Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Markets at a glance 30 October

Leah Gibbons | nabtrade

Around the grounds

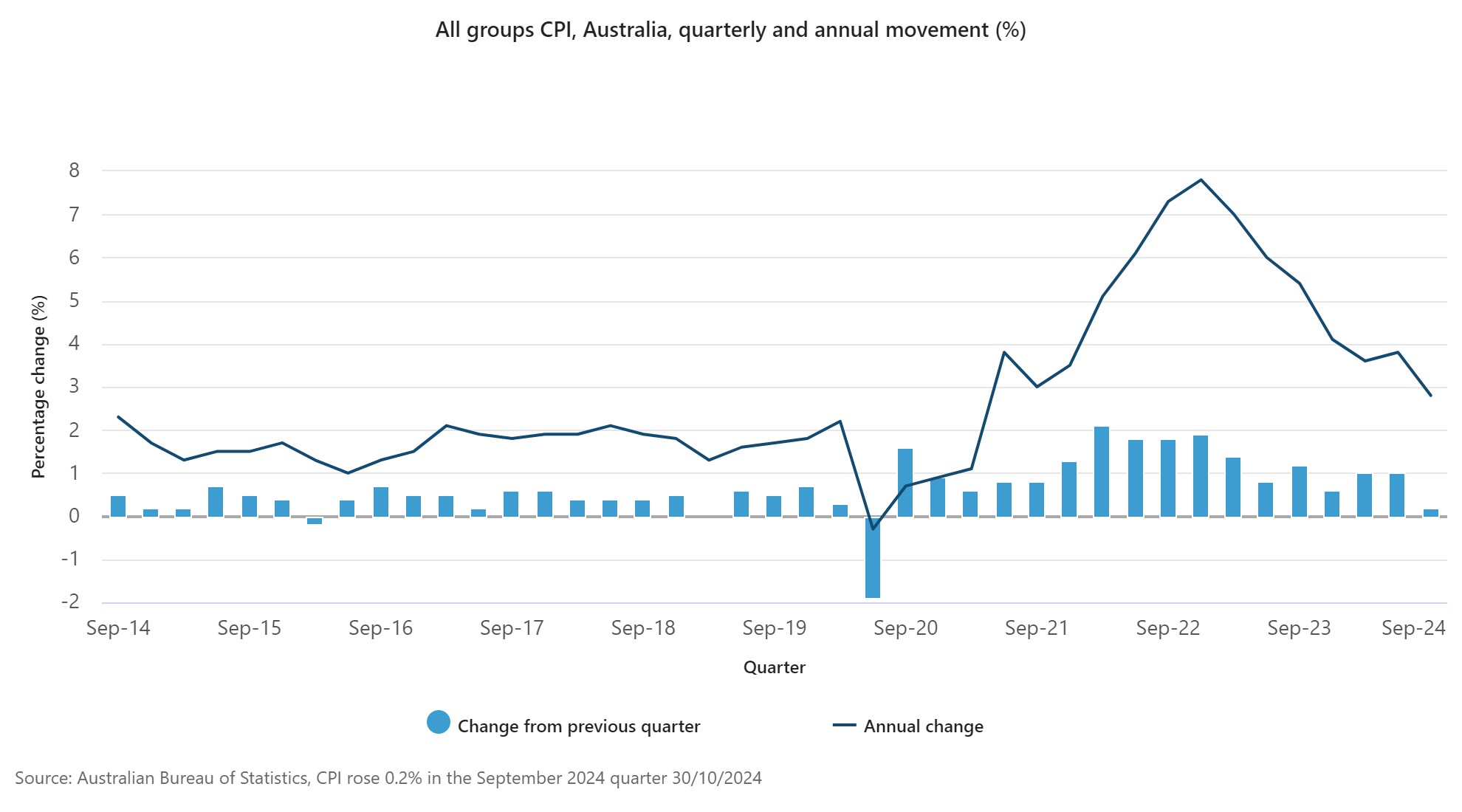

The Australian share market has snapped its three-day winning streak, despite third quarter inflation dropping to its lowest level in more than three-and-a-half years. Data from the ABS showed the consumer price index rose 0.2% in the period, under forecasts of 0.3%, largely due to government rebates on electricity and a drop in gasoline prices.

On an annual basis, inflation dropped to 2.8% versus the 3.8% expected, and taking it back into the Reserve Bank of Australia’s 2-3% target band for the first time since late 2021.

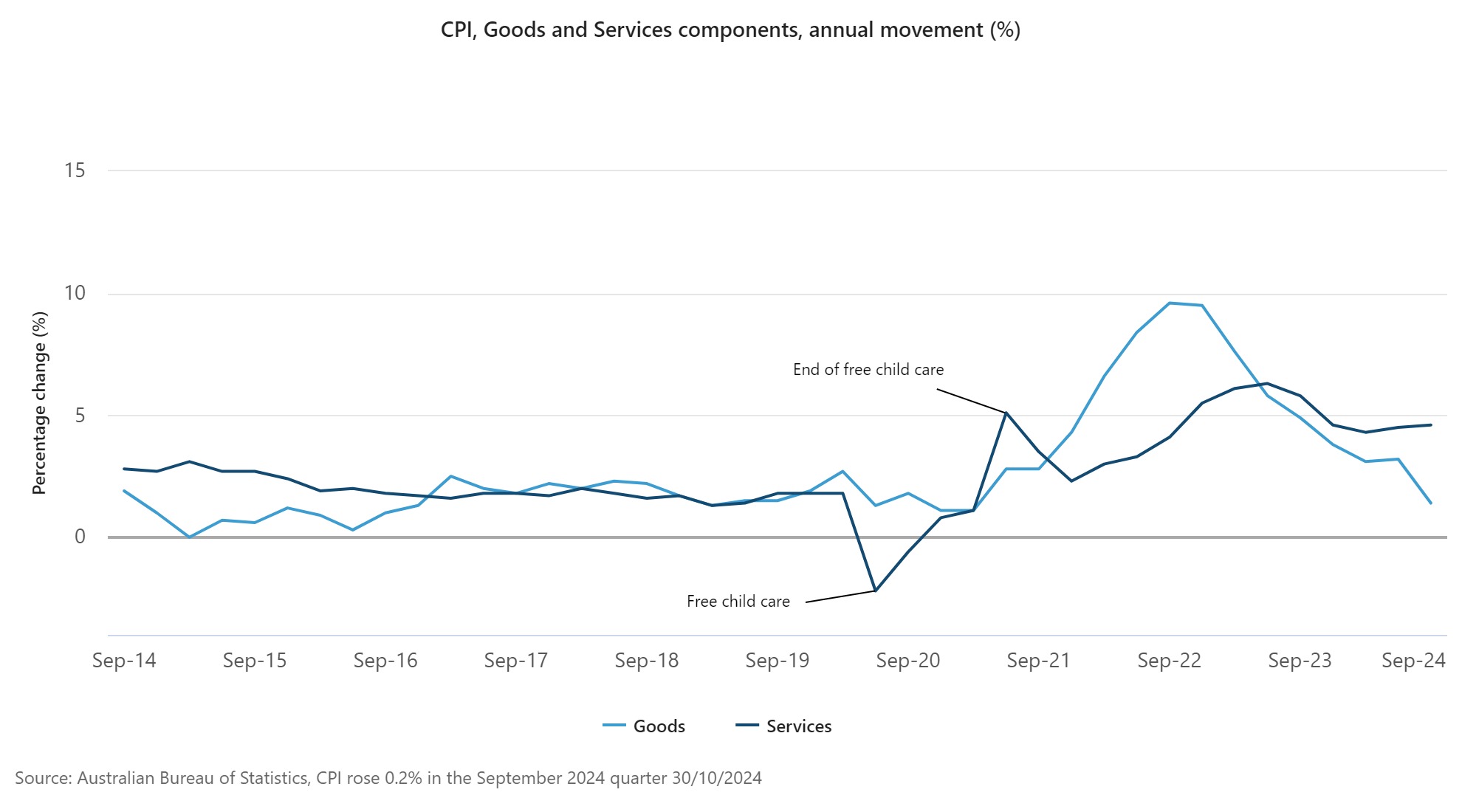

However, the core print, closely watched by the RBA, remains sticky, increasing by 0.8% in the quarter, in line with NAB forecasts and just a shade above market forecasts of a 0.7% gain. Drilling down further into the detail, while there was a 17.3% drop in electricity prices, services inflation remains hot, staying elevated at 4.6%, slightly higher than the June quarter’s and little changed over the past 12 months.

In response the Australian dollar edged lower, closing in on a three-month trough. Back to the broader market, the Australian technology sub-index is tracking higher in today’s trade, on track to record a fourth consecutive session of gains, if the trend holds, mirroring overnight gains on Wall Street. Miners and property trusts were also higher while the rate-sensitive financials slipped.

In the news

Quick check in on some of the stocks to watch in today’s trade. Australian listed shares of Woolworths (ASX: WOW) have crashed in today’s trade as the grocer warns first-half profit from its main Australian food division would fall as a hunt for bargains and intense scrutiny of supermarkets during a cost-of-living crisis lower shelf prices.

Embattled casino operator Star Entertainment (ASX: SGR) is back in the news, as shares slump after it swung to a first=quarter loss and reported a drop in revenue, adding to rising uncertainty about the future revamp and earnings turnaround.

On the flip side, shares of Appen (ASX: APX) have surged as the data services provider swings to quarterly profit, with underlying EBITDA of AU$1 million, compared to the AU$7.5 million loss last year, though revenue came in 13% lower to AU$54.1 million.

The stock is up over 230% YTD, as of last close.

Elsewhere, shares of Pilbara Minerals (ASX: PLS) meantime are tracking higher, as the lithium miner says its Western Australia operations will be managed to reduce costs and improve its financial position. This despite cutting its fiscal 2025 output guidance as it plans to put its lower capacity and higher cost Ngungaju plant into care and maintenance by the beginning December.

Staying in the rare earths space, Lynas Rare Earths (ASX: LYC) is in focus, after the company reported a near 6% decline in first-quarter revenue thanks to falling prices for strategic minerals and muted demand.

Finally, in the broker space, Morningstar sees a 100% chance Myer (ASX: MYR) will merge with five of rival Premier Investments’ (ASX: PMV) brands, though the broker says Myer is slightly overpaying for the deal on a stand-alone basis. Fair value estimate of Myer lifted by 11% to AU$0.83 while Premier estimate is held steady at AU$20.50 per share.

MYR is up over 59% this year, as of last close while PMV is up 23%.

Going global

Rounding things out on the global stage, equities around the Asian region are moderately higher as investors eye crucial data state side. On the currency front, the rally in the US dollar has taken a breather but continues to hover close to a three-month high. Both the dollar and U.S. bond yields have seen a bid in recent sessions on the back of rising speculation in markets and on some betting sites Republican presidential candidate Donald Trump will return to the White House.

Elsewhere, the dollar-yen pay slipped, while the euro has edged up and sterling is trading relatively flat ahead of the Labour government’s first budget released tonight. Finally, US futures have come back online signalling a positive start to the Wall Street session with investors eagerly awaiting earnings from more of the ‘Mag 7’ including Microsoft.

All prices and analysis at 30 October 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.