Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Will China's move to "big" stimulus work?

Dr Shane Oliver | AMP

After a run of disappointing economic data, collapsing property prices and Chinese shares falling to their lowest since 2019 giving rise to increasing concerns about the outlook, China appears to be moving towards aggressive policy stimulus. But what’s driving the change? Will it work? And what does it mean for investors and Australia?

Cyclical slump

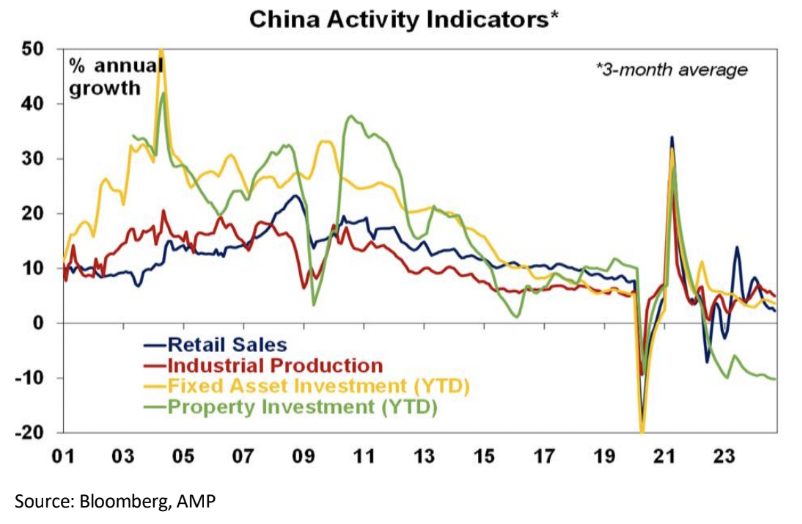

The pivot towards aggressive stimulus looks to have been driven by increasing concern about China’s economic outlook. Chinese growth bounced after its Covid restrictions were eased late in 2022. But the bounce was short-lived, and growth has remained weak by Chinese standards ever since slowing to around 4.5% year-over-year - with poor growth in retail sales, investment and imports and annual credit growth falling to a record low.

China Activity Indicators (Source: Bloomberg, AMP)

The softness has been confirmed by ongoing weakness in business conditions PMIs, and with spare capacity arising, it's reflected in very low consumer price inflation and deflation in producer prices. The slowdown reflects a combination of factors, but key drivers have been:

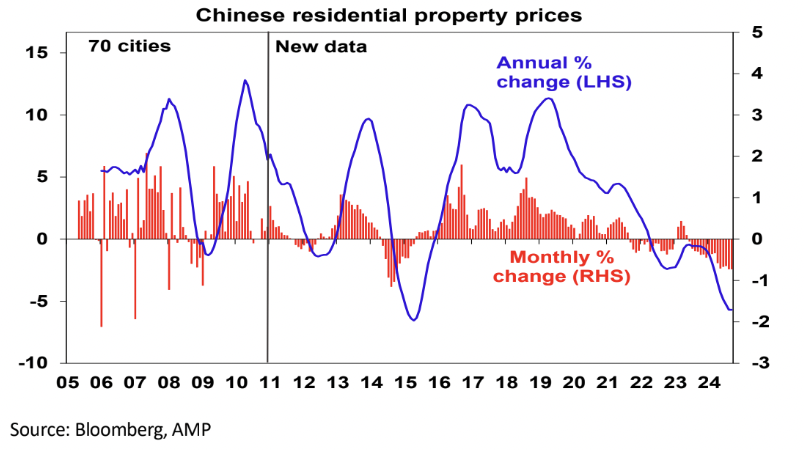

- The ongoing property collapse – home prices have been steadily sliding and property sales have slumped (down 25% year to date) reflecting an oversupply. This has led to big problems for developers (eg, Evergrande and Country Garden); local governments that rely on land sales for revenue; and households that have seen property-related investments sour. Property investment has also collapsed.

Chinese residential property prices (Source: Bloomberg, AMP)

Chinese residential property prices (Source: Bloomberg, AMP)

- Households remaining cautious in the face of falling property and share market wealth and relatively high unemployment.

Structural problems

Cyclical problems have been exacerbated by structural problems, notably:

- Excessive savings- China has a very high total saving rate of around 45% of GDP, roughly double Australia’s.

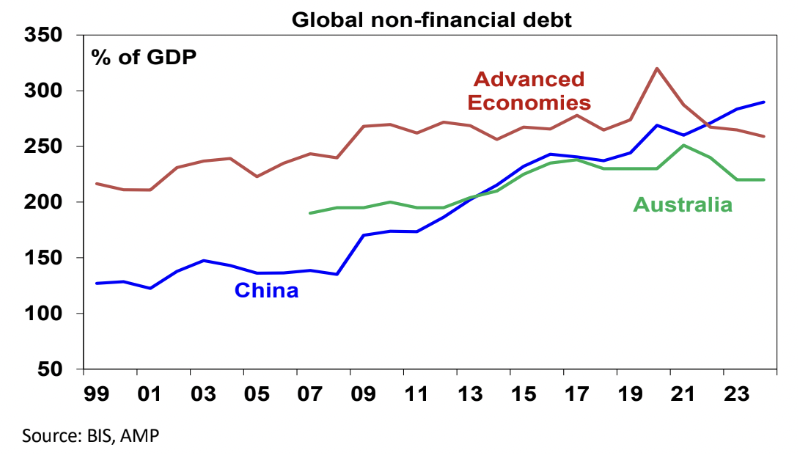

- This makes China’s debt problems very different to other countries as China has borrowed from itself. But it means the savings have to be recycled (usually via debt) into demand or else high unemployment and chronic deflation can result. China did this for many years through corporate borrowing for investment focussed on driving exports and then into property which has resulted in a rapid rise in China’s debt levels. China’s non-financial debt to GDP ratio is now above the advanced economy average and Australia's.

Source: BIS, AMP

- Problems in export-related investment – recycling excess savings into export-related investment has soured as rising levels of fresh capital and debt are leading to a diminishing payoff in terms of GDP and geopolitical tensions and trade restrictions have led to slowing export growth.

- Problems in property-related investment - using property to recycle high savings has also soured. This was viable when urbanisation was rapid but it’s now led to an oversupply of property and collapsing prices.

- Poor demographics – China’s workforce is shrinking and its population is rapidly aging. This weighs on property demand and economic growth.

- Increasing government intervention – the easy gains of industrialisation have been seen and China runs a high risk of falling into the “middle-income trap” (where countries fail to transition to being high-income countries). This is partly because of increasing state intervention in the economy and regulatory crackdowns on tech companies and other sectors which are acting as a disincentive to future entrepreneurs at a time of tightened access to foreign technology.

- There is a fiscal imbalance between the central and local governments – with the former having most of the revenue and the latter doing much of the spending resulting in local government debt problems.

- As a result of all this, estimates of its potential real GDP growth have fallen from around 10% in 2006-10 to around 5% now & around 3% next decade.

Will policy stimulus work?

Reversing the demographic decline will be an uphill battle - as many other countries have found. Addressing the other structural problems and cyclical issues requires aggressive monetary and fiscal stimulus and reforms to clear the property overhang, rebalance the economy towards consumer spending (via pension, health and education spending and reforms) to lower precautionary household saving and boost productivity growth and fiscal reform to make local government finances more sustainable.

Over the last year or so, China has been providing just enough support to the economy to avert a major crisis. It looked like the Government was: more focussed on trying to avoid reflating credit and housing bubbles (like Japan in the early 1990s); wanted to avoid “decadent” consumer stimulus as seen in various Western countries; or was not aware of the problem.

But with the economy and property market continuing to slide there was increasing concern that China would not meet its 5% growth target for this year and worse still might slide into a decades-long period of slow growth and deflation like Japan did after its 1980s boom years as it fails to address its structural problems.

A run of soft economic data last month appears to have galvanised the government into action, so, starting in late September there has been a steady flow of stimulus announcements:

- The People’s Bank of China announced a long list of measures to ease monetary policy including a cut to the reserves banks need to keep, lower interest rates, lower required down payments on second homes and allowing funds and brokers to tap PBOC funds to buy shares.

- The Politburo committed to increased counter-cyclical policies, “necessary” levels of fiscal spending and measures to halt the property decline. A move towards much bigger fiscal stimulus has been confirmed by the Ministry of Finance with more bond issuance to resolve local government debt, allow local governments to buy unsold property and help banks rebuild capital.

- Monetary stimulus on its own would have been like pushing on a string as the supply of money is not an issue in China but the lack of demand for it is.

To address this requires fiscal stimulus. So far, the announcements have been in the right direction but lack detail regarding size and help for consumers. We are now waiting for the National People’s Congress Standing Committee late this month to confirm the size of the fiscal stimulus. Most expectations are for around 2 trillion Renminbi ($420 billion) in stimulus or 1.6% of GDP.

Based on what we have heard, something of this order is likely and it could boost growth in 2025 to maybe 5.5% and at least stabilise property prices.

However, we are less confident that it will address China’s structural problems – saving is likely to remain too high and consumer spending too low; the trend towards increasing state intervention is likely to remain; the revenue/spending mismatch of local governments will remain; and it will be very hard to reverse the deteriorating demographics. So, a longer-term trend towards slower growth in China will likely remain in place.

The Chinese share market

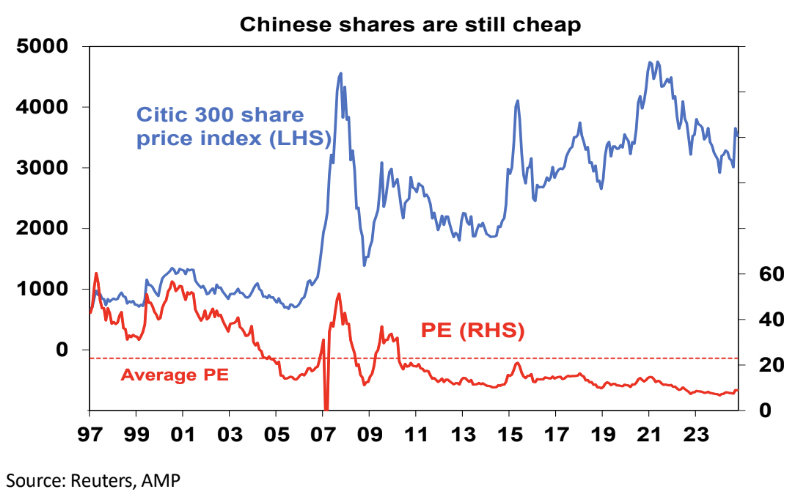

While Chinese shares are 22% above their low in mid-September, on the back of policy stimulus they are still relatively cheap, suggesting room for more upside if significant stimulus is confirmed by the NPC.

Source: Reuters, AMP

Implications for Australia

Despite a slump in Australian goods exports going to China in 2021 (from around 42% of the total to 30%) and weak Chinese nominal growth, the Australian economy has been relatively resilient compared to its past correlation to China reflecting a combination of solid bulk commodity prices; strong population growth; and a muted mining investment cycle. So a stimulus-driven cyclical rebound in Chinese growth may not provide as big a boost to the Australian economy as it might have in the past. But it will still help support export demand, commodity prices and resource shares.

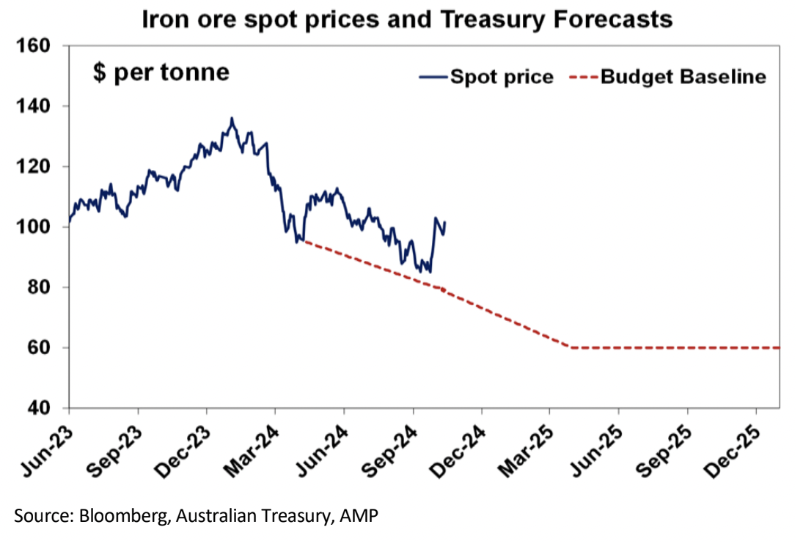

And it will likely help keep the iron ore price tracking above the Federal Government’s budget assumptions albeit the boost to the budget (via stronger mining profits) won’t be as strong as it has been over the last two financial years.

Implications for investors

For investors, the move by China towards more aggressive policy stimulus should help the global economy avoid recession and along with central banks lowering interest rates is positive for shares on a 6-12 month horizon.

It may not be enough to reverse the Australian share market’s relative underperformance, but it may help reduce it.

Chinese stimulus is positive for the Australian Dollar but the main positive here remains an improving Australian/US interest rate gap, as the RBA lags the Fed in cutting interest rates.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 16 October 2024. This document was originally published in Livewire on 16 October 2024. This information has been provided by AWM Services Pty Ltd (ABN 15 139 353 496)(AFSL No. 366121), part of the AMP Group. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.