Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Markets at a glance 27 November

Leah Gibbons | nabtrade

Around the grounds

The Australian share market is higher in today’s trade as financials and gold stocks lead the gains.

Diving into the detail of the sectors, gold stocks were up by as much as 1.8%, while the price of bullion trades flat around the US$2,631.10/oz mark. Gold prices remain caught in a tug-of-war, falling to touch a one-week low overnight as safe-haven demand softened with news of an agreement for a ceasefire between Israel and Lebanon, while concern over Ukraine and Trump's tariff plans added some support.

Technology shares are also higher, tracking overnight gains by peers on Wall Street, as health care have added as much as 0.6%. Energy stocks are a shade higher, while miners are trading flat.

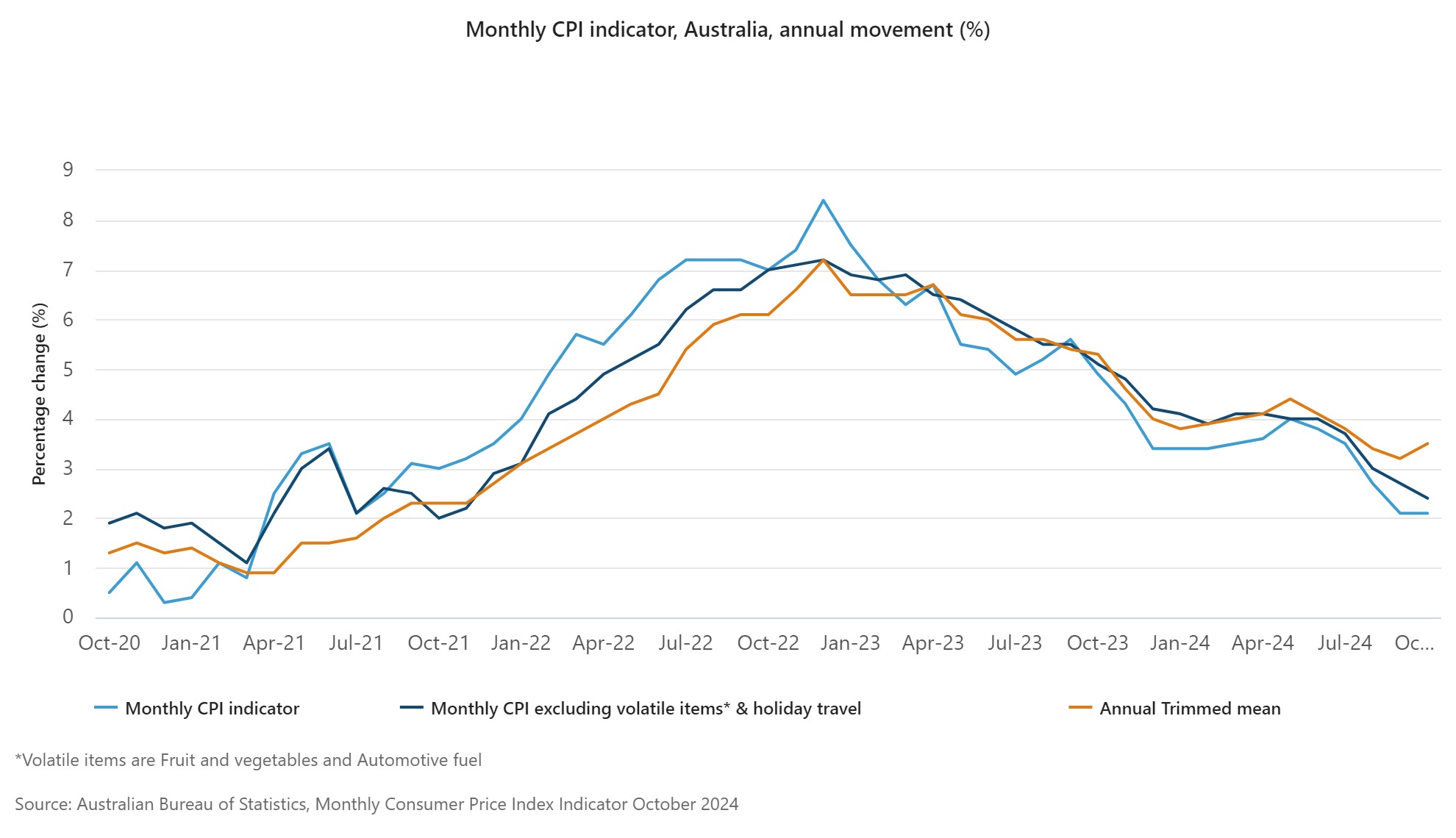

On the economic front October’s inflation print has held steady at a three-year low, with the price index up 2.1% annually. This as government rebates drove electricity and rent prices down, though core inflation picked up in a sign of lingering cost pressures.

Under the hood, the trimmed mean, closely watched by the RBA, rose to an annual 3.5% from 3.2% in September, taking it further above the central banks 2 to 3% target band, making the hurdle to cut interest rates that much higher.

Markets have not fully priced in a cut in rates until May next year, with a move in December at just a 14% probability.

The Australian dollar was little changed at $0.6474 after the data.

Across the ditch, the Reserve Bank of New Zealand has cut the cash rate by 50 basis points to 4.25%, as annual inflation nears the 2% midpoint of the central bank’s target range and economic activity remains subdued.

In the news

Quick check in on some of the news to watch in today’s trade. An Australian Senate committee has backed a bill that would ban social media for children under 16, but said social media platforms should not force users to submit personal data, like a passport or other digital identification to prove their age.

In separate submissions, Google (NASDAQ: GOOGL) and Facebook-owner Meta Platforms (NASDAQ: META) said the social media ban should be delayed until the age-verification trial finishes. Bytedance's TikTok said the bill needed more consultation, while Elon Musk's X said the proposed law might hurt children's human rights.

The planned law would force social media platforms to take reasonable steps to ensure age-verification protections are in place and could see them fined up to AU$49.5 million for systemic breaches.

The Albanese government is looking to pass the bill by the end of the parliamentary year on Thursday.

Turning to some of the stocks to watch in today’s trade. Harvey Norman (ASX: HVN) shares are marching higher, as the appliance retailer says aggregated sales revenue for July-October is up 1.7% versus a year ago. HVN shares are up 14.1% this year, as of last close.

Elsewhere, Australian listed shares of City Chic Collective (ASX: CCX) have taken a hit after flagging revenue is down nearly 5% in the first 20 weeks of FY25 on PCP across all market channels. The stock is down over 70% YTD, including today’s moves.

Finally, to the smaller end of town shares of Novonix (ASX: NVX) have tumbled to a three-year low as the company competes an AU$44.4 million placement at an offer price of AU$0.60 per share, which represents a 37.8% discount to the stock’s last closing price.

As of last close, the stocks is up over 30% YTD.

Going global

Rounding things out on the global stage stocks around the Asian region are mixed, with Tokyo’s Nikkei 225 trading in the red dragged by falls in auto and shipping stocks amid uncertainty over U.S. trade policies. Investors are also keeping a close watch on the Middle East after Israel reached a ceasefire deal with the Lebanese militant group Hezbollah.

Finally, US futures are back online pointing to a mixed start to when the Wall Street session gets underway with both the S&P 500 and Dow futures up, while the Nasdaq 100 is marginally in the red.

In the currency space, both the Mexican Peso and Canadia dollars took a tumble overnight after U.S. President-elect Donald Trump again pledged to impose new tariffs on imports from Canada, and Mexico by as much as 25% and an additional 10% tariff on goods from China.

The greenback is relatively flat and has experience some turbulence in the past few sessions, faltering on the back of Trump’s naming of hedge fund manager Scott Bessent to become U.S. Treasury secretary, before surging after his tariff vows.

The euro is little changed, while sterling is up a shade.

All prices and analysis at 27 November 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.