Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is there an effective line of defence against the Ringmaster?

Henry Jennings | Marcus Today

There’s no doubt the US administration has become a bit of a circus. There’s the Ringmaster, and all must bow to his demands and orders (preferably with jazz hands). It makes it hard for investors, though, to second-guess what the Ringmaster is going to do next. Then there are the clowns—or the courts (as Trump would say)—which have somehow become the only effective line of defence. Who needs institutions when you’ve got face paint and a subpoena?

Tariffs, though, are here to stay. Whichever way you slice it, they will happen, they are happening—so we’d better get used to it. Think of them like circus popcorn: overpriced, unnecessary, but somehow always there.

So far, the effects on the US economy have been muted. Much of the impact has been absorbed through front-loading and building up inventories before the tariff hammer drops. The pro-tariff lobby points to no visible change in inflation, no change in unemployment. But the cracks are starting to show—like the floor under an elephant on stilts.

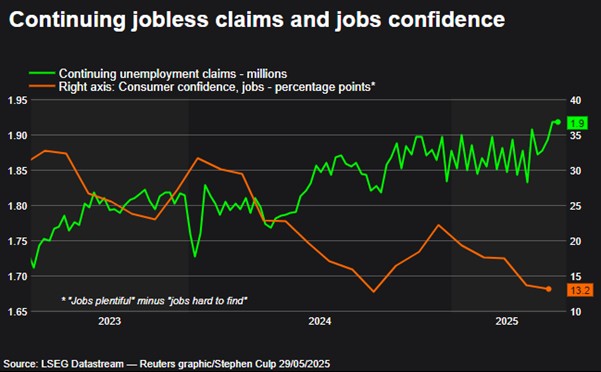

Jobless claims are starting to rise. Confidence is falling—faster than Elon Musk’s rocket-powered reputation.

Corporate America is slowing. Profits from current production—with inventory valuation and capital consumption adjustments—fell US$118.1bn in Q1, the biggest drop since Q4 2020. Guidance is being pulled like a bad trapeze act. Profits from domestic non-financial firms dropped US$96.7bn. Companies are ditching 2025 guidance altogether, citing tariff uncertainty. And the Fed? Well, they’re busy defending their independence from the Ringmaster. In the words of Tom Petty: Jerome Powell won’t back down. Thankfully, he’s still got room to cut rates and cushion the landing.

The thing about a Ringmaster is they’re good at keeping all the balls in the air. But they’re also a massive distraction—while all sorts of other things are happening behind the curtain. And there’s a lot happening.

Meanwhile, Wall Street is rebounding like a bungy-jumping bull. We’ve got FOMO again. Bitcoin is on the march. I still find the whole Bitcoin thing strange—it's a mathematical formula being traded and spruiked by vested interests and celebrities. And now a President. It’s hard to ignore—but why is it worth US$110k? Why would it rise to US$250k, as some suggest? If you don’t get it, you’re just an old fuddy-duddy. A dinosaur. Apparently.

Crypto is the future. But remember, not that long ago, crypto was mainly used to buy dodgy stuff on the Dark Web by money launderers, hackers and villains with Eastern European accents. In every spy movie, the baddie always wants crypto. Now we’ve got a Ringmaster making obscene amounts of money from promoting this digital sleight-of-hand.

If crypto didn’t exist, would we miss it? Honestly?

Then we’ve got the elephant in the room—sorry, the jumbo elephant—worth US$37 trillion. The lion tamer, Scott Bessent, is doing his best to keep everything under control and the audience from running for the exits. Meanwhile, Howard Lutnick is soaring on the flying trapeze, and Elon Musk is juggling chainsaws in the corner. That hasn’t ended well. Even the crowd has joined in the knife-throwing—that’d be the bond vigilantes. And no one escapes them. No one.

The hedge fund managers and US investment bank bosses? Fire-eaters. They make it look easy, but one wrong move and poof—no eyebrows.

Back here in Australia, we’re seen as slow-moving and dull by comparison. A unicyclist wobbling along, with our only trick being the banks. Not as exciting as Nvidia or Microsoft, apparently.

But boring? Dull? CBA has been a rock star. Forget Nvidia and the Nasdaq this year—CBA was the one. Give me dull any day.

Elsewhere, Rheinmetall (a big German arms maker) has been absolutely extraordinary—up 2,500% in the last five years. Does anyone ever talk about that? Nope. It’s always US tech this, US tech that. Crowded trades. US exceptionalism. Trump and the US suck all the oxygen out of the room—and the Ringmaster has us hypnotised.

But as the US severs global trade ties, maybe it’s time investors started thinking outside the box. Outside the tent. Outside the US.

Blessed are the chipmakers—but will they inherit the earth? Or accidentally turn it into a toasted marshmallow?

The dirty little secret is that AI—and soon, agentic AI (the kind that runs off on its own like a rebellious teenager)—will take many jobs. Companies are learning how to swap out cheap humans for expensive machines. How will you get stock tips off a robotaxi driver! Massive amounts of money have been thrown into this arms race. Even the Saudis have joined in—and they don’t mess around when it comes to cash. They are partial to a good arms race!

Great for Nvidia—but who actually makes money out of all this investment? Will consumers pay for it? We've only just gotten used to paying for subscriptions as it is. The days of free love on the internet are over. Now it’s $14.99 a month and no eye contact.

AI is already being used by institutions and traders to analyse body language and voice patterns—to measure stress, and even subtle shifts in confidence. We used to rely on our noses for that—but now that big red nose is AI-powered and getting smarter every day.

Computers are trading off these models, reacting instantly to keywords, driving volatility, and creating opportunities. What chance do retail investors have?

Every chance.

As I’ve written before, we get to pick our battles. We choose when and where to invest. Cash or leverage. Sectors or themes. Countries or currencies. We’re not shackled to the American circus.

We can tumble like market acrobats—from one opportunity to the next. One sector to another. One theme to the next tightrope.

We are not always wedded to the American circus.

The ASX 200 has actually been a decent performer this year—up 3.1%. The S&P is up just 0.5%. The Nasdaq? Still down for the year.

Just because the circus is in town doesn’t mean we have to buy tickets. We can look elsewhere. Even in our own backyard.

After all, Australia has all the resources the world runs on. Not many countries can say that—and fewer still can say it with a straight face.

Charlie Aitken from Regal sent this to me during the week. His case for why Australia is the place to invest:

- Low sovereign risk

- Stable government

- Strong rule of law

- Undervalued Aussie dollar

- Natural resources

- Compulsory superannuation

- Low inflation

- RBA rate cuts already starting

- Full employment

- Minimal US tariff exposure

- Leverage to China

Hard to argue with that—especially when the other option is a flaming circus tent full of jugglers, chainsaws, and a Ringmaster shouting at the bond market.

The experts say to diversify. Great. Just don’t end up with all your eggs in a US-centric basket. That’s not diversification—that’s just Russian roulette.

It’s easy to get distracted by the pretty lights of the circus tent. We all are. But sometimes the best move… is to quietly walk away from the popcorn stand.

Back Australia perhaps. Or even Europe.

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

All prices and analysis at 30 May 2025. This information has been prepared by Marcus Today Pty Limited. Marcus Today Pty Ltd ABN 57 110 971 689 is a Corporate Authorised Representative (no. 310093) of AdviceNet Pty Ltd ABN 35 122 720 512 (AFSL 308200). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.