Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is the Luxury Goods Market a Good Investment? Here’s the Latest Data

Jelena Sokolova, CFA | Morningstar

While the luxury goods sector is complex, it also offers opportunities for those willing to navigate its nuances. In the words of Warren Buffett, “Price is what you pay. Value is what you get.”

Financial advisors and asset managers can leverage insights around the market trends, key drivers, and valuations driving the luxury goods sector to help their clients make sound investment decisions.

In the “Luxury Goods Industry Pulse” first-quarter 2025 report, we dive into key questions about the luxury sector, and share insights on revenue and cost trends, challenges such as subdued demand, rising costs, and margin pressures, as well as current opportunities within the industry.

Here’s the latest on brands like Kering (PPRUF), SWGNF (SWGNF), Burberry (BBRYF), Hugo Boss (HUGPF), and Capri (CPRI), including insights on overvaluation and undervaluation areas and the evolving influence of inflation and supply chain bottlenecks from pandemic times.

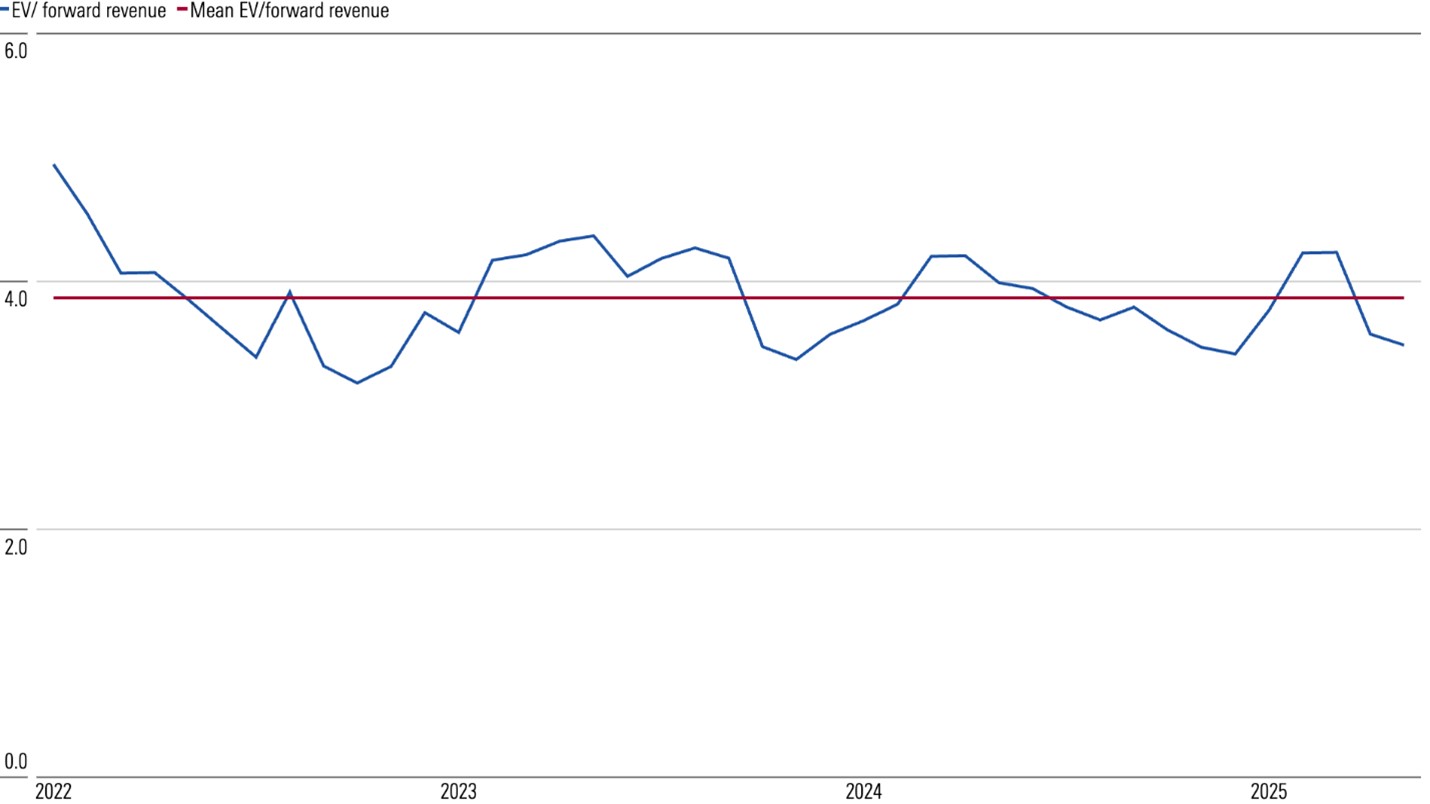

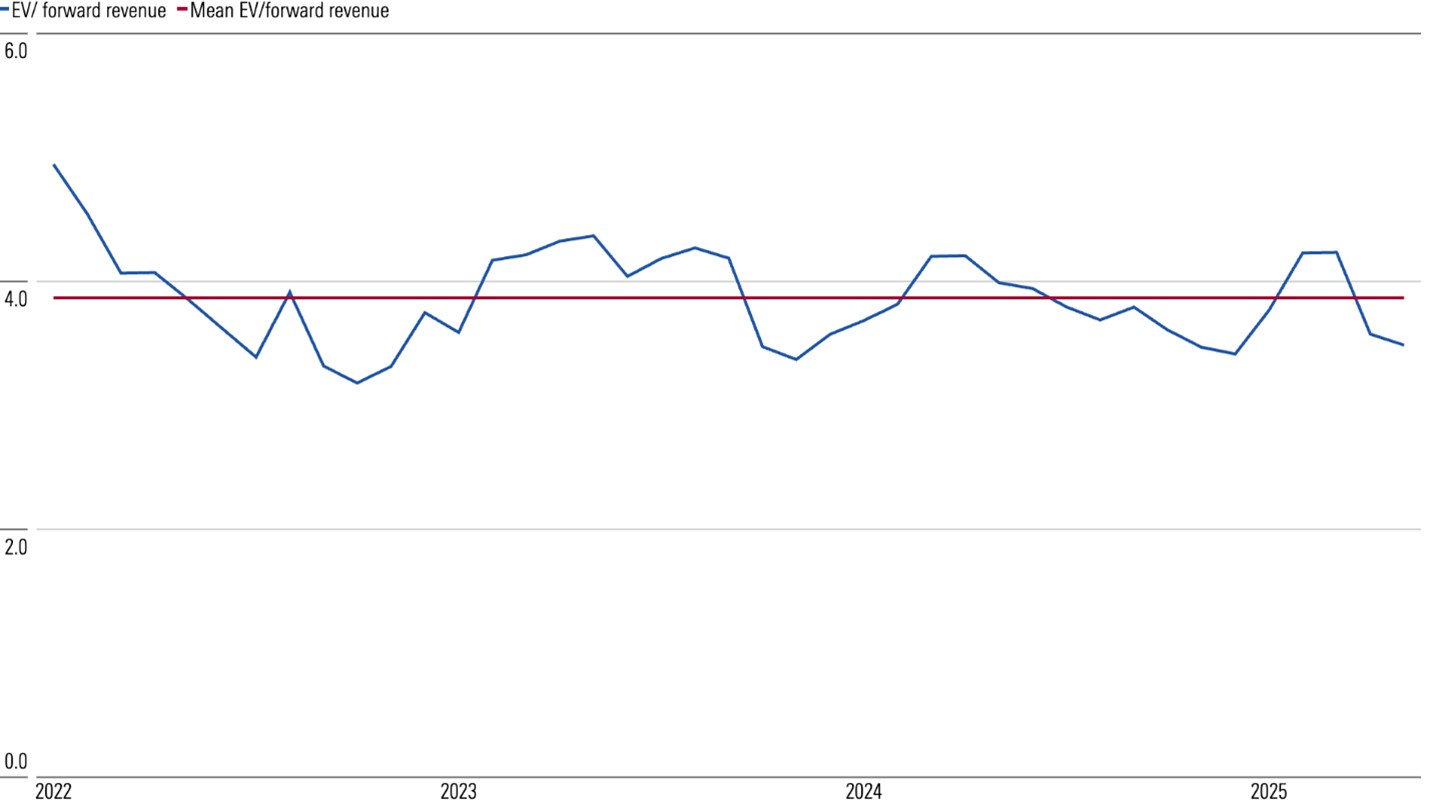

A Closer Look at Luxury Valuations

Luxury share valuations have experienced significant fluctuations over the past few years. During 2022-23, these valuations oscillated between being attractive and overpriced as markets assessed the effects of inflation on consumer demand, the duration of lockdowns and the pace of economic recovery in China, and whether the strong postpandemic demand in Western countries could be sustained.

The luxury sector is largely fairly valued at this point, with few instances of overvaluation and undervaluation. One of the significant findings in this area is the rise in earnings multiples due to eroding returns. In contrast, the sales multiples are lagging slightly behind the historical data.

Luxury Valuations Start Looking Attractive Again

Source: Morningstar, PitchBook. Data as of March 2025.

Source: Morningstar, PitchBook. Data as of March 2025.

Sales Multiples Dip Below Historical Levels

Source: Morningstar, PitchBook. Data as of March 2025.

Source: Morningstar, PitchBook. Data as of March 2025.

Recently, investor focus has shifted to evaluating the recovery or potential decline in demand within the US, influenced by stock market performance, as well as the speed and timing of market improvement in China. At this moment, we believe that the luxury sector appears increasingly appealing, despite certain areas of overvaluation and undervaluation. The current cyclical dip in demand is not expected to be enduring, given that, over the past three decades, periods of damped demand have not persisted beyond two years.

Investment Opportunities for Luxury Brands: What Are the Top Picks?

The most recent research on luxury brands pinpoints some undervalued names in the luxury sector, including Kering, Swatch, Burberry, Hugo Boss, and Capri. But as far as what investors may be interested in specifically from each of these brands, there are three key product areas to explore:

- Luxury leather goods

- Luxury watches

- Luxury apparel

Our top undervalued opportunities in the luxury sector right now include:

It might be a good time to find opportunities related to luxury leather goods with the Kering brand, as it clocks in at the second-largest luxury group based on revenue. Despite its popular flagship brand, Gucci, experiencing slower momentum, the brand has access to extensive marketing resources, over 90% control of its distribution, and well-established name recognition. It is a competitive option in the luxury goods sector with a high rating and fair valuation.

Luxury apparel brings even more options as far as branding goes, with a well-known name like Burberry taking center stage. Burberry has a potentially interesting future. Despite experiencing slow growth recently, we believe that Burberry benefits from strong brand recognition, pricing power, and control over distribution, all of which reinforce its narrow moat. We see the current underperformance compared with the industry as both cyclical and operational. Creative director Daniel Lee’s collections were introduced at a premium price, which more price-sensitive consumers did not embrace. We think that performance can be enhanced by fortifying more affordable assortments and concentrating marketing efforts on iconic products, which the company is actively pursuing.

Another area of the luxury market to consider is luxury watches. This industry has seen steady growth over the years, with consumers willing to invest in high-quality timepieces as a symbol of wealth and status. Brands like Swatch and Rolex dominate this sector with their reputation for precision, craftsmanship, and exclusivity.

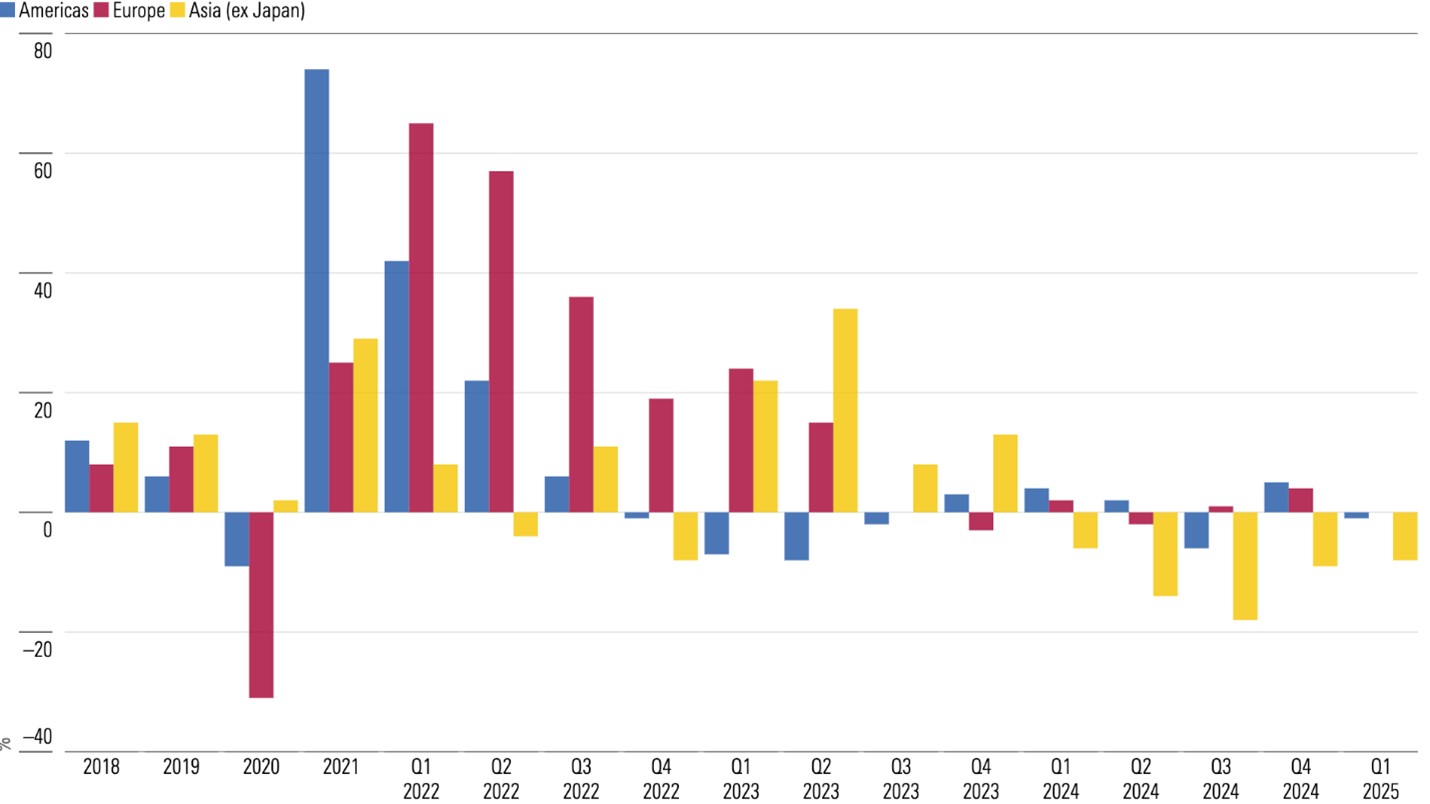

Luxury Sales Trends: A Mixed Bag

Taking a closer look at luxury sales trends, it’s evident that there are regional nuances. While the third quarter of 2024 saw a decline in sales for many players in the luxury market, there were pockets of growth. Sales in the Americas and Europe have seen a marginal increase, providing a silver lining amid the generally weak performance.

Luxury Sales Show Signs of Sequential Improvement in Fourth Quarter, Led by Americas and Europe

Over the last four years, luxury sales have progressively weakened across the Americas, Europe, and Asia (excluding Japan). But they are starting to come back.

Source: Company reports, Morningstar. Data as of Dec. 30, 2024. Data for Burberry and Richemont corresponds to calendar, not fiscal, quarters.

Source: Company reports, Morningstar. Data as of Dec. 30, 2024. Data for Burberry and Richemont corresponds to calendar, not fiscal, quarters.

The fourth-quarter 2024 data revealed a weakening in luxury sales across all regions. A particularly noticeable dip was seen in Asia, excluding Japan. Despite slight improvements, sales in the Americas and Europe remained underwhelming, especially after the postcovid rally. A fluctuating recovery in Chinese consumption also affected luxury sales in the region. The Chinese share of buying in the mainland decreased to 60%-70% toward the end of 2023 and beginning of 2024 from virtually 100% in 2022 but remains way above 30%-40% prepandemic levels of domestic buying.

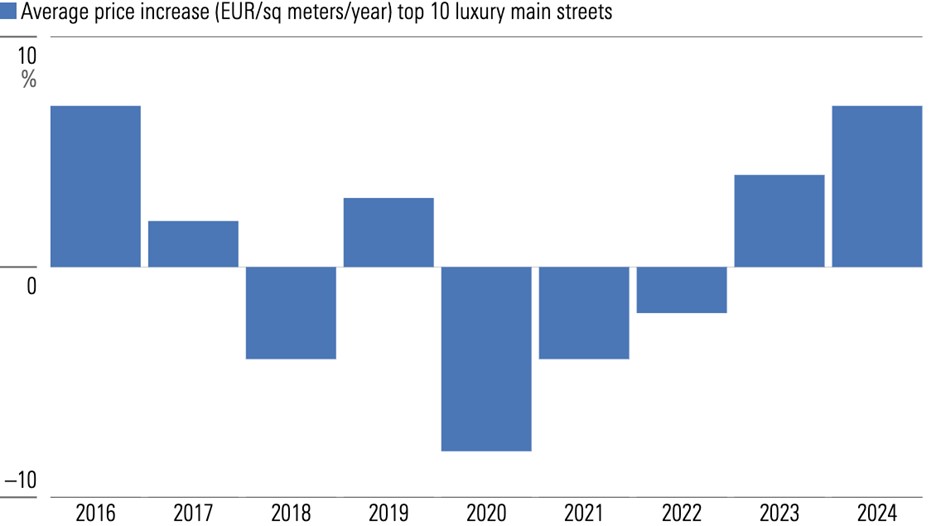

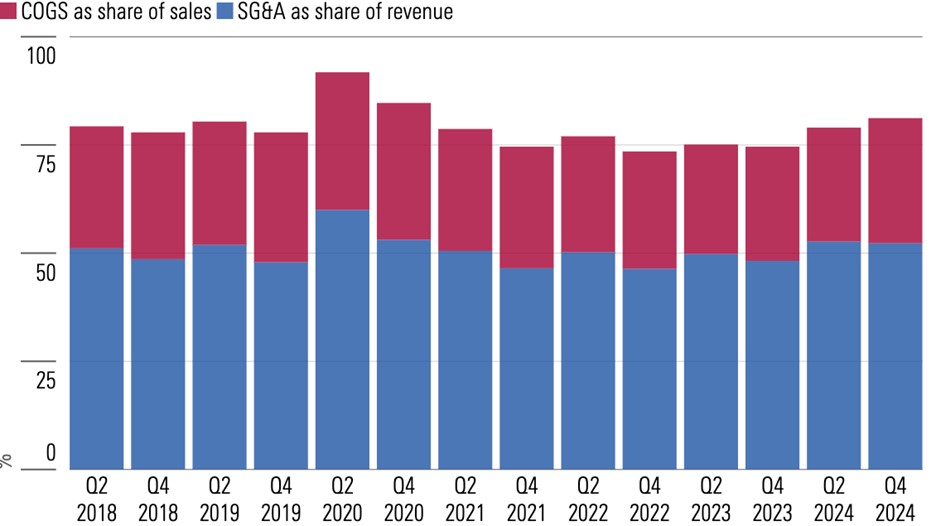

The Impact of Rising Costs in the Luxury Sector

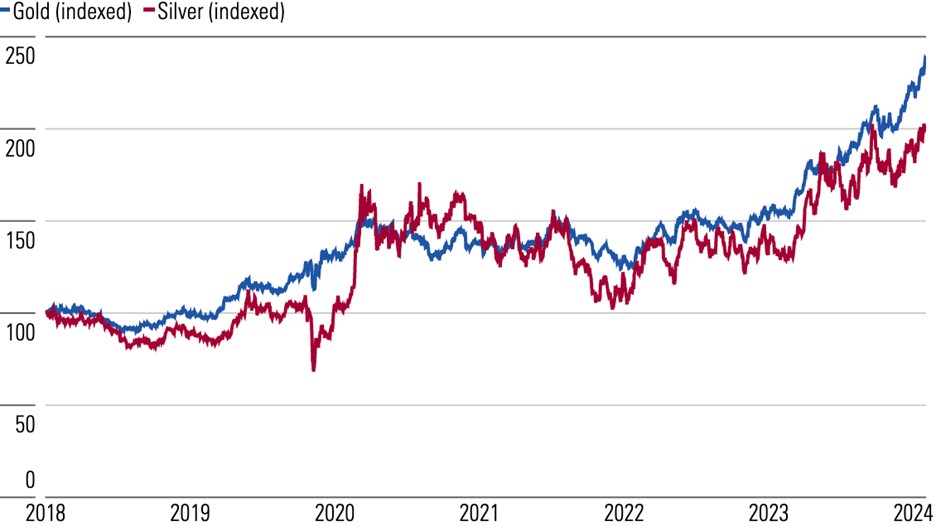

In addition to shifting sales trends, rising costs have added to the challenges faced within the luxury goods sector. Increases have been witnessed notably in rental costs and raw material prices, such as gold and silver. These escalating operating costs pose a challenge to maintaining margins for luxury firms. The inflation in rental costs has been more pronounced in European capitals and Tokyo, subsequently affecting the profitability of the luxury sector.

Rental Inflation Accelerates in 2024

Source: Morningstar, Cushman & Wakefield, Comex, company data.

Source: Morningstar, Cushman & Wakefield, Comex, company data.

Gold and Silver Prices Rally in 2024

Source: Morningstar, Cushman & Wakefield, Comex, company data.

Source: Morningstar, Cushman & Wakefield, Comex, company data.

Operating Costs Weigh on Margins

Source: Morningstar, Cushman & Wakefield, Comex, company data.

Source: Morningstar, Cushman & Wakefield, Comex, company data.

Empowering Smart Decisions in the Luxury Sector

Every industry experiences global economic shifts, and the luxury goods sector is no exception. Sales and margins have been under pressure because of declining luxury consumption. This, in turn, has led to an increase in fixed costs. However, even in this challenging climate, the sector remains fairly valued, suggesting potential for careful investors. Armed with this data, financial advisors and asset managers can help clients make informed investment decisions.

Despite the apparent obstacles, recent data shows that there are still investment opportunities in the luxury sector: Brands like Kering, Swatch, Burberry, Hugo Boss, and Capri Holdings are currently undervalued.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 20 May 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.