Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

AU unemployment continued to track broadly sideways in March

Taylor Nugent | Markets Research

Key points:

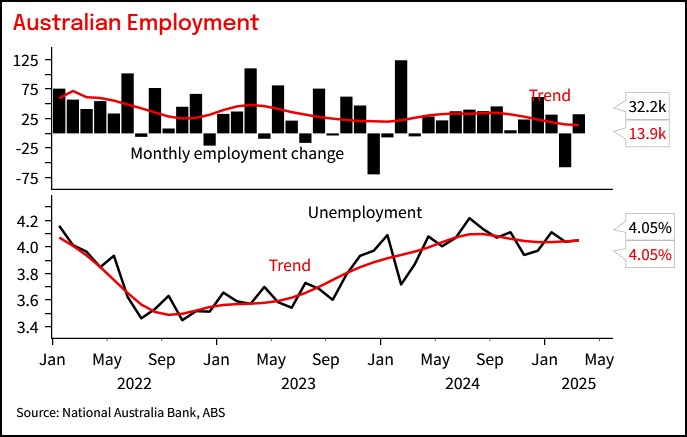

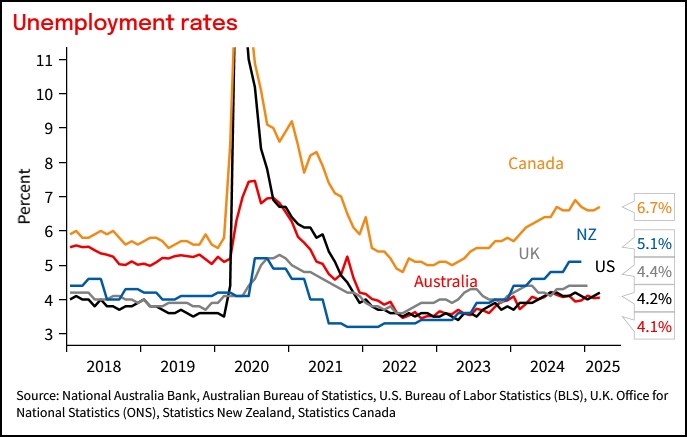

- The unemployment rate was 4.1% in March (NAB 4.1%, consensus 4.2%)

- The unemployment rate has been in a 3.9-4.2% range for the past year

- Employment rose 32k (NAB +20k, consensus +40k) after February’s 57k fall

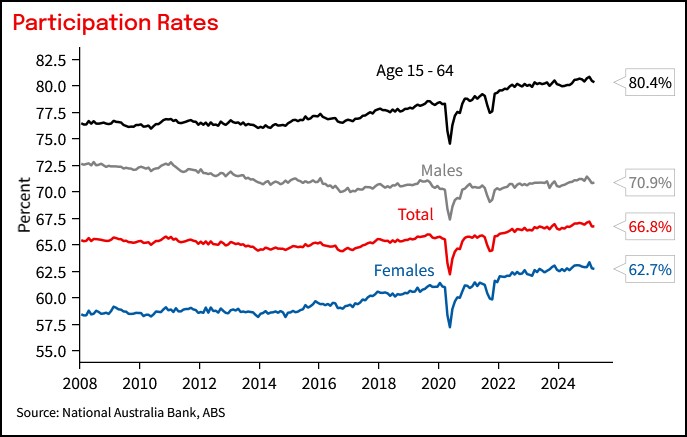

- The participation rate was 66.8%, failing to rebound after the large fall in February

- The RBA won’t be rewriting their labour market assessment on this, but a range of indicators continue to point to a more balanced labour market than the RBA fears

Bottom line and assessment

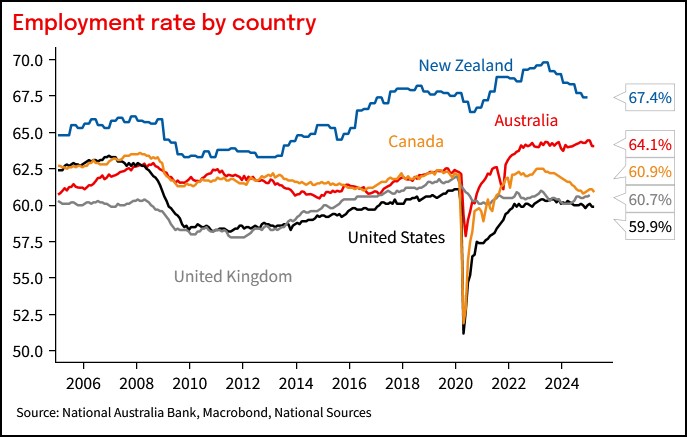

The unemployment rate was 4.1% in March, from a downwardly revised 4.0% in February (but that is essentially no change, it rose from 4.04% to 4.05% unrounded). Employment rose 32k in March, following a surprise 57k fall in the prior month alongside a 5 tenths slide in the participation rate. There was no payback from that volatility in today’s data, instead suggesting some of the employment strength prior to February may have been a bit overstated. It takes about 30k a month to keep pace with population growth, and trend employment growth has now slowed to 14k. While the unemployment rate remains little changed, employment as a share of the population is now 64.1%, it was 64.5% in December.

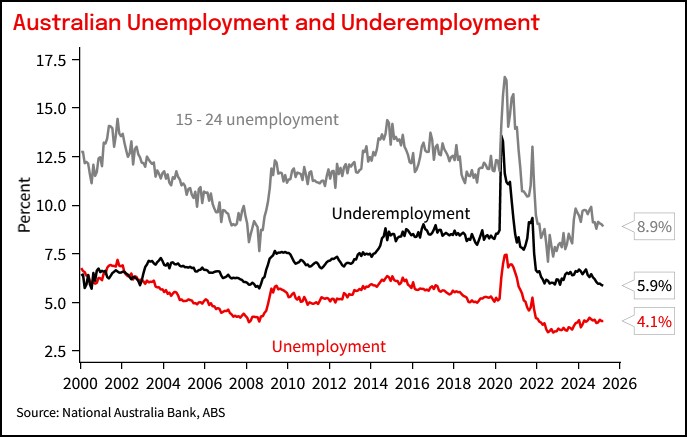

The still low unemployment rate and fallback in underemployment over the past year have kept the RBA cautious that the labour market may remain tighter than is consistent with full employment. We continue to assess the labour market is healthy, but an unemployment rate in the low 4s is not a barrier to sustaining inflation near target, as discussed in a recent macro thematic - ‘RBA not yet convinced on lower NAIRU’.

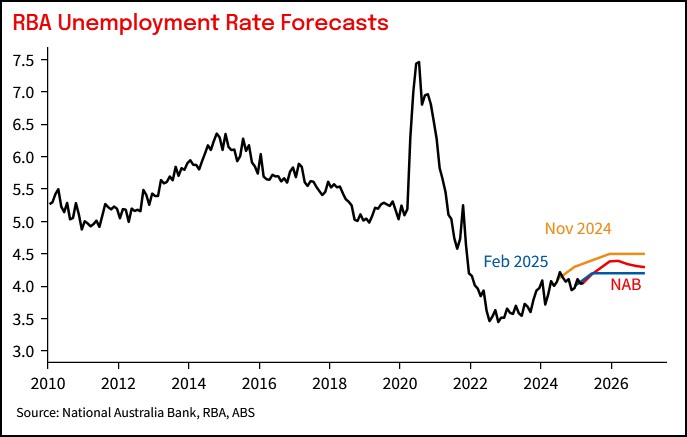

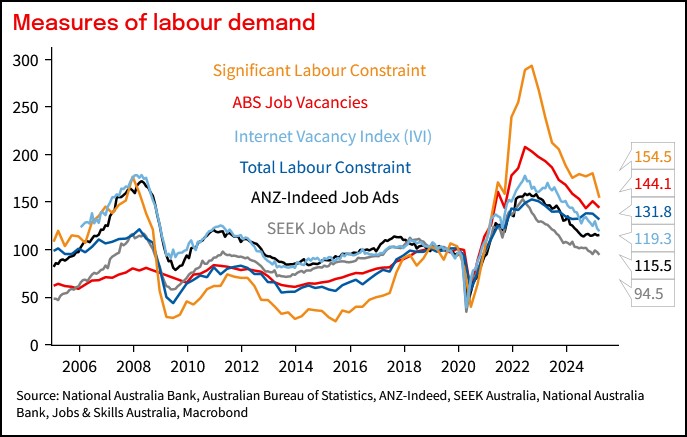

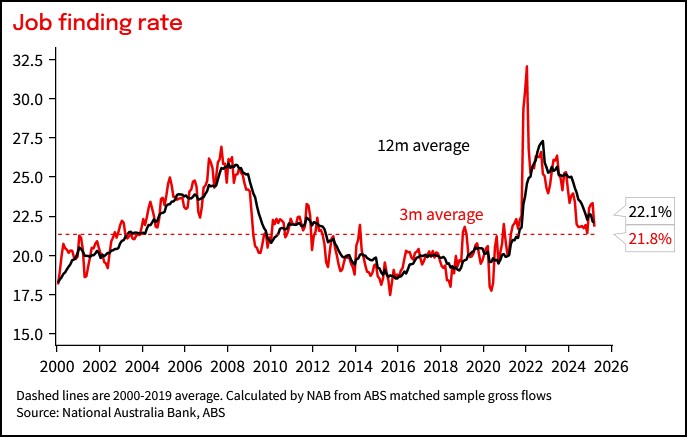

While there is little in today’s data to force a rethink from the RBA, larger headwinds emanating from the global backdrop should put some upward pressure on the RBA’s unemployment forecast at the May meeting and broader indicators of labour demand are not adding to the RBA’s residual concern about the risk of sustained retightening. The job finding rate and vacancies have both fallen back after a small lift at the end of 2024, and the number of firms citing labour as a significant constraint on output in the NAB Quarterly Business Survey fell back noticeably in Q1.

There is one more labour force print (15 May) ahead of the RBA’s 20 May meeting, as well as Q1 CPI (30 April, see preview) and WPI (14 May). That’s important for setting up the starting point, but the outlook come the May meeting will remain highly sensitive to tariff developments.

Detail

Hours worked fell 0.3% m/m in March, with more than usual people working reduced hours due to ex-Tropical Cyclone Alfred and other major weather events in New South Wales and Queensland. The underemployment rate remained at 5.9% in March.

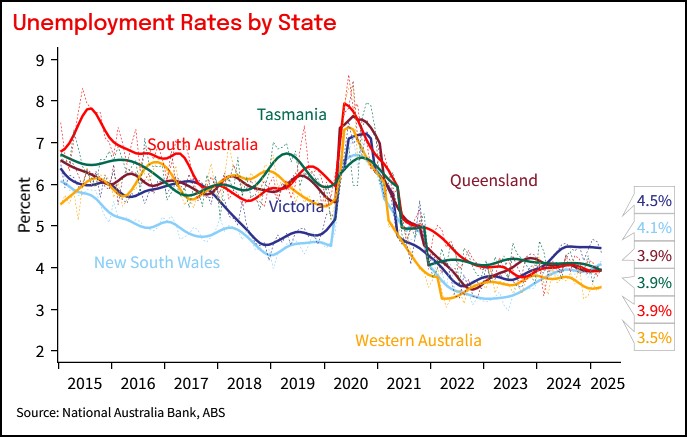

Indicators at the state level tend to be even more volatile month to month than the aggregate outcomes, but on a trend basis there has been some flattening out from the earlier more pronounced lift in the unemployment rate in Victoria. Trend unemployment at 4.5% remains elevated relative to other states and much nearer pre-pandemic levels. Other states are clustered tightly around 4%, while WA continues to have an unemployment rate lower than the national average and sharply below the softer pre-pandemic conditions that prevailed for that state.

Chart 1: Employment and unemployment

Chart 2: The unemployment rate rose less a tenth to 4.1% in March, while the underemployment held at 5.9%.

Chart 3: The RBA saw unemployment plateauing at 4.2% from Q2. Today’s data doesn’t threaten that, but we think intensified headwinds from the global backdrop will add some modest upward pressure to those forecasts come May

Chart 4: Measures of labour demand solid, but maybe pointing to fading retightening risk at the margin

Chart 5: The job-finding rate has fallen back near long run average.

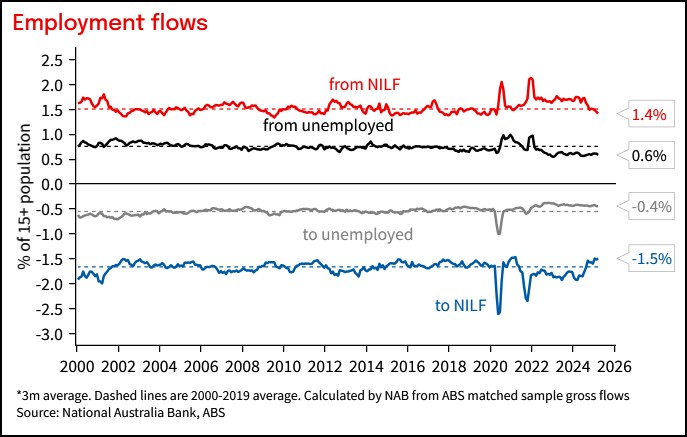

Chart 6: Gross flows into and out of employment from outside the labour force were elevated during the pandemic recovery and expansion but had largely normalised and more recently have fallen to below average levels. The participation rate and employment are being supported by lower-than-usual outflows, rather than elevated inflows.

Chart 7: The participation rate was 66.8% from a downwardly revised 66.7% in February. It had risen 3 tenths to 67.2 over the 2 months to January but is now below its November 2024 levels.

Chart 8: Employment as a share of the working age population was 64.1%, tracking sideways in a trend sense but no longer obviously trending higher.

Chart 9: Unemployment rates by country

Chart 10: Trend unemployment by state

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 17 April 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.