Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

A tale of two banks: The trade Australian investors need to consider

Dr David Allen | Plato Investment Management

Australian investors exhibit one of the highest levels of “home bias” globally—allocating 44% of their equity portfolios to domestic stocks. This is striking when you consider that Australian companies represent just a few percent of global equity market capitalisation.

To be fair, there are some rational justifications for this preference: franking credits, foreign dividend withholding taxes, and currency risk all make offshore investing less attractive on the surface.

And yes, we are fortunate - an entire continent rich in natural resources. But if necessity is the mother of invention, abundance might just be the mother of stagnation. It's no coincidence that Australia lacks meaningful global leadership in industries like AI, robotics, and biotech.

This domestic bias can come at a cost. We risk missing out on world-class opportunities beyond our borders. Take banking, for instance. Even in our strongest sector, there are superior alternatives abroad.

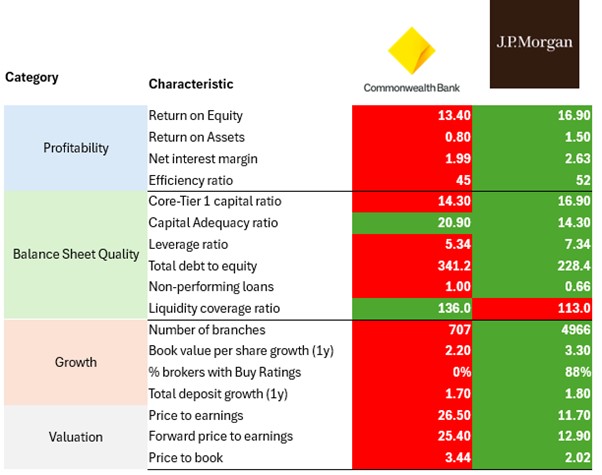

Compare Commonwealth Bank of Australia (ASX: CBA) with JPMorgan Chase (NYSE: JPM). Now, full disclosure: I spent 15 years at JPMorgan. But to keep things objective, let’s stick to the numbers. Across every major profitability metric, JPMorgan comes out ahead.

Its return on assets is 76% higher, and its all-important net interest margin is 32% higher. Both banks maintain high-quality balance sheets, but JPMorgan’s is exceptionally strong, with non-performing loans at just 0.66%.

Growth? Neither bank is setting the world alight. CBA is closing branches while JPMorgan is expanding. Deposit growth is roughly similar, but JPMorgan has a slight edge in book value per share growth.

And then there’s market sentiment: not a single sell-side analyst has a “buy” rating on CBA, while 88% are positive on JPMorgan. At this point, you might assume JPMorgan trades at a premium. But you'd be wrong.

CBA trades at a 126% premium to JPMorgan on a price-to-earnings basis. Its price-to-book ratio is 70% higher.

Source: Plato Investment Management

Academics often argue that markets are highly efficient—so mispricings like these shouldn’t exist.

One common explanation for CBA’s inflated valuation is the sheer weight of superannuation fund money and the rise of passive investing. But this logic has a flaw: passive funds buy stocks in proportion to their existing market weights, meaning this effect should be broad-based - not something that uniquely benefits CBA.

A more compelling explanation is behavioural.

Many long-term CBA shareholders bought in decades ago, have enjoyed strong returns, and now face significant capital gains tax if they sell. With no urgent reason to exit, they hold on.

This inertia may help explain CBA’s persistent premium.

Perhaps markets aren’t quite as efficient as textbooks would have us believe. Consider the curious case of Taiwan Semiconductor Manufacturing Company (TSMC), one of the world’s largest companies.

It has shares listed on the Taiwan Stock Exchange and an American Depositary Receipt (ADR) listed in the U.S. In theory, according to the Law of One Price, these two should trade at near-identical values. In practice?

As of yesterday’s close, the U.S.-listed ADR was trading at $32.68, while the Taiwan-listed shares were priced at $27.62 - a premium that has persisted for months.

Given JP Morgan’s global scale, strong fundamentals, and the potential tailwinds from U.S. deregulation and M&A activity we believe it is well positioned for future growth.

Finally, the steepening of the yield curve that we are witnessing is constructive for the company’s core business, borrowing short and lending long.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 29 April 2025. This document was originally published in Livewire on 29 April 2025. This information has been provided by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (“Plato”). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.