Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why smart money is quietly shifting gears

Reece Birtles | Martin Currie

Time and again, after being left in the rearview mirror, Value has staged powerful comebacks. Value style investing has been in the doldrums for some time, but change is afoot.

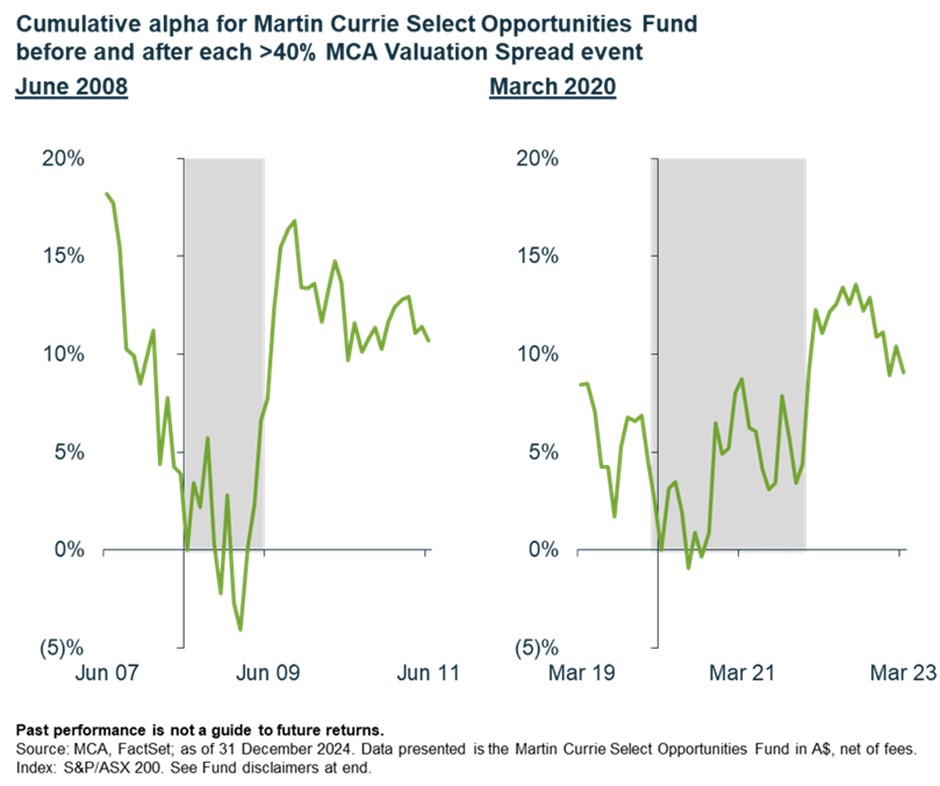

The widening disconnect between price and earnings forecasts—along with the growing chasm between the market's most expensive and cheapest stocks—suggests we're approaching a moment of reckoning that could significantly reward Value-oriented investors. For us, the question isn’t if Value will outperform but when—and based on our history of managing Australian Value Equity portfolios, when it does, the acceleration is fast and powerful.

The Value Gap: Bigger than we've seen in decades

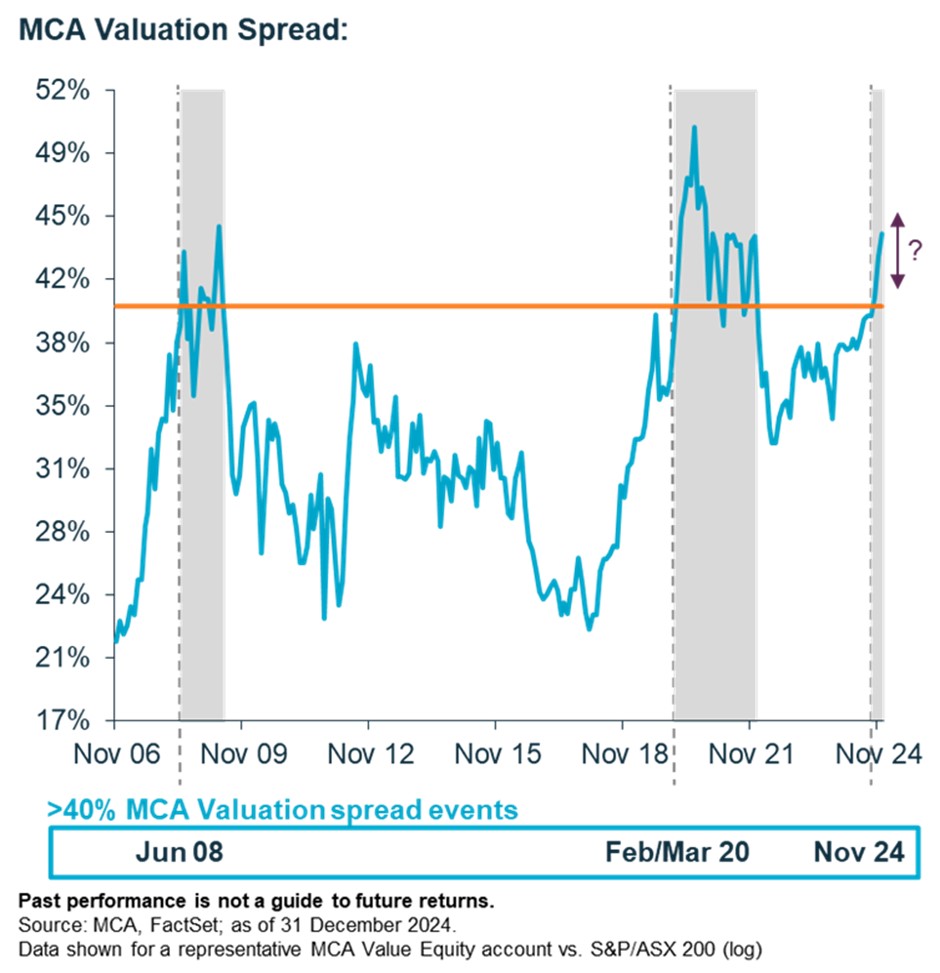

Drawing on over 20 years of fundamental company valuations, our team has a unique lens into just how extreme today's opportunity has become. We measure this by tracking the valuation spread between our Value Equity portfolio holdings and the broader S&P/ASX 200 Index.

The data is striking: today's valuation spread has surpassed 40%—a level we've only seen three times in the past two decades. Each previous instance—following the Tech Bubble, during the Global Financial Crisis, and after the COVID-19 crash—marked the beginning of extraordinary outperformance for Value investors.

Safety first: The unusual protection play in today's value stocks

Typically, Value rallies come with higher risk profiles. What makes today's setup unique? The Value opportunity is concentrated in lower-risk, low-beta stocks—essentially giving investors both upside potential and downside mitigation.

The current conditions closely mirror what we saw in early 2000, when the MSCI Australian Value Index, after years of lagging performance, suddenly surged ahead and delivered market-beating returns for several years running. Over the months that followed, the premium of the Value style in Australia was uniquely valuable. In the face of deep US and global market drawdowns, Australian Value investors were able to realise positive absolute returns.

Today, we see a similar opportunity. We're particularly excited about the quality and diversification of undervalued Australian stocks available today. In our active portfolios, we're overweight what we believe are attractively valued quality businesses including Medibank Private (ASX: MPL), ANZ Banking Group (ASX: ANZ), QBE Insurance (ASX: QBE), Aurizon (ASX: AZJ), Flight Centre (ASX: FLT), and AGL Energy (ASX: AGL), while maintaining underweight positions in fully valued names like CBA (ASX: CBA) and CSL (ASX: CSL).

The sentiment shift: Why fundamentals are about to matter again

Markets have been riding high on a wave of optimism and momentum, with prices seemingly detached from underlying business fundamentals.

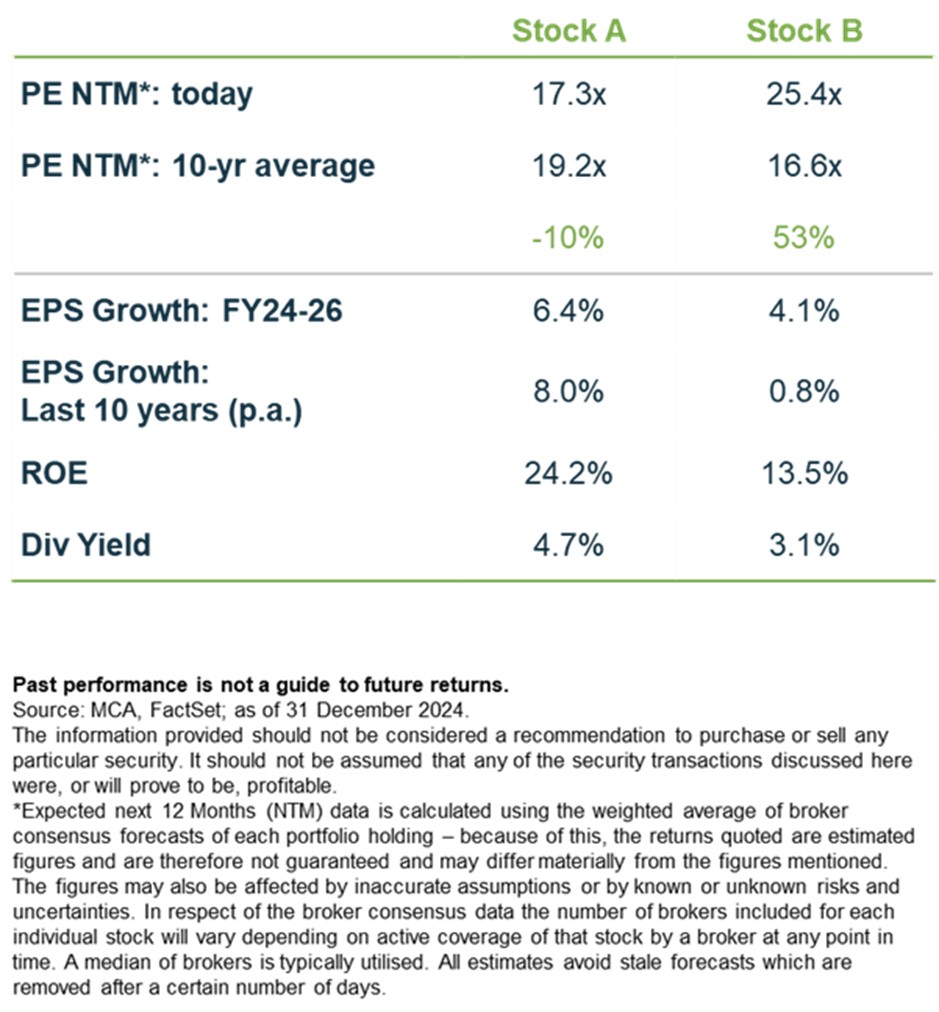

An example of this can be seen in the stocks shown in the table below. We have concealed the identities of these two Australian listed stocks, but they both trade in the same sector and operate in the same geographic regions targeting primarily the mass middle market of Australian households. They are both established leaders in their respective segment.

On current metrics, Stock A offered a better return on equity, dividend yield and EPS growth than Stock B. Whilst there is more to the assessment of both company’s prospects than merely a simple comparison of the numbers, the market has rewarded Stock B with a significant premium.

History reminds us that periods of market euphoria inevitably give way to reality checks—and those transitions can happen with startling speed. The key challenge for investors is identifying when this will shift—forcing the market to refocus on the fundamentals, valuation and earnings.

Why act now? The opportunity won't last forever

Valuation disconnects of this magnitude rarely persist beyond 18 months. For investors who recognise what's happening, we believe that the time to reassess Value exposure is now—before the market catches up. In fact, February returns for our Australia Value Equity strategy portfolios, including the Martin Currie Select Opportunities Fund, already show early signs that Value is truly ‘back’.

Like all market opportunities, this one comes with its own set of considerations. Value investing requires patience and conviction. The largest returns often come after periods of maximum pain, making it psychologically challenging to maintain positions against prevailing market sentiment.

However, for investors willing to look beyond short-term market noise and focus on fundamental business valuations, the potential rewards appear substantial. Whether through high-active share approaches that maximise alpha potential or through style-neutral, risk-controlled strategies that prioritise fundamental valuation while managing broader risk factors, the Value opportunity appears robust enough to benefit multiple implementation approaches.

Multiple ways to capitalise

Given the size of the Value opportunity, we believe that all investors can benefit, even those facing strict performance and risk benchmarks. Our team are available to discuss how best to position for the opportunity through either:

- Research-driven contrarian stock picks that target undervalued companies with strong fundamentals (Martin Currie Select Opportunities Fund), or

- A risk-managed strategy combining fundamental analysis with quantitative techniques to capture value opportunities while minimising sector and style risks (Martin Currie Active Insights Fund).

As Warren Buffett famously observed, "Price is what you pay; value is what you get." In today's market, the gap between those two concepts has rarely been wider—and history suggests that gap won't persist indefinitely.

The question for investors isn't whether valuation will matter again, but whether they'll be positioned to benefit when it does.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 17 March 2025. This document was originally published on Livewire Markets website on 17 March 2025. This information has been prepared by MARTIN CURRIE INVESTMENT MANAGEMENT LIMITED, operating within Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.