Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Volatility creates opportunity to buy great companies at attractive prices

Tim Carleton | Auscap Asset Mangement

We believe observation, not prediction, is an underappreciated element of successful investing. When markets are volatile, heavy focus is put on prediction, what might happen in the future. This is clearly the current focus of many given the volatile conditions being experienced. So we thought it most useful to outline a number of our observations about markets in recent months and how this has shaped our investment decisions.

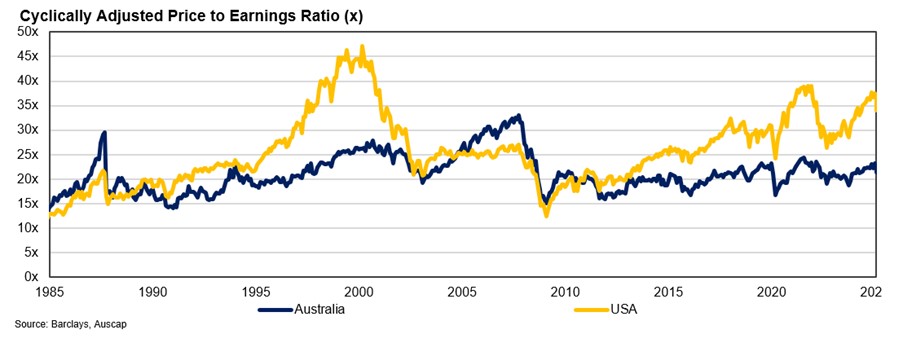

Prior to the tumultuous period following the announcement of the imposition of tariffs on most of the United States’ (US) trading partners, many markets were somewhat expensive compared to their own history. The US equity market, shown below, was trading at an extremely elevated multiple of cyclically adjusted earnings.

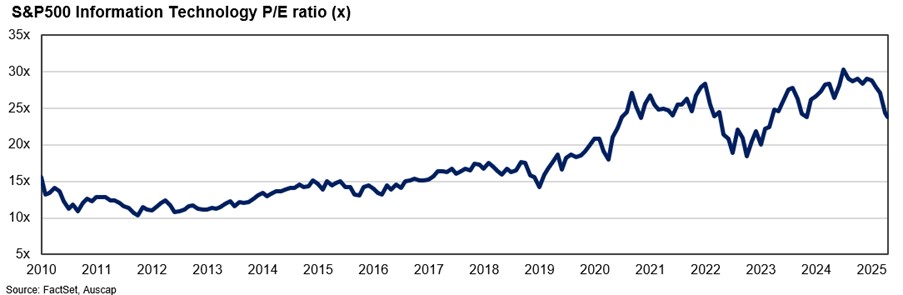

What’s more, particular parts of the market were even more expensive. Technology stocks were the beneficiary of the earnings growth generated by the ‘Magnificent 7’ and the perceived tailwinds from artificial intelligence developments.

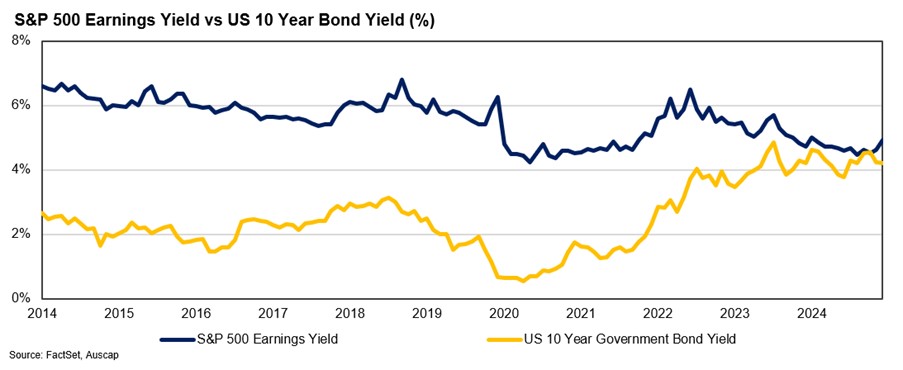

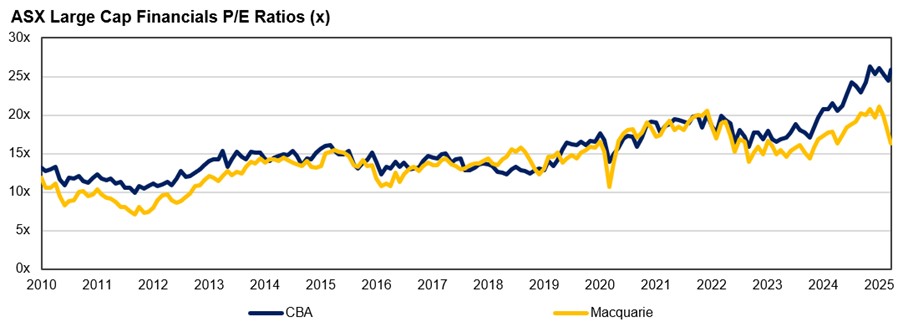

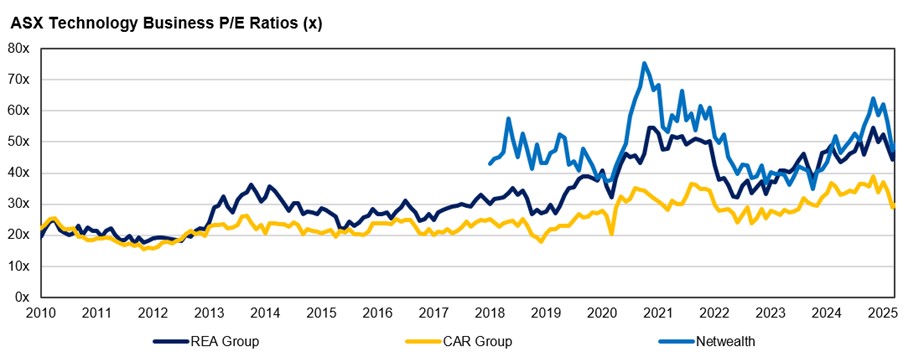

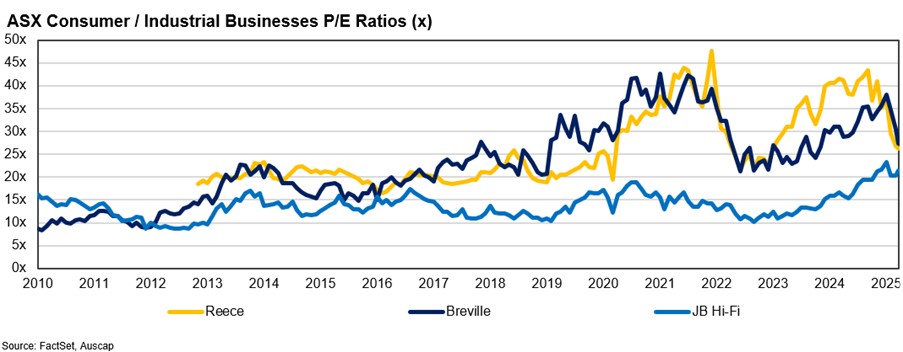

There had also been a re-rating of companies perceived to be high quality. This could be observed in both the US and Australian markets, where price to earnings (P/E) multiples for many of these businesses had risen back to COVID-19 like levels. Yet we struggled to see the fundamental logic of this re-rating. During COVID-19, interest rates globally went to close to zero. Government bond yields are considered a proxy for the risk-free rate. Every asset is valued relative to the risk-free return you can get from investing in a Government bond. A decline in interest rates, as we saw during COVID-19, should lead to stocks being valued on a higher multiple of earnings. If a Government bond is yielding 0% then stocks may look attractive yielding 4%, but this is far less likely to be the case if that same Government bond is now yielding 4%. So we could understand the logic of the market trading on a higher P/E multiple when rates were very low, as a low risk-free rate meant longer dated cash flows were worth more in terms of their present value.

By contrast, the stock re-rating we saw in 2023 and 2024 was not as logical. Government bond yields had broadly moved back to levels, in fact often higher than the levels, where bond yields had sat prior to COVID-19. Of course, for fund managers it can be dangerous to act on this view by aggressively reducing exposure. The timing of any mean reversion in valuation multiples is unpredictable and, unless the overvaluation is extreme, over longer time horizons earnings growth is often a more significant driver of stock returns than movements in a P/E multiple.

However, it is important to make the observation so that if a change in conditions presents itself, one is aware of the relatively expensive nature of parts of the market, or sometimes of the whole market.

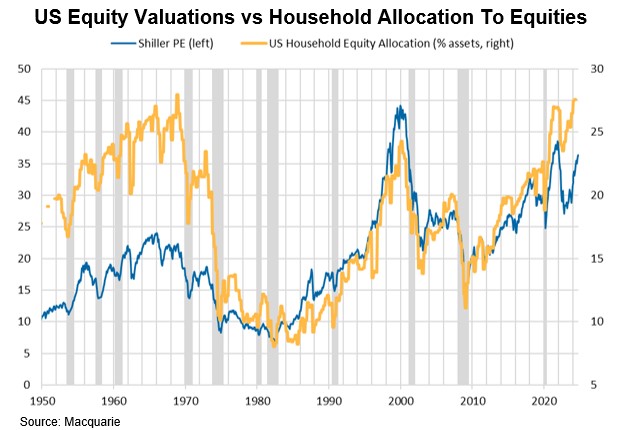

Stocks have been expensive and households in the US have been as overweight US equities as they ever have been. This is a combination that warrants caution.

In Australia this re-rating had also occurred in many of the companies that are widely regarded as high quality. We observed this trend towards higher P/E ratios in companies that we consider high quality business, including the likes of Commonwealth Bank of Australia (ASX: CBA), Macquarie Group (ASX: MQG), REA Group (ASX: REA), CAR Group (ASX: CAR), Reece (ASX: REH), Netwealth (ASX: NWL), Breville (ASX: BRG) and JB Hi-Fi (ASX: JBH). Many of these companies we hold in our funds.

In fact, the major ASX benchmark index, the All Ordinaries Index, was also expensive compared to history when viewed on a current rather than cyclically adjusted P/E ratio.

Often when stocks and/or markets become expensive, all they need to de-rate to a more normal multiple of near-term earnings is a catalyst. Observing this significant overvaluation, we had reduced our exposure to many of these names. The catalyst arrived with the imposition of tariffs in the US, and as we can see in the charts above the multiples have started to contract to more normal levels.

At present, and putting aside the potential and unknown impact on global economic growth, there are many Australian companies’ earnings that are unlikely to be directly materially affected by the imposition of tariffs in the US. This is fairly self-explanatory for companies that have no business activities in the US. There are also some ASX listed companies that have the potential to benefit from tariffs. For example, those businesses which currently source products from China to exclusively service non-US markets, who may now receive better supplier terms, or those who manufacture products for the US market in favourable jurisdictions from a tariff perspective, who may now have an opportunity to gain market share.

Of course, there are also a number of companies that have operations in the US that may be negatively affected. Ultimately, any assessment of tariffs on a potential investment needs to be considered in the context of the business’ valuation, underlying quality and long-term growth outlook.

At this stage, there are many unknowns, including answers to the following questions:

- What level of tariffs will ultimately be applied to which countries, sectors and products?

- How long will tariffs be in place?

- How much of the tariffs will companies ultimately absorb, versus passing the incremental cost on to consumers through higher prices?

- Will some companies need to move more of their operations into the US, what will this cost and how will this affect prices?

- How will individual companies and products be affected and who will be exempt?

We are not primarily focused on predicting the answers to any of these questions. In fact, even acting on the actual tariffs announced by the US Government is fraught with danger in this environment given how quickly changes are being made, reversed and reinstated.

However, we can make some overall observations:

- Tariffs are effectively a consumption tax. To the extent US consumption is dependent on products and services supplied by the rest of the world that cannot easily be manufactured domestically, prices will need to rise to reflect the imposition of the tariffs. This has the potential to be inflationary, is likely to negatively impact consumer demand in some way and hence economic growth. How much demand will be impacted is impossible to tell and is likely to also be dependent on any offsetting tax relief or increase in Government expenditure.

- How much a company is impacted is likely to be a function of both the market structure and the elasticity of demand. If a company operates in a sector where all of the major suppliers source the majority of their products from China, it is relatively difficult to change this in the short term and the products are necessities with inelastic demand, it is likely that the tariffs will be passed on to consumers and the impact on these companies’ earnings is likely to be smaller. By contrast, if a company operates in a market where there is a mix of US manufacturers and offshore manufacturers, and demand is dependent on price and hence elastic, the outlook is potentially quite grim for those manufacturing in the unfavourable jurisdiction. Where substitution to an advantaged competitor is easy, the risks are far higher and the probability that the company will need to wear the pain of the tariffs is much greater.

- It is likely that uncertainty in relation to Australian companies that have significant operations in the US is going to continue and be disruptive for these businesses, so investors will likely want a higher risk premium for investing in these companies. A higher risk premium implies a lower P/E multiple, suggesting a decline in share price that needs to reflect both the greater risk to earnings and the likely impact on earnings.

We had been reducing our exposure to companies we considered expensive for some time prior to the announcement of the imposition of tariffs by the US.

This was not premised on any expectation of disruption on the part of a new US Government administration, but on the observation that valuations were extended and history tells us that these things often have a way of normalising over time.

We had also been finding more attractive opportunities in defensive parts of the market, such as healthcare and retail real estate, that had been out of favour for some years but whose stable and growing earnings we thought were and are underappreciated. As a result, the portfolio has been positioned somewhat defensively, with a higher than normal cash weighting and a larger allocation to defensive businesses.

We are gradually getting excited about the opportunity to add to more cyclical and high-quality industrial businesses as they derate to more attractive multiples.

Patient deployment when opportunities arise lays the groundwork for higher prospective returns.

So while the volatility can be disconcerting, we encourage our investors to realise that money is made in the buying of great companies at attractive prices.

Such opportunities only come along during periods of heightened uncertainty and volatility.

We will continue to observe market conditions to take advantage of the opportunities as they arise.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 24 April 2025. This document was originally published on Livewire Markets website on 24 April 2025. This information has been prepared by Auscap Asset Management Limited (ACN 158 929 143)(AFSL 428014). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.