Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Morgans' equity strategy insights and 11 key calls for February 2025

Andrew Tang | Morgans Financial

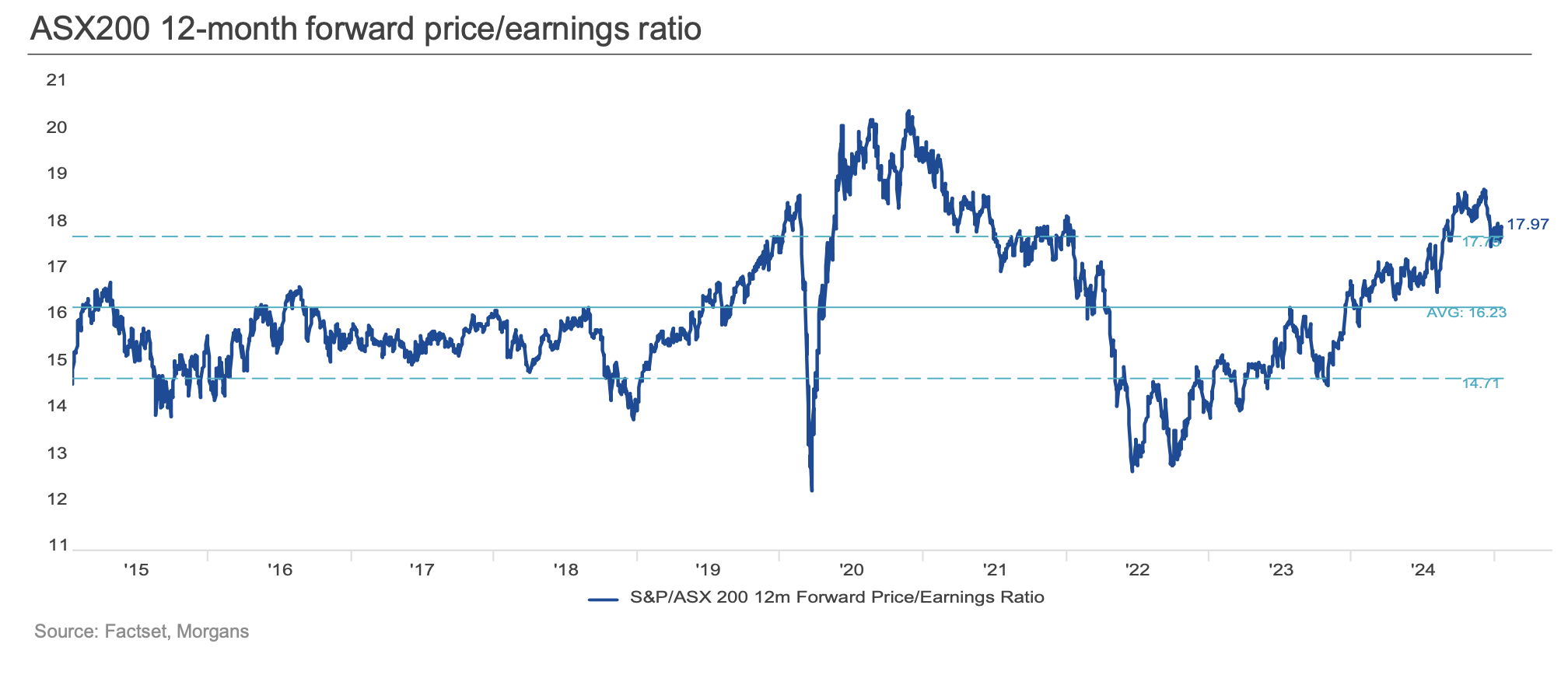

In 2024 the Australian equity market remained resilient despite headwinds from higher interest rates and cooling demand with the ASX200 Accumulation Index returning 11%. We expect earnings to grow 1.3% in FY25 and 7.1% in FY26. The market is trading at 18x forward earnings and will require evidence of positive earnings momentum to sustain another uptick in prices.

Andrew Tang, Morgans Financial

Andrew Tang, Morgans Financial

February in focus - adapting to a changing environment

With a modest earnings outlook companies have been forced to adapt to the softer trading environment. Our focus in February is on companies and sectors that continue to see margin resilience and positive earnings trends.

Large caps is another area to monitor given historically high valuations and strong performance over the past 12 months. Last August demonstrated that high expectations and in-line results might not be enough. The recent swing in the AUD will also complicate FY25 earnings and those exposed to currency fluctuation could see earnings volatility around the result.

Our key calls include Computershare (ASX: CPU), Guzman y Gomez (ASX: GYG), Lovisa (ASX: LOV), Megaport (ASX: MP1), Pinnacle Investment Management (ASX: PNI) and Superloop (ASX: SLC).

Elevated multiples leave little margin for error

ASX 200 12-month forward price/earnings ratio (Source: Factset, Morgans)

ASX 200 12-month forward price/earnings ratio (Source: Factset, Morgans)

The ASX200 is trading at a premium to its 10-year average valuation. With earnings slowing in aggregate, valuations appear to have less room for error this season, even with the distortion the major banks have on aggregate metrics. We think stock and sector-specific opportunities are best placed to succeed over ASX200 benchmark strategies.

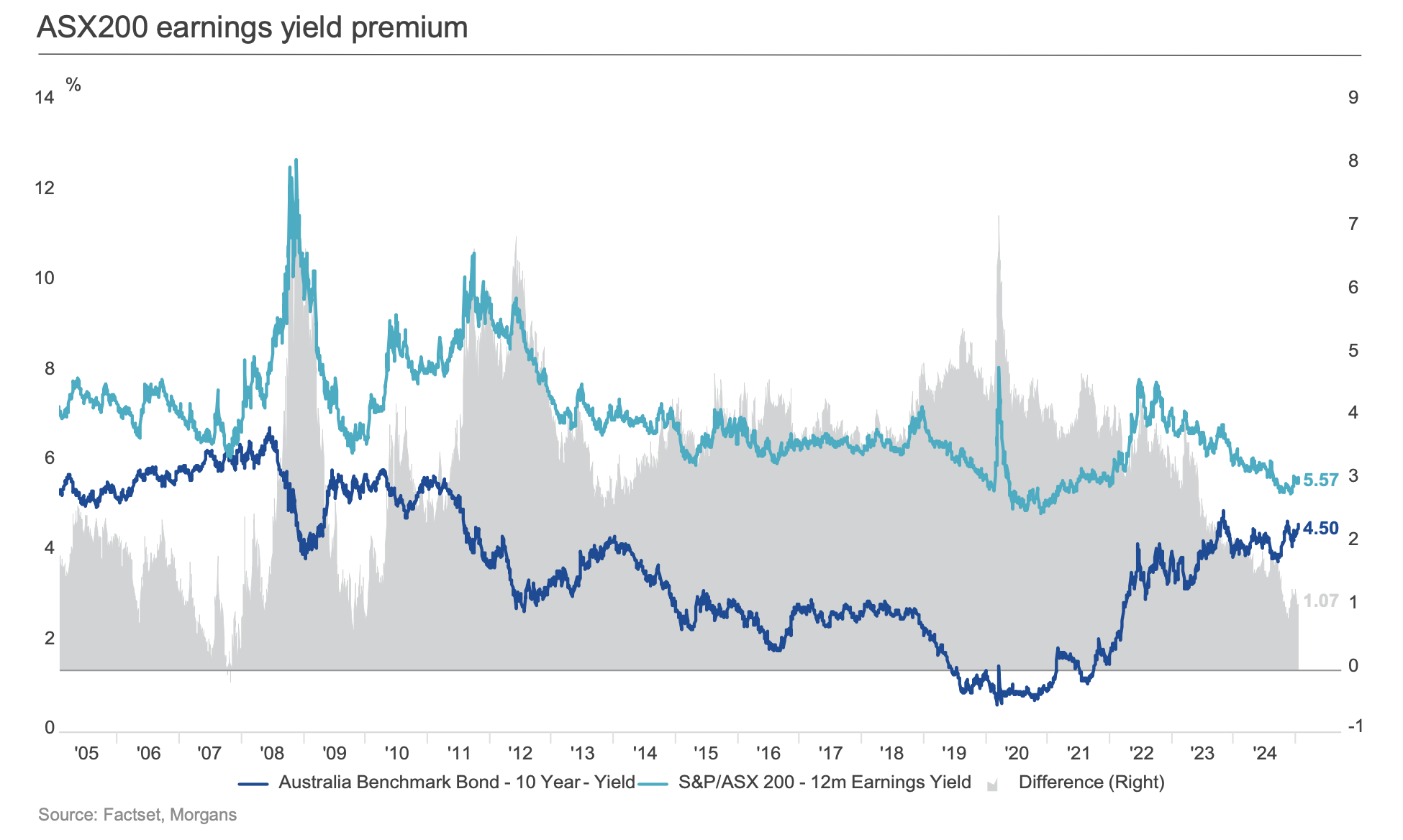

Limited compensation for equity risk

ASX200 earnings yield premium (Source: Factset, Morgans)

ASX200 earnings yield premium (Source: Factset, Morgans)

Investors' compensation for taking on equity risk continues to look slim versus higher risk-free income. Equities appear to be pricing in a better-than-expected outlook for earnings, or the start of an aggressive RBA interest rate cutting cycle. We’re cautious that companies that fail to deliver on high valuations will be punished.

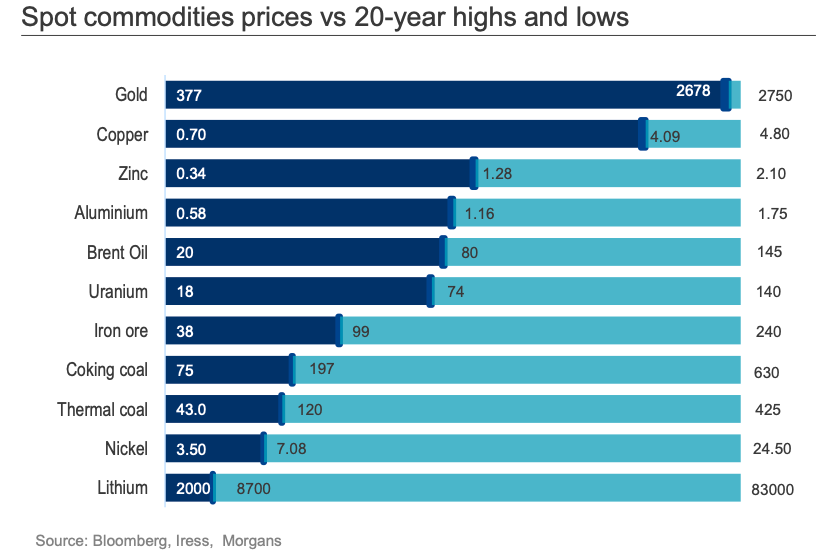

Commodity prices look to be trading slightly below 'mid-cycle' levels

Spot commodities prices vs 20-year highs and lows (Source: Bloomberg, Iress, Morgans)

Spot commodities prices vs 20-year highs and lows (Source: Bloomberg, Iress, Morgans)

A confluence of nearer-term cyclical headwinds held back commodity market performance through 2024. These included Chinese economic uncertainty and concerns about the impact of Trump’s proposed tariff regime on global trade. Despite this, structural tailwinds into the medium term remain compelling. These include strong demand for the building blocks of global energy transition versus persistent supply-side constraints in the global mining industry.

US dollar headwinds have surprised

The strong surge in the US dollar since the US Presidential election, linked to stickier-than-hoped inflation and emerging US protectionism, has also proven to be a major headwind for commodities. We believe that strong forecast growth in the US budget deficit will catch up to currency markets in 2025, and that the roll-over of the USD could re-stimulate commodity markets in the year ahead.

Sentiment yet to turn around but it’s only a matter of time

Despite showing some signs of life post China stimulus in 2024, investor interest in the ASX resources and energy sectors continues to lag the broader market and particularly the banks. Potential triggers of a reversion in sector interest in 2025 include:

1. momentum in US rate Cuts;

2. downward inflection in the USD; and

3. better clarity on Trump’s trade tariff agenda.

Our preferred exposures on current weakness include BHP (ASX: BHP), Sandfire (ASX: SFR), South32 (ASX: S32), Whitehaven (ASX: WHC) and Woodside (ASX: WDS).

This commentary is an extract of the Morgans Reporting Season February 2025 Playbook

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 10 February 2025. This document was originally published on Livewire Markets website on 10 February 2025. This information has been prepared by Morgans Financial Limited. (A.B.N 49 010 669 726 )(AFSL 235410).The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.