Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

RBA holds, shows no pre-commitment to May, welcomes decline in inflation

Tapas Strickland | Markets Research

Key points:

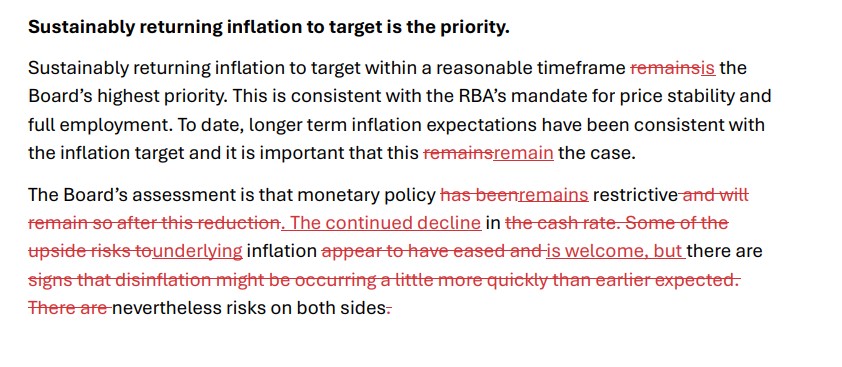

Bottom line:The RBA kept rates on hold as widely expected. The post-Meeting Statement and the Governor’s press conference played a relatively straight bat in terms of not giving a steer to May. While the Board “did not explicitly discuss a rate cut”, the Governor noted “it did talk a little bit about downside risks and including the global downside risks”. NAB’s impression was there was nothing to suggest the RBA Board won’t cut in May if data comes in line or below their forecast track (or in the Governor’s words: “prudent to wait and get a bit more data…the labour market and inflation to make sure we’re continuing to track where our forecasts are saying we’re tracking, and if we’re continuing to track, we just get a bit more confident each time”). NAB continues to be of the view that the RBA will cut rates again in May. Our call thereafter is for three further rate cuts taking the cash rate to 3.1% by February 2026. A key risk to that view is that the labour market is tighter than our assessment. On the other side of that, the global backdrop is growing as a source of downside risk to activity. Details:The most notable change in the post-Meeting Statement was the noting of progress on inflation– “continued decline in underlying inflation is welcome” – which is a clear nod to the Monthly CPI Indicator. The RBA currently sees this as being “in line with the most recent forecasts”, though on NAB’s analysis it is consistent with a trimmed mean inflation print of 0.6% q/q vs. the RBA’s Feb SoMP forecast of 0.7% q/q. There was also encouraging further progress on market services inflation. The Governor noted uncertainty on the labour market and was open to it not being as tight as their current assessment: “We are alert to the fact that it might not be quite as tight, and we can sustain an unemployment rate down around these levels without adding to inflation pressure. That would be great. But we are still alert to the possibility that it might still be a little bit tight, and that what might put wages under upward pressure, and hence inflation.” On market pricing, there was no explicit push back on market pricing. Governor Bullock said: “We’re not disputing the markets, [they] have a particular view and that’s fine … but I think our job is to be a little bit more cautious because we don’t want to let all the hard work we’ve done getting inflation down to get away from us.”. The Governor also notes that their assessment on the outlook becomes clearer closer to the end of the quarter. Q1 CPI (April 30) and Q1 WPI (May 14) are key data points ahead of the May meeting, though labour market data will be important as the RBA seeks to build confidence more benign inflation outcomes will be sustained. Geopolitical uncertainties are starting to be discussed more extensively and certainly is one large potential downside risk for the outlook. The negative directional impact on global activity is clear. Less clear though is how it could impact on global inflation (“inflation, however, could move in either direction”) and the follow-on impact for Australia given the potential for trade flows to re-direct. Chart 1: Track changes of the April RBA Board Statement to prior February (click here for the full statement).

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. All prices and analysis at 1 April 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

|