Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

RBA cuts rates as expected, forecasts suggest a mild easing cycle

Tapas Strickland | Markets Research

Key Points:

- RBA cuts rates by 25bps to 4.10% as widely expected with hawkish framing

- Trimmed mean CPI falls to 2.7% by June 2025 …

- …but flatlines at 2.7% y/y (above the mid-point) even as three more cuts are assumed

- NAB continues to see a gradual easing cycle, expecting the next rate cut in May 2025

- In total we expect four more cuts this cycle, taking the cash rate to 3.10% by early 2026

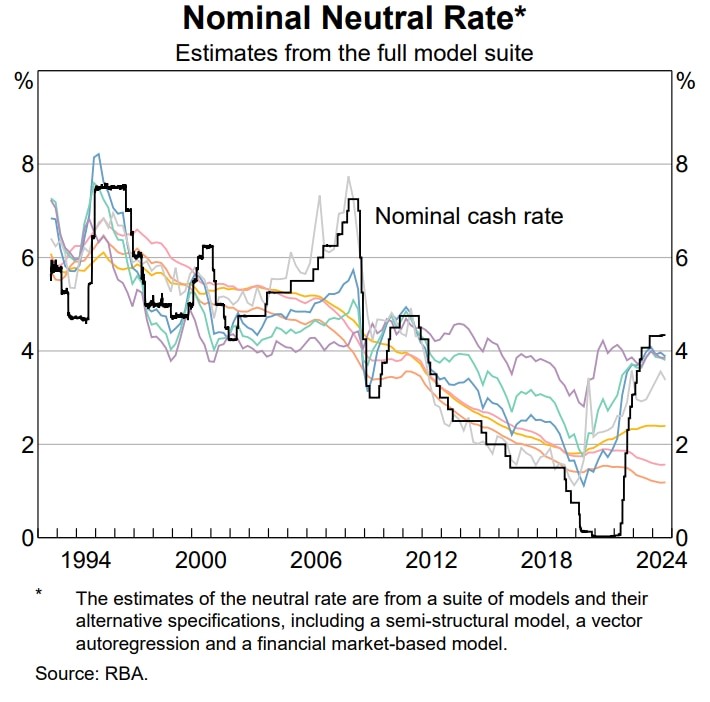

- Interestingly, some reference to some model estimates of neutral having been lowered

Details:

The RBA cut rates by 25bps today as widely expected. The framing was to a hawkish cut which was also expected. Forecast revisions were notable. The post-Meeting Statement noted “some of the upside risks to inflation appear to have eased and there are signs that disinflation might be occurring a little more quickly than earlier expected”. However, risks were seen as two sided and if policy is “eased too much too soon, disinflation could stall, and inflation would settle above the midpoint”.

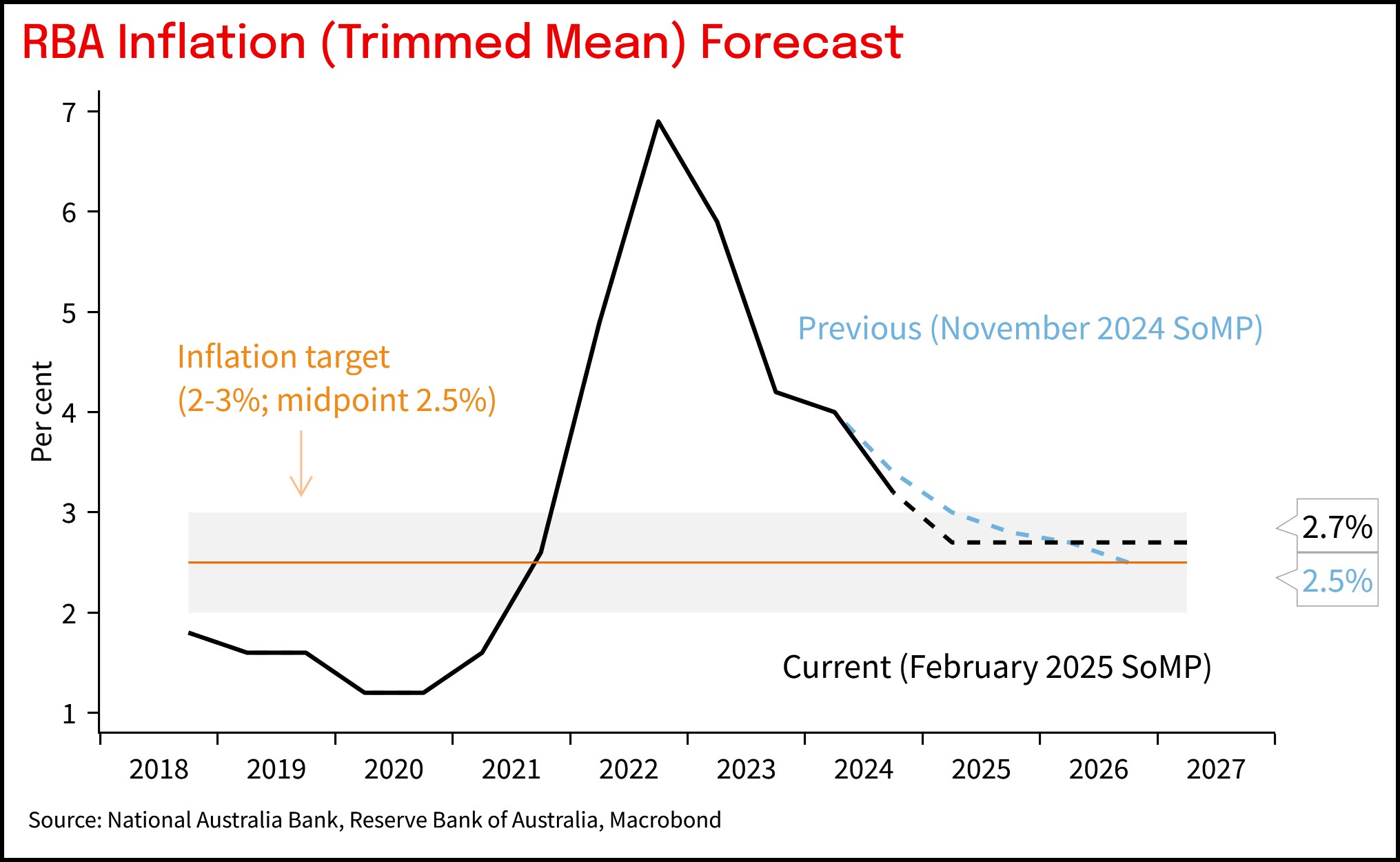

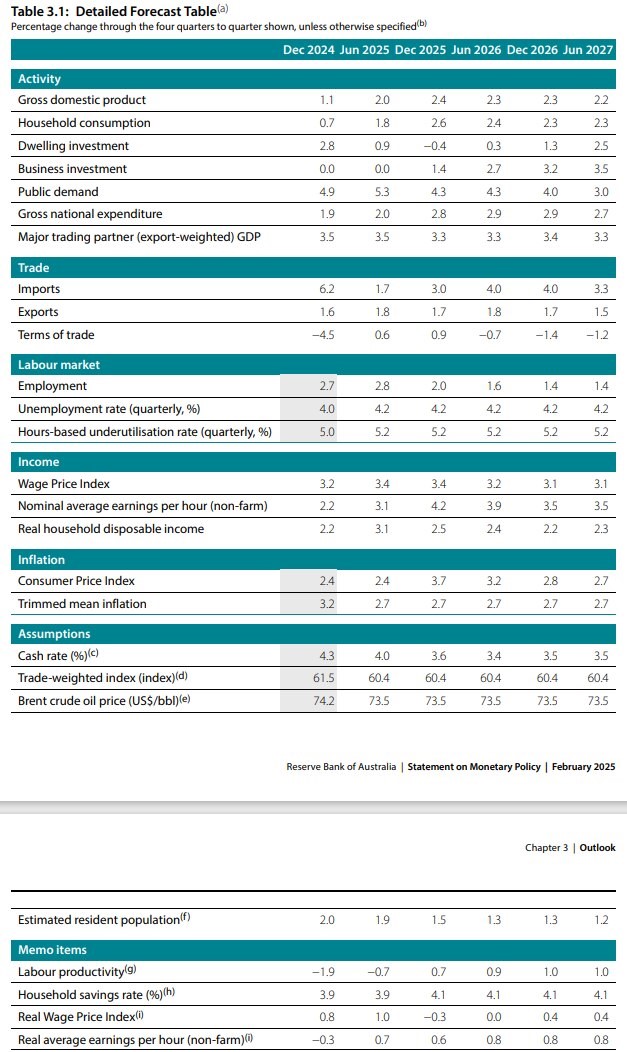

That two-sided risk was most evident in the forecasts. Trimmed mean inflation is now forecast to return to the 2-3% target band six months earlier, however it flatlines at 2.7% from mid-2025 (whereas in the November 2024 SoMP it was 3.0% in June 2025, and 2.8% in Dec 2025). This effectively means trimmed mean inflation does not reach the mid-point of the inflation target unlike the prior November SoMP forecasts which had pencilled a return to the mid-point by December 2026.

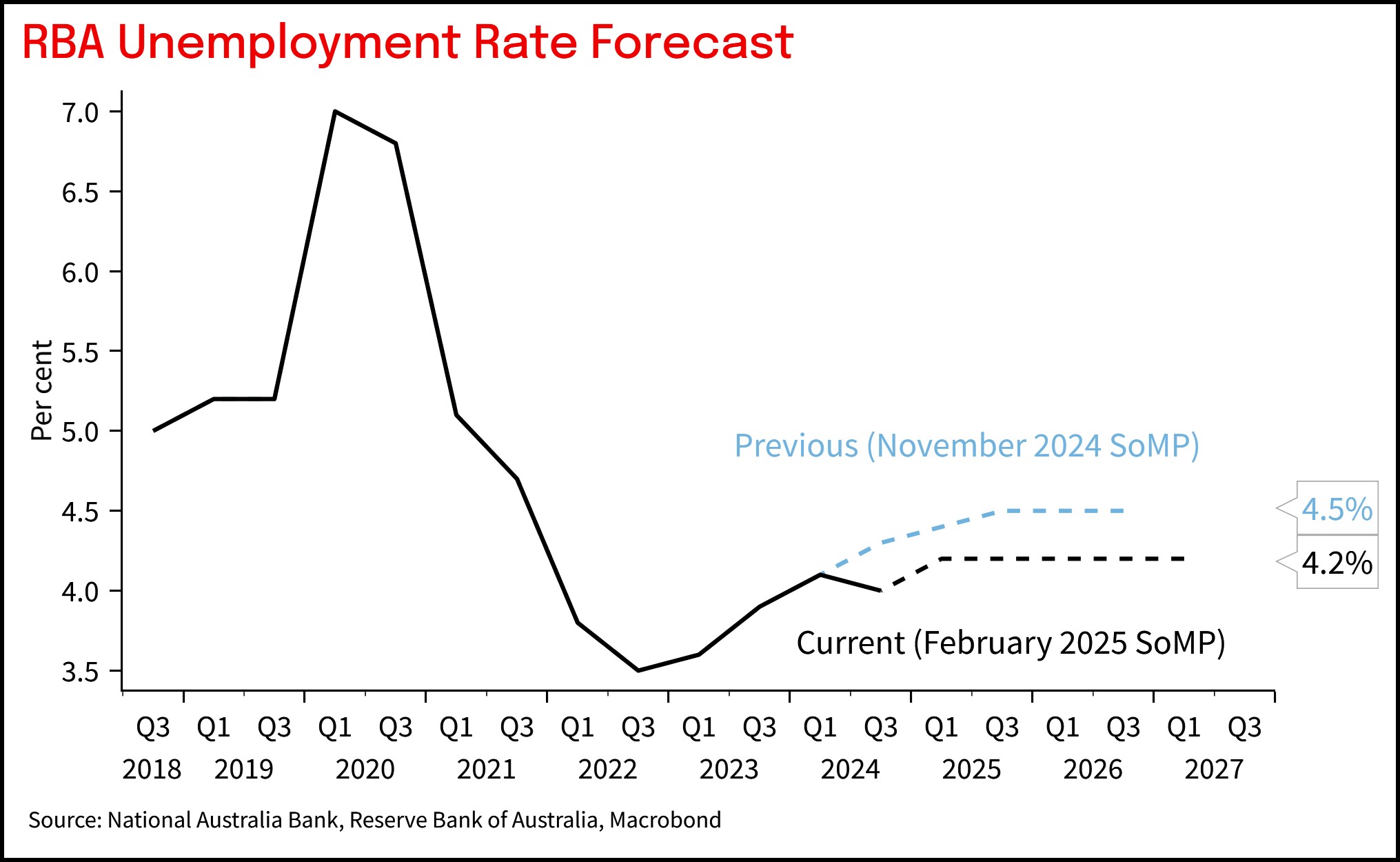

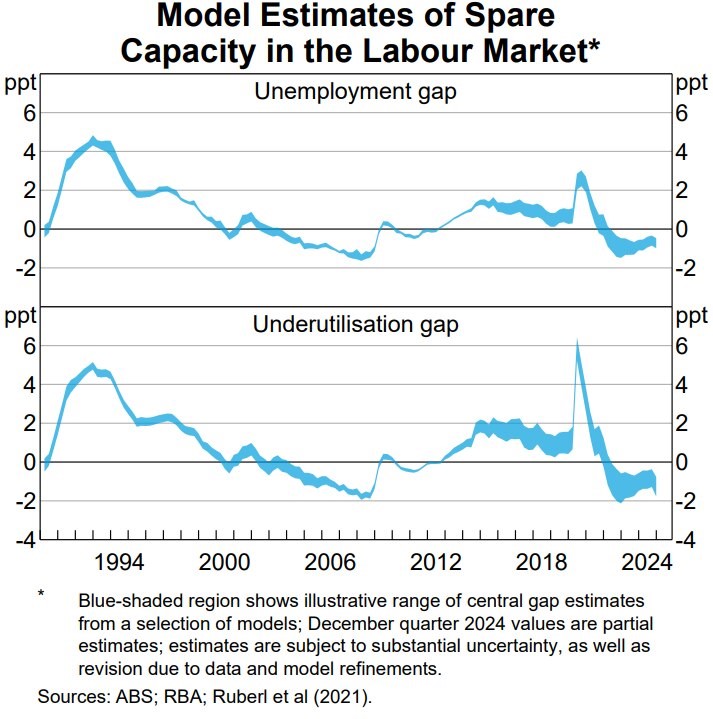

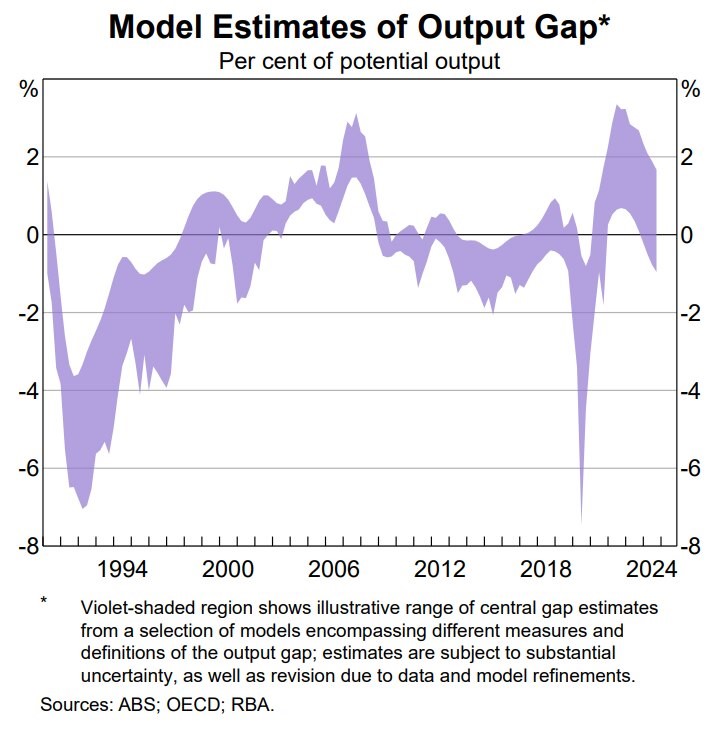

The other notable development is that the RBA has lowered its projection of the unemployment rate by three tenths, seeing unemployment peaking at 4.2% in June-2025 from a prior peak of 4.5% by December 2025. Supporting the inflation forecast further out in the horizon is that the central forecast is for labour market conditions to remain tight over the forecast period, although the RBA notes as a risk that they have overestimated excess demand in the labour market. Some of that risk has already been incorporated into downward judgement to their inflation forecast.. Indeed, the range of models based on Q3 GDP data has a narrowing, but still positive output gap.

The RBA still views monetary policy as being restrictive after the reduction in the cash rate. Interestingly, the RBA may have lowered their neutral estimates after refining how models account for the pandemic period. The re-calibration has led to a downward shift in some estimates of neutral. Finally in terms of GDP growth, forecasts were little changed apart from the near-term. Growth is expected to be 1.1% in December 2024 from a prior November 2024 SoMP forecast of 1.5%. Longer term growth thereafter returns to around 2.2-2.4%.

Chart 1: Core inflation back to target six months earlier, but doesn't reach the mid-point

Chart 2: Unemployment rate forecast has been lowered

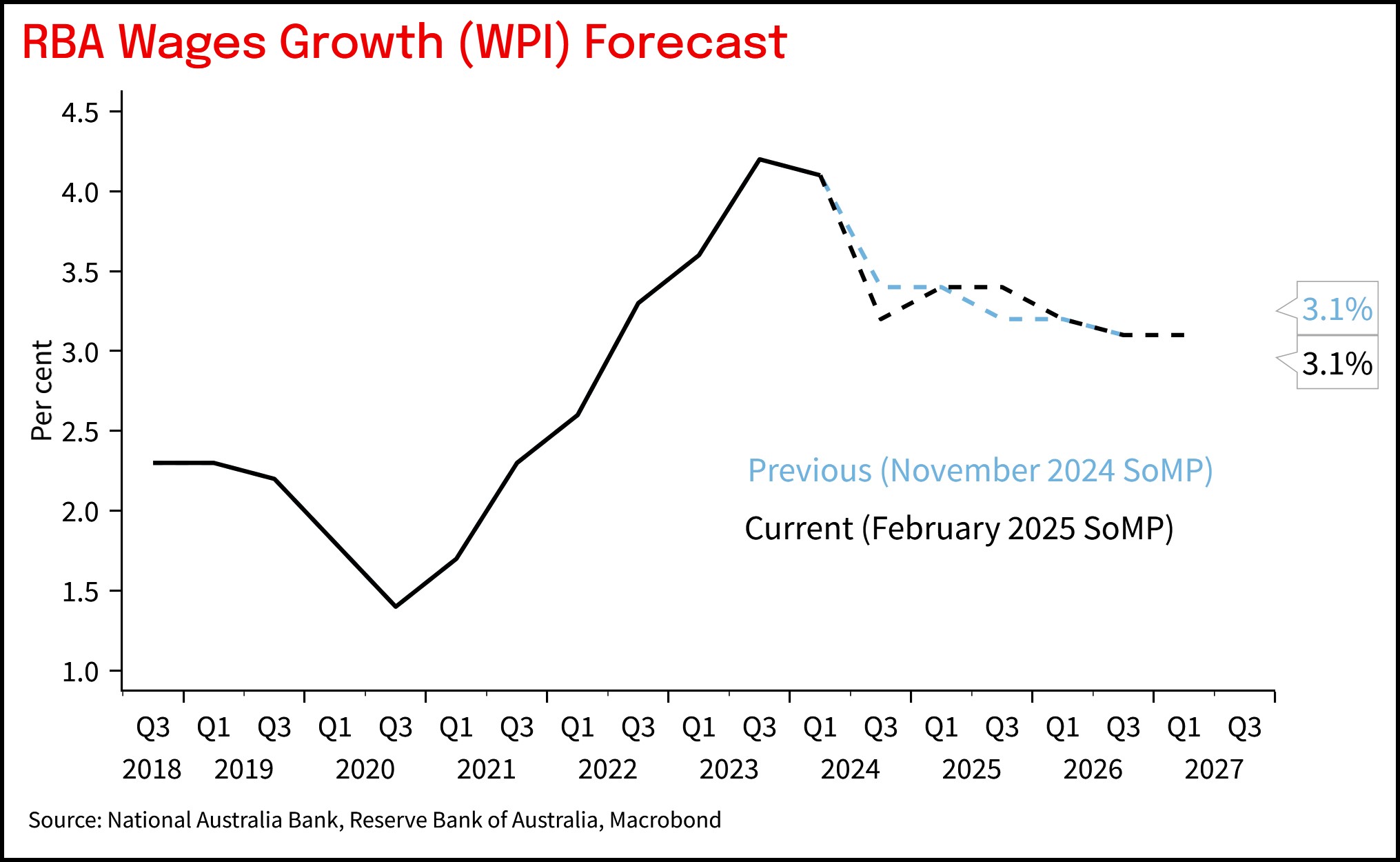

Chart 3: Wages forecasts broadly similar

Chart 4: Labour market still seen as tight

Chart 5: Output gap is closing, but is still positive

Chart 6: Some neutral rate estimates have been revised down

Chart 7: The RBA's key forecasts

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 18 February 2025. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.