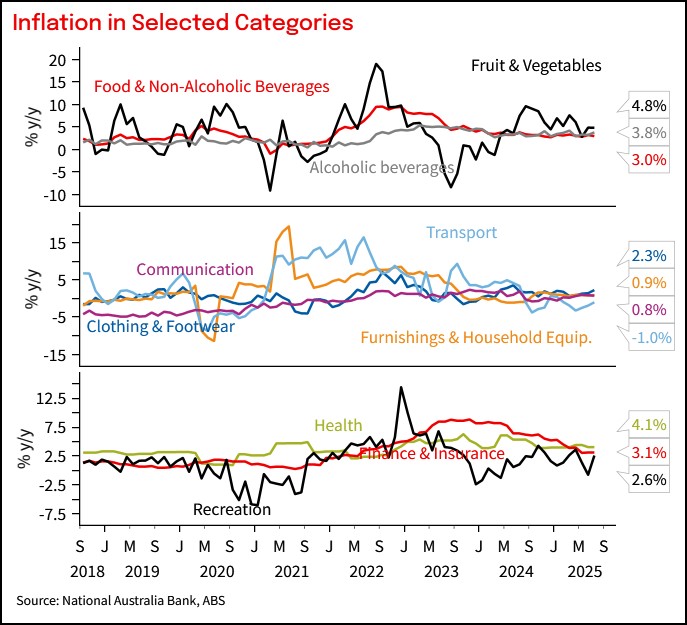

Detail

The first month of the quarter provides quarterly price changes for a range of goods prices. These were broadly consistent with consumer durables inflation slowing from Q2 on a seasonally adjusted basis, and inflation broadly similar to a year ago. Furniture prices fell relative to normal seasonal changes, but some other categories like accessories were on the stronger side. Grocery price inflation slowed on a year-ended basis, driven by cooler meat and cereals prices.

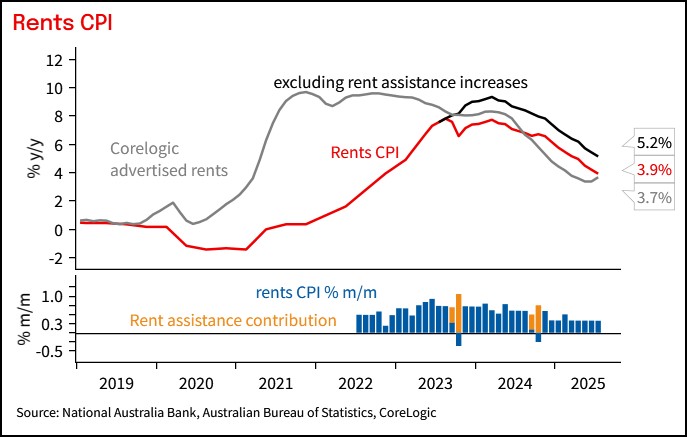

Rents inflation was 0.3% mom continuing the recent trend. Advertised rents growth has steadied around 0.4% mom recently and vacancy rates remain low. The stabilisation in rents growth means it is no longer a source of downward pressure on aggregate inflation.

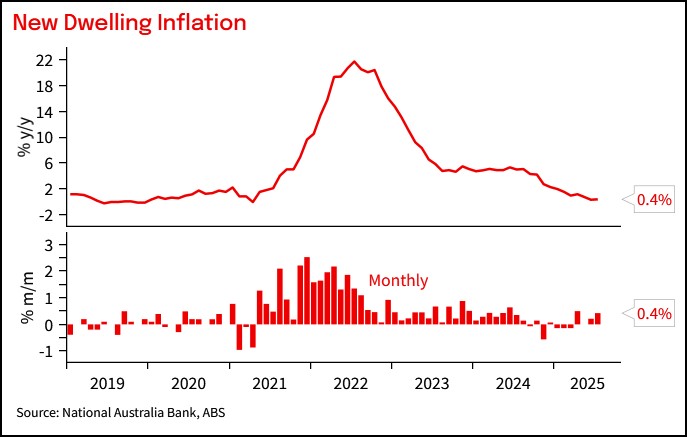

New Dwellings prices rose 0.4% mom. Earlier price declines were driven by discounting in addition to easing cost pressures as demand slowed. We expect the reacceleration evident in Q2 to sustain. The component is volatile month to month, but 0.4% mom is stronger than we expect to continue. Shelter remains a source of upside risk in the inflation outlook.

Chart 1: Electricity subsidies reversed unexpectedly sharply in July because Q3 payments were delayed until August in NSW.

Chart 2: Electricity CPI

Chart 3: Monthly and Quarterly CPI

Chart 4: Services inflation rose (travel) and goods inflation rose (electricity)

Chart 5: New Dwelling inflation has picked up

Chart 6: Rents inflation has stabilised

Chart 7: Inflation by category

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 27 August 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.