Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why US-shy investors are packing their bags for Europe

Tamara Haban-Beer Stats | BlackRock

In the first quarter of 2025, European equities generated their best performance versus US shares in 30 years1, driven by supportive economic policy and better than expected domestic data.

Since then, global investor sentiment on Europe has continued to be positive, particularly on the back of more muted outlooks for other regions as they face challenges on US trade policy. According to a June 2025 survey of more than 200 BlackRock European clients, 68% have a more positive view of their home region than they had at the beginning of 2025.2

In Australia this trend has also shown through in a dramatic turnaround in inflows to the iShares Europe ETF (IEU) so far this year. IEU has picked up more than $52 million year to date in net flows3, placing the fund in BlackRock’s top 20 most popular iShares ETFs of 2025.

Compared to around $37 million in outflows for the fund in 20244, this highlights the degree to which investors are taking notice of the economic recovery in Europe. Globally, too, 15% of all iShares ETF flows year to date have gone to European equity products – the highest percentage share of any region5.

What’s driving the European rally?

A large part of investor optimism around Europe has been driven by large-scale spending plans initiated by both the German and broader European government (see chart below).

BlackRock Investment Institute, NATO, World Bank, European Commission, 25 June 2025. Note: The solid lines show the defence spending as a share of GDP for Germany and European NATO countries. The dotted lines assume current plans to boost defence spending are realised.

The European Commission’s ambitious ReArm Europe plan includes around 800 billion euros in government spending to boost defence capabilities.6 The EU goal as part of ReArm is to raise local defence procurement from the current 20-35% to 50% by 2030 to reduce reliance on the US, making European industrials a particularly ripe area for potential growth.

Meanwhile Germany has outlined a long-term defence spending increase of as much as 3-3.5% of German GDP, as part of an overall 1 trillion euro investment into its domestic economy over the next decade.7

Secondly, a gradual consumer recovery appears to be underway in Europe, with corporate and consumer loans both growing strongly, leading to more profit upside for European banks despite interest rates starting to come down. The most recent Purchasing Manager’s Index (PMI) data also indicates that new manufacturing orders in the Eurozone have stabilised after nearly three years of declines, with manufacturing output rising consistently over March, April and May 2025.8

Even though European equity valuations have increased significantly in the first half of 2025, they still remain historically low compared to the US. This trend has developed over the past decade as investors preferred US tech innovations and viewed Europe as an 'old world' economy. However, these lower valuations may gradually rise as Europe undergoes structural changes.

Looking at how industry weightings in the MSCI Europe Index have changed over time, for instance, we see that energy, banks and telecommunications have seen the largest declines from 2014-2024, while life sciences, semiconductors and capital goods have increased the most.9 European companies have also become more global, with constituents of the Stoxx 600 Index now deriving around 60% of revenues from outside the EU, compared to around 40% in 2005.10

While the imposition of tariffs by the US may act as a drag on Europe’s positive long-term trajectory, investors should consider the context. For instance, around 26% of revenue from companies in the MSCI Europe Index comes from the US, but just 6.5% comes from US exports that will be directly subject to trade barriers. It’s important to note that European corporates may be affected by any US economic downturn as a result of trade policy, but there’s perhaps less direct impact from the tariffs themselves.

Diversifying into new markets

In today's global market, uncertainty in trade policies and geopolitical tensions are causing varied performance across different sectors, regions, and asset classes. ETFs can help investors to strategically adjust their portfolios and take advantage of opportunities in specific markets, which has been a popular strategy this year.

Strategic ETFs – those allowing investors to dial into a particular single market or sector – have seen more than US$95 billion in flows from iShares investors, the most popular ETF category globally for 2025 to date. European equities is one such single market exposure investors can tap into through the iShares Europe ETF (ASX code IEU).

Investors can use IEU to either add to their existing global equity investments as a long-term portfolio ‘building block’, or trade tactically to take advantage of the current strong growth in European markets. With financials, industrials and healthcare among IEU’s largest sector weightings, investors can tap into the recovery of the European consumer, reinvigorated defence spending in the EU, and longer-term ‘mega forces’ such as demographic change and global rewiring of supply chains.

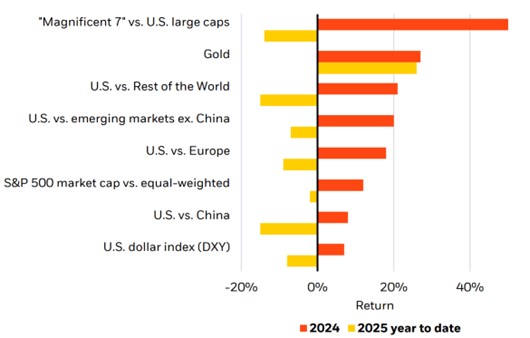

Adding an allocation to European equities may also make sense as a portfolio diversifier given ongoing volatility in the US.11 As seen in the chart below, we’ve seen 2024’s market trends essentially reverse in 2025, as US equities in particular give back gains versus other equity markets. In this context, a Europe-specific exposure may allow investors to tap into the region’s growth opportunities that are being driven by domestic forces and are relatively isolated from tariff-related uncertainty

For illustrative purposes only. This is not a recommendation to invest in any particular financial product.

Source: BlackRock Investment Institute, MSCI, with data from Bloomberg, 30 April 2025. The “magnificent 7” index includes Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. Index proxies: Bloomberg US Large Cap ex. Magnificent 7 for U.S. large caps, MSCI USA for U.S., MSCI Europe for Europe, MSCI World ex. USA for Rest of the World, MSCI Emerging Markets excluding China for Emerging markets ex. China, MSCI China for China. Past performance is not a reliable indicator of future performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Of course, investors should also be aware of the risks of investing in a single-market exposure like IEU, including concentration risk, and should think about their investment timeline before making an investment. As an unhedged international exposure, investors are also exposed to currency fluctuations which could affect the performance of the fund over time.

Overall, as the search for returns in turbulent equity markets gets increasingly specific, European equities may represent a compelling option in the months ahead.

- Source: Bloomberg as of 31 March 2025. Past performance is not a reliable indicator of future performance.

- Source: BlackRock data as of 1 June 2025

- Source: BlackRock data as of 20 June 2025

- Source: BlackRock data as of 20 June 2025

- Source: BlackRock data as of 20 June 2025

- Source: BlackRock data as of 16 April 2025

- Source: Bloomberg data as of 31 March 2025

- Source: Trading Economics, as of 22 May 2025

- Source: BlackRock and MSCI data, based on top and bottom three index changes by industry group from 1 September 2014 – 15 August 2024

- Source: Factset, Goldman Sachs Global Investment Research, May 2025

- Diversification and asset allocation may not fully protect you from market risk.

Product details

iShares Europe ETF (IEU)

https://www.blackrock.com/au/products/273427/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

Disclaimer

Opinions are subject to change and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation. Indexes are unmanaged and one cannot invest directly in an index.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 26 June 2025. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide on its website for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction.