Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Goldilocks stayed for 2024, but what’s in store for investors in 2025?

Dr Shane Oliver | AMP

2024 was like a rerun of 2023 with lots of angst but it turned out okay. The key big picture themes of relevance for investors were:

1. Stronger than feared growth: Yet again the much feared recession failed to materialise. Despite the monetary tightening of 2022 and 2023 and China’s property collapse, global growth in 2024 remained just above 3%. In Australia, despite a “per capita recession”, economic growth remained positive albeit at only around 1% helped by strong population growth, stronger than expected growth in public spending and labour hoarding offsetting severe mortgage pain for some.

2. Global divergence: Within emerging countries, India grew around 6.5%, China grew around 4.8% (which is slow for China) but South America and the Middle East only grew around 2%. And within developed countries, US growth remained strong at around 2.8% but growth was just 0.8% in Europe and around 0.3% in Japan.

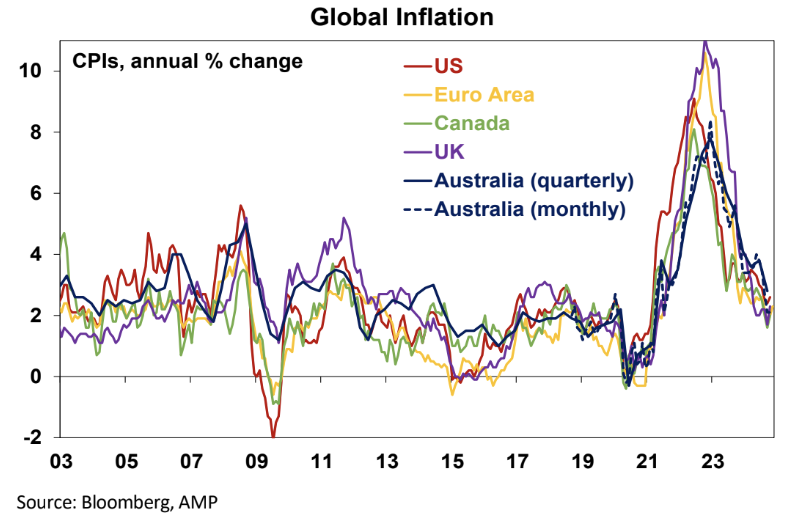

3. Further disinflation: Inflation in major countries has fallen sharply from peaks of 8 to 11% in 2022 to around 2 to 3% in 2024. Australia lagged on the way up and is doing the same on the way down.

4. Falling interest rates: It took longer to get there & rates didn’t fall as much as expected at the start of the year but most major central bank started to cut their policy rates. The RBA should start early in 2025.

5. Geopolitical threats were not as worrying as feared: In particular, the conflict in Israel widened to include Lebanon and missile exchanges with Iran but didn’t impact oil supplies and the oil price was little changed, the Cold War with China didn’t produce any major disruptions and Donald Trump’s re-election boosted US shares.

Another year of Goldilocks resulted in strong returns for investors

There were a few bumps along the way for shares – notably with an inflation scare in April and a growth scare into August – but they were relatively minor (with brief falls in shares off less than 10%). For diversified investors, 2024 was another strong year:

- Global shares had a strong year as rates fell, albeit less than expected, and profits were stronger than expected.

- US shares outperformed reflecting its stronger economy, tech exposure and a boost from Trump’ s re-election promising US friendly policies. By contrast non-US shares underperformed, particularly Eurozone shares which weren’t helped by French political uncertainty. Chinese shares got a boost from more stimulus.

- Australian shares did well in anticipation of stronger profits and rate cuts ahead but underperformed with China worries and no rate cut.

- Government bond returns were constrained by smaller than expected rate cuts and worries about Trump’s policies driving higher inflation.

- Real estate investment trusts saw solid returns in anticipation of better commercial property returns ahead.

- Unlisted assets were constrained by the valuation effect of high bond yields with office property seeing losses from reduced space demand.

- Australian home prices rose with the housing shortfall, but “high” rates saw gains stall into year end with prices falling in several cities.

- The $A fell but mainly against the $US, with the latter rising on Trump’s tax cut, deregulation and tariff plans.

- Reflecting all this, balanced super funds had very strong returns for the second year in a row. They were roughly double our expectations!

The key threats for 2025

Just as was the case for 2024 the worry list for 2025 is long and maybe even more threatening given the uncertainty Trump’s policies pose:

- Share valuations are less attractive, with the key US share market trading on a 26 times forward P/E and the earnings yield bond yield gap is negative. Australia is not so bad at 20 times but it’s not cheap.

- Uncertainty remains around how much the Fed, the RBA and some other central banks will cut rates as core inflation is still not at target.

- Bond yields could continue to rise on the back of Trump’s tax cut and tariff policies, placing pressure on shares.

- The risk of recession remains, particularly in the US if rising bond yields prevent a recovery in manufacturing and housing and in Australia if the RBA leaves rates too high for too long.

- A global trade war in response to Trump’s threatened tariffs could add to this risk particularly in Europe and Asia.

- Risks for the Chinese economy are high and could be amplified as Trump ramps up tariffs & if Chinese policy stimulus remains modest. There are signs of bottoming in China’s property market though.

- Geopolitical risk is high: “maximum pressure” from Trump to resolve the war in Ukraine and Iran’s nuclear aims could see the Ukraine and Middle East wars getting worse before they get better threatening higher oil prices; similarly tensions with China could escalate; political uncertainty will likely be high in Europe with issues around the French budget and another potential election and a German election in the first half (although the latter is likely to be benign with the centre right Christian Democrats likely to “win”); and the Australian election is due by May although it’s unlikely to lead to a radical change in economic policy but does run the risk of even more public spending after the relative calm of 2024.

These considerations point to at least a high risk of increased volatility after the relative calm of 2024.

Reasons for optimism in 2025

However, despite these worries there are several grounds for optimism.

- First, inflation is likely to continue to trend down as labour markets are continuing to ease, demand growth is still slowing and commodity prices are in a mild downtrend from their 2022 high.

- Second, central banks are likely to continue cutting interest rates. This is likely to range from the Fed which will become more gradual and cut to around 3.75% to the ECB which is likely to cut to 1.5% (partly to offset the negative impact of a possible trade war and political uncertainty in France).

- This is expected to include the RBA where quarterly trimmed mean inflation is likely to soon drop to around 0.6-0.7% q/q (or 2.4-2.8% annualised), enabling it to possibly start cutting in February but by May at the latest taking the cash rate down to 3.6% by year end.

- Third, global growth is likely to slow in 2025 but only to just below 3% with US growth around 2.5% helped by optimism on Trump’s policies, Chinese growth around 5% with more stimulus offsetting a potential trade war with the US and Japanese and European growth around 1%.

- Global growth is likely to strengthen in the second half helped by rate cuts. Australian growth is likely to edge up to 1.8% helped by rising real wages, tax cuts & rate cuts and this should see profit growth return.

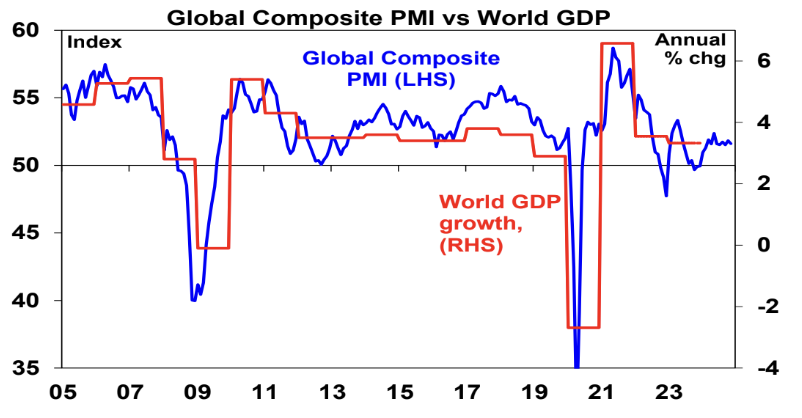

Fourthly, if recession does occur it’s likely to be mild as most countries including Australia have not seen a spending boom that needs to be unwound and traditionally makes recessions deep. And the Chinese government is likely to continue to do just enough to keep growth around the 5% level. Currently, global business conditions surveys are still around levels consistent with okay global growth.

PMIs are surveys of business conditions and confidence. Source: Bloomberg, IMF, AMP

Finally, while Trump’s policies will create a lot of uncertainty and disruption as he uses tariffs and other things as part of a maximum pressure strategy to negotiate better outcomes for the US his first term as President tells us he ultimately wants to see shares up, not down. He was also elected on a mandate to get the cost of living down for Americans, not to push it up. This could ultimately mean more of a focus on his tax and efficiency policies as opposed to his populist measures like tariffs.

Implications for investors

Just as trees don’t grow to the sky, 20% plus returns from global shares are not sustainable. So, we expect good investment returns over 2025, but it will likely be a rougher and more constrained ride than in 2024.

- Global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations after two strong years, the ongoing risk of recession, the likelihood of a global trade war and ongoing geopolitical issues will likely make for a volatile ride in 2025 with a 15% correction somewhere along the way highly likely.

- But central banks still cutting rates with the RBA joining in and prospects for stronger growth later in the year supporting profits should still see okay investment returns.

- Expect the ASX 200 to end 2025 at around 8,800 points.

- Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

- Unlisted commercial property returns are likely to start to improve next year as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

- Australian home prices are likely to see further weakness over the next six months as high interest rates constrain demand and unemployment rises. Lower interest rates should help from mid-year though and we see average home prices rising by around 3% in 2025.

- Cash and bank deposits are expected to provide returns of over 4%, but they are likely to slow in the second half as the cash rate falls.

- The $A is likely to be buffeted between the positive of a narrowing in the interest rate differential between the Fed and the RBA and the negative of US tariffs and a potential global trade war. This could leave it stuck between $US0.60 and $US0.70.

What to watch?

The main things to keep an eye on are: interest rates; recession risk; a likely trade war; China’s property market; and the Australian consumer.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 9 December 2024. This document was originally published in Livewire on 9 December 2024. This information has been prepared by AWM Services Pty Ltd (ABN 15 139 353 496)(AFSL No. 366121), part of the AMP Group. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.