Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Uranium investors are missing the global nuclear renaissance

Justin Lin | Global X

These days, it’s widely recognised that nuclear power will be a critical component of the global transition to clean energy. In fact, some might say the theme is “old news” ever since the rally and subsequent sharp contraction in spot uranium and uranium miners between 2023 and late-2024.

So, is the nuclear energy boom over? Is the need for nuclear energy in the future no longer as prevalent as it was a few years ago? If the steady stream of policy adoption and positive developments is any indication, the answer is a firm no.

Instead, we think the latest spot uranium boom-and-bust is best digested as a lesson to investors. A lesson that investing in the nuclear resurgence is not as simple as buying a single commodity. Demand for uranium does not simply materialise within a year, and the technology firms making nuclear safer and more modular are often completely detached from uranium itself.

Clearly, a broader investment perspective is required.

Key takeaways

- Investing in commodities alone can be volatile and unpredictable, characteristics which can make it an ill-suited way to express broader thematic trends.

- Investing in the full nuclear value chain allows investors to capture the upside from both uranium prices and growing policy support for nuclear infrastructure and technology.

- The strong performance of nuclear energy equities highlights how thematic strategies can shine despite macro uncertainty, supported by structural tailwinds and robust policy backing.

Can a commodity represent a theme?

Investing in commodities is rarely a smooth ride. Uranium investors know this well. Since early 2020, spot uranium prices have climbed from near all-time lows to 15-year highs, before falling again by 40% from mid-2024 to early 2025.

These sharp swings have been hardly surprising. As commodity investors like to say, “the cure for high prices... is higher prices.” i.e. Rising prices in goods driven by strong demand typically triggers a similarly strong supply response, which then extinguishes the rally, creating natural peaks and troughs in performance.

However, while ups-and-downs are to be expected with any investment, investors generally agree that less volatile exposures are more palatable – especially for more long-term thematic investments. Diversification is one of the most effective ways to manage investment risk and the principle can be applied to investors in the nuclear theme.

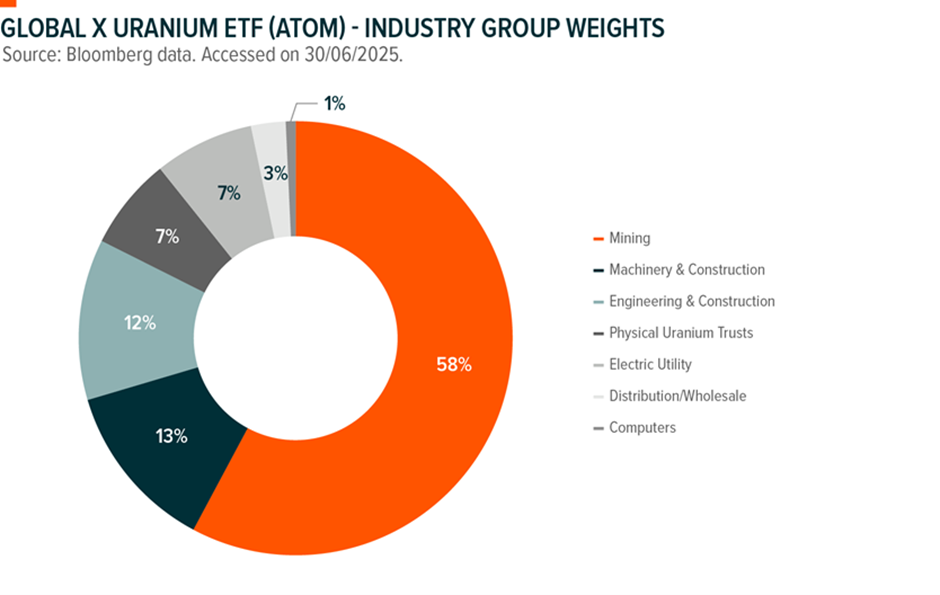

The Global X Uranium ETF (ASX: ATOM) provides exposure to the full value chain of nuclear energy. In addition to physical uranium trusts and uranium miners, the fund includes significant allocations to engineering and technology firms involved in the global buildout of nuclear power plants. We believe that these allocations not only make ATOM more true-to-label in capturing the nuclear energy thematic, but also fundamentally make ATOM more diversified and less volatile than investing in uranium and uranium miners alone.

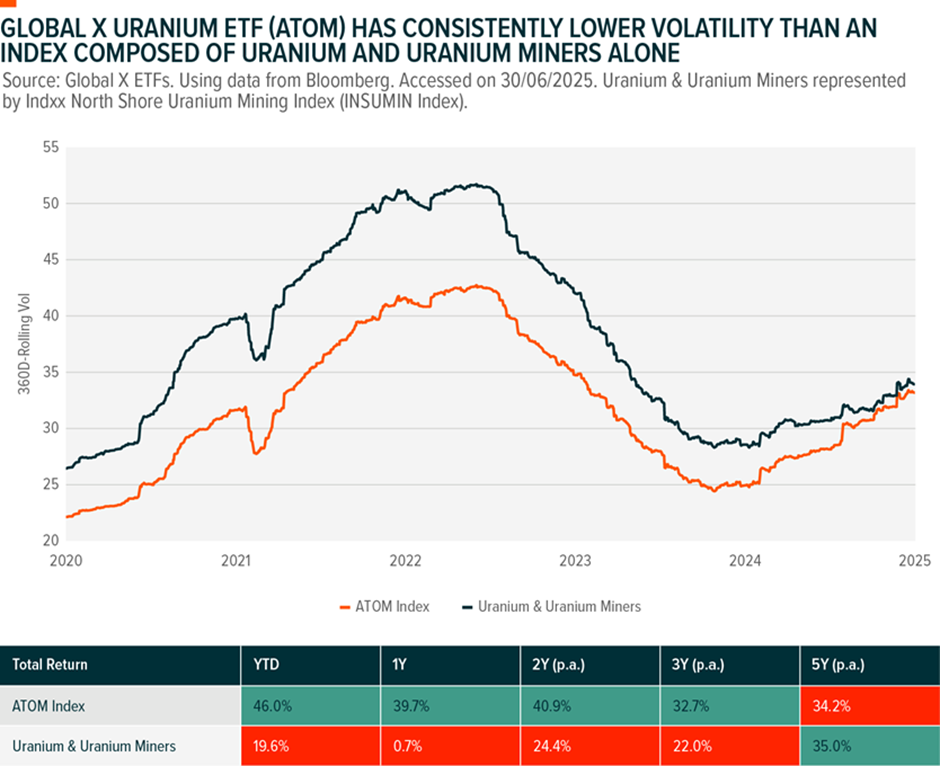

To illustrate the benefits of ATOM’s investment approach, the chart below compares its volatility to that of an index comprising only physical uranium trusts and uranium miners. As shown, ATOM has consistently exhibited lower volatility – and notably, has also outperformed across most timeframes.

Capture all the good news

Another challenge of using commodities to express thematic trends is that positive headlines for the theme often fail to translate into gains in the commodity’s price. In the case of nuclear energy, much of the support policies being announced are not directly related to uranium. For example, here are some of the most impactful nuclear headlines of the past 12-month:

- July 2024: The Biden Administration passes and enacts the ADVANCE Act which seeks to support the licensing of advanced nuclear technologies and strengthen the domestic nuclear fuel supply chain.

- March 2025: Big tech firms including Amazon, Google, and Meta sign the LEUP (Large Energy Users Pledge) to target a tripling of global nuclear capacity by 2050.

- May 2025: President Trump signs executive orders that aim to quadruple US nuclear capacity by 2050 and begin construction on 10 large reactors by 2030.

- June 2025: The World Bank ends its decade-long formal ban on financing nuclear projects. Following suit, the Asian Development Bank also kicked off a review of its funding ban on nuclear energy.

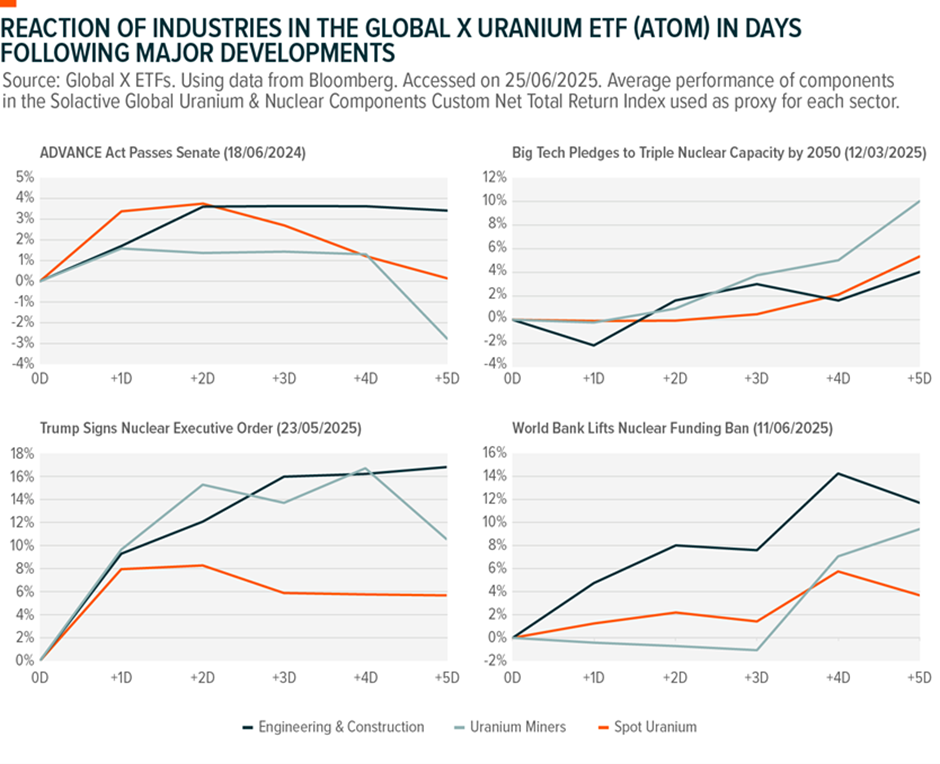

A closer look at the headlines above reveals that while each development is positive for the nuclear theme, few are directly tied to changes in uranium supply or demand. Instead, the dominant narrative centres on the construction of nuclear infrastructure and the accelerated deployment of next-generation technologies. As a result, investors focused solely on uranium missed much of the positive momentum generated by these announcements.

This point is reinforced in our analysis below, which tracks how different segments of the nuclear value chain responded to the same headlines. Of the four major developments listed, only one saw spot uranium and uranium miners outperform engineering and construction firms within the ATOM index over the five days following the announcement.

We’ve been tracking the outperformance of various segments across the nuclear value chain for some time. For a deeper dive into how different parts of the industry have performed, see our November 2024 insight also featuring the ATOM index.

Thematics can shine despite macro uncertainty

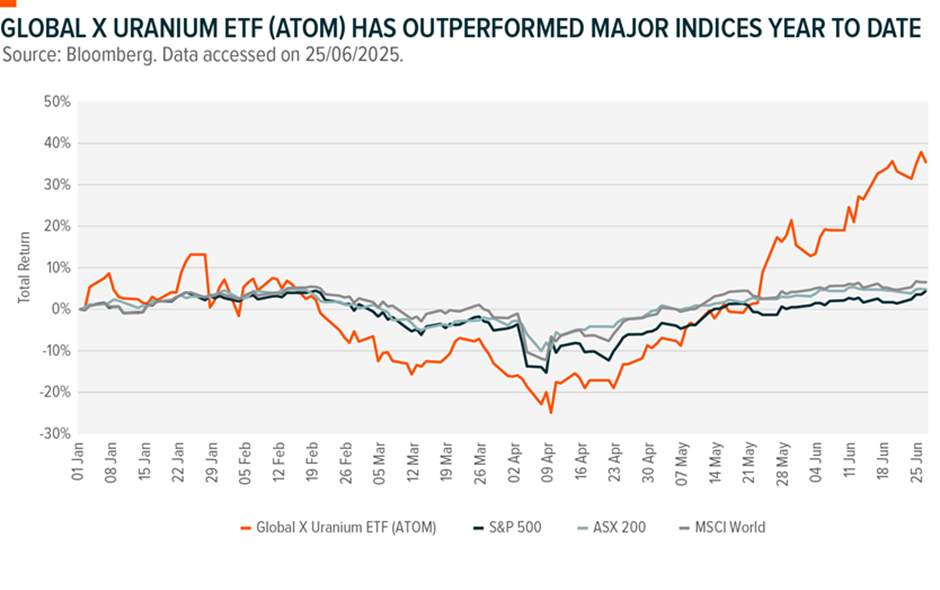

Finally, we think it is notable that The Global X Uranium ETF (ATOM)'s strong performance has come despite a rather hostile investment environment.

It is undeniable that investors are navigating one of the most volatile and uncertain market environments in recent history. In such conditions, even identifying isolated pockets of performance can prove challenging, as equities are buffeted by headlines, geopolitical tensions, and other macro shocks.

At times like these, investors may find greater confidence in assets underpinned by structural, long-term trends. This is not to suggest that investments with strong policy support, broad market consensus, and compelling economic drivers are immune to drawdowns. However, their long-term potential often remains intact despite short-term volatility.

The nuclear power and uranium thematic has exemplified this resilience in 2025. Despite escalating geopolitical tensions, policy uncertainty, and a weakening economic outlook, nuclear-related equities have continued to outperform broader markets. In fact, ATOM is currently the top-performing ETF on the ASX when excluding funds focused on risk-off themes such as gold and defence technology. ATOM’s strength stems from a steady stream of positive developments for the nuclear sector – a trend that is likely to continue, even as the wider investment landscape remains turbulent.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 14 July 2025. This document was originally published in Livewire Markets on 14 July 2025. This information has been prepared by Global X Management (AUS) Limited (ABN 13 150 433 828, Australian Financial Services Licence Number 466778) ("Global X").

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.