Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Employment falls, but don’t extrapolate given the part rate fell four tenths

Tapas Strickland | Markets Research Key points:

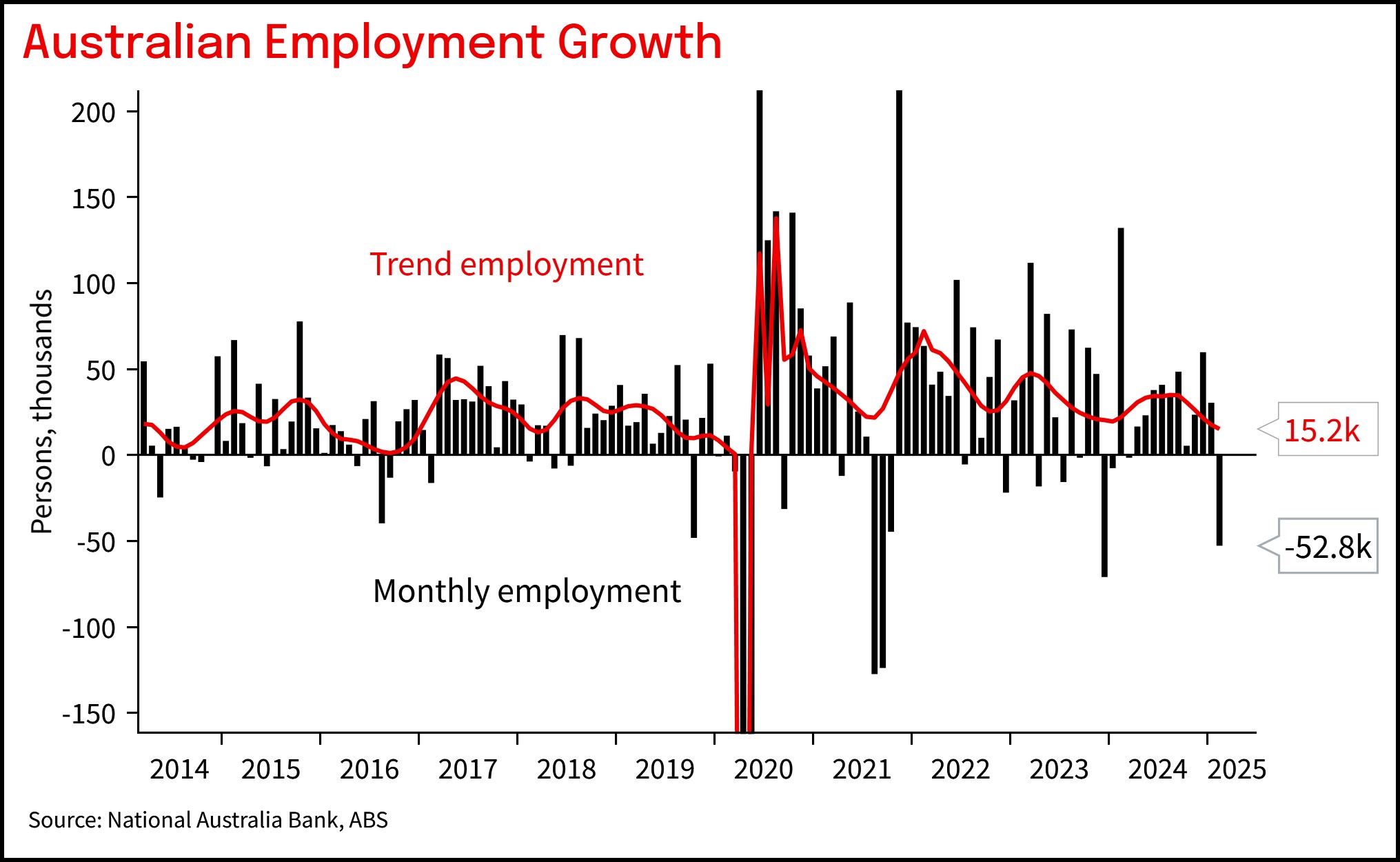

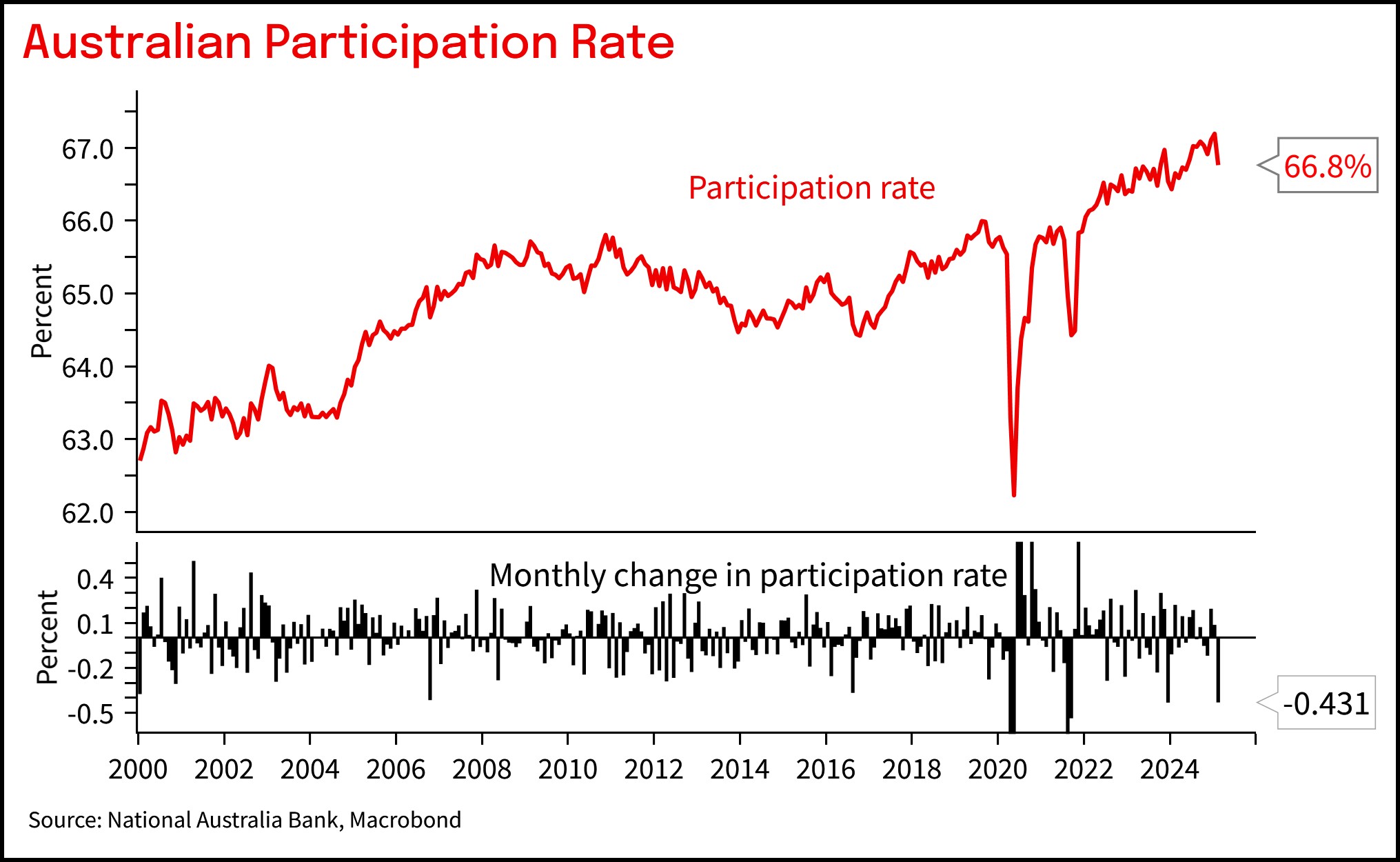

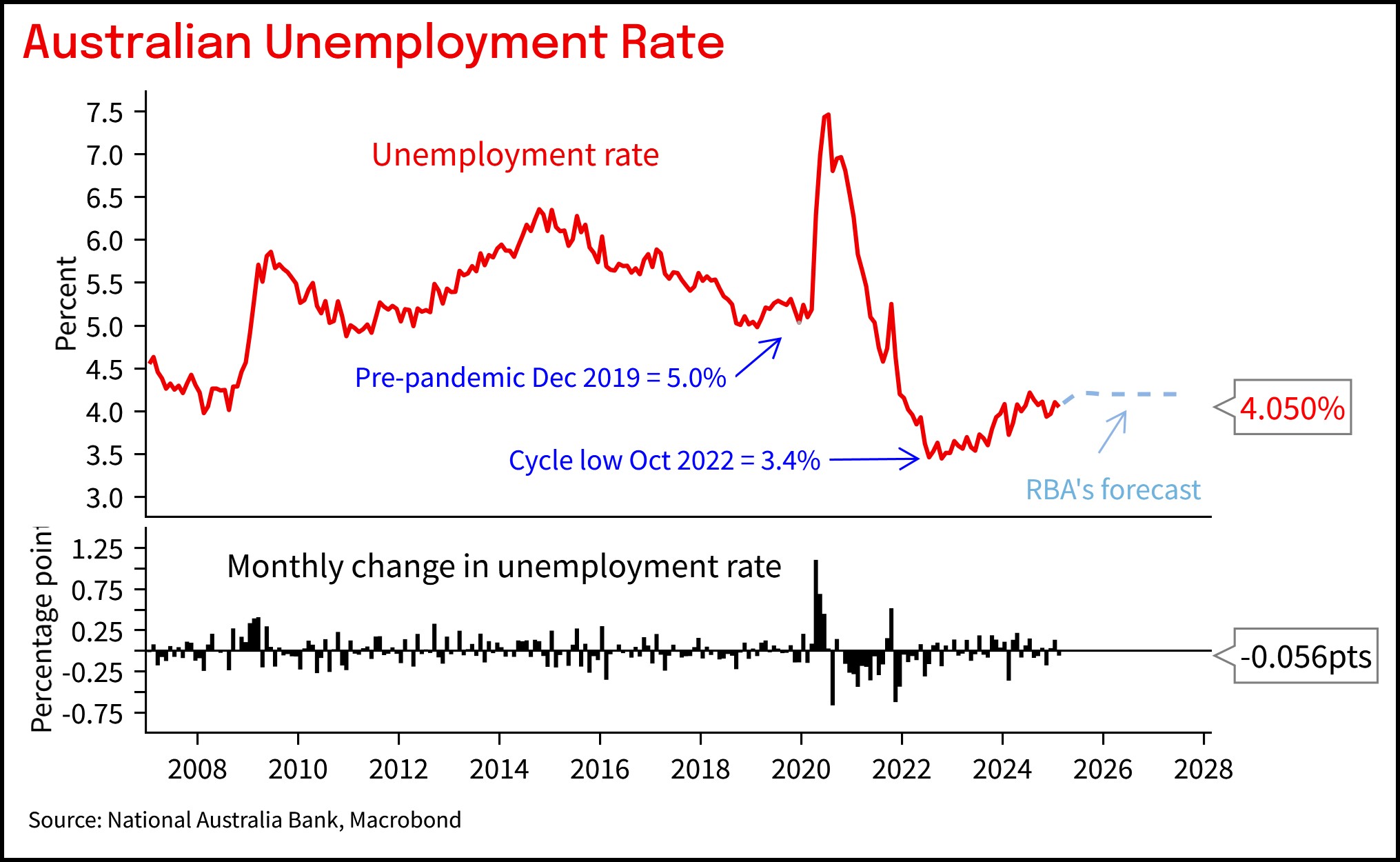

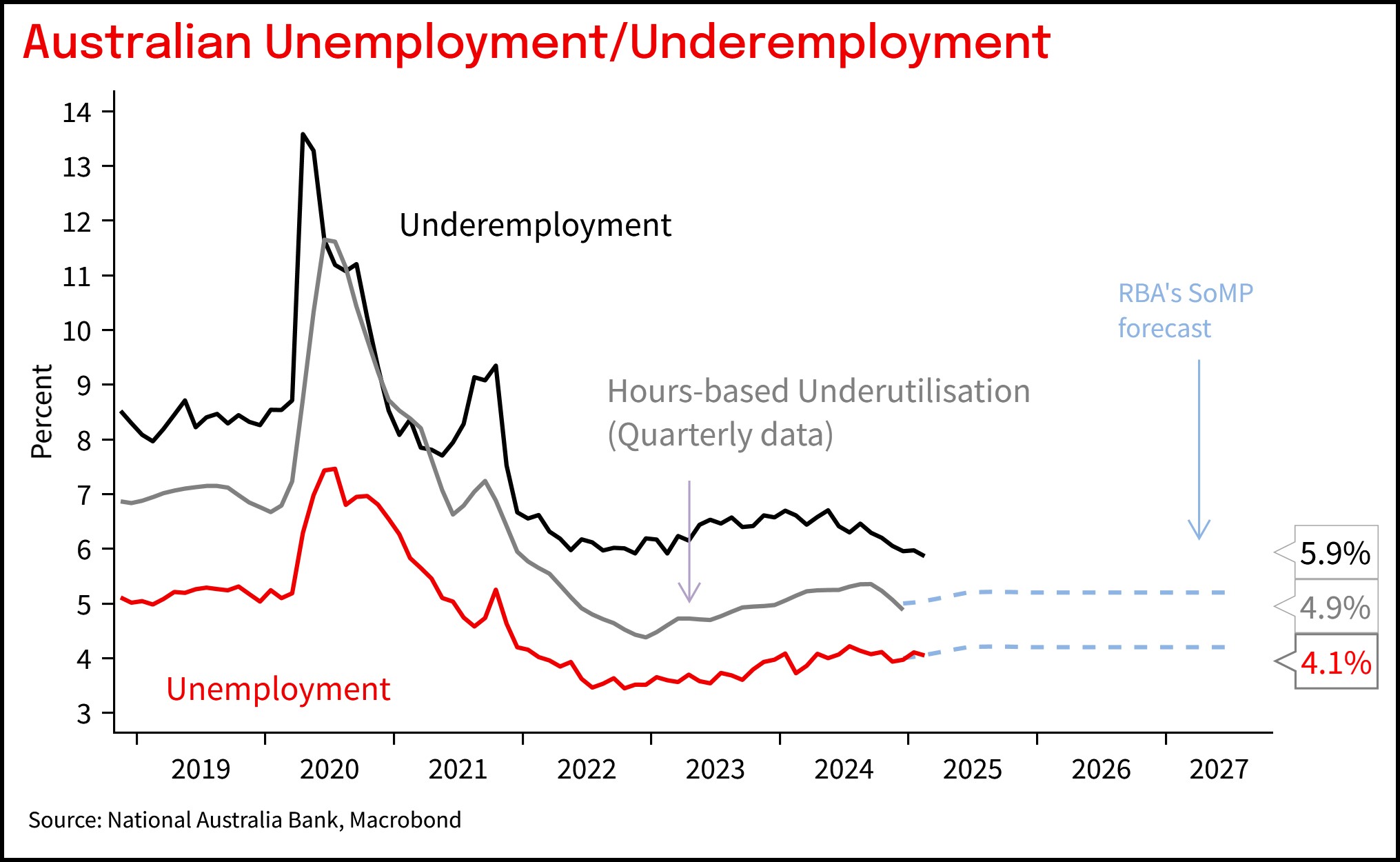

Details:Headline employment fell -52.8k in February against expectations of a +30k rise (NAB 45.0k). While certainly surprising, delving into the details suggest the fall in employment is more reflective of volatility rather than a change in underlying trends, with the participation rate falling four tenths to 66.8%. Prior sharp falls in the participation rate have generally reflected noise with the participation rate rebounding strongly in subsequent months. Hours worked fell 0.4% m/m. The unemployment rate was unchanged at 4.1%, though it did fall 0.056 points in unrounded terms (consensus 4.1%; NAB 4.0%). In trend terms the unemployment rate has been broadly stable at around 4.0% since November 2023 (ranging between 3.9-4.1%). The underemployment rate fell a tenth to 5.9%. When there are large changes in the participation rate, it is useful to cross check employment to the unemployment rate which tends to be less impacted. The ABS flagged flooding in Northern QLD in February 2025 as resulting in some disruptions, but overall, the assessment of the Statistician is that there had “not been an impact on the quality of estimates”. QLD employment did have an outsized fall of -22.9 m/m, though falls in employment were seen across all Australian states. Looking to March, the Statistician has also flagged possible impacts from Cyclone Alfred and from the subsequent flooding. The Statistician also noted: “Fewer older workers returning to work in February contributed to the fall in employment this month, with lower levels of employment in the older age groups in February 2025 compared with 2024. This follows higher levels of employment in these age groups in recent years, particularly in 2024, alongside growth in the employment-to-population ratio over the last few years”. It is unclear whether this is a genuine signal of the rate of retirement picking up, or again statistical volatility. ImplicationsWe do not see any major implications from today’s data for assessments of how tight the labour market is. The latest RBA SoMP forecast has the unemployment rate lifting and peaking at 4.2% in June 2025. The key question for the RBA, as Governor Bullock noted in her February Parliamentary Testimony, is whether the labour market is too tight to continue to bring inflation back down to target: “We still have, we think, a tight labour market, and let me absolutely say that this is a good thing—it's a good thing that people can get jobs. The question is: is it a little too tight to continue to bring inflation back down to the target and sustain it there? That's the million-dollar question. Some people think it is perfectly consistent; we're a little more wary. We think it's a little bit too tight, but we’re constantly re-examining our assumptions on this basis. We're constantly re-examining and looking for signs that it might be reflecting in prices. We're not seeing it yet but we're alert to it”. NAB expects the RBA will continue to build confidence that while the labour market is tight, it isn’t excessively tight so as to hamper a sustained moderation in inflation. However, given the RBA still views the labour market as “a little too tight”, it will take realised wages growth (WPI) and inflation (quarterly CPI) to make the case for further rate cuts. NAB continues to be of the view that the RBA will cut rates again in May. Our call thereafter is for three further rate cuts taking the cash rate to 3.1% by February 2026. A key risk to that view is that the labour market is tighter than our assessment, or that it potentially re-tightens alongside a pickup in activity. |

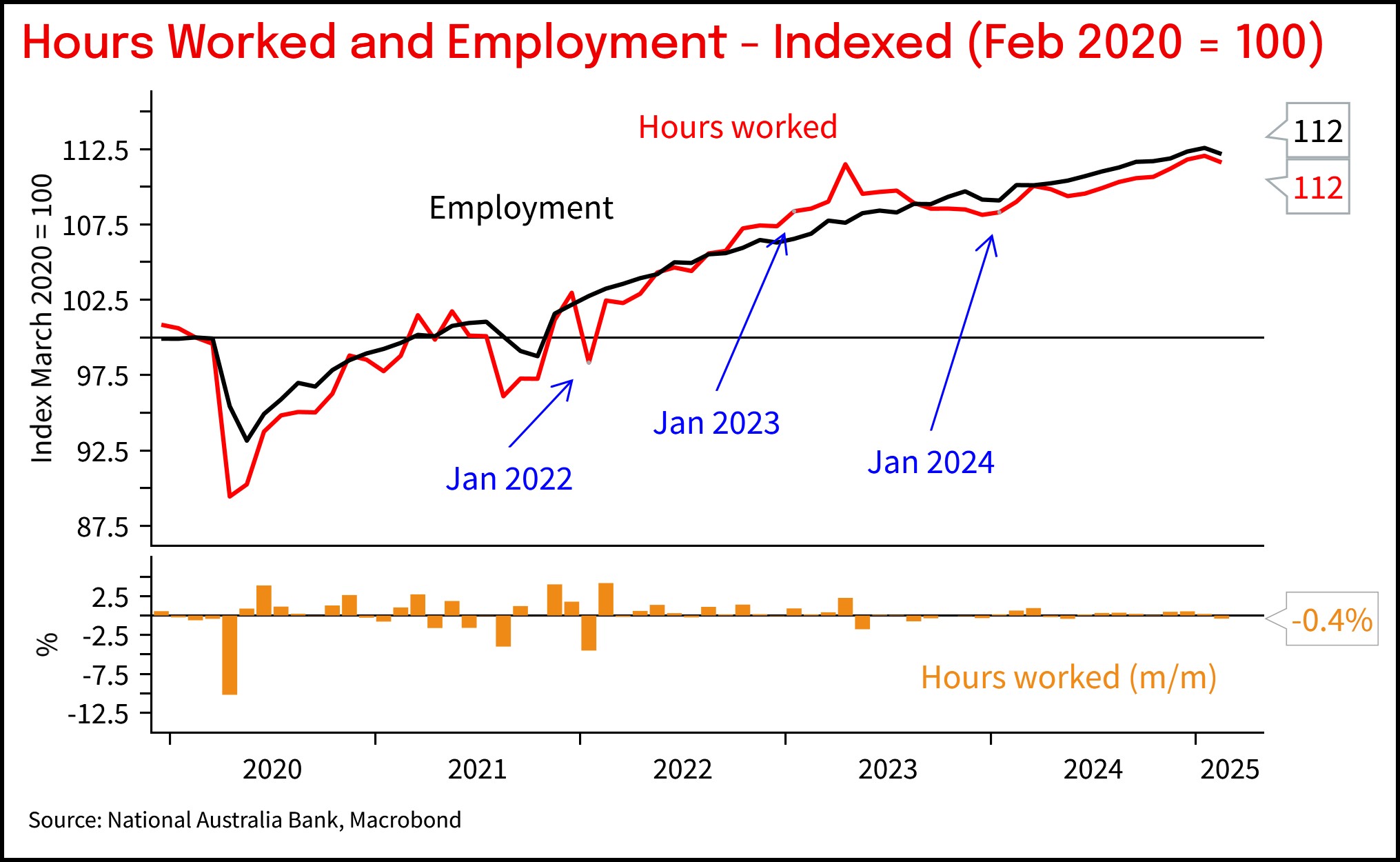

Chart 1: Employment fell

Chart 2: But so did the part rate

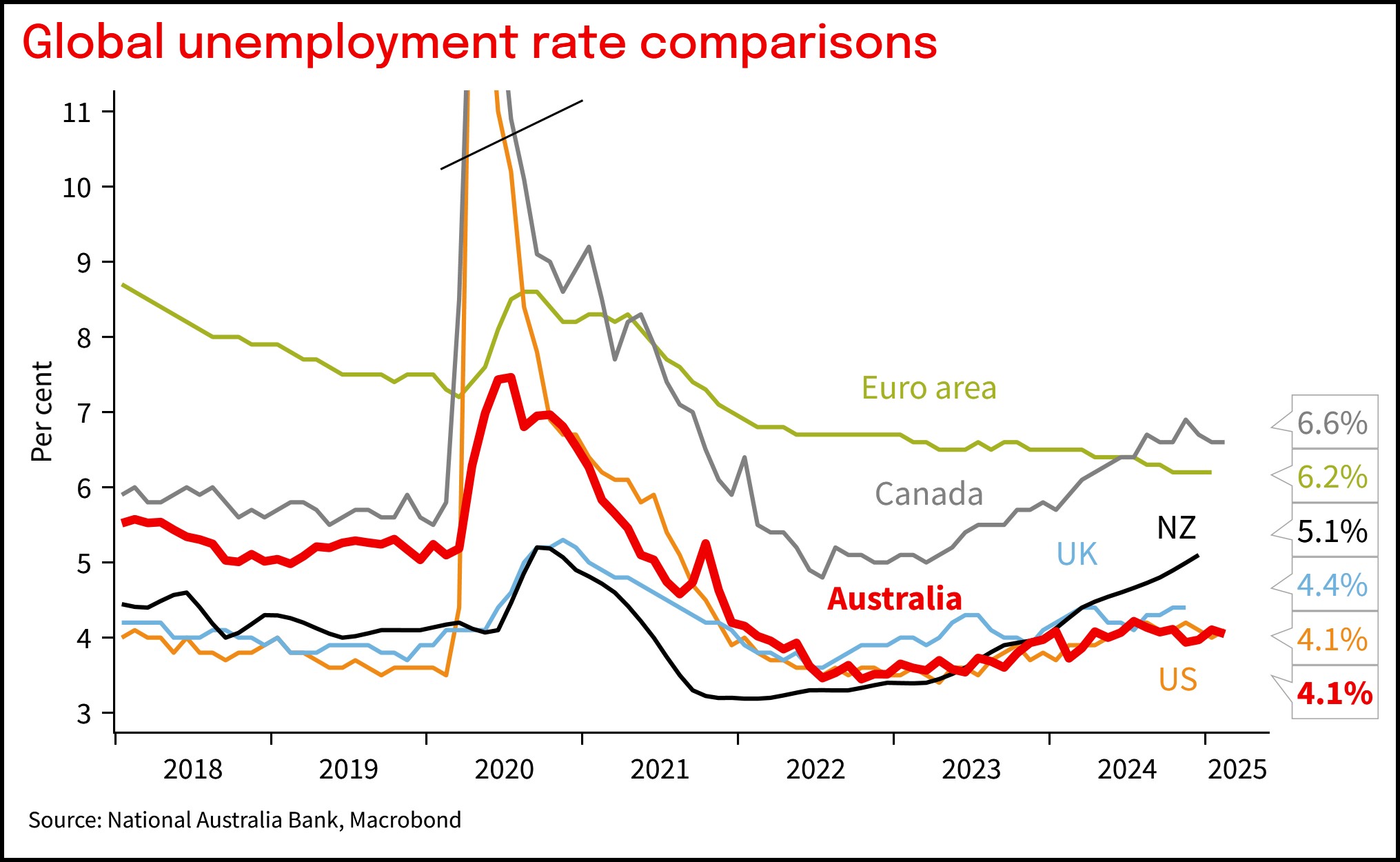

Chart 3: Unemployment rate fell in unrounded terms

Chart 4: Underemployment also fell

Chart 5: Hours worked fell in line with the fall in employment

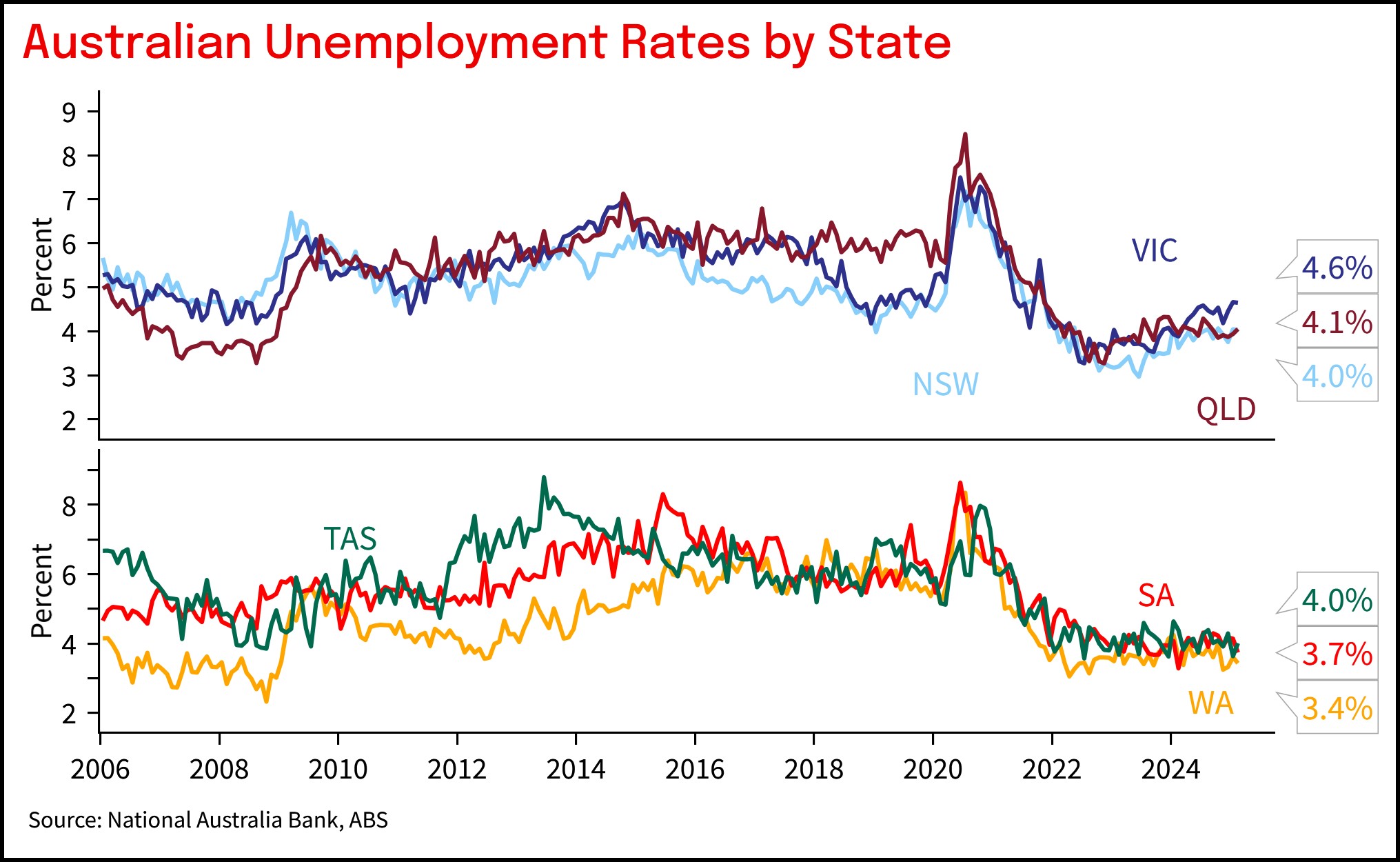

Chart 6: Victoria continues to have the highest unemployment rate

Chart 7: Australia's unemployment rate remains low compared to offshore

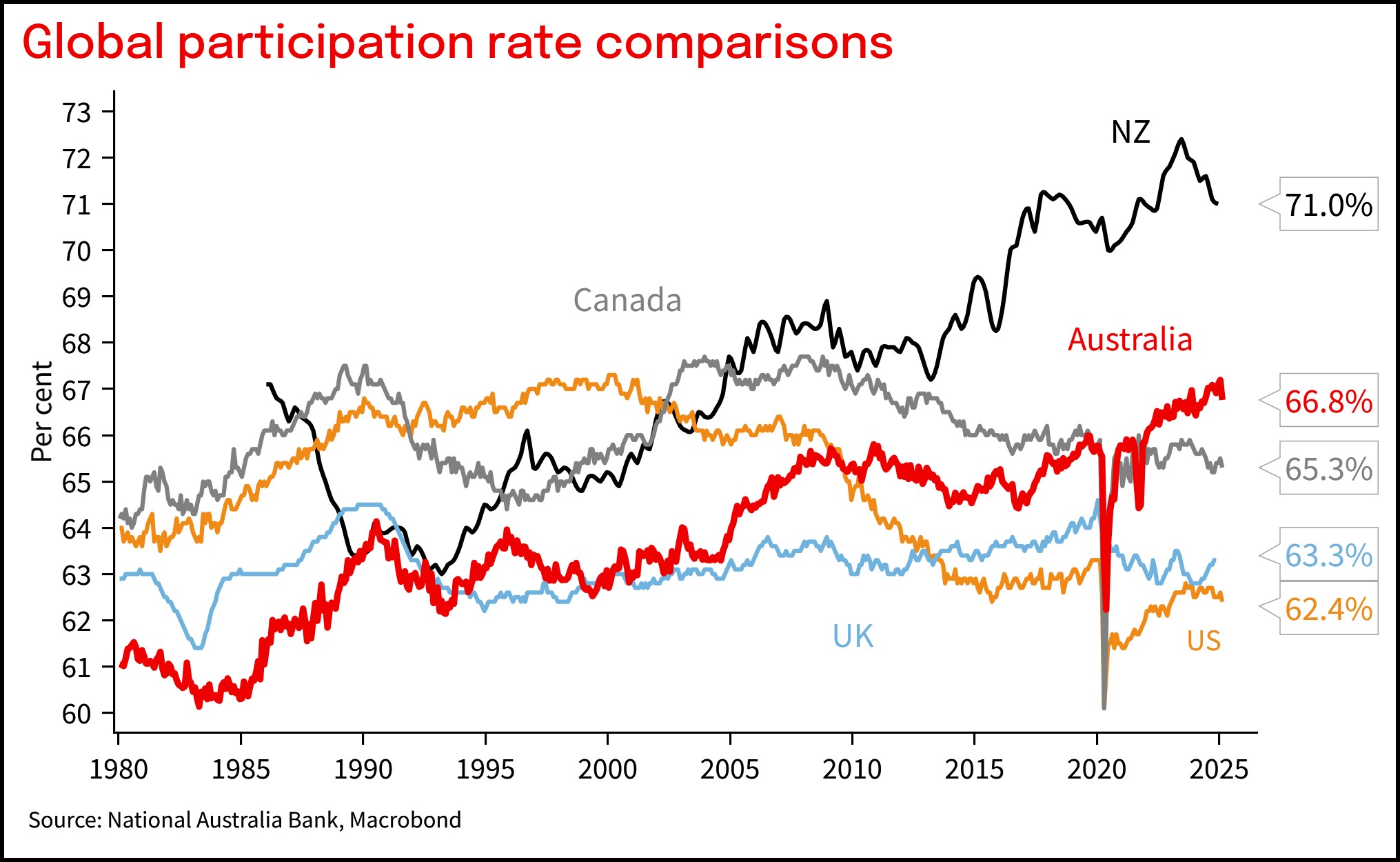

Chart 8: Part rate in Australia is higher compared to some other countries

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide. All prices and analysis at 20 March 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here. |