Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Four trends that are upending portfolios

James Gruber | Firstlinks

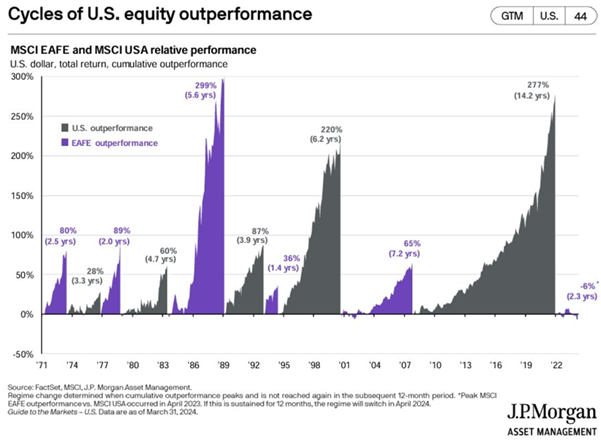

Investors love to extrapolate the recent past into the future. They see the US has outperformed the rest of the world for 15 years and assume that it will continue in future. And they’ll wrap a narrative around it by describing the US as ‘exceptional’ to assure themselves about the future.

Yet, the world isn’t static and that makes extrapolation inherently lazy. It’s amazing how many people think Trump was solely to blame for the recent market volatility when he was just the trigger for several broader changes taking place.

Zooming out on what’s really happening in markets and economies at present, there are four clear trends that are shaping investor portfolios, and are expected to last for a decade or more:

1. Politics is driving markets, not economics

The era of economic data driving markets is over. That was the world of globalization that reigned supreme for 40 years. It’s no more.

Governments and politicians have taken over. Trump didn’t start this because it’s been happening for some time.

It’s what investment strategist Russell Napier calls state-directed investment. Governments around the world are directing investments to purposes they want to achieve. Some are calling it re-industrialisation, industrial policy, friend-shoring, and de-risking. It all amounts to the same thing: Government-direct investment.

Trump is the obvious example of trying to force companies to invest money in the US. Yet, it was his predecessor, Joe Biden, who started this.

In Australia, the Labor Government has explicitly told the Future Fund to direct capital towards its priorities, including social housing and infrastructure.

And with debts levels at record highs around the globe, and markets often not providing finance at acceptable rates for Government-directed projects, national savings are being tapped. The next step with this is deliberately suppressing interest rates, which Trump is already trying to do.

With debt levels expected to increase from already exorbitant levels, politics will drive markets for the foreseeable future.

The problem for institutional investors is that they’ve never lived in a world where Governments influence markets to this degree and are largely unprepared for the changes afoot.

2. The 60/40 portfolio really is dead.

The traditional 60% equities, 40% bonds portfolio is obsolete.

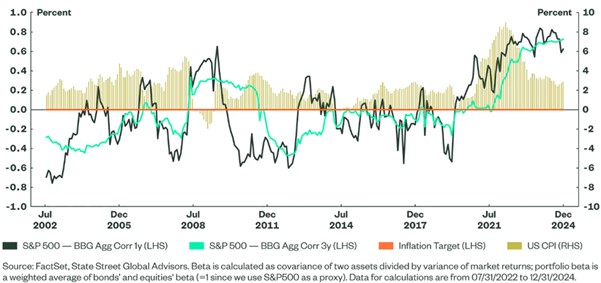

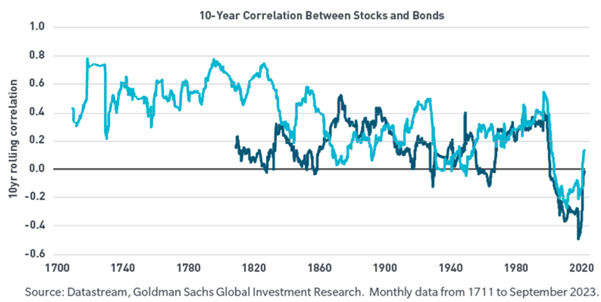

Since the early 1990s, when stocks went up, bonds usually went down, and vice versa. Bonds provided a nice hedge or ballast when sharp equity pullbacks took place.

Investor portfolios relied on this inverse correlation between stocks and bonds.

Yet, that correlation broke down in 2021-22 as both stocks and bonds tanked. And more recently following ‘Liberation Day’ in April, it broke down again. Yes, bonds fell less than stocks in the week after Trump’s tariffs first took effect, but they still went down.

60/40’s problems shouldn’t come as a surprise. First, it was always based on a false premise. It took the negative correlation from the early 1990s to 2021 as gospel when a longer thread of history told a different tale. The following chart from Goldman Sachs in 2023 shows that throughout most of history in the US and UK, there’s been a positive correlation between stocks and bonds ie. they’ve generally gone up together and down together. In other words, the 30 years to 2021 weren’t the norm; they were an anomaly.

Second, 60/40 ignored first principles: both stocks and bonds can be adversely impacted by excessive inflation and systemic risk. Excessive inflation puts upward pressure on bond yields, and consequently, tighter financial conditions can impact corporate profitability, creating conditions for a less favorable equity market. Systemic risk can have similar effects, as witnessed by the recent ‘Liberation Day’ events.

So, what are investors looking for diversification supposed to do? Well, stocks and bonds should remain the core of portfolios, with some potential nuances:

- Investors can consider having cash and short-term bonds alongside their intermediate- and longer-duration core bond holdings. Cash has diversified portfolios better than bonds in recent years, especially as interest rates have trended up.

- Rotating out of longer-duration bonds or funds and into intermediate- or short duration alternatives can reduce potential volatility during interest-rate spikes.

- Commodities are an option for smaller portion in portfolios. Correlations between stocks and commodities have trended down in recent years. The downside is the volatility in commodity returns.

- It’s worth considering gold. Gold isn’t an inflation hedge, as 2022 showed. However, it functions as crucial ‘insurance’ against systemic risks, especially amid growing concerns about currency devaluation, counterparty risk, and the integrity of the financial system itself.

- International stocks offer some diversification benefits though not a lot. The same goes for REITs.

- Private assets are more for the experienced investor than the novice. Their illiquidity makes them unsuitable for many portfolios.

3. Inflation may prove structural

As inflation subsides, the world’s central bankers are ready to pop open the champagne bottles. They should hold off for a few reasons.

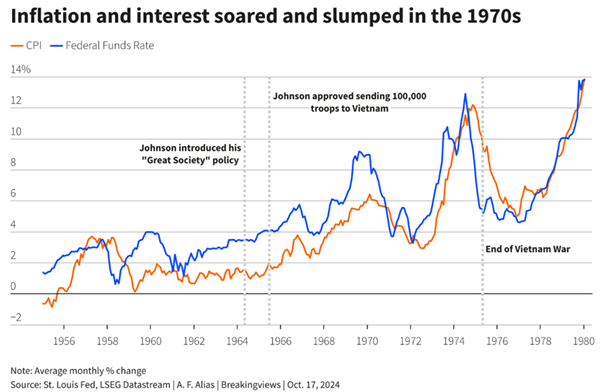

First, there’s a long history of central bankers declaring inflation dead before it rears its head again. The 1970s offer the latest example.

During the late 1960s, inflation rose as the ‘guns and butter’ policy of US President Lyndon Johnson took hold, with increased spending on the Vietnam War and social programs at home. The Fed raised rates to almost 10%, which led to a recession and a nasty pullback in the share market. Inflation fell to 2.7% in 1971.

Stocks mounted a stirring comeback, only to then be obliterated as inflation spiked again to 10% and rates were hiked to 13%. This resulted in a serious recession.

There were several factors behind the resurgence in inflation. In 1971, the dollar lost its monetary anchor after President Richard Nixon ended the convertibility of the U.S. dollar into gold. At the same time, Nixon put pressure on Fed Chair Arthur Burns to pump up the U.S. economy during his successful 1972 re-election campaign. A year later, OPEC imposed an embargo on oil-importing countries that had supported Israel during the Yom Kippur War. The price of oil trebled. Finally, the Fed initially accommodated the energy crisis by cutting interest rates, which most economists at the time opposed.

This isn’t the 1970s though it should make you wary of those proclaiming an end to inflation.

That’s especially the case when the world’s Governments are loaded with debt and the most politically palatable way of reducing that debt is through inflation. Trump and Musk’s failed ‘DOGE’ experiments shows how hard it is for Governments to cut debt. Inflation is the easier route as it means borrowers like Governments can repay lenders with money that is worth less in terms of purchasing power, effectively lowering the real burden of the debt.

If right, there’s an argument for dedicated inflation-protected investments like commodities and inflation-protected bonds to become a permanent component of portfolios rather than a tactical allocation.

4. Stock markets outside the US offer upside on multiple fronts

After the recent comeback for US stocks, the S&P 500 is trading on more than a price-to-earnings ratio (PER) of more than 28x, 43% higher than the 17x average of the past 75 years.

Australia isn’t cheap either, on a trailing PER of 20x, with low single digit EPS growth expected over the next 12 months.

Other markets offer better value. Europe is on PER of 14x, and Governments there are significantly boosting infrastructure and defence spending, which should flow through to better economic growth, and higher corporate earnings. Investor Joachim Klement calculates that European spending could raise the EU’s annual trend growth rate over the next 10 years from 1.6%, the current OECD estimate, to levels like the 2.1% projected for the U.S.

Meanwhile, Japan’s market is trading at 13x PER, with continued benefits from a Government-initiated corporate restructuring program.

Emerging markets are even cheaper at 12x PER, while China is at 11x. Yes, there are plenty of risks with these markets, though they've previously had sustained periods of significant outperformance.

And with Trump intent on depreciating the US dollar, there is currency appreciation potential for non-US markets too.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 22 May 2025. This document was originally published on firstlinks.com.au on 22 May 2025 and has been prepared by Firstlinks, a Morningstar publication (Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.