Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Core infrastructure investments: Stability and growth potential

Ben McVicar | Magellan

Infrastructure serves an important role in a diversified portfolio. First, it is a real growth asset, providing inflation-adjusted growth that allows investors to build wealth over time. Second, infrastructure assets, when selected thoughtfully, offer meaningful downside protection as earnings from infrastructure assets are less economically sensitive than broader equities.

These are businesses delivering essential services – such as water, electricity, roads and communication networks – that experience stable demand even during economic downturns, unlike businesses in more cyclical industries.

Overview of 2024 performance

The asset class delivered robust returns in 2024, reflecting renewed investor interest. This strong performance followed more subdued performance in recent years as markets absorbed rapidly rising interest rates, which tend to weigh on the valuation of longer-duration defensive asset classes like infrastructure. In 2024, however, market expectations for interest rates began to stabilise. Many central banks in developed markets reduced policy interest rates for the first time since inflation spiked in the post-pandemic period. This created a favourable environment for infrastructure assets. Additionally, intermittent concerns about the global economic outlook during the year led investors to gravitate back to the defensive characteristics of infrastructure, further supporting the asset class.

A standout performer within the sectors was utilities, which saw particularly strong gains. Utilities cover services like water, gas and electricity. These assets, even within the defensive assets of infrastructure, stand out for their defensive qualities. While the underlying earnings were generally in line with expectations, the market re-rated these businesses strongly due to the defensive growth qualities and undemanding valuations.

What to expect in 2025 from the asset class

Infrastructure is well-positioned to return to delivering expected annual returns of CPI + 4–5%. This aligns with its historical performance, supported by both structural growth drivers and defensive qualities. While recent years have seen pressure from spiking inflation and therefore rapid interest rate increases, this trend is, on balance, expected to abate in 2025.

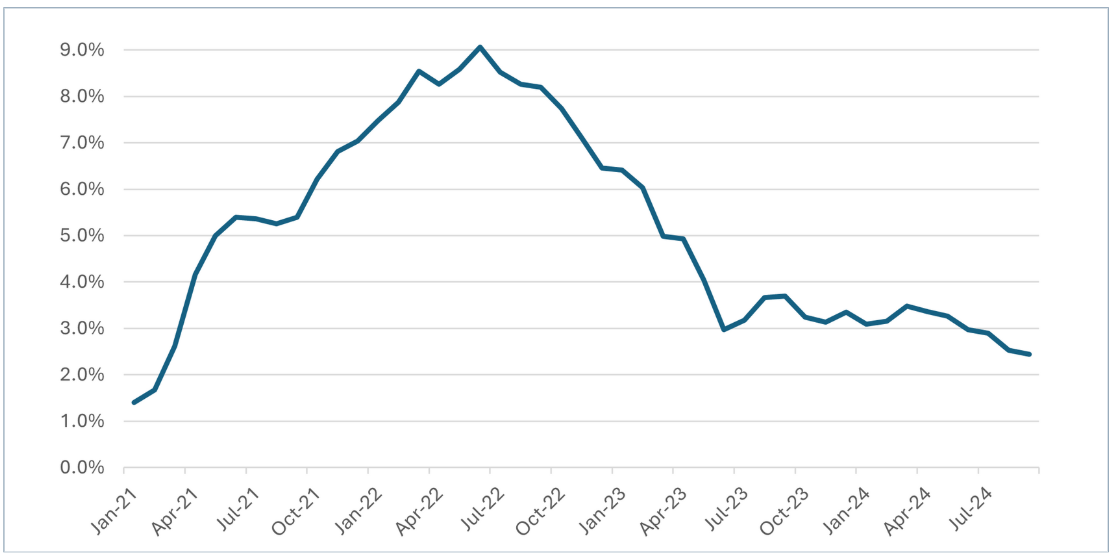

Figure 1: US Headline CPI, year-on-year.

Figure 1: US Headline CPI, year-on-year.

Source: Bloomberg, US Bureau of Labor Statistics

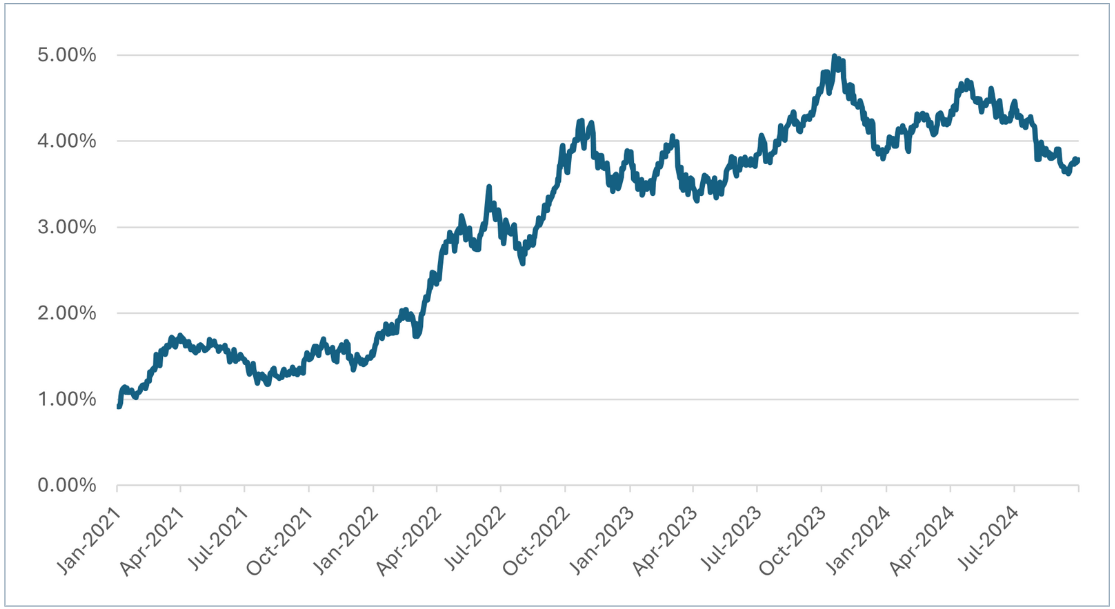

Figure 2: UST 10 year rates.

Source: Factset

The macroeconomic landscape is likely to see:

- Continued demand for defensive, essential-service businesses in an environment of slower global growth;

- Ongoing opportunities for these businesses to continue to grow both from in-place assets and new opportunities for investment; and

- A more stable or even declining interest rate environment, benefiting the valuation of infrastructure and other longer-duration assets.

Some of the most attractive opportunities in the sector are companies trading at discounted valuations due to short-term company-specific issues, particularly in regions outside the United States.

For investors willing to take a long-term view, these businesses offer strong potential upside as short-term concerns abate.

One such example is Severn Trent (LON: SVT), a UK water company. Severn Trent is a straightforward utility business, focused on providing essential water and wastewater services to customers in regulated UK markets. Its revenue model is underpinned by a stable regulatory framework, ensuring predictable cash flows and consistent underlying returns on the company’s regulated asset base.

Despite its defensive and regulated business model, Severn Trent’s share price has been affected by an unrelated company in the sector, Thames Water, running into service and funding problems. While this creates noise and some uncertainty, the operating performance of Severn Trent has remained strong. For investors with patience, such discounted opportunities offer a combination of stability and growth potential.

Areas to avoid

Investors seeking diversification should exercise caution with more cyclical assets that purport to be infrastructure but, lack the predictable and defensive cash flows that distinguish infrastructure from other asset classes. As an example, these higher-risk assets include merchant power stations that depend on market-based electricity pricing rather than stable, regulated returns.

In our view, maintaining a focus on core infrastructure assets is critical for achieving the desired investment outcomes. Core infrastructure provides both long-term structural growth and the defensive qualities needed to weather economic downturns.

When investing in the sector, we apply strict criteria to ensure a practical and diversified portfolio. True infrastructure investments should demonstrate low correlation with other asset classes, particularly global equities. To achieve this, we avoid companies with significant exposure to commodity price risk, excessive competition or sovereign risk. Instead, we focus on monopoly-like businesses that offer essential services and face limited economic sensitivity.

Our analysis highlights the resilience of conservative infrastructure investments. Since 2010, there have been 18 instances where global equity markets experienced drawdowns of more than 5%, lasting an average of two to three months. During these periods, infrastructure investments (as defined by our criteria) fell on average only 51.5% as much as global equities. In contrast, the broader S&P Global Infrastructure Index, which has approximately 34% exposure to higher-risk, cyclical assets, experienced declines that averaged 76% of the fall of global equities during these same drawdowns. These results underscore the importance of focusing on high-quality, defensive infrastructure investments.

Conclusion

Infrastructure continues to serve as a compelling asset class for investors seeking inflation-protected growth, downside protection and portfolio diversification. As we look to 2025, the asset class is poised to deliver strong returns, supported by stabilisation in interest rates, and global economic trends.

The best opportunities will likely arise in regions outside the US and among companies experiencing temporary, stock-specific challenges – offering significant potential for patient, long-term investors. At the same time, avoiding cyclical exposures and focusing on core infrastructure assets is essential to achieving sustainable and defensive investment outcomes.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 20 January 2025. This document was originally published in Livewire Markets on 20 January 2025. This information has been prepared Magellan Asset Management Limited (ABN 31 120 593 946)(AFSL 304301). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.