Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three scenarios to manage market turmoil

Isaac Poole, Ascalon Capital

Background

Global equities tumbled last week, after President Trump announced sweeping tariffs on what he dubbed "Liberation Day". That included 10% tariff on all countries (in effect April 5) and reciprocal tariffs on more than 50 countries that took effect on April 9. Global equity markets saw double digit losses over two-day periods.

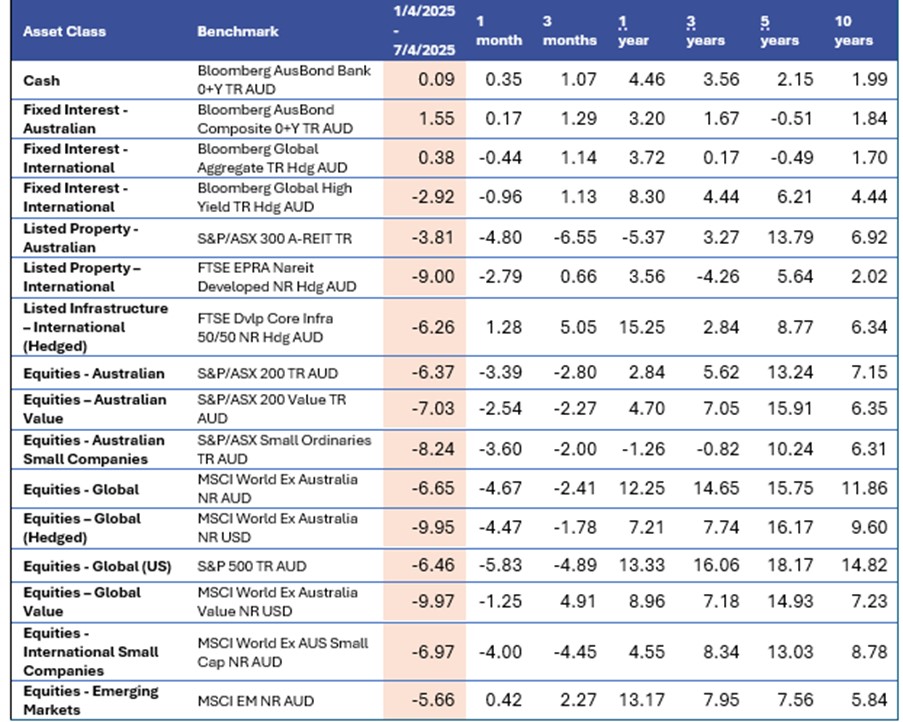

Table 1: Major indices fell sharply after tariff announcements.

Source: Ascalon Capital

Source: Ascalon Capital

Last week marked a material shift in the consensus view on the outlook. Most major banks have revised their GDP forecasts lower for the US and global economy over 2025. Several banks have also adjusted their probability of a recession materially higher.

Three scenarios to make sense of the outlook.

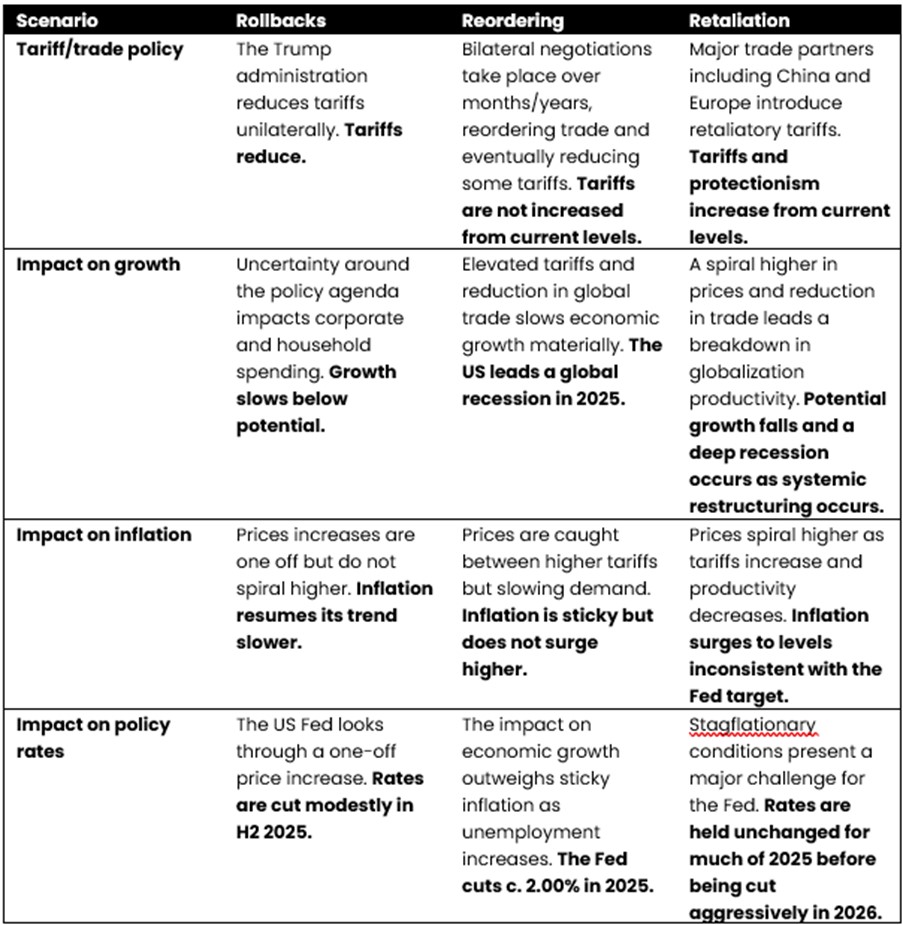

While uncertainty is extremely elevated right now, we have considered three broad scenarios. All of these scenarios involve some slowing in economic growth but will have different implications for markets.

Table 2: Three scenarios to make sense of tariffs.

Source: Ascalon Capital

Source: Ascalon Capital

What is priced in markets right now?

The brutal movements in equities last week present a challenge in gauging which scenario is being priced by markets.

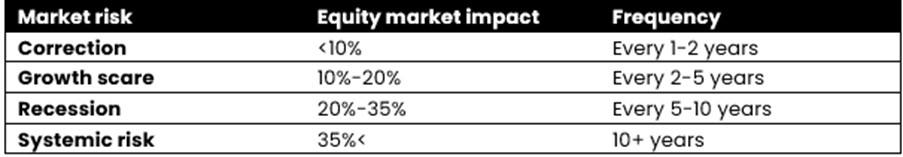

Table 3 shows typical movements in equities in response to different economic outcomes.

Table 3: Equity market responses to different economic outcomes.

Source: Ascalon Capital

Source: Ascalon Capital

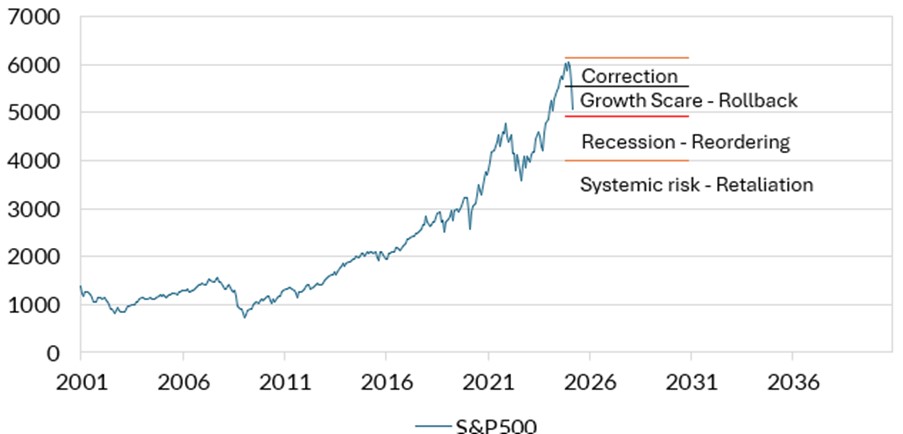

Chart 1 shows how our scenarios correspond to these different economic outcomes for the US S&P500 – and the different prices levels that would be consistent with those scenarios.

Chart 1: What the US S&P500 is pricing relative to our scenarios.

Source: Bloomberg LP, Ascalon.

Source: Bloomberg LP, Ascalon.

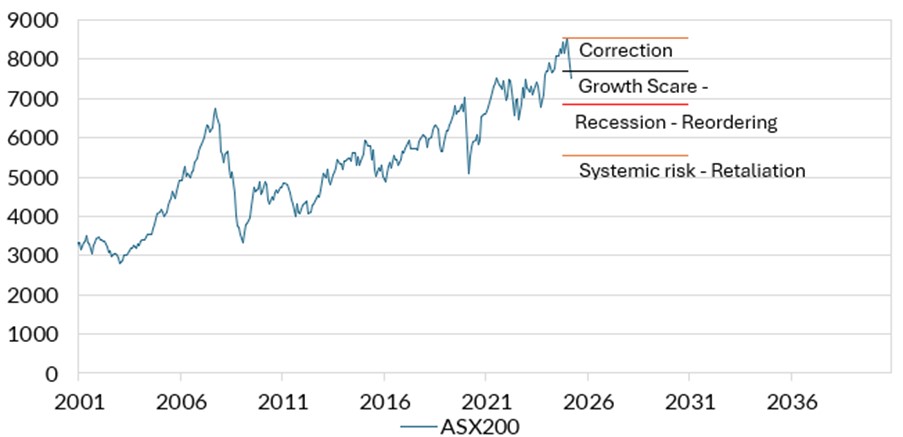

Currently US markets appear to be pricing in a growth scare – but have not fully priced a recession. In Australia, the story is somewhat similar, although pricing is further away from a recession.

Chart 2: What the Aus ASX200 is pricing relative to our scenarios.

Source: Bloomberg LP, Ascalon.

Source: Bloomberg LP, Ascalon.

A key driver of outcomes is going to be the impact on earnings. Equity valuations were extended at the start of the year because a consensus view had built that earnings growth was set to reaccelerate. Right now, US and Australian valuations remain above long-term valuations. We estimate that earnings growth will need to reaccelerate further compared to last year to justify these valuations. This is possible, but will be a challenge in each of the three scenarios. The upcoming earnings reporting seasons in the US could provide some sense of the likelihood – and we think the risk is that earnings growth is guided lower leaving some further downside risk to valuations.

What to monitor as the outlook evolves.

Chart 1 and Chart 2 suggest that markets are more concerned about the US sliding into recession, than Australia entering recession. While economic data have been solid recently, the risk is that uncertainty leads businesses to postpone investment spending, reducing hiring and increase firing, and that leads consumers to retrench spending. The prospect for higher prices could also weigh on consumer spending.

To that extent, we would advise continuing to focus on sentiment indicators, labour market indicators and consumer spending indicators to gauge the economy. Our favourite indicators remain the manufacturing PMI, the change in the unemployment rate, and the US Treasury yield curve. All of these indicators have been flashing orange for some time – indicating growth was set to slow – but they do not yet confirm recession.

Slowing growth is a risk to valuations.

We have been concerned about elevated valuations and slowing global growth for some time. By any metric, global equities were at historically stretched valuations at the start of the year. We have been communicating for some time that returns appear to have been dragged forward, leaving forward-looking returns somewhat lower relative to history. We had also been more concerned than the consensus that tariffs were not merely a negotiating tactic, and instead were likely to represent a drag on growth and a boost to inflation.

How will we manage portfolios going forward?

Market volatility highlights the need to stick to investment processes and philosophies. We have a clear, repeatable asset allocation process that can be adjusted in real-time as market and political information updates.

We observe that falling equity prices move valuations closer to fair value, allowing the opportunity to reduce underweights to these assets. We also are monitoring currency movements that tend to be a pressure release valve for global markets in times of turmoil. Australian investors could soon see good opportunities to adjust their hedge ratios on international equities.

Critically, we remind investors to:

- Remain focused on the longer term. History shows that remaining invested and sticking to processes delivers long-term portfolio returns.

- Continue to embrace a diversified portfolio. Portfolio diversification has been critical in managing downside volatility through Q1 2025.

- Not try to time markets. We are not able to pick the bottom in any specific market, and we believe investors will not be compensated for trying to make big position changes in this environment.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 11 April 2025. This document was originally published on Livewire Markets website on 11 April 2025. This information has been prepared by Ascalon Capital Pty Ltd (ABN 18 657 552 657, AFSL 554599). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, Oreana Financial Services (ABN 91 607 515 122 AFSL 482234)makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance.