Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

What’s driven the fall in the Australian Dollar?

Dr Shane Oliver | AMP

Currency markets are well known to be volatile – as there is no clear agreement on how to value them and they are vulnerable to international shocks and shifts in investor sentiment. Changes in the value of the Australian Dollar are important as they impact Australia’s export competitiveness and the cost of imports, including that of overseas holidays. For investors they directly impact the value of international investments and indirectly impact the performance of domestic assets via the impact on competitiveness.

Unfortunately, currency forecasting is a bit of a mugs game to which John Kenneth Galbraith’s observation in relation to economic forecasters that there are “those who don’t know and those who don’t know that they don’t know” may apply.

So, it should not be surprising the value of the Australian Dollar continues to surprise. Six months ago, when the Australian Dollar rose to $US0.67, we thought it would go higher for various reasons including that it was slightly undervalued and interest rate differentials looked likely to shift in favour of Australia. As it turns out it did go higher, rising above $0.69 in September. But then it fell sharply, recently reaching a low of $US0.615.

This in turn has led to concern about a boost to inflation and the RBA being less able to cut interest rates and possibly having to raise rates. This note looks at what’s driven the fall, the outlook and its implications.

Why has the Australian Dollar fallen since September?

The fall in the value of the Australian Dollar reflects a combination of three things:

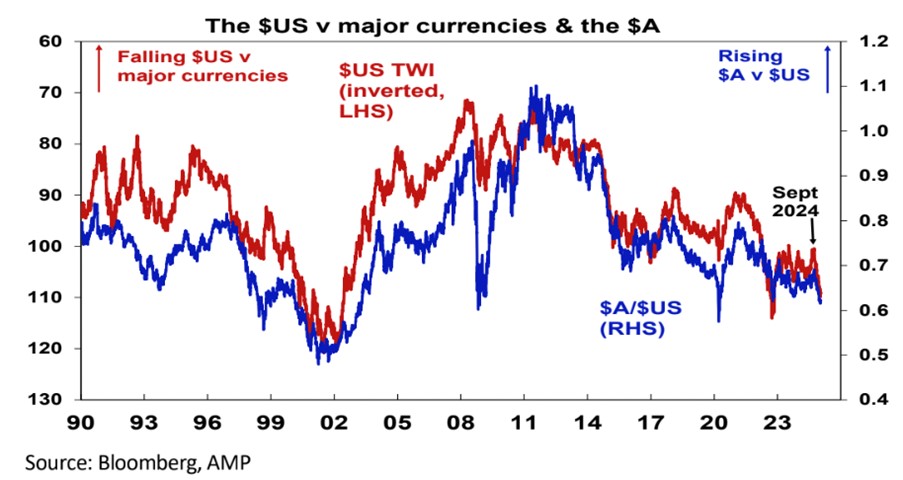

- The return of Trump – support for the Democrats peaked around late September/early October and so markets moved to price in the rising probability and then reality of his return to the presidency. Since his policies – tax cuts and deregulation which could boost US productivity, tax cuts which could add to the US budget deficit and result in tighter Fed policy, and tariffs – all imply a stronger US dollar this is what we have seen with the $US rising around 9% against a basket of major currencies from its September low.

- A hawkish pivot by the Fed versus the RBA – whereas the Fed cut rates in December to 4.25 to 4.5% it signalled less cuts than previously expected through 2025 whereas confidence has grown that the RBA will start to cut rates. As a result, the interest rate gap between the Australia and the US is expected to deteriorate in contrast to previous expectations for an improvement. Historically the $A goes up when the Australian interest rates rise versus US rates and vice versa.

Source: Bloomberg, AMP

Source: Bloomberg, AMP

- Finally, concerns about the outlook for the iron ore price, Australia’s biggest export, rose after disappointing stimulus announcements in China and fears that US tariffs on China could reduce demand for Australian commodities – that said iron ore prices and wider commodity price indexes are above their September lows suggesting commodities have not really been a major driver of the fall in the Australian Dollar.

So, the fall since September is mainly a strong US dollar story rather than a weak Australian Dollar story as since September the Australian Dollar fell around 10% but the US Dollar rose around 9% as other major currencies also fell against the US Dollar.

Will the fall add to inflation and hamper RBA rate cuts?

It’s not the RBA’s role to defend the Australian Dollar or maintain it at a particular level - otherwise it would defeat the whole purpose of having a flexible exchange rate which is to provide a shock absorber to events that threaten our growth outlook – like less demand for our exports. But it’s fall will be of some concern to the RBA in terms of the risk that it poses to inflation as a fall in the value of the Australian dollar by boosting import prices could add to inflation. However, there are several reasons why the RBA is unlikely to be too concerned.

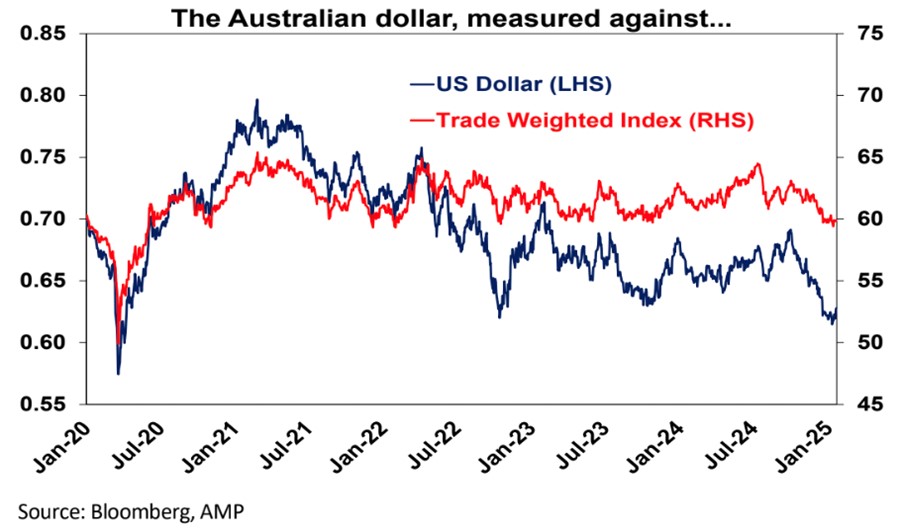

- Firstly, while the Australian Dollar has had roughly a 10% fall from September against the US Dollar, other countries’ currencies have also had sharp falls against the US Dollar so the value of the Australian Dollar on a trade weighted basis is only down by around 5% over the same period which is neither here nor there in terms of the impact on in inflation.

- Secondly, on a trade weighted basis the Australian Dollar is in basically the same range it’s been in for the last four year now. And with President Trump holding off from Day One tariffs and opting instead for a US government review of them and a “more negotiating approach” with China (according to a Bloomberg report) the range appears to be holding with the Australian Dollar bouncing slightly from oversold levels.

- Thirdly, with consumer spending depressed it’s hard to see businesses being able to pass on higher import prices anyway – beyond higher petrol prices and international travel – without depressing demand. So, it’s hard to see a significant boost to the inflation outlook from the fall in the Australian Dollar so far and so the RBA shouldn’t be too concerned - albeit I have no doubt it will mention it in upcoming communications.

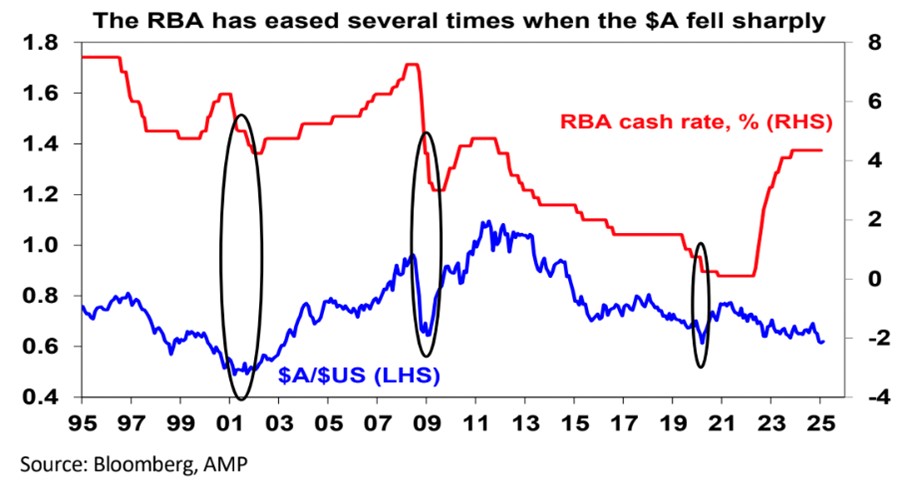

It’s worth noting that the $A plunged in 2001 (to $US0.48); 2008 (from $US0.98 to $US0.60 in 3 months) and in the pandemic (to $US0.57) and yet the RBA eased on each occasion with other factors dominating!

In short, while the fall in the $A will concern the RBA we don’t see it as being enough to stop the RBA from cutting rates ahead. Ultimately, the rates decision next month will come down to December quarter inflation data to be released next week. If trimmed mean inflation comes in at 0.6% quarter-over-quarter or less as looks likely as against implied RBA expectations for a 0.7% quarter-over-quarter rise, it will be very hard for the RBA not to cut in February.

Despite the slide, there are several positives for the Australian Dollar

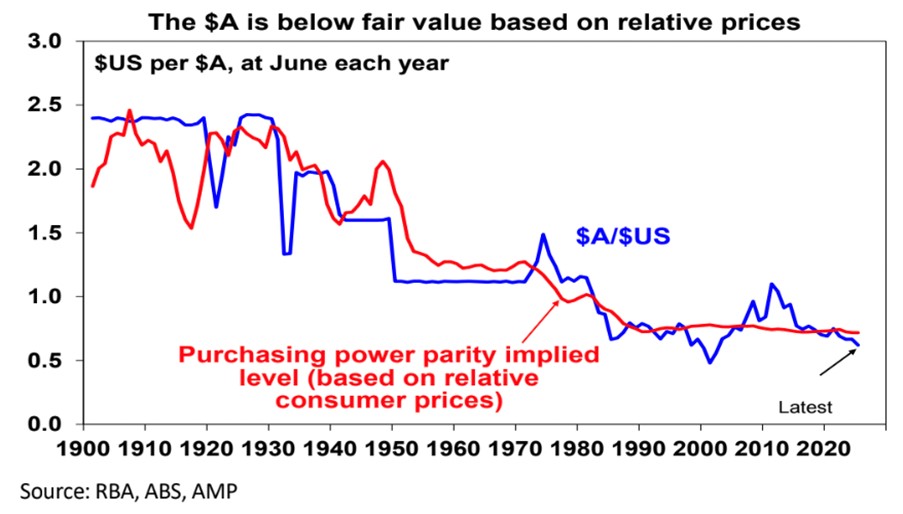

Firstly, from a long-term perspective, the Australian Dollar remains cheap. The best guide to this is what is called purchasing power parity (PPP) according to which exchange rates should equalise the price of a basket of goods and services across countries (the red line in the next chart). If over time Australian prices and costs rise relative to the US, then the value of the Australian Dollar should fall to maintain its real purchasing power and vice versa if Australian prices fall versus the US.

Consistent with this, the Australian Dollar tends to move in line with relative price differentials over the long-term. Right now, it’s cheap at around $US0.63 compared to fair value around $US0.72 on a purchasing power parity basis.

Second, sentiment towards the Australian Dollar is negative, reflected in short or underweight positions. Many of those who want to sell the Australian Dollar may have already done so and Trump’s return may already be factored in, and this leaves it susceptible to a rally if there is any good news.

Finally, commodity prices look to be embarking on a new super cycle. The key drivers are the trend to on-shoring reflecting a desire to avoid a rerun of pandemic supply disruptions and increased nationalism, the demand for clean energy and increasing global defence spending all of which require new metal intensive investment compounded by global underinvestment in new commodity supply.

Where to from here?

In the short term, the Australian Dollar is bouncing from oversold levels (and the US Dollar

falling from overbought levels) as Trump’s return was largely factored and so far his bite has been less than his bark.

Over the next 12 months, it’s likely to be buffeted between changing views as to how much the Fed will cut relative to the RBA and how far Trump goes on tariffs (so far so good – but there is a way to go yet as Trump is still saying tariffs are coming) versus potential positives of undervaluation, negative sentiment and maybe more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside if Trump acts more aggressively on tariffs.

Implications for investors

While the fall in the value of the Australian Dollar will add to the cost of petrol and overseas travel (mostly to the US) and could constrain the RBA in cutting rates, although we don’t think this will be significant, there is a silver lining to the cloud in that the fall has boosted the value of (unhedged) international assets so it has enhanced returns in global shares.

This highlights the benefits of having a well-diversified investment portfolio across both assets and also across currencies.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 21 January 2025. This document was originally published in 21 January 2025. This information has been prepared by AWM Services Pty Ltd (ABN 15 139 353 496)(AFSL No. 366121), part of the AMP Group. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.