Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Don’t become a victim of volatility: Use it to your advantage

James Cooper | Fat Tail Investment Research

The disparity between best-case versus worst-case outcomes in the ‘tariff panic’ is colossal.

At its worst, tariffs can potentially split global trade between the world’s two largest economies, China and the US.

No one knows how to price that, but it has been a case of selling and asking questions later.

On Monday, a single tweet was enough to ignite a chain reaction in the market that sent markets into a multi-trillion dollar joy ride. A brief surge, followed by a collapse after it was found to be ‘fake news:’

Source: X

Source: X

Then, a nearly 10% surge in the S&P500 on Wednesday delivered a feeling of euphoria.

But overnight, markets were down again. The S&P500 fell 3.5% on Thursday, which would be a huge move under normal conditions. But in today’s market, it’s a blip. It begs the question…

What comes next?

At times like this, you have to take a breath, walk the dog, and, most importantly, turn off the news! As I told my paid readership group yesterday, this is not the time to become a victim of volatility. Instead, you need to use it to your advantage.

With the market bounce yesterday, we offloaded weaker positions in the portfolio. Freeing up capital to take advantage of the next potential downdraft in global markets.

Capital that can be used to add a quality name or two that’s been too expensive under normal market conditions.

And that’s another advantage you can capture from this volatility…

Markets are telling you which stocks to focus on. It comes down to relative strength: stronger stocks fare better in a weak market. And tend to lead (or rise more) when the recovery starts.

The price action offers valuable insights during these volatile market events.

Another thing I’m reminding my paid readership group

As resource investors, we’ve been here plenty of times before. We’re a battle-hardened group! It’s just that the rest of the market is finally experiencing what major volatility looks like.

You might recall the bloodbath in mid-2024: Iron ore prices were catering. That was thanks to weak GDP growth from China. Across the board, resource stocks moved into freefall. Extending an already prolonged bear market in commodity markets.

Over that time, I pleaded with my paid readership group not to sell. At the height of the panic in mid-2024, I issued a piece titled:

‘IMPORTANT UPDATE: Resource Market Sell-off and What You Need to Understand’

We could have panicked. We could have agreed with the narrative that iron ore would collapse to $60 per tonne and that resource stocks would crater into a mass liquidation event.

But we held firm.

At our more active commodity trading service, we took advantage of last year’s commodity bloodbath, jumping into a TSX-listed copper junior, Aldebaran Resources, close to the market bottom. A couple of months later, its share price doubled. Not all of our timings have worked out that well, of course.

Meanwhile, at our entry-level service, Diggers & Drillers, we’re focused on long-term growth.

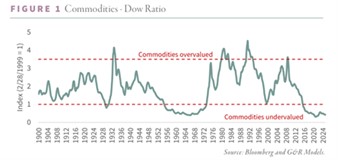

That’s why I always return to one critically important chart whenever markets reach a phase of nerve-racking volatility. As you can see, against financials, resources remain incredibly cheap:

In this market, you’ll sleep better at night holding stocks with an element of undervaluation. And in terms of commodities, this level of undervaluation hasn’t been seen in over a century!

That has to be viewed as an opportunity, no matter what the broader market throws at us.

One Final Point…

Some market commentators suggest we remain on the verge of a 2008-like stock market crash. And that yesterday’s bullish move was just a dead-cat bounce.

But as you might recall, 2008 was a credit crisis and systemic failure in the financial system that spread across global banking and real estate.

In 2008, the pillars of the global economy crumbled.

Today, we have a ‘headline panic’ driven entirely by the Trump Administration. Sure, there are risks to global growth if the tariff war between China and the US continues to ramp up.

But there’s still so much that can happen from here…

In late 2024, China announced that it would take whatever measures necessary to counter the impact of US tariffs. I suspect we could be on the verge of seeing what that looks like very soon.

As I told my paid readership group on Monday, major stimulus from China remains a very real possibility. There’s also overwhelming pressure on central banks to cut interest rates.

This market is full of opportunities. But as I detailed, you need to focus on the strongest names.

Until next time.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 11 April 2025. This document was originally published on Livewire Markets website on 11 April 2025. This information has been prepared by Fat Tail Investment Research (ACN: 117 765 009)(AFSL: 323 988). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.