Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

ETF in Focus: Why the big tech trade may not be over yet

James Waterworth | BlackRock Australia

The Magnificent 7 technology stocks (Apple, Microsoft, Tesla, Google, Amazon, Meta, and NVIDIA)1 have significantly driven the US equity market rally over the past two calendar years, returning over 150% compared to about 30% for the rest of the S&P 500 Index.2

Last year, Australian investors flocked to technology-themed investments. The iShares Global 100 ETF (IOO), our fund with the most exposure to tech, saw around $300 million in inflows, making it one of the top 5 most popular iShares ETFs.3

While the sector’s dominance has been tested this year by the new AI model from Chinese tech lab DeepSeek, the rapid growth of the Magnificent 7 means technology and communications now make up almost 35% of the MSCI World Index - the highest share since the early 2000s.4

Indeed, if we presume the “usual” business cycle conditions that defined the pre-pandemic era, it may seem as if these sectors are overvalued.

However, we would argue artificial intelligence – which is driving this unprecedented growth in tech – is a long-term mega-force disrupting the global economy, to the extent that it’s breaking historical trends in real time.

For instance, we estimate global spending on AI infrastructure – such as data centres, chips and the power systems required to fuel AI technology – could top US$700 billion, or 2% of US GDP, by 2030.5

Are valuations still fair?

Despite a huge couple of years for tech and US equities more broadly - the first time the S&P 500 Index has generated 20% returns for two consecutive calendar years since the late 1990s – Australian advisers remain optimistic about the sector’s prospects in 2025. Data from our first quarterly pulse survey conducted in Q4 2024 shows that most financial advisers believe tech will generate the strongest returns of any sector this year.

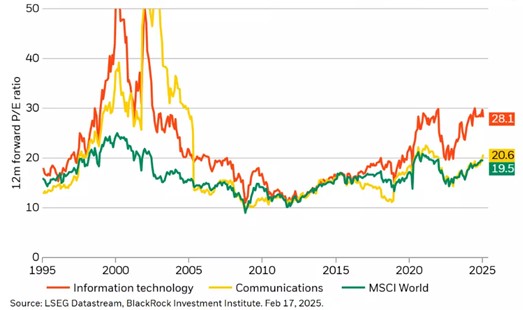

This may be because the economic fundamentals of the tech sector indicate we are still some way off a bubble. Taking a look at 12-month forward price to earnings ratios for the sector (see below chart), we can see that these are higher than the broader equities market, but significantly lower than the extremely stretched valuations that heralded the crash of the early 2000s.

Tech and communications forward P/E ratios

The question of over-investment by the big tech firms has also been raised, particularly given the recent release of DeepSeek’s seemingly more efficient AI model, which has seen NVIDIA6 in particular give back some gains from a price perspective.

We think investors need to take a long-term view on spending given AI’s potential to unlock new revenue streams – broad adoption of the technology is still to come, and we have barely scratched the surface of all the AI use cases. Recent developments with DeepSeek could push AI adoption sooner and ensure AI remains a key focus in US-China strategic competition, including any resulting US trade barriers.

Tapping into tech through the Global 100

ETFs with a high weighting to tech may be suitable for investors wanting to tap into the long-term growth opportunities offered by AI, while also building in broader diversification7 to other sectors. Opportunities to invest in technology through Australian equities are limited, with the sector making up just 3% of the ASX 200,8 so building out a broad global equity exposure with a tilt towards technology may make sense for investors with an existing portfolio of Australian shares.

The S&P Global 100 Index, tracked by IOO, offers an over 40% weighting to the tech sector. Companies in this index are selected for their global significance, deriving at least 30% of their revenue from outside their own geographic region and with a minimum market cap of US$5 billion.9

Generating an average annual return of more than 13% over 10 years, and with significant non-tech holdings including JPMorgan and Eli Lilly, IOO gives investors access to some of the largest economic ‘mega forces’ including the ageing population and the future of finance.10

Of course, the exact trajectory of the AI transformation is not yet certain, meaning there may be bumps along the way, so investors should always consider tech exposure as just one part of a broader, diversified portfolio. However, we think the investment arms race underway in the technology space makes this thematic a compelling part of portfolios in the years ahead.

- For illustrative purposes only. This is not a recommendation to invest in any particular financial product.

- Source: BlackRock Investment Institute/LSEG Datastream data, 20 January 2025

- Source: BlackRock data, 20 January 2025. Refers to calendar year 2024 data

- Source: BlackRock Investment Institute/LSEG Datastream data, 17 January 2025

- Source: BlackRock Investment Institute data, December 2024

- Subject to change. This is not a recommendation to invest in any particular product

- Diversification may not protect you from market risk

- Source: S&P Dow Jones as at 31 December 2024

- Source: S&P Dow Jones, 31 December 2024

- Source: BlackRock data as of 31 December 2024. The 2 stocks mentioned are the most significant non-tech holdings in the fund (within the top 10 holdings overall)

Product details

iShares Global 100 ETF (IOO)

https://www.blackrock.com/au/products/273428/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

Opinions are subject to change and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation.This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.