Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Riding the Golden Bull

Michael Goldberg | Collins St Value Fund

Why investing in gold is a value play

The early months of 2025 have seen exceptional returns for the price of gold, with gold trading higher by over US$400/oz at approximately US$3,000/oz.

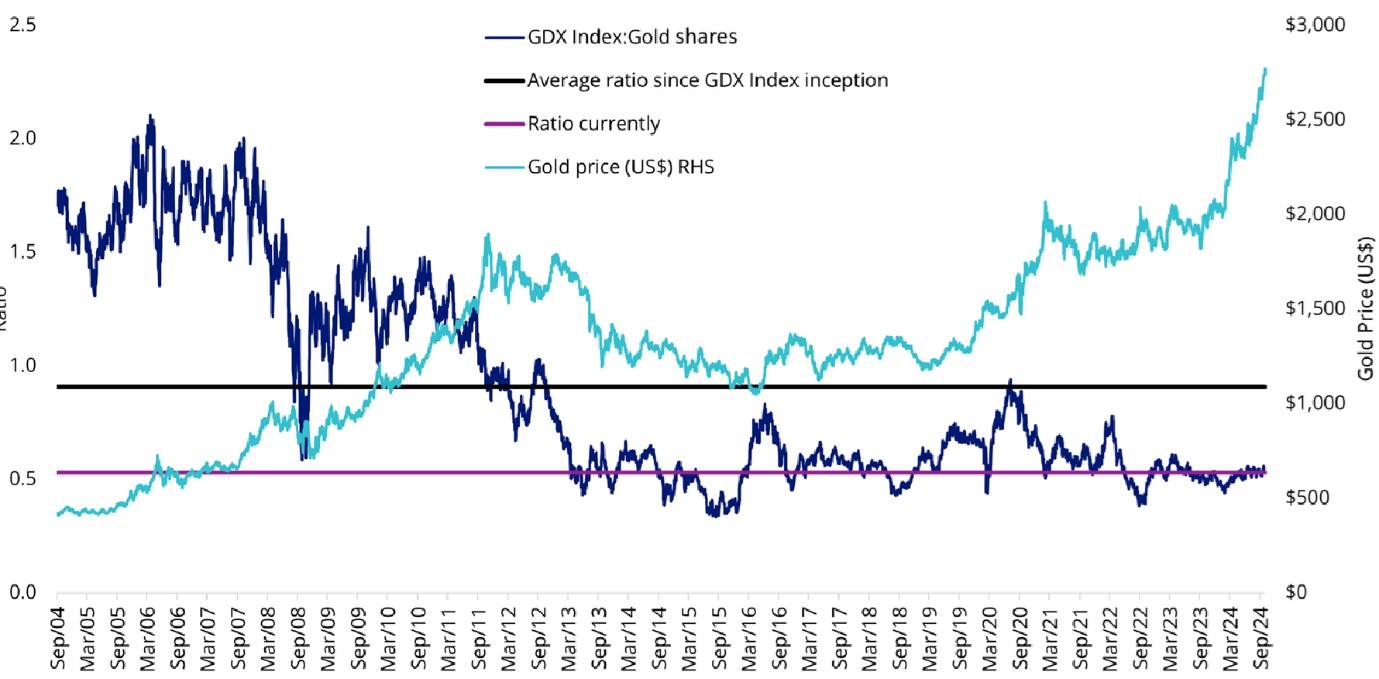

Bizarrely, even as gold prices have moved higher, gold equities have significantly underperformed. Indeed, so great is the gap between earnings potential and share prices that many fund managers have launched (or in our case re-opened) gold funds to satiate new investor demand.

Much has been made of gold’s recent performance, but the truth is that the drivers of higher gold prices have been in place for some time now:

1. Under investment in new development remains a prevailing problem for the industry. Recent activity within the sector suggests that many of the larger participants are looking to replace their reserves and grow their development projects by acquiring smaller peers.

2. A continued shift away from reliance on the US dollar has seen some central banks and global companies increase the pace of gold purchasing as an alternative to holding both US cash and US Treasuries. Recent reports from China suggest that the government has instructed several insurance companies to purchase gold as part of their reserves.

3. Global unrest persists. Governments across the Western world continue to be at odds on the most effective way to end wars in Europe and the Middle East. Rhetoric persists that suggests trade wars may be at risk of escalating.

Each of these factors on their own could have driven gold prices to current levels.

Historic Performance of Gold

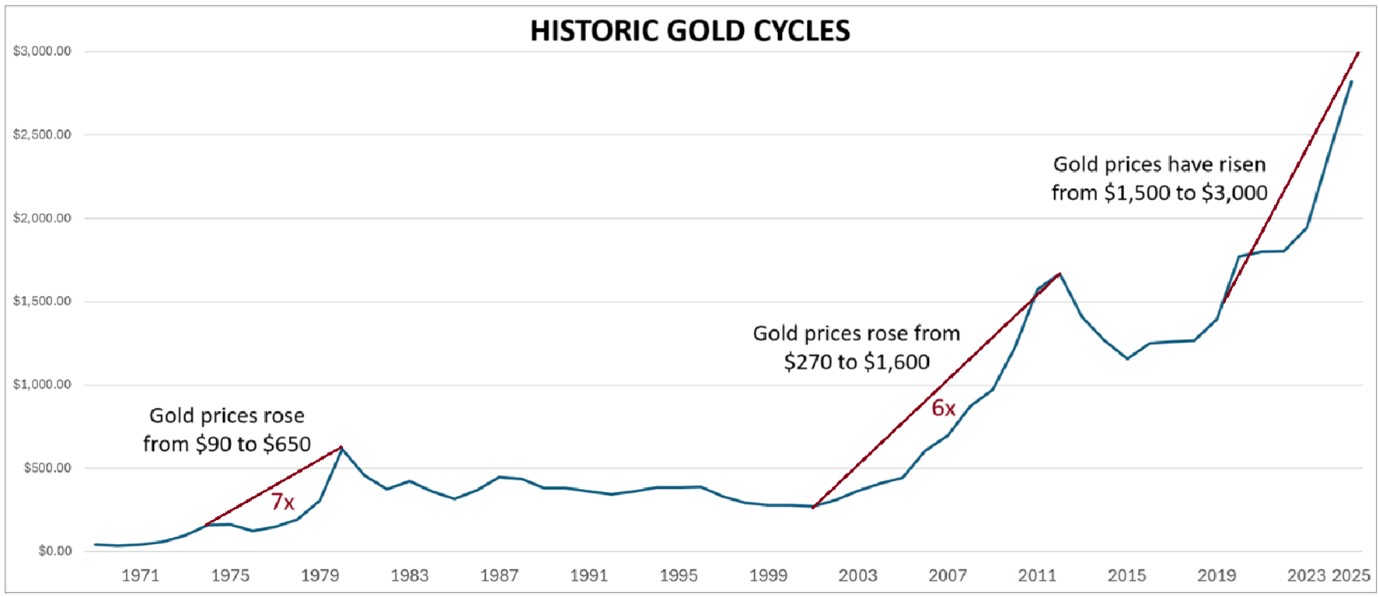

All that being said, in the context of historical gold cycles, the prevailing price is not exceptional.

Indeed, by simply assessing the inflationary adjusted price of gold since its last peak (in 1980), gold has not yet achieved a new high. A new high in today’s dollars would require gold to trade above $3,450.

When assessing an asset class that has prevailed for thousands of years, it’s worth considering how gold has performed through previous cycles. Since the decoupling from the US dollar in 1971, gold has enjoyed three bull markets.

- For ten years, from 1970 - 1980 gold rose from USD$36 to USD$600 (peaking at over $800). Part of this remarkable return is no doubt due to the de-pairing of the US dollar to gold. From 1973 - 1980 gold prices increased 7x.

- After a prolonged period of unremarkable performance, gold entered a new bull market in 2001 through 2012. Perhaps initially seeking safety from the dot-com crash and global terrorism, over the next 11 years gold rose from USD$275 to USD$1,650, a return of 6x.

- Gold prices once again remained static until the events of Covid19 brought about a new gold bull market. As at the end of 2019, gold traded at US$1,500. Today gold trades at US$3000, a paltry 1x return (so far).

Source: Collins St Value Fund

Source: Collins St Value Fund

historically cycles have seen a greater than 6x increase in gold prices. So far the current cycle has generated just 1x.

There can be no certainty as to where in the cycle we currently find ourselves. Indeed, without the benefit of hindsight, it’s very difficult to assess history as it’s being written. Nevertheless, it appears to me that we are in the early stages of a new bull market for gold. If that is so, and if history is to be our guide, there may indeed remain much upside to gold prices from here.

How to best invest in a gold bull market

In seeking the purest unhedged exposure to the impact of higher gold prices, the most effective way to invest is in medium and small gold companies.

Historically, gold companies outperform gold prices in bull markets due to the rapid rise in margins once fixed costs are covered and profits begin to flow.

Notwithstanding some impressive recent returns from several gold companies, the difference between what one would expect gold share prices to do in the face of current gold prices and what has transpired to date has become as wide as we’ve seen. Despite the potential profits for gold companies (at current gold prices), share prices reflect much lower expectations with many high-quality gold companies trading on single digit earnings multiples.

Gold shares have underperformed gold prices. The dislocation is as stark as it’s ever been

Source: Collins St Value Fund

Source: Collins St Value Fund

The dislocation between gold prices and gold stocks is unusual. We expect that it will not last and the 'jaws' will be closed (and reversed).

Recent reporting by Gold Companies

Reflecting the higher gold prices, most of the pure gold companies within the ASX reported very strong results in their most recent half year reports.

Common themes included:

- Margins were higher as All In Sustainable Costs (AISC) remained generally in line with expectations, aided by lower energy costs and the benefits of economies of scale.

- Corporate activity continued apace, with several companies announcing intentions to merge, engage in acquisitions or be taken over. Anecdotally, more offtake agreements are being entered into within the sector, reflecting strong sentiment by participants.

- Even as new development struggles to keep up demand, global stockpiles (among gold companies) continue to climb, suggesting that management anticipate higher prices in the future.

- Historic challenges in obtaining finance have to this point impacted the supply of gold, maintaining a subdued supply despite recent increases in demand.

We are strong believers in the upside for gold markets and gold stocks in the coming years. Indeed, we’ve gone so far as to make a gold holding the largest position in our flagship fund and launched an unhedged global gold equities fund in 2023 to achieve the most exposure to gold prices and the dislocation between gold prices, gold company earnings, and gold stock share prices.

While gold companies have certainly performed well over the last 2 years, we continue to believe that the best is yet to come and expect that many of our underlying holdings have as much as or more than 100% additional upside.

As gold prices breach US$3,000 and attention to gold starts to ramp up, we believe that now is the time to take advantage of all the factors that are likely to drive higher share prices, before equity markets have had the chance to properly respond. As we’ve often seen in previous commodity cycles, once the markets imagination is captured, share prices can move very quickly.

Some things to consider when investing in gold

Given gold’s recent rally, there have been several new investment options opened to investors. When discerning what approach to take, consider the following:

Do I want to own gold or gold companies?

- There are many ways to invest in gold. For those looking for pure gold exposure, there are listed investments available to you. On the ASX the ticker code: GOLD gives investors exposure to the price of gold in Australian dollar terms, without having to incur the costs of storing physical bullion.

- For investors looking for leverage via gold company equity, there are several options available, including ETFs, and actively managed funds.

Do I want actively managed exposure or an ETF?

- ETFs provide broad and diversified exposure to gold companies. However, an ETF’s selection process is based on market cap size rather than valuation considerations. As such, a gold ETF will hold many companies with less than pure gold exposure. It also means investors in ETFs will own more of the largest companies, and fewer of the smaller companies.

- Actively managed exposure supports pure gold exposure, and portfolio weightings based on the attractiveness of each company. Such positions tend to be more concentrated – exposing the investor to greater upside from gold performance.

Do I want hedged or unhedged exposure?

- Hedged exposure: By betting against gold prices, and betting on gold companies, one can take advantage of the current mispricing in the market. This is a great option if you recognise the value of company earnings, but don’t have an interest in being exposed to gold prices.

- Unhedged: By not hedging your bets, this exposure sees you benefit from both higher gold prices and improving share prices.

At Collins St we are seeking to achieve the best risk adjusted returns from gold price moves by positioning ourselves for:

- Unhedged exposure to higher gold prices, and

- Concentration on listed companies with the greatest dislocation from expectations and highest potential.

Since launching our Fund two years ago, we’ve already experienced some exceptional share price returns on a number of our holdings, some of which are up over 200% since we first bought them. Even as gold equities continue to trade at historically low prices relative to gold prices and expectations, some big moves in our portfolio include:

- Black Cat Syndicate (ASX:BC8) +150%

- Catalyst Metals (ASX:CYL) +250%

- Discovery Silver Corp (TSE:CXB) +130%

- G Mining Ventures (TSX:GMIN) +300%

Still, even given those returns, we believe that on average, our holdings are currently trading at just half what we think they are worth.

There are very few Australian managers that have established gold funds, and even fewer that are driven by value and fundamental consideration. Based on these factors, we believe that the best is yet to come!

If you have any questions about this article or want to talk about our Gold Fund, which is closing 15 April, please be in touch.

Collins St Value Fund may own some of the companies it discusses.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 28 March 2025. This document was originally published on Livewire Markets website on 28 March 2025. This information has been prepared by The Collins Street Value Fund (CSVF) is managed by Collins St Asset Management Pty Ltd (CSAM) AFSL 468935 ABN 16 601 897 974. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.