Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

ETF in Focus: Will healthcare get a growth injection in 2025?

Tamara Stats, Director and ETF Specialist, BlackRock

Last year, 75% of companies in the MSCI ACWI Healthcare Index exceeded earnings expectations in the first three quarters of the year – the highest percentage among all global sectors, even surpassing technology.

As a result, we saw local investor sentiment in the sector begin to rise in 2024, with around $80 million of inflows to the iShares Global Healthcare ETF (IXJ) last year – placing it within iShares’ top 20 ETFs of 2024 on an inflow basis.

Investor interest in the healthcare sector has continued to grow in 2025, largely due to the sector’s traditional defensive properties. Globally, iShares healthcare sector ETFs have seen more than US$155 million net inflows since the start of the year.1

In calendar year 2025, the healthcare sector is projected to grow even further, recording the highest year-on-year increase in 18 years (excluding during the COVID-19 vaccine rollout in 2021)2. Globally, healthcare has been one of the best performing sectors for the year to date, returning almost 5%.3

So what are the key factors contributing to optimism in the healthcare sector?

Innovation and regulation

Political changes in the US have caused some healthcare investors to reevaluate their positive outlook- particularly in the vaccine and pharmaceutical sectors. While leadership within key federal agencies will no doubt shape regulatory agendas, we think immediate or drastic policy changes around vaccines, drug approvals and pricing are unlikely.

With one of the lowest supply chain exposures to China, and the strongest earnings growth of all sectors in the Q1 US earnings season, healthcare may also be a resilient exposure while trade uncertainty continues. However, the potential pharmaceutical tariffs flagged by the US administration could add to costs for US drug manufacturers.

Beyond trade policy, we believe the regulatory agenda of the new US administration could lead to more flexibility around healthcare mergers and acquisitions, potentially easing scrutiny on patents and delivering sector-wide benefits.

In the longer term, we think innovation in areas like obesity medication, surgical robotics and oncology – the branch of medicine that specialises in the treatment of cancer – will continue to drive growth in healthcare.

For example, Glucagon-like peptide-1 agonists (GLP-1s), which treat diabetes, have emerged as one of the most significant and contemporary therapeutic trends influencing the healthcare landscape in recent years.

Making these medications available in pill form could also significantly reduce manufacturing costs, as nearly half of the weight loss drugs currently being developed are tablets.4

Additionally, robotic assisted surgeries continue to be a strong growth story, with the global surgical robotics market expected to grow by US$16 billion over the next seven years5.

Oncology is also a hotbed of innovation, with over 100 new cancer treatments including antibody and cell therapies expected to launch within the next five years, driving nearly US$400 billion in pharmaceutical spending by 2028.6

As with many industries, AI also has the ability to transform productivity in the healthcare sector.

Currently, most biotechnology drugs fail to pass clinical trials and get approved, taking about 12–18 years to reach the market.7 However, with many companies now using AI-powered tools, these timelines could be significantly shortened, speeding up research on diseases and improving patient recruitment strategies.

Global healthcare – a balanced diet for your portfolio

In addition to benefiting from a number of long-term growth trends, adding global healthcare stocks to a portfolio can help diversify investments and reduce risk during market downturns.

Investors with an existing portfolio of broad Australian and global equities will typically have less exposure to healthcare on a relative basis.

For instance, the ASX 200 Index is made up of approximately 10% healthcare stocks versus 19% materials and 34% financials, while the MSCI World Index has 11% healthcare exposure compared to 25% technology and 17% financials.

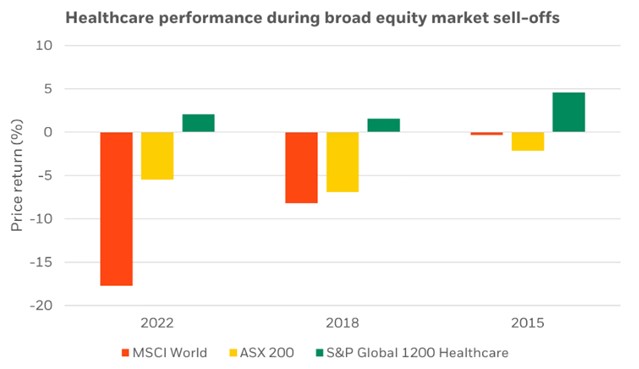

Healthcare stocks can be a good choice for investors who want to reduce short-term market volatility. As a defensive sector, healthcare often performs well during market downturns. This was the case in each year over the last decade when global equity markets had negative returns – as seen in the chart below, the healthcare index tracked by iShares Global Healthcare ETF (IXJ) generated positive returns in all these years.

Source: MSCI/S&P/BlackRock data, as at 31 January 2025. Chart refers to all calendar years 2014-2024 where global equities (as represented by the MSCI World Index) generated a negative return

With the sector set to potentially benefit from significant growth and transformation, as well as being a useful defensive play and portfolio diversifier, we believe healthcare is well worth investor consideration in 2025. Of course, there are risks involved with investing in any single sector, including concentration risk, and investment in healthcare should be considered as one part of an overall diversified portfolio.

Offering access to over 1000 of the sector’s biggest names including GLP-1 manufacturer Eli Lilly and pharmaceutical giant Johnson & Johnson8, IXJ is a simple way for investors to tap into innovation in health and wellness.

iShares Global Healthcare ETF (IXJ)

https://www.blackrock.com/au/products/273430/ishares-global-healthcare-etf

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a high to very high risk/return profile

Sources:

- Source: BlackRock data as of 25 April 2025

- Source: BlackRock, FactSet August 2024. Global Healthcare Sector as represented by the MSCI ACWI Health Care Index. COVID-19 vaccine rollout period refers to calendar year 2021

- Source: BlackRock data, 31 March 2025. Based on returns of the S&P Global 1200 Healthcare Index for the three months to March 2025

- Source: Biospace, April 2024

- Source: Market.us, October 2023. Forecasts may not come to pass.

- Source: IQVIA, July 2023. Forecasts may not come to pass.

- Source: Fierce Biotech, November 2024

- Portfolio is subject to change. The specific securities identified and described above do not represent all of the securities purchased or sold, and no assumptions should be made that the securities identified and discussed were or will be profitable. Positions do not necessarily represent current or future holdings. Holdings shown are for illustrative purposes only and should not be deemed as a recommendation to buy or sell the securities listed.

Disclaimer:

Opinions are subject to change and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation. Indexes are unmanaged and one cannot invest directly in an index.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 29 April 2025. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide on its website for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction.