Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

CPI Indicator lower than expected as travel prices reverse last month’s rise

Tapas Strickland | Markets Research

Key points:

- May CPI Indicator at 2.1% y/y vs. 2.3 consensus (NAB 2.2%)

- Big fall in travel prices as expected at -7.0% m/m from +6.0% in April

- Importantly new dwelling purchase prices flat, no repeat of April’s +0.5% m/m

- Slight downside risks to the RBA’s Q2 trimmed mean due to insurance

- Overall core measures mostly benign, keeps RBA on track to cut rates in July

Details:

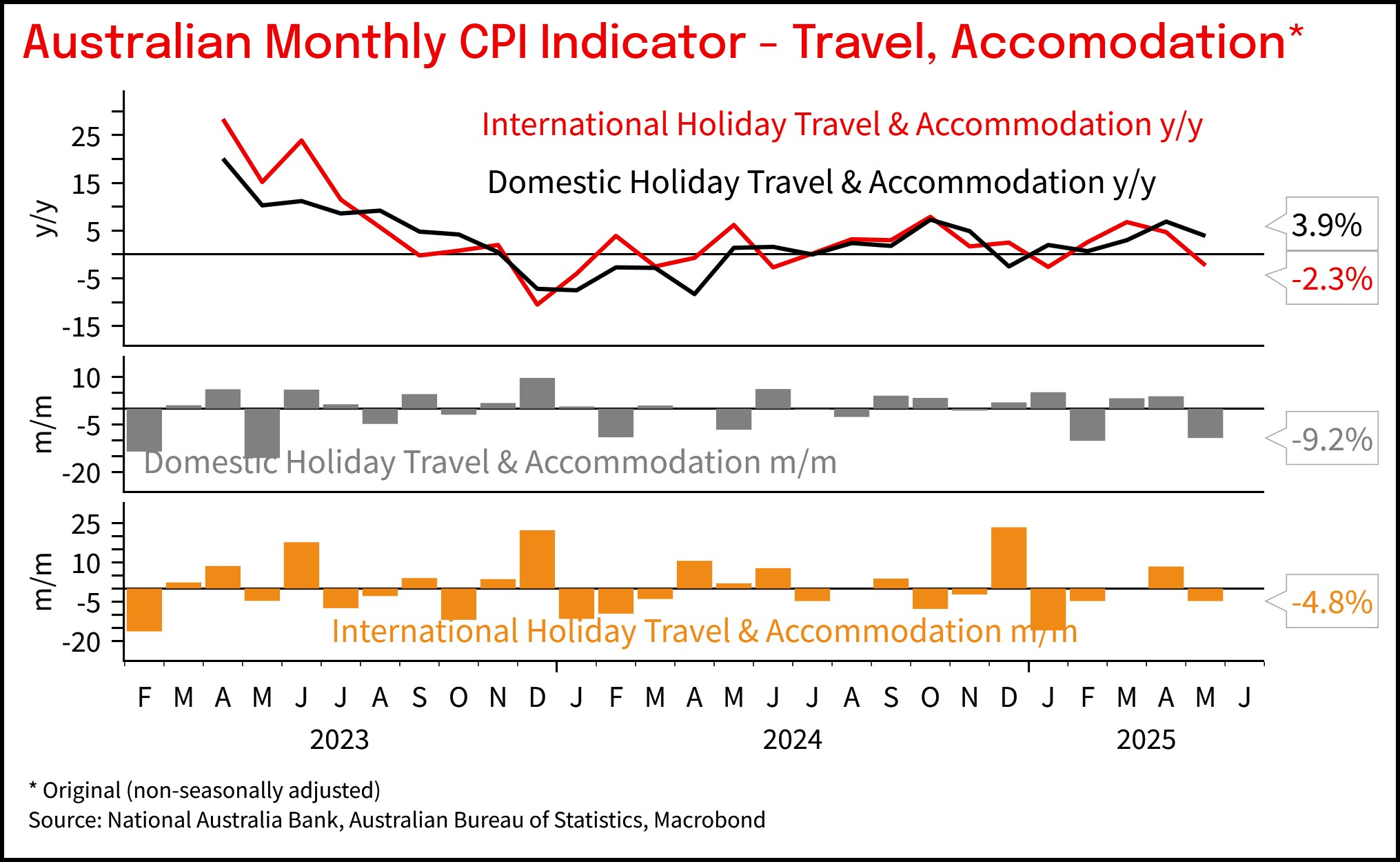

The May CPI Indicator at 2.1% y/y was below the market’s expectation of 2.3%, but was broadly in line with NAB’s view of a 2.2% print (we were at the divide of 2.1-2.2). The main reason why we were lower than the market was that we thought there would be a sizeable fall in travel prices after an outsized rise in April that stemmed from the bookended Easter/ANZAC long weekends. ‘Holiday travel and accommodation’ prices did indeed fall -7.0% m/m after last month’s +6.0% rise.

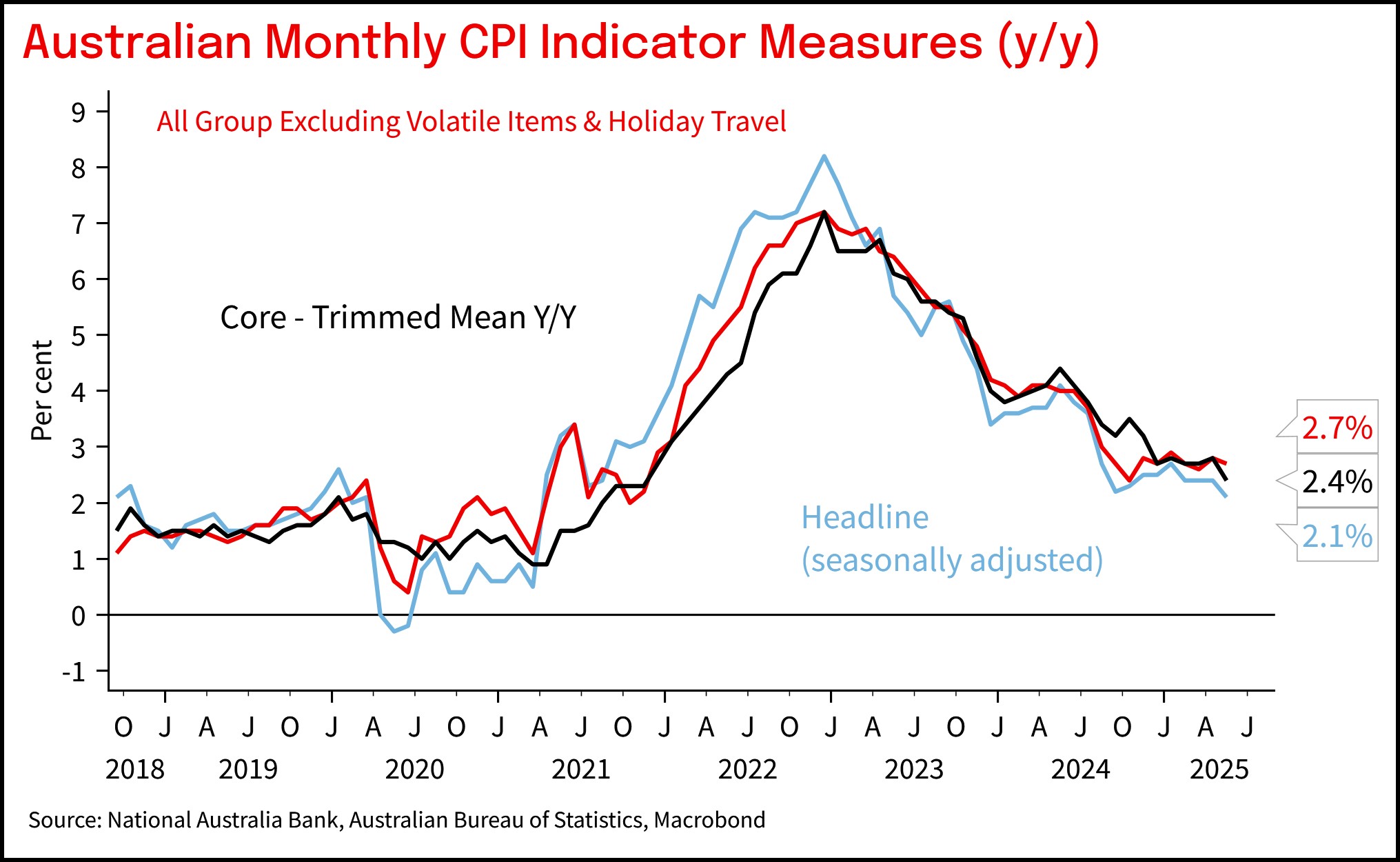

Consequently, we would suggest looking at the ‘CPI excluding volatile items [i.e. fruit, vegetables and automotive fuels] and holiday travel’ as a better indication of underlying inflation and this was 2.7% y/y from 2.8% in April. The alternative core measure, the annual trimmed mean was 2.4% y/y. Broader price trends were mostly in line with our expectations, though there are two points worth noting that could influence the near-term trajectory for inflation:

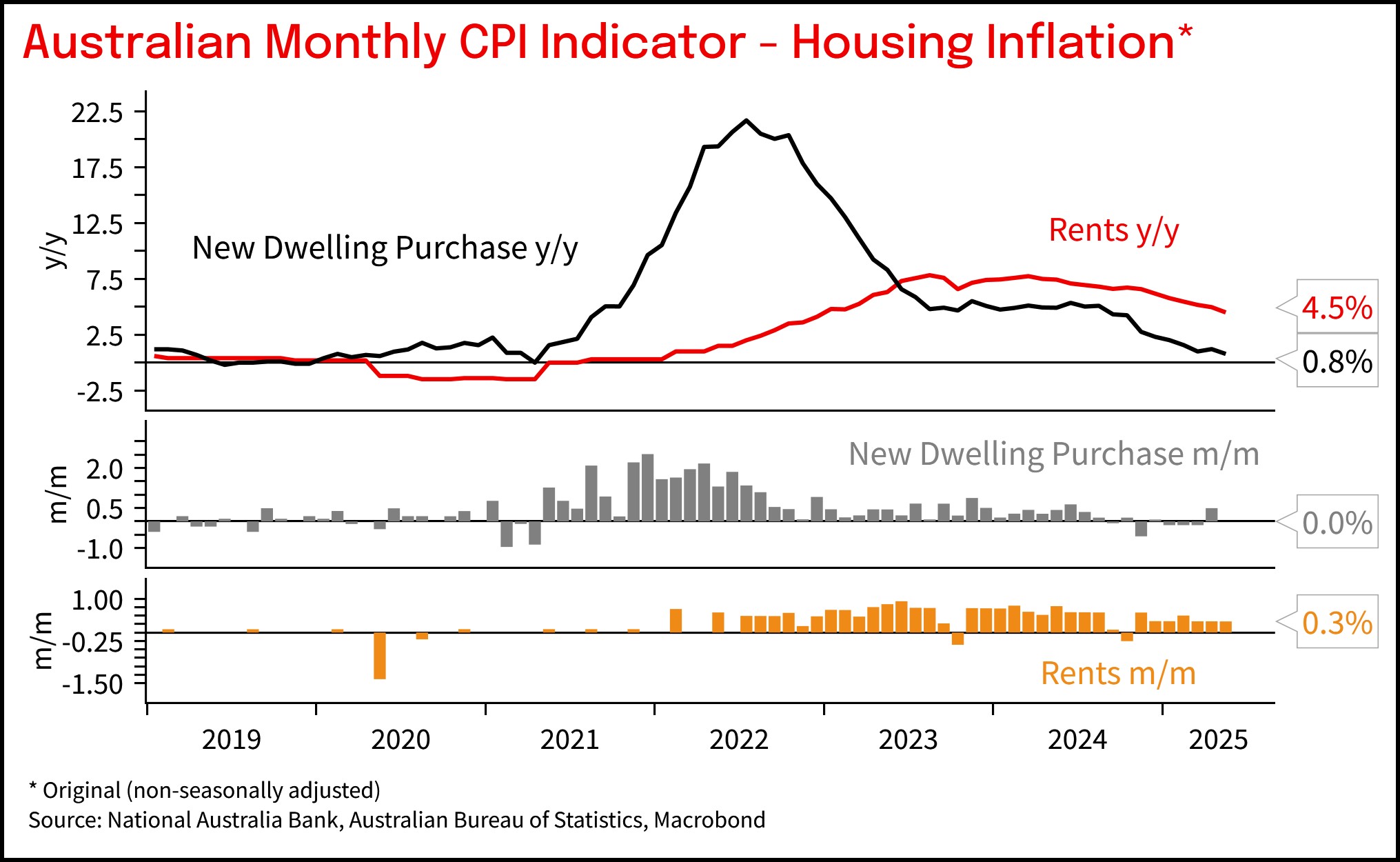

- ‘New dwelling purchase by owner occupiers’ was flat at 0.0% m/m and 0.8% y/y, after last month’s +0.5% rise. The ABS noted: “project home builders offered discounts and promotional offers to entice business”, perhaps suggesting little momentum came from the RBA’s February interest rate cut. However, with momentum now starting to pick up, following the rate cut in May, it is less likely there will be sizeable discounts or promotional offers. In this context it is less likely new dwelling purchase prices will be so benign. Rents also continued to tick along at 0.3% m/m.

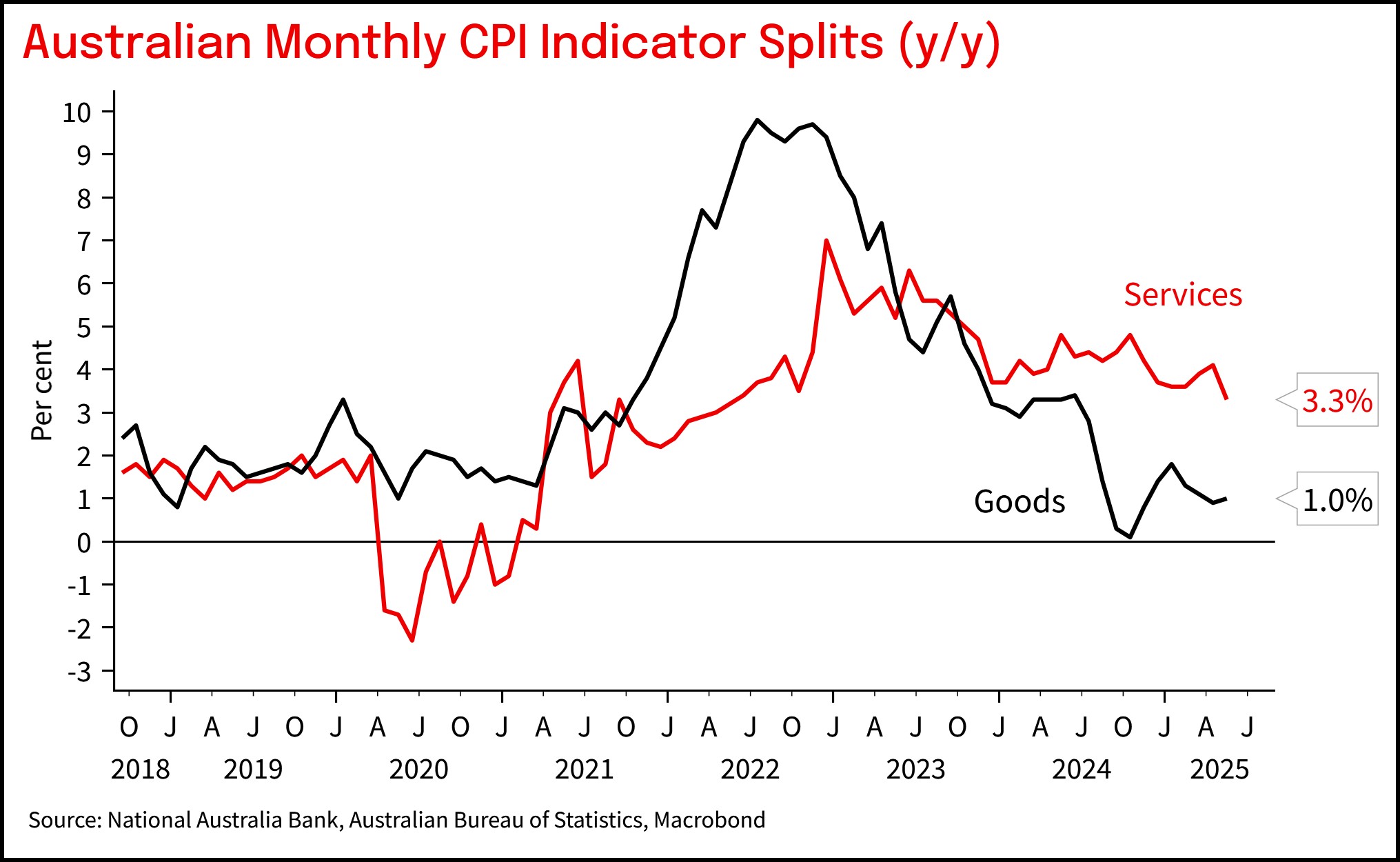

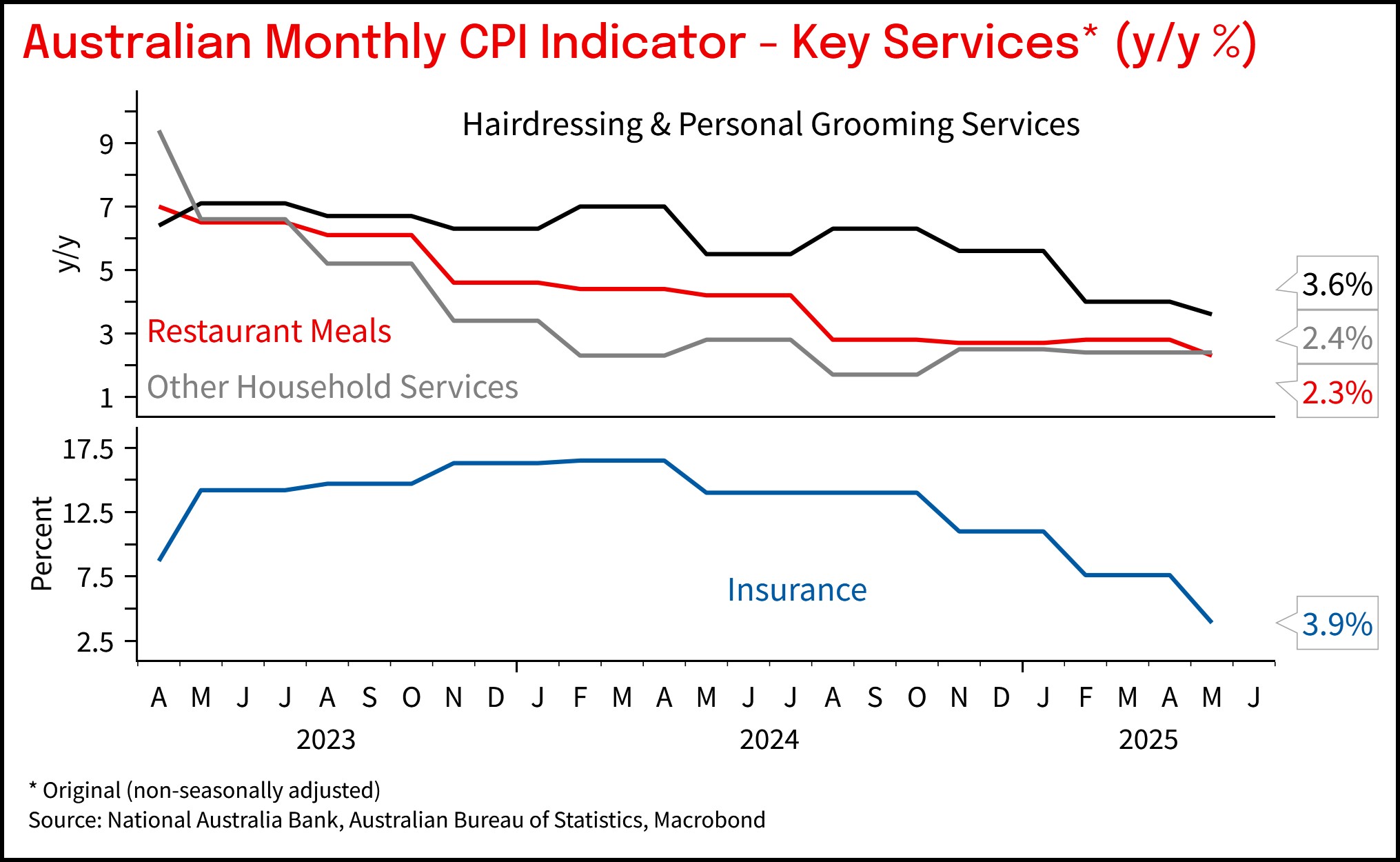

- Service price inflation looks mostly benign, though with again some hints of caution on the sustainability. Insurance prices fell -0.5% and the statistician noted “the annual rate of price increases [at 3.9% y/y] continued to slow for insurance, particularly for house and motor vehicle insurance”. That rate of price growth though runs slightly counter to anecdotal evidence on insurance price increases, but will be important in the RBA’s trimmed mean measure. Other service trends were broadly in line with total services inflation running at 3.3 y/y.

Implications:

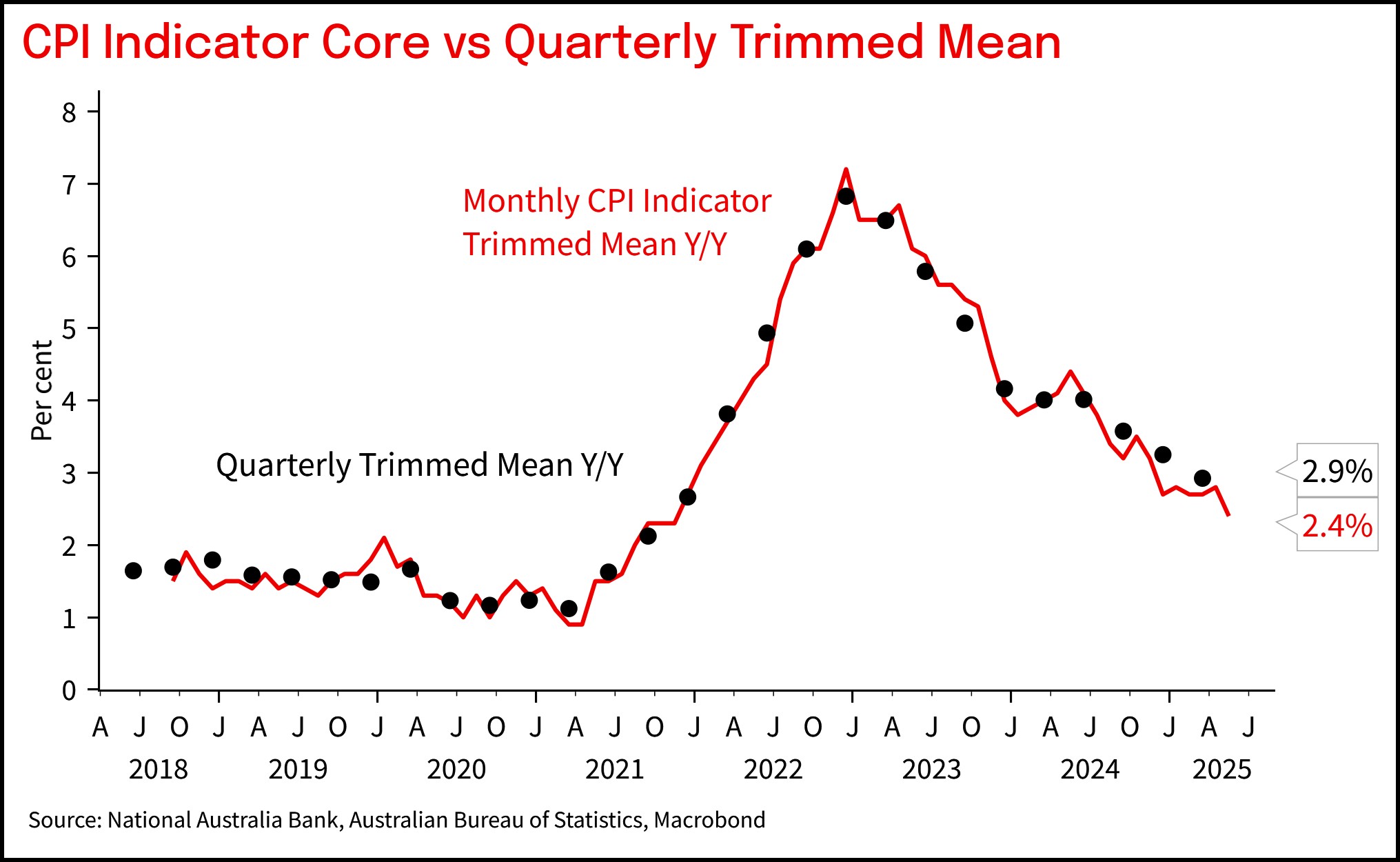

The second month CPI Indicator gives a better view of the services side of the economy, and in this respect services inflation trends are becoming more benign. However, a quick map to the quarterly CPI suggests slight downside risks to the RBA’s preferred quarterly trimmed mean forecast of 0.6% q/q and 2.6% y/y, which mainly comes from insurance prices which surprised at -0.5%. We will firm up our Q2 CPI forecast over the next few days (previously we had slight upside risks to the RBA’s forecast forecast).

Overall services inflation on the monthly indicator is running at 3.3% y/y, its lowest since May 2022. This should see the RBA have greater confidence that there is further room to ease policy back to a more neutral setting. However, with the labour market still resilient, we see little rationale to ease policy below neutral at present. And there are still a few CPI component trends that suggests we should be careful in extrapolating trends too far. NAB continues to see the RBA cutting rates in July, August and November, bringing the cash rate down to 3.1%, a level which we see as broadly neutral.

Chart 1: Monthly CPI Indicator printed at 2.1% y/y, though excluding volatile items was 2.7%

Chart 2: Monthly trimmed mean measure benign

Chart 3: Services inflation is moderating

Chart 4: New dwelling purchase prices did not sustain April's rise

Chart 5: Big decline in travel, reversing the strength seen in April due to bookended Easter/ANZAC long weekends

Chart 6: Insurance inflation was unusually low

All prices and analysis at 25 June 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.