Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

GDP Q4 2024 – Past the trough

Key points:

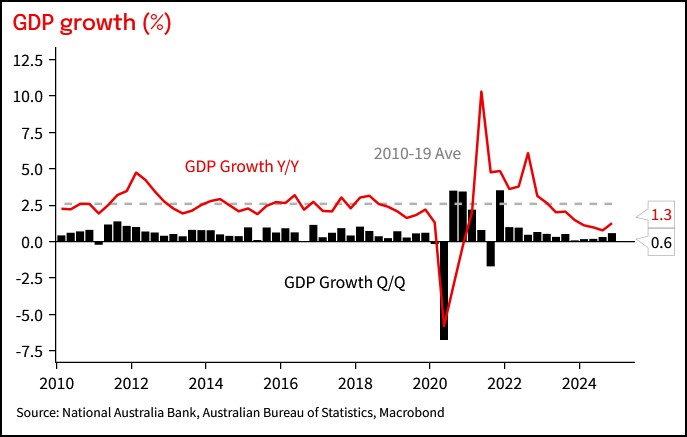

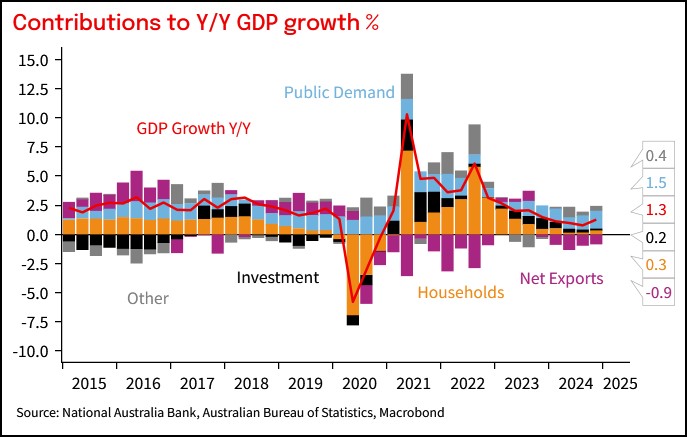

- Q4 GDP growth was 0.6% q/q and 1.3% y/y (NAB 1.4%, Consensus 1.3%, RBA 1.1%) with both public and private demand contributing to growth

- While a little above the RBA’s expectation, we don’t see anything narrative shifting in today’s data

- Household consumption rose 0.4% q/q – better than recent quarters but not strong yet

- Public demand remained a support for growth, with quarterly growth 0.9% q/q and 5.7% y/y.

Overview & Implications:

GDP growth was 1.3% over 2024 (NAB 1.4%, Consensus 1.3%, RBA 1.1%). Despite the small upside surprise to the RBA's recent forecast, we do not see this as narrative shifting. Consumption growth was in line with the RBA’s forecast at 0.4% q/q and 0.7% y/y. Today’s data is consistent with the assessment that growth is past its trough and should pick up further helped by an improvement in real household income. Real household income growth was 1.8% over 2024, near its pre-pandemic average of 2.0% y/y, after a period of declines alongside elevated inflation. The net savings rate was 3.8%, below the 5-6% that prevailed prior to the pandemic, but up from its low of 2.4%.

GDP per capita rose 0.1% q/q, its first rise in seven quarters, as growth drivers rebalance with population growth past its peak and per capita spending picking up. Domestic final demand growth was 0.5% q/q, with a positive contribution from net trade in the quarter but remains stronger than GDP growth in year-ended terms at 2.1%. Public and private demand both contributed positively to growth in the quarter.

Looking forward, we continue to expect growth of 2¼% over 2025. That would reflect a return to trend after a period of rebalancing that has moved the economy to better balance and so is not necessarily threatening to the inflation outlook. NAB’s view is that the RBA’s inflation outlook remains a little too cautious, and that will be enough to support gradual policy normalisation as the RBA seeks to support a healthy labour market and avoid unnecessarily leaning against growth outcomes. We expect the next cut in May and a terminal policy rate of 3.1% in 2026. Signs of retightening in the labour market or less benign inflation would delay easing, and while the focus will remain on CPI data, it is worth noting that productivity growth remains weak and unit labour cost measures remain elevated in today’s data, which support the RBA caution that disinflation could stall.

For the full detail of today's Q4 National Accounts Release, see the full report here.

Chart 1: Growth is past its trough

Chart 2: Consumption growth has picked up

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 5 March 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.